Who is eligible for e-invoice in GST

You have to follow the process of e-Invoicing process under the following conditions:

- If you have a turnover of INR 100 crores or more (as per the latest update of 1st January 2021) in the previous financial year

- If you issue B2B invoices

- If you supply goods or services to a registered person

Note:

- The following types of citizens are eligible for e-invoices:

- Taxpayers involved under Exports and Deemed Exports

- Suppliers to SEZs

- SEZ Developers who have the defined turnover

- DTA units if they meet all the guidelines.

Who Gets Exemptions From E-invoicing?

The following categories of taxpayers get exemptions from the process of e-invoicing:

- Insurance Companies

- Banking Companies, including financial institutions, including non-banking financial companies (NBFC)

- Goods Transport Agency (GTA) transports goods by road in a goods carriage service.

- Transport service provider agents providing passenger transportation service

- A registered person is providing services of – admission to an exhibition of cinematograph films on multiplex screens.

- SEZ(Special Economic Zone) units

- Free trade and warehousing zones (FTWZ)

Note:

- Currently, the B2C invoices issued by notified persons are outside the provision of e-Invoicing.

- The entry of import bills does not need e-invoicing.

- When notified persons receive supplies:

- From an unregistered person under GST (attracting reverse charge) or through import services, e-invoicing is not applicable.

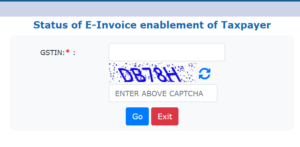

How to Check E-invoicing Eligibility on IRP?

Taxpayers can view the eligibility for a GSTIN on the e-invoice portal with the given steps:

- Firstly, go to https://einvoice1.gst.gov.in/.

- Then, under the ‘Search’ tab, select ‘e-Invoice Status of Taxpayer’.

- Next, enter your ‘GSTIN’ and ‘Captcha’ code, then click on ‘Go’.

- View the submitted details on the IRP.

Note: In case of person needs to register with the e-invoice portal, they first need to register themselves on the portal.