e-Way Bill Login in Mobile: Generate, Cancel, Reject e-Way Bills Through SMS

e-Way bill login in mobile or Mobile e-Way Bill is an SMS-based generation of e-way bills on mobile. This service is introduced for small business owners who require less number of e-way bills or don’t have infrastructure like PCs or laptops to generate e-way bills.

The mobile-based e-way bill service can also be used in emergencies, such as the urgent movement of goods, or during odd hours, such as midnight or late hours.

e-Way Billing Through SMS Using Mobile

Using the mobile e-way bill facility, taxpayers can perform different e-way bill-related operations through their mobile, including –

- Update the Vehicle Details

- Update the Transporter Details

- Get e-Way bills generated by other parties

- Reject e-Way Bill

- Get details of all e-Way bills generated on the previous date

To generate e-Way bills using a mobile number, the taxpayer/transporter has to register the mobile number from which he/she wants to generate e-way bills on the e-way bill official portal. Once registered against the taxpayer’s GSTIN, the same mobile number must be used to generate the e-way bills for that GSTIN. Only one mobile number can be registered for each GSTIN.

How to Use the e-Way Bill SMS Facility

To generate e-Way bills using a mobile number, the taxpayer/transporter has to register the mobile number from which he/she wants to generate e-way bills on the e-way bill official portal. Once registered against the taxpayer’s GSTIN, the same mobile number must be used to generate the e-way bills for that GSTIN. Only one mobile number can be registered for each GSTIN.

How To Register the mobile number for e-way bill SMS facility

The taxpayer or transporter can register their mobile numbers to generate e-way bills on mobile.

- To register, go to e-way bill official portal

- Login using username and password (if already registered)

- If not registered, click on ‘New Registration’ provide the required information and register. Once registered, login to the account using the credentials.

- Once logged in, go to ‘Registration’ menu and select the ‘For SMS’ option.

- In the next screen, enter your e-mail ID and mobile number and click on ‘Send OTP.’

- Enter the received OTP in the next box and click on ‘Verify OTP.’

- The next screen confirms the registered mobile number against the User ID and its active or frozen status. Click on Exit to complete the registration.

Steps to Generate an e-Way Bill Through Mobile SMS

e-Way bill generation through mobile is simple and easy. However, sending the SMS request in the right format without any mistake is important for successfully generating the e-way bills. Here is the SMS format for taxpayers to generate e-way bills from their registered mobile numbers.

SMS Format for e-Way Bill Generation by Taxpayer

Once your mobile number is registered, use the same number to send an SMS in the following format to 7738299899:

EWBG TranType RecGSTIN DelPinCode InvNo InvDate TotalValue HSNCode ApprDist Vehicle

Sample SMS: EWBG OSUP 29AABCX0892K1ZK 560012 546 10/06/2024 75000.00 1001 234 KA12AB1234

| Parameter | Description | Code |

|---|---|---|

| EWBG | e-Way Bill Generate Keyword. Fixed for generation by taxpayer | Fixed |

| TranType | Transaction Type as per the Code list | OSUP – Outward Supply OEXP – Outward Export OJOB – Outward Job Work OSCD – Outward SKD/CKD ORNK – Outward Recipient Not Known OFOU – Outward For Own Use OEOF – Outward Exhibitions & Fairs OLNS – Outward Line Sales OOTH – Outward Others ISUP – Inward Supply IIMP – Inward Import ISCD – Inward SKD/CKD IJWR – Inward Job Work Returns ISLR – Inward Sales Returns IEOF – Inward Exhibitions & Fairs IOTH – Inward Others IFOU – Inward For Own Use |

| RecGSTIN | Recipient’s GSTIN | 15 character alphanumeric |

| DelPinCode | PIN Code of the delivery location as per invoice | Fixed 6 digit number |

| InvNo | Invoice or bill number | Alphanumeric with allowed special characters /- |

| InvDate | Invoice date | Date in DD/MM/YYYY format |

| TotalValue | Total invoice/bill value | Up to 15 numbers with 2 decimal values |

| HSNCode | HSN code of the goods | HSN Code |

| ApprDist | Approximate distance between consignor & consignee in KMs | Number with a maximum of 4000 km |

| Vehicle | The vehicle number in which you transport the goods | AB12AB1234 or AB12A1234 or AB121234 or ABC1234 or AB123A1234 or TRXXXX or DFXXXX or NPXXXX or BPXXXX Format |

Explanation for the sample SMS

This SMS represents a request by the taxpayer to generate an e-way bill for the Outward supply of goods to the recipient with GSTIN 29AABCX0892K1ZK, to be delivered at pin code 560012 with Invoice/Bill No 546, dated 10/06/2024, of value Rs. 75000.00 with HSN 1001, for a distance of 234 km through vehicle KA12AB1234.

SMS Format for e-Way Bill Generation by Transporter

Here is the SMS format for transporters to generate e-way bills from their registered mobile number:

EWBT TranType SuppGSTIN RecGSTIN DelPinCode InvNo InvDate TotalValue HSNCode ApprDist Vehicle

The codes are the same as listed in the above table.

Steps to Update Vehicle Details – Both Taxpayer & Transporter

If you want to update your vehicle number, send an SMS request in the format below to 7738299899:

EWBV EWB_NO Veh_Tran_No ReasCode Mode.

Sample SMS

EWBV 120023450123 KA12BA1234 BRK 1

This request is to update the e-way bill carrying the number 120023450123 with new vehicle number KA12BA1234 due to Break-down of previous vehicle with Road as mode of transportation.

| Parameter | Description | Code |

| EWBV | e-Way Bill vehicle update keyword. Same for vehicle number updation | EWBV |

| EWBNo | e-Way Bill Number for which

a new vehicle has to be updated |

12 digit numeric value |

| Veh_Trans_

NO |

Vehicle number in case of road

and Transport document number in case of other modes for the movement of goods |

AB12AB1234 or AB12A1234 or

AB121234 or ABC1234 or AB123A1234 or TRXXXX or DFXXXX or NPXXXX or BPXXXX Format |

| ReasCode | Reason Code to indicate why the

vehicle number is being added. |

FST – First Time Vehicle

BRK – Breakdown, TRS – Transshipment OTH – Others |

| Mode | Mode of Transportation | 1- Road

2- Rail 3- Air 4- Ship |

Steps to Cancel e-Way Bill Through SMS

Both taxpayers and transporters can cancel an e-way bill using the below SMS. To cancel an e-way bill through SMS, send an SMS request in the format below to 7738299899:

- SMS format to Cancel e-Way Bill

EWBC EWB_NO

Ex: EWBC 120023450123

| Parameter | Description | Code |

| EWBC | e-Way Bill cancellation keyword. Same for vehicle number updation | EWBC |

| EWBNo | e-Way Bill Number to be cancelled | 12 digit numeric value |

Note:

- You can cancel an e-way bill only if you are the generator within 24 hours of its generation.

- You cannot cancel a verified e-way bill.

If you wish to update the transporter details in a generated e-way bill, send an SMS to 77382 99899 from your registered mobile number in the following format.

- SMS Format to Update Transporter Details

EWBU EWB_NO TRANSIN/GSTIN

Sample SMS – EWBU 120023450123 27AABBC1234S1ZN

| Parameter | Description | Code |

| EWBU | e-Way bill transporter update keyword. Same for vehicle number updation | EWBU |

| EWBNo | e-Way Bill Number to be cancelled | 12 digit numeric value |

| TRANSIN/GSTIN | TRANSIN/GSTIN of the

Transporter |

15 character alphanumeric |

Get e-Way Bills Generated by Other Parties Through SMS

This SMS code helps you get the list of all the e-way bills generated by other parties on your GSTIN or TRANSIN. Both taxpayer and transporter can send this SMS.

Send SMS to 77382 99899 from your registered mobile number in the following format.

EWBL Date

| Parameter | Description | Code |

| EWBL | e-way bill list by other party keyword. | EWBL |

| Date | Date for which the list is required | DD/MM/YYYY |

How to Reject an e-Way Bill through Mobile SMS

This SMS code is to reject e-way bills generated by other parties on your GSTIN or TRANSIN. Both taxpayer and transporter can send this SMS.

Send SMS to 77382 99899 from your registered mobile number in the following format.

EWBR EWB_NO

| Parameter | Description | Code |

| EWBR | e-Way bill rejection keyword. | EWBR |

| EWBNo | e-Way Bill Number to be cancelled | 12 digit numeric value |

Generate e-Way Bills on myBillBook Mobile App

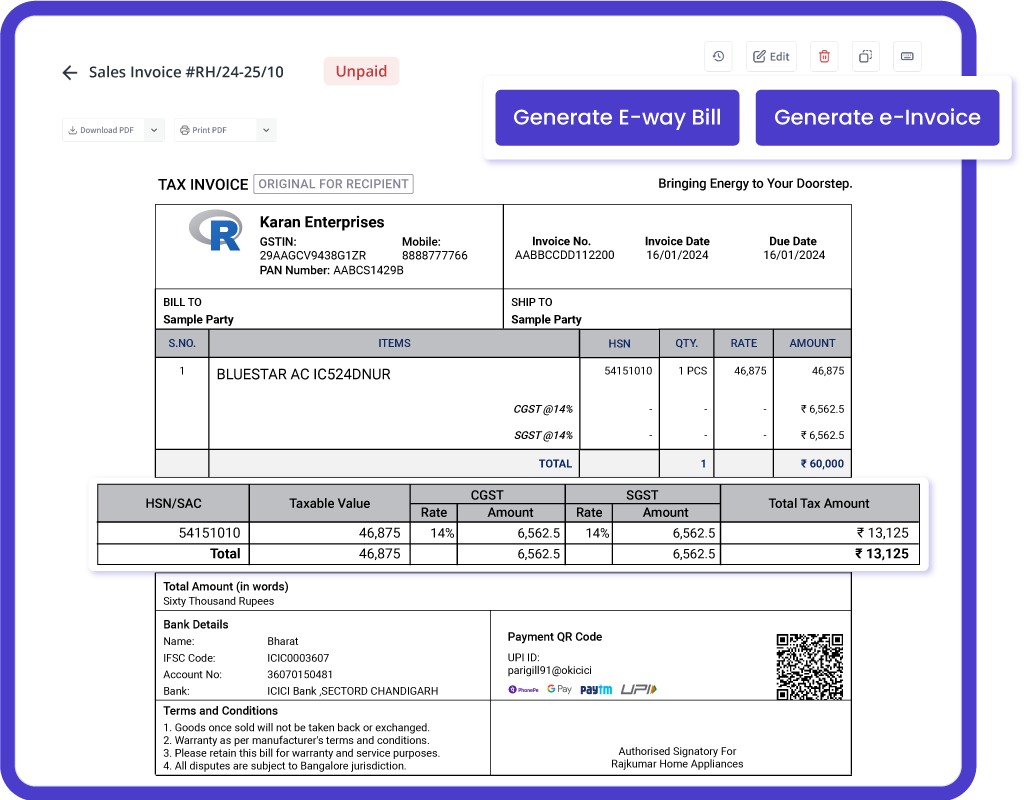

Another easy way to generate eway bills from your mobile phone is through myBillBook mobile application. myBillBook is an online billing and invoicing software that provides eway bill and einvoice generation options for its premium users.

With the myBillBook eway bill feature, users can create eway bills with a single click and track all the eway bills generated in one place.

Here is a step-by-step guide to generating e-Way bills on myBillBook mobile app.

To generate eway bills using myBillBook, users need to have a premium plan with myBillBook. After becoming a paid member follow the below steps to generate eway bills from myBillBook mobile app.

Step 1: Open your myBillBook app. Go to “Invoice Settings”> “e-Way Bill/e-Invoice.”

Step 2: You will be shown a banner after creating an e-way bill >=50000. You can view the e-Way bill setup with the value proposition by pressing “Generate” on the banner.

Step 3: You can then witness instructions to fill in GSP credentials.

Step 4: After filling in the credentials, click on the “Generate e-Way bill” button.

Step 5: Fill in the details in the e-Way bill form and check the preview of the same on the screen.

Step 6: Afterwards, click on “Download e-Way Bill.”

myBillBook eway bill software is India’s No:1 billing and accounting software that helps businesses streamline their billing and accounting processes. With the government mandating e-way bills, myBillBook upgraded the software to support e-way bill generation. myBillBook is powered by Masters India GST Suvidha Provider to simultaneously generate e-invoices and e-way bills. Once you enable the einvoicing option on the myBillBook billing app, you can directly convert all your B2B invoices into e-invoices in a single click. In the same step, you can generate e-way bills for all the applicable invoices.

Top Features of myBillBook e-Way Bill Software

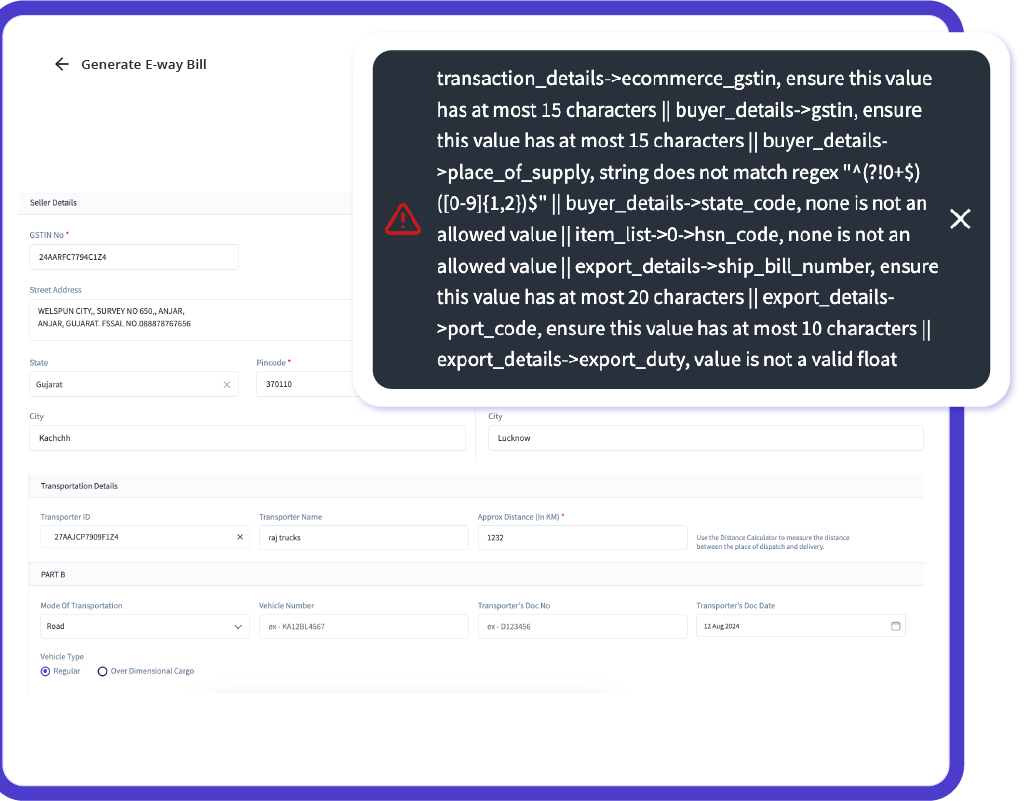

Effortless e-Way Bill Generation with Auto-Validation

Generate flawless e-way bills in just 30 seconds by automatically filling in critical details like GSTIN, vehicle number, and transporter ID. With 25+ smart error checks, you can ensure compliance, avoid costly penalties, and streamline your logistics operations.

Hassle-Free GST and e-Invoicing Integration

Experience flawless integration with GST billing and e-invoicing modules. Effortlessly generate and share e-way bills from your invoices without any manual input, making compliance smoother and more efficient.

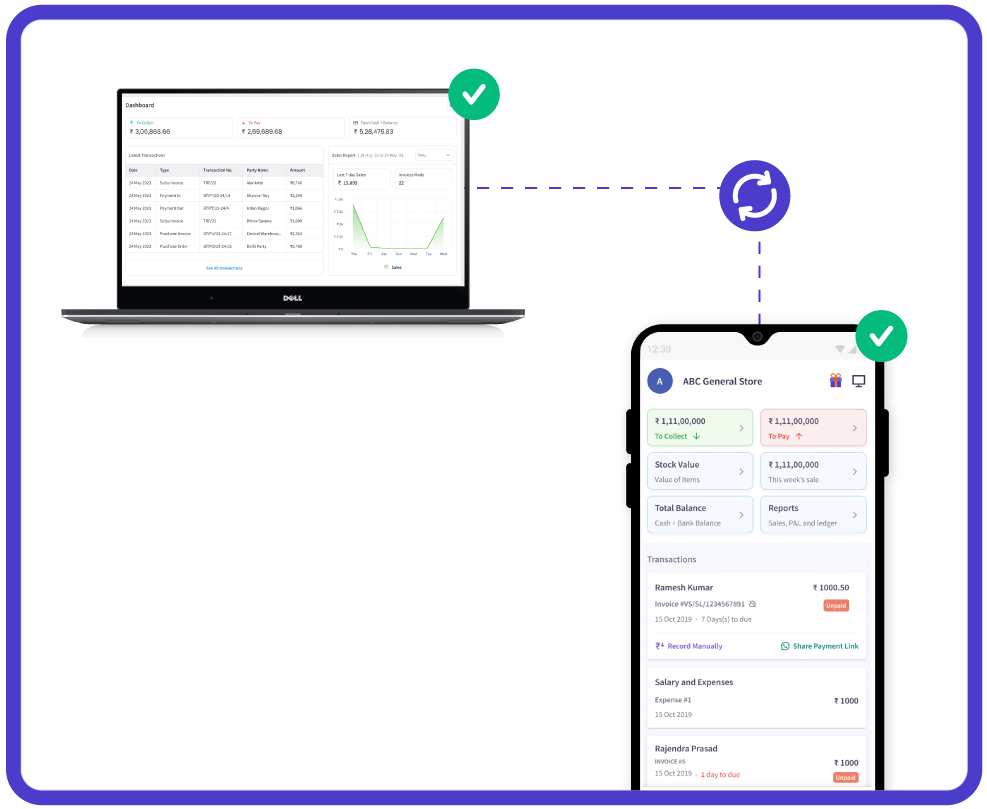

Access Anytime, Anywhere with Multi-Device Support

Securely access your e-way billing transactions from multiple devices (phone, computer, tablet) using myBillBook’s cloud-based platform. Real-time data synchronization ensures your information is always current across all devices.

Trusted by 1 Crore+ businesses for Billing, Inventory, e-Way Billing & e-Invoicing

``Generate e-way bills effortlessly with myBillBook, ensuring GST compliance and simplifying your business operations.``

“Generating e-way bills was a hassle for our logistics team. With myBillBook’s instant e-way bill generation and auto-validation, we now create error-free e-way bills in under 30 seconds. The smart error checks ensure compliance, saving us time and avoiding costly penalties.”

Kavish Pawar

Ajay distributors, Hyderabad

Recommends myBillBook for:

myBillBook helps business succeed

“Integrating GST billing and e-invoicing with e-way bills used to be a challenge. Thanks to myBillBook, we now generate and share e-way bills directly from our invoices without manual steps, streamlining compliance.”

Ravish Rathod,

The Craft Store – Chennai

“Data security is critical for our business, and myBillBook delivers. With bank-grade security and compliance support, our data is protected, and any e-way billing issues are resolved swiftly, keeping us fully compliant.”

Ravi Rao,

Rapid Logistics – Bangalore

“Managing e-way bills on the go is seamless with myBillBook’s cloud-based solution. Whether in the office or traveling, I can access, generate, and share e-way bills securely, ensuring our logistics run smoothly wherever I am.”

Arun Rane,

Speedy Auto Parts – Delhi

Pricing plans

Diamond Plan

₹217

Per month. Billed annually. Excl. GST @18%

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

Platinum Plan

₹250

Per month. Billed annually. Excl. GST @18%

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

Enterprise Plan

₹417

Per month. Billed annually. Excl. GST @18%

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills

FAQs on e-Way Bill Generation Through Mobile SMS

How do I generate my eWay bill from my phone?

To generate an eway bill from your registered mobile number, you need to send an SMS in the below format to 77382 99899.

EWBG TranType RecGSTIN DelPinCode InvNo InvDate TotalValue HSNCode ApprDist Vehicle

Sample SMS: EWBG OSUP 29AABCX0892K1ZK 560012 546 10/06/2024 75000.00 1001 234 KA12AB1234

Go through the above article to get the code details.

Is there an app for eway bill?

Currently, there is no app to generate e-way bill. You can access the e-way bill official website to generate an eway bill or use your registered mobile number to send an SMS to generate an eway bill.

Can I update my vehicle details through SMS, even though my e-way bill has expired?

No. You cannot update the e-way bill details if your e-way bill has crossed the date of expiry.

I missed generating e-way bills and am in a hurry as my vehicle is in transit. How can I fix this?

Even though your vehicle is in transit, you can still generate an e-way bill via SMS.

What are the functions of e-way bill operation via SMS mode?

You can update vehicle details, generate e-way bills, and cancel them through SMS.