Receipt and Payment Account Format

A Receipt and Payment Account is a summary of all cash and bank transactions of an organisation during a specific period. This document can be prepared in Word, Excel, and PDF formats, but using myBillBook makes the process more efficient and automated.

✅ Quick & Easy Receipt & Payment Account Generation

✅ Customisable Templates

✅ Professional Look

✅ Unlimited Receipts & Payment Documents

✅ Affordable Plans Starting INR 399/Year

Receipt and Payment Account Format in Word, Excel & PDF | Download Free

Features of myBillBook Receipt and Payment Account Format

Automated Calculations

The system automatically calculates totals for receipts and payments, reducing the likelihood of errors and saving time. This feature ensures that financial records remain accurate and consistent without the need for manual intervention.

Customisable Formats

Users can select from a variety of predefined templates or modify them to create a unique layout suited to their specific requirements. This flexibility allows organisations to maintain a consistent format in their financial documentation.

Excel & PDF Export Options

The ability to export documents in both Excel and PDF formats ensures ease of sharing and accessibility. Users can leverage Excel for editing and calculations, while PDFs offer a secure and professional format for reporting and record-keeping.

Cloud Storage

Secure cloud-based storage allows users to save and access receipts and payment accounts from any device, ensuring that data is never lost due to hardware failures or accidental deletions. This also enables remote work and multi-location access.

Multi-User Access

Organizations can grant access to multiple users, facilitating collaboration and improved financial management. This feature is particularly useful for teams handling finances collectively, allowing real-time updates and edits to be made seamlessly.

Affordable & Cost-Effective

With budget-friendly plans starting at INR 399 per year, myBillBook provides professional accounting tools at a fraction of the cost of traditional accounting software. This ensures that businesses and non-profits can maintain high-quality financial records without incurring high expenses.

₹217

Per month. Billed annually

Diamond Plan

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

₹250

Per month. Billed annually

Platinum Plan

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

₹417

Per month. Billed annually

Enterprise Plan

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills Popular

₹399 per year

Silver Plan for Android App

✅ For 1 device, 1 business and 1 user

What is a Receipt and Payment Account?

A Receipt and Payment Account is a summary cash book that records all cash and bank transactions of an entity over a financial period. Unlike an income and expenditure account, it does not show the surplus or deficit but only captures cash inflows and outflows. It is prepared on a cash basis and does not account for outstanding expenses or accrued income.

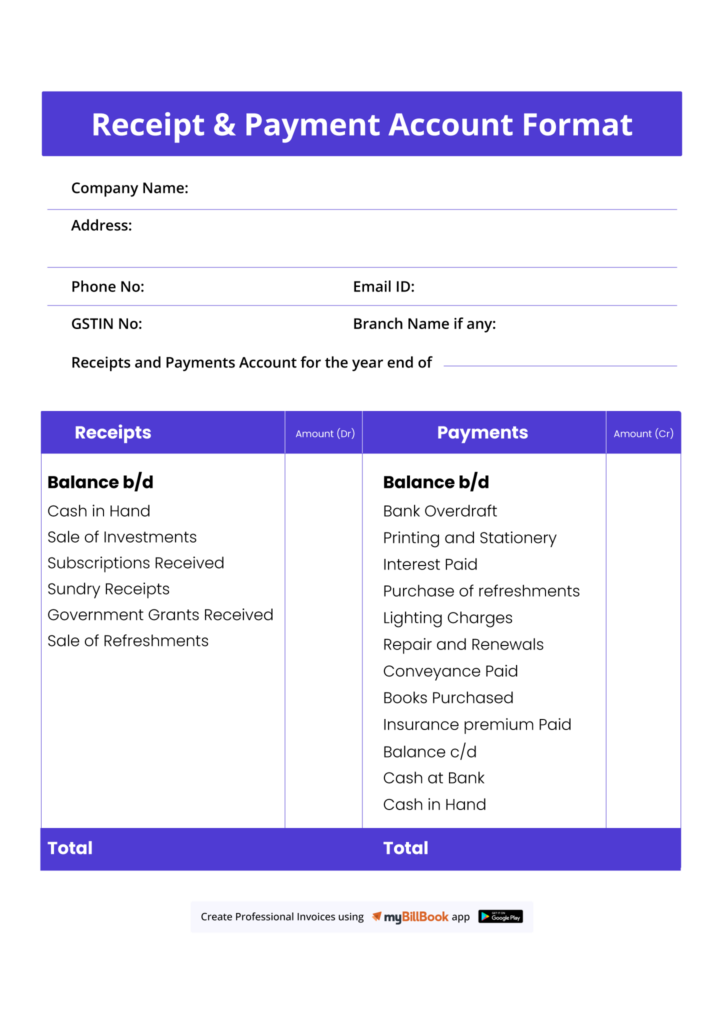

Format of Receipt and Payment Account

The format of a receipt and payment account consists of two columns:

| Receipts (Dr) | Payments (Cr) |

| Opening Cash Balance | Salaries & Wages Paid |

| Subscriptions Received | Rent & Utilities Paid |

| Donations | Purchase of Equipment |

| Interest Received | Office Expenses |

| Sale of Old Assets | Loan Repayment |

| Any Other Income | Closing Cash Balance |

This format provides a clear overview of all cash inflows and outflows in a structured manner.

Key Elements of a Receipt and Payment Account

- Opening Balance – The amount of cash and bank balance at the start of the period.

- Receipts – All cash and bank inflows, including donations, subscriptions, and interest received.

- Payments – All cash and bank outflows, including salaries, rent, and expenses.

- Closing Balance – The remaining cash and bank balance at the end of the period.

- Non-Profit Context – Used mainly by non-profits, clubs, and institutions rather than businesses.

Example of a Receipt and Payment Account

| Receipts | Amount (INR) | Payments | Amount (INR) |

| Opening Balance | 20,000 | Salaries | 5,000 |

| Subscriptions | 15,000 | Rent | 3,000 |

| Donations | 10,000 | Office Expenses | 2,500 |

| Interest Received | 2,000 | Purchase of Equipment | 7,000 |

| Total | 47,000 | Total | 17,500 |

| Closing Balance | 29,500 |

Receipt and Payment Account Format in Excel, Word & PDF

Creating a receipt and payment account can be done in Word, Excel, and PDF, each offering its unique advantages.

Steps to Create in Excel:

- Open Excel and create a table with two columns: Receipts and Payments.

- List down all cash inflows under Receipts and all outflows under Payments.

- Use formulas like =SUM(range) to calculate totals automatically.

- Format the table using borders and bold headings for clarity.

- Save as an Excel sheet or convert it to a PDF for sharing.

Steps to Create in Word:

- Open Word and create a table with two columns: Receipts and Payments.

- Enter all financial transactions, ensuring clear formatting.

- Adjust font styles and table formatting for a professional appearance.

- Save the document and export it as a PDF if needed.

Steps to Create in PDF:

- Use a template or create the receipt and payment account in Word or Excel.

- Convert the document to PDF for easy sharing and secure record-keeping.

- Ensure the document is properly formatted and locked for official use.

Best Practices for Creating and Using Receipt & Payment Accounts

- Record Transactions Regularly – Avoid missing transactions by updating records daily.

- Use Software for Accuracy – Excel helps with calculations, but myBillBook provides automated tracking.

- Categorize Receipts & Payments – Grouping transactions makes financial reporting more transparent.

- Ensure Year-End Reconciliation – Compare the closing balance with actual bank and cash balances.

- Maintain Digital Backups – Storing records in cloud-based platforms ensures easy retrieval and safety.

FAQs

1. What is the main purpose of a Receipt and Payment Account?

It provides a summary of all cash and bank transactions within a financial period, mainly for non-profit organizations and institutions.

2. How does a Receipt and Payment Account differ from an Income and Expenditure Account?

A receipt and payment account records only cash transactions, while an income and expenditure account considers both cash and non-cash transactions, including outstanding liabilities and accrued income.

3. Can a Receipt and Payment Account show a deficit or surplus?

No, it only records receipts and payments without calculating profits or losses.

4. Why is Excel preferred for preparing a Receipt and Payment Account?

Excel provides automated calculations, structured formatting, and easy data modifications, making financial record-keeping more efficient.

5. How can myBillBook simplify Receipt and Payment Account creation?

myBillBook offers automated templates, cloud storage, and multi-user access, making it a more efficient solution than manual preparation in Word or Excel.