When a company purchases goods or services, there may come a time when they need to return them due to various reasons such as damage, wrong item delivered, or overstocking. This process of returning purchased goods or services is known as a purchase return, recorded by a purchase return journal entry. Recording it precisely in the financial statements is essential, and billing software can make this task easier and more accurate.

Understanding Purchase Return Journal Entry

A purchase Return Journal Entry is a type of accounting transaction that records the return of goods to the supplier. It is a crucial aspect of the purchasing process and requires accurate recording to ensure the financial statements reflect the true state of affairs.

Definition of Purchase Return Journal Entry

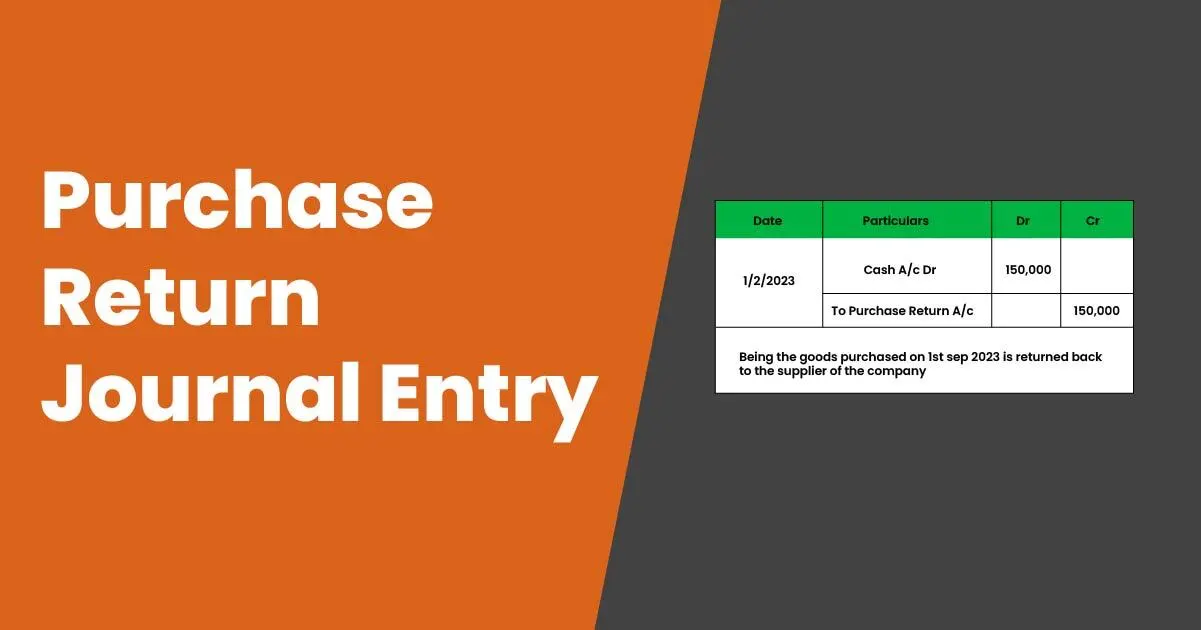

Journal entries for purchase returns are a record of a purchase return transaction. It shows the credit entry to the supplier’s account and the debit entry to the inventory account. This journal entry is essential for maintaining accurate records of purchases and returns.

Importance of Purchase Return Journal Entry

Accurate journal entry for purchases ensures the financial statements reflect the correct inventory levels, accounts payable, and cost of goods sold. It also helps in tracking the purchase returns and keeping a record of the reasons for the return.

What to include in Purchase Return Journal Entry

Purchase return journal entry should include the transaction date, the supplier’s name, the amount of the return, and the reason for the return. It should also have a credit entry to the supplier’s account and a debit entry to the inventory account.

Types of Purchase Return Journal Entry

When recording a purchase return, two types of journal entries can be made: full purchase return and partial purchase return.

Full Purchase Return occurs when the entire purchase is returned to the supplier. In this case, the journal entry will credit the accounts payable account and debit the cash or accounts receivable accounts if the payment was already made.

Partial Purchase Return occurs when only a portion of the purchase is returned. In this case, the journal entry will credit the accounts payable account for the returned amount and debit the inventory account for the number of goods returned.

Steps to Record Purchase Return Journal Entry

- Review the invoice to determine the items being returned and their original cost.

- Identify the accounts involved, including the accounts payable account, inventory account, and cost of goods sold account.

- Create the journal entry by debiting the accounts payable account and crediting the inventory account and cost of goods sold account.

- Include any applicable taxes or fees in the journal entry.

- Double-check the accuracy of the journal entry.

- Post the journal entry to the general ledger to update the company’s financial records.

Importance of Accurate Purchase Return Journal Entry

Avoiding errors in financial statements:

An accurate journal entry for purchases helps avoid errors in financial statements. The financial statements give a clear picture of the company’s financial position, and any errors in the statements can lead to wrong decisions.

Ensuring accurate inventory tracking

An accurate purchase return journal entry helps track inventory levels accurately. This helps avoid overstocking or understocking inventory, which can lead to financial losses.

Maintaining good vendor relationships

Maintaining accurate journal entries for purchase returns helps maintain good vendor relationships. Vendors appreciate businesses that keep accurate returns records, which helps build trust and better relations.

Summarising the significance of purchase return journal entries, the conclusion emphasises the avoidance of errors in financial statements, accurate inventory tracking, and maintaining vendor relationships.

FAQs on Purchase Return Journal Entry

1. When does a Full Purchase Return occur?

A Full Purchase Return occurs when the entire purchase is returned to the supplier, and the journal entry will credit the accounts payable account and debit the cash account or the accounts receivable account if the payment was already made.

2. When does a Partial Purchase Return occur?

A Partial Purchase Return occurs when only a portion of the purchase is returned. The journal entry will credit the accounts payable account for the returned amount and debit the inventory account for the number of goods returned.

3. Why is an accurate purchase return journal entry crucial in maintaining vendor relationships?

Accurate journal entries for purchase return helps maintain good vendor relationships. Vendors appreciate businesses that keep accurate returns records, which helps build trust and better relations.