Depreciation Account Format

A Depreciation Account is essential for tracking the reduction in the value of assets over time. Businesses use this account to record and manage asset depreciation systematically, ensuring compliance with accounting standards. You can create a Depreciation Account in Word, Excel, or PDF formats, but using myBillBook simplifies the process significantly.

✅ Quick & Easy Depreciation Account Generation

✅ Customisable Templates

✅ Professional Look

✅ Unlimited Depreciation Account Formats

✅ Affordable Plans Starting INR 399/Year

Depreciation Account Format in Word, Excel & PDF | Download Free

Features of myBillBook Depreciation Account Format

Pre-Designed Templates

myBillBook provides professionally designed depreciation account templates that can be easily customised to meet specific business needs. These templates follow standard accounting principles and allow users to modify entries as required.

Auto-Calculation

The platform automatically computes depreciation using multiple methods, such as the Straight Line Method (SLM) and the Written Down Value (WDV) Method. This feature eliminates manual errors and ensures accurate financial reporting.

Export & Print Options

Users can conveniently download and print depreciation reports in Word, Excel, or PDF formats. This allows businesses to maintain proper documentation and share reports with auditors, investors, or stakeholders.

Multi-Asset Management

myBillBook enables businesses to track depreciation for multiple fixed assets in one place. Users can categorize assets, apply different depreciation rates, and generate consolidated depreciation reports effortlessly.

Tax & Compliance Ready

The depreciation calculator adheres to industry-specific accounting norms and taxation requirements. It ensures compliance with tax regulations and helps businesses prepare depreciation schedules for tax filings.

Cloud Storage & Accessibility

With cloud-based storage, users can securely store their depreciation records and access them anytime, anywhere. This feature provides flexibility for accountants and business owners who need quick access to financial data.

₹217

Per month. Billed annually

Diamond Plan

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

₹250

Per month. Billed annually

Platinum Plan

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

₹417

Per month. Billed annually

Enterprise Plan

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills Popular

₹399 per year

Silver Plan for Android App

✅ For 1 device, 1 business and 1 user

What is a Depreciation Account?

A Depreciation Account records the gradual decrease in the value of tangible assets over time due to wear and tear, obsolescence, or usage. This account helps businesses allocate asset costs systematically to reflect their declining value in financial statements.

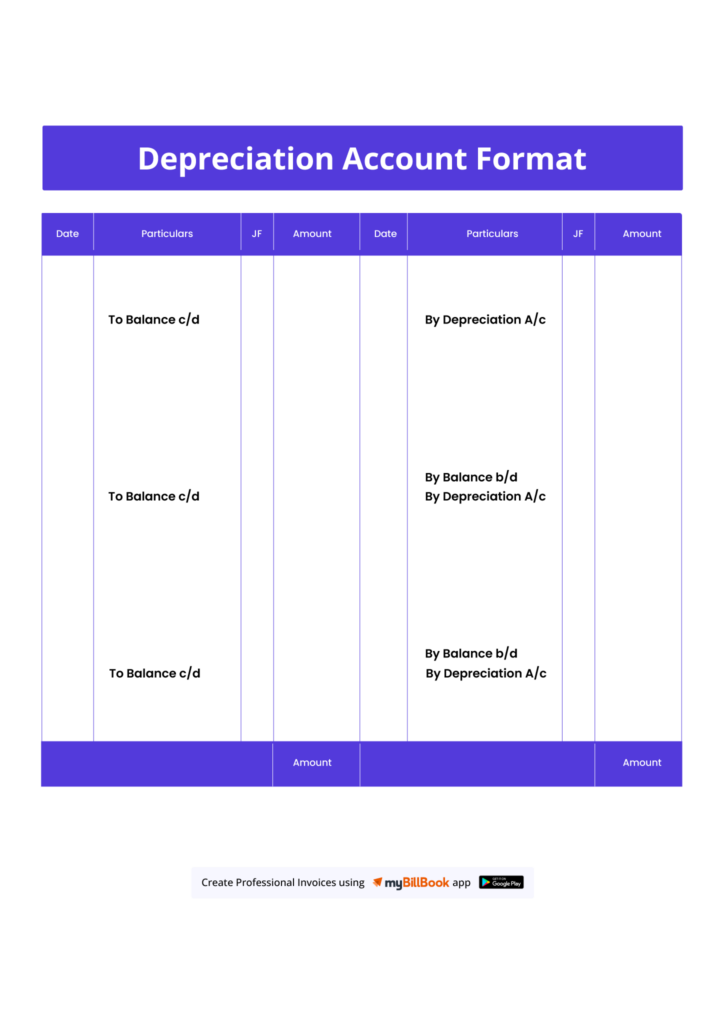

Format of a Depreciation Account

A Depreciation Account typically includes the following elements:

- Date: When depreciation is recorded.

- Particulars: Description of the asset being depreciated.

- Opening Balance: The asset’s value before depreciation.

- Depreciation Amount: The calculated depreciation.

- Closing Balance: The asset’s value after applying depreciation.

Sample Depreciation Account Format

| Date | Particulars | Opening Balance | Depreciation | Closing Balance |

| 01/04/2024 | Machinery | ₹1,00,000 | ₹10,000 | ₹90,000 |

| 01/04/2024 | Furniture | ₹50,000 | ₹5,000 | ₹45,000 |

Depreciation Account Format in Word, Excel & PDF

Word Format:

Using Microsoft Word, you can create a simple table format for recording depreciation entries. You can customize the document by adding formulas for easy calculations.

Excel Format:

Microsoft Excel is ideal for depreciation accounting as it allows for automated calculations. Formulas such as SLN (Straight Line) and DB (Declining Balance) functions can simplify computations.

PDF Format:

Exporting a Word or Excel format to PDF ensures that depreciation records are secure and easily shareable without any modifications.

Key Elements of a Depreciation Account

A well-structured Depreciation Account should include:

- Asset Details: Name, acquisition date, and cost of the asset.

- Depreciation Method: The formula used for depreciation calculation.

- Rate of Depreciation: The applicable depreciation percentage.

- Depreciation Amount: The yearly depreciation value.

- Accumulated Depreciation: The total depreciation recorded over time.

- Net Book Value: The asset’s remaining value after depreciation.

Best Practices for Creating & Using a Depreciation Account

- Choose the Right Depreciation Method: Methods like Straight Lines or Written Down Value affect financial reporting differently.

- Maintain Accurate Records: Keep asset acquisition dates and depreciation entries up to date.

- Automate Calculations: Use Excel formulas or accounting software to reduce errors.

- Ensure Compliance: Align depreciation calculations with tax laws and accounting standards.

- Regular Review: Periodically update depreciation values to reflect asset usage changes.

FAQs

1. What is the purpose of a depreciation account?

A depreciation account helps businesses allocate the cost of an asset over its useful life, ensuring accurate financial statements and tax deductions.

2. Which depreciation methods are commonly used?

The two most common methods are:

- Straight Line Method (SLM): Equal depreciation every year.

- Written Down Value Method (WDV): Depreciation is calculated on the reduced book value annually.

3. Can I generate a depreciation account in Excel?

Yes, Excel provides templates and formulas for automated depreciation calculations. However, tools like myBillBook offer enhanced features with built-in accounting functions.

4. Is depreciation mandatory for all businesses?

Yes, depreciation is a key aspect of financial accounting, and businesses must record it to comply with accounting and tax regulations.

5. How does myBillBook help with depreciation management?

myBillBook automates depreciation calculations, generates customisable reports, and integrates with other financial records, making asset tracking seamless.

By using myBillBook, businesses can efficiently manage depreciation and maintain accurate financial records without manual errors.