Best Accounting Software for e-commerce

Streamline your e-commerce finances with automation and efficiency.

Trusted by 1 Crore+ businesses for Billing, Inventory and Accounting

``myBillBook is designed for businesses to generate accurate GST-compliant invoices and automate their entire accounting process.``

“Managing multiple retail outlets and keeping track of stock movement used to be a nightmare. With myBillBook, we can now monitor sales, manage inventory, and generate reports effortlessly. The software’s real-time data sync has significantly improved our operational efficiency.”

Rajesh S

Ravi Sharma, Retail Business Owner

Recommends myBillBook for:

Product Demo of Accounting Software for e-commerce

“Superb customer service. Helped me set up my account as required”

Key Features of Accounting Software for e-commerce

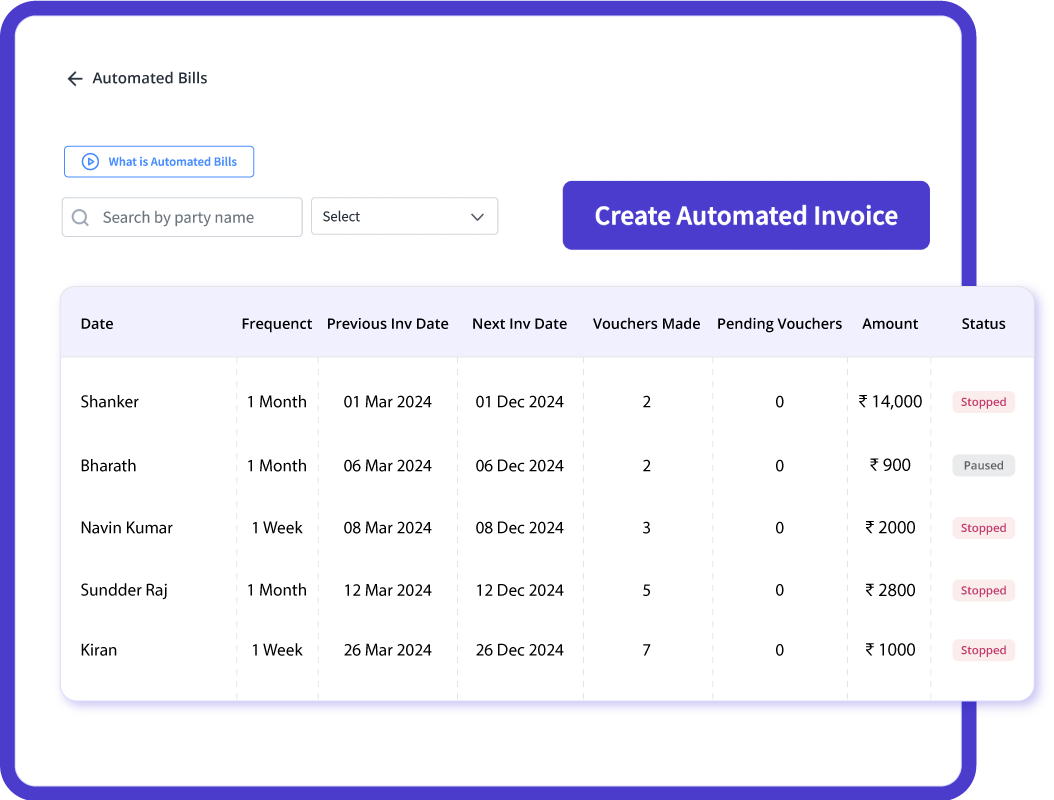

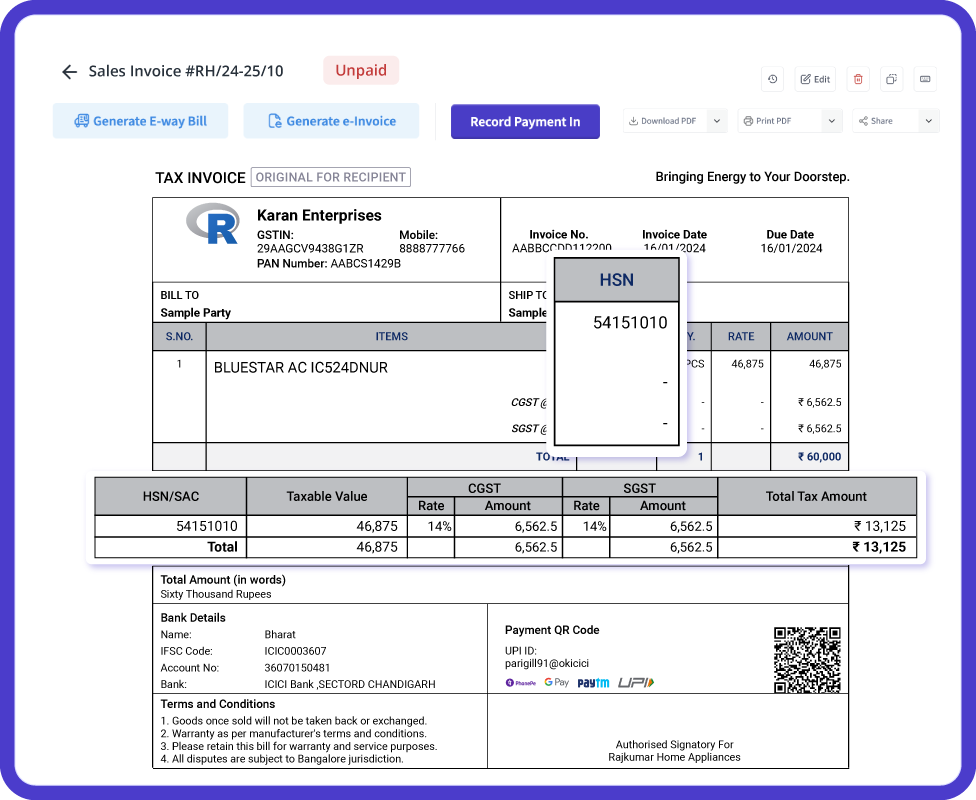

Automated Invoicing and Billing

An efficient e-commerce accounting software automates invoice generation, ensuring compliance with GST and other tax regulations. myBillBook allows businesses to create professional invoices with auto-populated tax details, including GSTIN, HSN/SAC codes, and more.

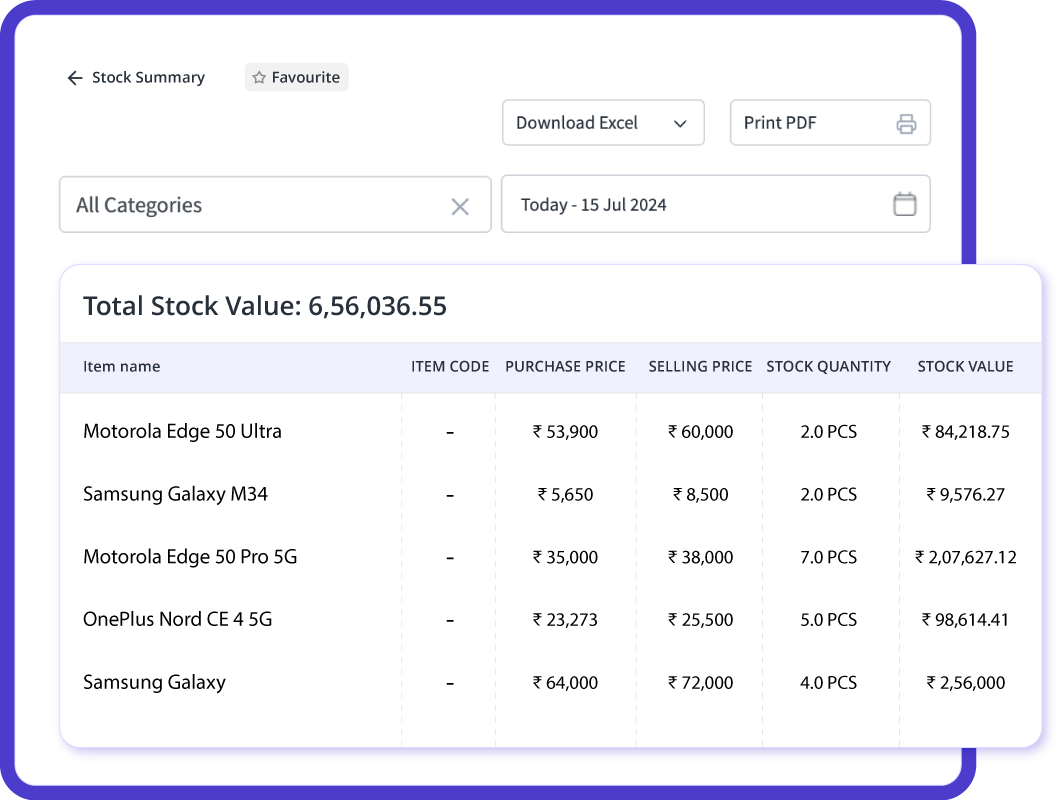

Inventory Management

Effective inventory management is essential for e-commerce businesses. myBillBook integrates inventory tracking with accounting, allowing automated stock updates with each transaction and setting alerts for low stock levels.

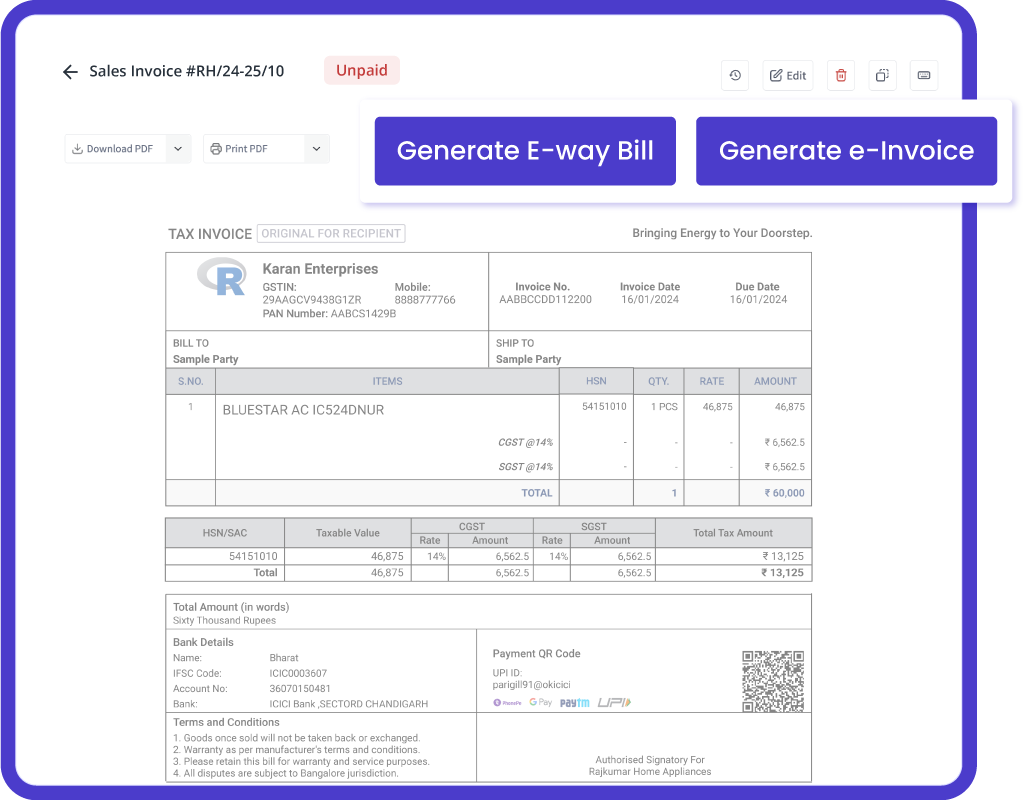

E-invoicing and E-way Billing

For businesses dealing with inter-state transactions, e-invoicing and e-way billing are critical. myBillBook facilitates quick generation of e-way bills and authenticated e-invoices through GSTN for B2B transactions.

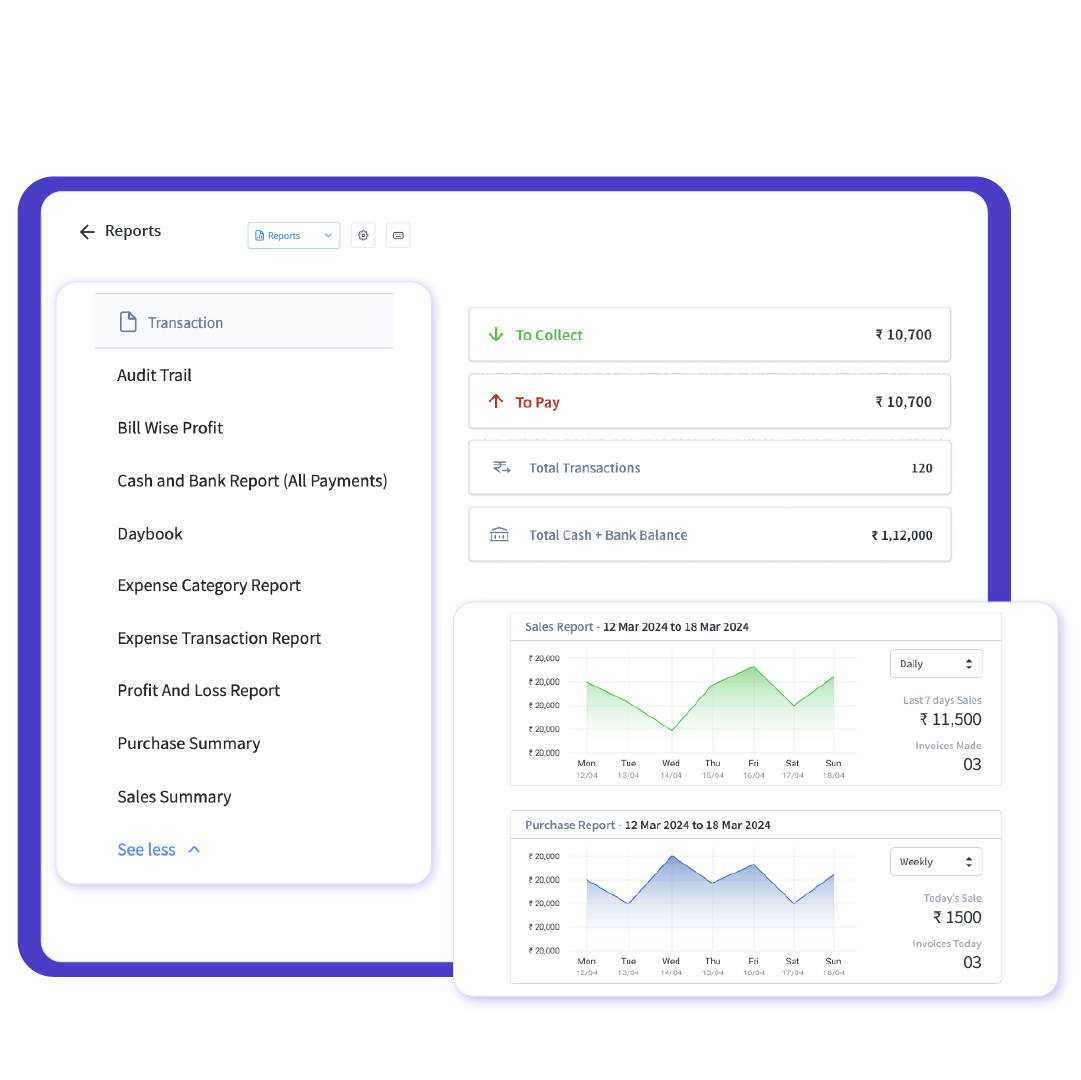

Reports and Analytics

Data-driven decision-making is key to scaling an e-commerce business. With myBillBook, businesses can generate sales reports, profit and loss statements, tax reports, and other financial insights to make informed decisions.

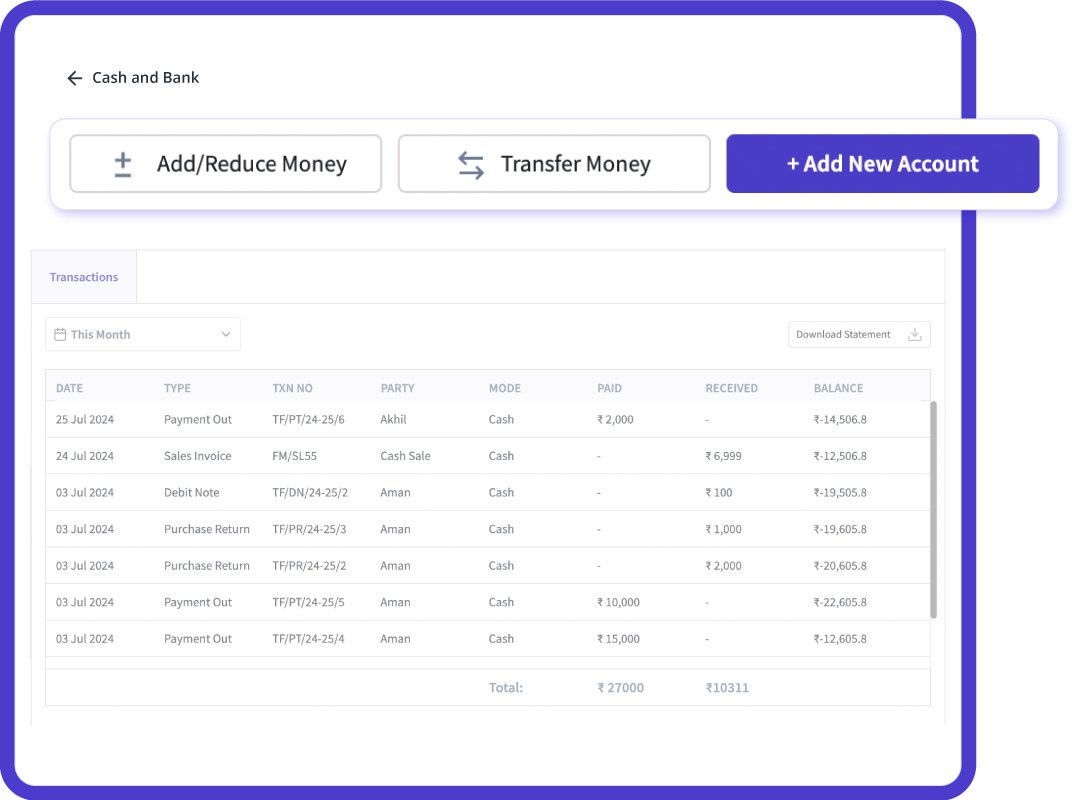

Expense and Payment Management

Managing expenses and tracking payments efficiently is essential. myBillBook helps businesses record payments, manage cash and bank accounts, and track outstanding payments to ensure financial stability.

GST Compliance and Filing

E-commerce businesses need to comply with GST regulations. myBillBook enables easy GST return filing, including GSTR-1 for sales, GSTR-2 for purchases, and GSTR-3B for consolidated returns, ensuring tax compliance with minimal effort.

myBillBook helps Business succeed

“Tracking sales and inventory across different platforms was a challenge for our e-commerce business. myBillBook’s automation features have made invoicing, expense tracking, and tax compliance seamless. Now, we can focus on growing our business without worrying about accounting complexities.”

Prathik Malhotra,

E-commerce Entrepreneur

“Before using myBillBook, we struggled with maintaining accurate financial records and tax compliance. This software has simplified our bookkeeping with automated GST calculations, real-time financial tracking, and easy return filing, saving us valuable time and effort.”

Rajesh Kumar,

Online Store Owner

“As a small manufacturer, staying on top of financial records and GST compliance was a challenge. myBillBook has transformed our accounting process by automating tax calculations, invoice creation, and financial reporting. Now, we can focus on growing our business without worrying about manual errors.”

Neha Verma,

Marketplace Seller

Pricing plans

Diamond Plan

₹217

Per month. Billed annually. Excl. GST @18%

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

Platinum Plan

₹250

Per month. Billed annually. Excl. GST @18%

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

Enterprise Plan

₹417

Per month. Billed annually. Excl. GST @18%

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills

What is Accounting Software for e-commerce?

Accounting software for e-commerce is a digital solution designed to help online businesses manage their finances efficiently. It automates various accounting tasks such as invoicing, expense tracking, tax calculations, and financial reporting. These tools integrate seamlessly with e-commerce platforms, allowing businesses to consolidate sales, track inventory, and comply with tax regulations effortlessly.

Why Do e-commerce Businesses Need Accounting Software?

e-commerce businesses handle a large volume of transactions, multiple sales channels, and complex tax compliance requirements. Using specialized accounting software streamlines financial operations by automating bookkeeping, tracking revenue, and ensuring tax accuracy. It reduces manual errors, saves time, and enhances business efficiency.

Key Considerations When Choosing e-commerce Accounting Software

- Scalability: As your e-commerce business grows, so will the complexity of your financial transactions. Choosing scalable accounting software ensures that it can handle increased sales volume, new product categories, and expanding customer bases without performance issues.

- Integration: Seamless integration with e-commerce platforms, payment gateways, and banking systems is critical for efficient financial management. The right software should automatically sync transactions, update inventory, and reconcile accounts without manual intervention.

- Automation: Automating repetitive accounting tasks like invoicing, tax calculations, and expense tracking reduces human errors and saves time. Look for software that minimizes manual data entry while maintaining financial accuracy.

- User-Friendly Interface: A well-designed interface should allow business owners and accountants to navigate effortlessly, manage transactions, and generate reports with minimal training. Intuitive dashboards and simple workflows enhance efficiency.

- Cloud Accessibility: Cloud-based accounting solutions provide the flexibility to access financial data anytime, anywhere. This feature is especially useful for e-commerce businesses that require real-time financial monitoring and remote collaboration.

Common Challenges in e-commerce Accounting

- Managing Multi-channel Sales: Many e-commerce businesses operate across multiple online marketplaces such as Amazon, Flipkart, Shopify, and their own websites. Consolidating sales data from these platforms into a single accounting system can be complex. Proper accounting software should automate data collection, categorize transactions accurately, and provide a unified view of overall financial performance.

- Tax Compliance: E-commerce businesses must comply with GST regulations, which include handling multiple tax slabs, reverse charge mechanisms, and frequent changes in tax policies. Keeping up with these regulations manually can be tedious and error-prone. Automated tax compliance features in accounting software help generate accurate GST reports, file returns on time, and reduce the risk of penalties.

- Tracking Expenses: E-commerce businesses incur various operational expenses such as shipping fees, warehousing costs, advertising budgets, and payment processing charges. Efficient tracking and categorization of these expenses are crucial for budgeting, profitability analysis, and tax deductions. The right accounting software enables automated expense tracking, reducing manual entry errors and providing insightful financial analysis.

- Handling Refunds & Chargebacks: Returns, refunds, and chargebacks are common in the e-commerce industry but can disrupt financial tracking if not properly managed. Businesses must ensure accurate reconciliation of these transactions to avoid discrepancies in revenue calculations. A robust accounting solution should track refunds, manage chargeback disputes, and reflect accurate financial data in real-time.

How myBillBook Addresses These Challenges

myBillBook provides a comprehensive solution to e-commerce accounting challenges with advanced features that ensure seamless financial management and compliance.

- Automated Tax Compliance: Staying compliant with GST regulations is crucial for e-commerce businesses. myBillBook automates tax calculations, generates GST-compliant invoices, and assists in filing tax returns on time. It also supports e-invoicing, ensuring businesses meet legal requirements without manual effort.

- Multi-platform Integration: Managing financial data across multiple selling platforms can be challenging. myBillBook integrates seamlessly with various e-commerce platforms, consolidating all sales data in one place. This eliminates manual data entry, reduces errors, and provides a unified view of business finances.

- Real-time Expense Tracking: Keeping track of expenses is essential for maintaining profitability. myBillBook helps businesses monitor and categorize expenses in real time, ensuring accurate financial records. The software generates expense reports that help entrepreneurs understand cost trends and optimize spending.

- Seamless Refund Processing: Returns, refunds, and chargebacks can disrupt financial accuracy. myBillBook simplifies refund processing by automatically updating records, reconciling payments, and ensuring that all transactions are properly documented. This reduces discrepancies and ensures smooth financial reporting.

Benefits of Using e-commerce Accounting Software

- Saves Time: Automating repetitive accounting tasks such as invoicing, tax calculations, and financial reporting significantly reduces the time spent on manual bookkeeping. This allows business owners to focus on strategic growth rather than being overwhelmed with administrative tasks.

- Ensures Accuracy: Manual bookkeeping is prone to errors, which can lead to financial discrepancies and compliance issues. E-commerce accounting software ensures accurate calculations, reducing the likelihood of mistakes in financial records, tax filings, and balance sheets.

- Improves Compliance: Staying compliant with evolving GST regulations and other tax laws is crucial for e-commerce businesses. Advanced accounting software helps in generating GST-compliant invoices, tracking tax liabilities, and filing returns on time, minimizing the risk of penalties.

- Enhances Cash Flow Management: Monitoring incoming payments and outgoing expenses in real time helps businesses maintain a healthy cash flow. With accounting software, business owners can track payables and receivables, send automated payment reminders, and optimize financial planning.

- Simplifies Multi-channel Accounting: Selling across multiple platforms like Amazon, Flipkart, and Shopify can make financial tracking complex. E-commerce accounting software consolidates sales data from all platforms, categorizes transactions efficiently, and provides a clear financial overview, simplifying revenue management

How myBillBook Helps e-commerce Businesses

myBillBook accounting software is designed to cater to the needs of e-commerce businesses with its user-friendly interface and powerful automation features. It offers a comprehensive suite of tools that help streamline financial management, ensuring businesses can focus on growth without worrying about accounting complexities.

Real-time Financial Tracking

Keeping track of income and expenses in real-time is crucial for e-commerce businesses. myBillBook provides instant access to financial reports, allowing business owners to monitor cash flow, account payables, and receivables effortlessly. With real-time tracking, entrepreneurs can make informed financial decisions and improve business profitability.

GST-Compliant Invoicing

Tax compliance is a major concern for e-commerce businesses. myBillBook simplifies GST-compliant invoicing by auto-populating essential details like GSTIN, HSN/SAC codes, and tax components. It ensures that businesses generate accurate invoices, reducing the risk of errors and penalties.

Automated Reports and Insights

Analyzing financial performance is essential for business growth. myBillBook generates automated reports, including profit and loss statements, sales summaries, and tax reports, helping businesses track revenue and expenses efficiently. These insights empower entrepreneurs to make data-driven decisions and optimize operations.

Seamless Inventory Management

Managing inventory effectively can be challenging for e-commerce businesses. myBillBook integrates inventory tracking with accounting, ensuring that stock levels are updated automatically with each sale and purchase. The software also provides low-stock alerts, preventing disruptions in supply and helping businesses maintain optimal stock levels.

Multi-platform Integration

Many e-commerce businesses operate on multiple platforms, including Amazon, Flipkart, and Shopify. myBillBook allows seamless integration with these platforms, consolidating financial data in one place. This integration eliminates manual data entry and ensures that all sales transactions are accurately recorded.

Efficient Expense and Payment Management

Tracking expenses and managing payments efficiently is crucial for maintaining financial health. myBillBook enables businesses to record payments, manage cash and bank accounts, and track outstanding dues. It provides detailed payment reports, helping businesses manage vendor payments and customer receipts effectively.

By leveraging myBillBook’s powerful accounting and financial management features, e-commerce entrepreneurs can optimize their business operations, improve cash flow, and ensure tax compliance with ease.

FAQs

1. What is the best accounting software for e-commerce?

The best accounting software for e-commerce depends on business needs, but myBillBook stands out for its automated invoicing, GST compliance, and real-time financial tracking.

2. Can e-commerce accounting software integrate with multiple selling platforms?

Yes, most e-commerce accounting software can integrate with platforms like Amazon, Shopify, and Flipkart to consolidate financial data.

3. How does myBillBook help e-commerce businesses with GST compliance?

myBillBook automates GST invoicing, e-invoicing, and return filing, ensuring accurate tax calculations and timely submissions for multi-platform sales.

4. Is accounting software necessary for small e-commerce businesses?

Yes, even small e-commerce businesses benefit from accounting software as it helps track finances, manage invoices, and stay tax-compliant efficiently.

5. How does myBillBook help e-commerce businesses with inventory management?

myBillBook updates stock levels in real-time with each sale or purchase, provides low-stock alerts, and integrates seamlessly with financial records for efficient inventory tracking.