Debtors Account Format

A debtors account is a ledger that records all transactions related to customers who owe money to a business. It helps businesses track outstanding payments and manage credit transactions efficiently. You can create a debtors account in Word, Excel, or PDF using a structured format, or use myBillBook for seamless debtor tracking.

✅ Quick & Easy Debtors Account Generation

✅ Customisable Templates

✅ Professional Look

✅ Unlimited Debtors Account Entries

✅ Affordable Plans Starting INR 399/Year

Debtors Account Formats in Word, Excel & PDF | Download Free

Features of myBillBook Debtors Account Format

Automated Debtor Entry Recording

Manually maintaining debtor accounts can be time-consuming and error-prone. myBillBook automates the recording of debtor entries, ensuring accuracy and reducing workload.

Real-Time Due Payment Tracking

With myBillBook, businesses can track due payments in real time. The software alerts users of upcoming or overdue payments, preventing revenue loss and ensuring cash flow stability.

Customisable Account Templates

Every business has different debtor management needs. myBillBook offers flexible templates, allowing businesses to modify columns, add credit terms, and include extra details as required.

Secure Data Storage & Backup

Losing debtor records can disrupt financial management. myBillBook securely stores all debtor accounts on the cloud, ensuring access from anywhere while maintaining backup copies.

One-Click Reports for Outstanding Dues

Analysing outstanding payments is crucial for financial planning. myBillBook generates instant reports that provide insights into overdue payments, customer payment behaviours, and total outstanding balances.

Seamless Integration with Billing & Accounting Software

A debtors account does not function in isolation. myBillBook integrates with invoicing, billing, and accounting systems, ensuring seamless financial tracking and reducing redundancy in data entry.

₹217

Per month. Billed annually

Diamond Plan

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

₹250

Per month. Billed annually

Platinum Plan

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

₹417

Per month. Billed annually

Enterprise Plan

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills Popular

₹399 per year

Silver Plan for Android App

✅ For 1 device, 1 business and 1 user

What is a Debtors Account?

A debtors account is a financial record maintained in a business’s accounting system to track amounts receivable from customers who have purchased goods or services on credit. When a business extends credit to customers, the amount owed is recorded in the debtors account, forming part of the company’s accounts receivable. This account helps businesses monitor outstanding payments, assess customer payment patterns, and manage cash flow efficiently.

In a double-entry accounting system, a sale made on credit is recorded as a debit in the debtors account and a credit in the sales account. When the customer makes a payment, the corresponding amount is credited to the debtors account and debited to the cash or bank account. This ensures a transparent record of all financial transactions.

The debtors account is essential for businesses that offer credit sales, as it allows them to:

- Keep track of pending payments and due dates.

- Assess the financial health of their customers.

- Implement credit policies and follow up on overdue payments.

- Generate debtor reports for better financial planning.

Neglecting debtor account management can lead to cash flow problems and increased bad debts, making it crucial for businesses to regularly update and reconcile their debtors account. Using automated accounting software like myBillBook simplifies this process, reducing manual errors and ensuring smooth debtor tracking.

Difference Between Debtor and Creditor

A debtor is a person or business entity that owes money to another party, usually for goods or services purchased on credit. The amount owed by debtors is recorded under accounts receivable on the balance sheet.

A creditor, on the other hand, is a person or business entity to whom money is owed. This can be a supplier or lender that has provided goods, services, or loans to a company. The amount payable to creditors is recorded under accounts payable in financial statements.

Key Differences:

| Basis of Comparison | Debtor | Creditor |

| Definition | A person or business that owes money | A person or business to whom money is owed |

| Accounting Entry | Recorded as an asset under accounts receivable | Recorded as a liability under accounts payable |

| Role in Business | Customers who have purchased goods/services on credit | Suppliers or lenders who provide goods/services on credit |

| Balance Sheet Position | Current asset | Current liability |

| Nature of Transaction | Amounts to be received | Amounts to be paid |

| Example | A customer who buys goods on credit | A supplier who provides raw materials on credit |

Understanding the difference between debtors and creditors is essential for effective financial management, ensuring businesses maintain a healthy balance between receivables and payables.

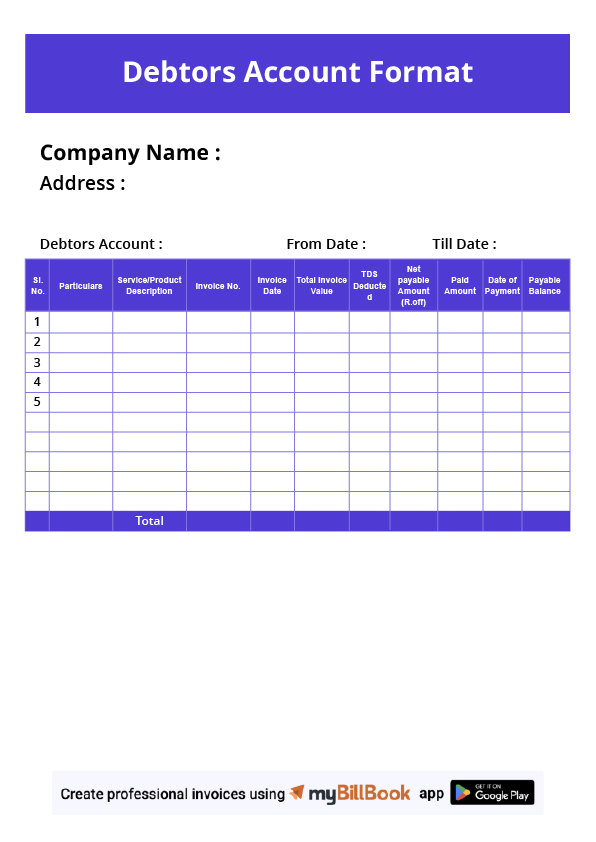

Format of a Debtors Account

A debtor’s account follows a structured format that records all credit transactions made by customers and their corresponding payments. This account helps businesses keep track of unpaid invoices, identify overdue accounts, and manage cash flow efficiently.

A standard debtor account ledger includes the following key columns:

1. Date

This column records the exact date on which a transaction occurs. It is important for tracking payment due dates and maintaining an accurate chronological order of transactions.

2. Particulars

The particulars section provides a brief description of the transaction, such as sales invoices issued, payments received, or adjustments made.

3. Invoice Number

Each transaction is linked to an invoice number, making it easier to cross-reference payments with corresponding sales invoices.

4. Debit (Amount Owed)

Whenever a credit sale is made, the amount owed by the customer is recorded in the debit column. This represents the receivable amount.

5. Credit (Amount Paid)

When a debtor makes a payment, the amount is recorded in the credit column, reducing the outstanding balance.

6. Balance

The balance column reflects the total outstanding amount the customer still owes after each transaction is recorded. It provides an up-to-date view of the customer’s credit status.

Here’s an example of how a debtors account format appears in a ledger:

| Date | Particulars | Invoice No. | Debit (Amount Owed) | Credit (Amount Paid) | Balance |

| 01/03/2024 | Opening Balance | – | 10,000 | – | 10,000 |

| 05/03/2024 | Sale to XYZ Ltd. | INV-101 | 5,000 | – | 15,000 |

| 10/03/2024 | Payment Received | INV-101 | – | 5,000 | 10,000 |

| 15/03/2024 | Sale to ABC Traders | INV-102 | 8,000 | – | 18,000 |

| 20/03/2024 | Payment Received | INV-102 | – | 4,000 | 14,000 |

A well-maintained debtors account ensures businesses can track overdue payments, send timely reminders, and maintain a healthy cash flow.

Debtors Account Format in Word, Excel & PDF

Word Format

A debtors account in Word is structured as a table with columns for date, invoice details, debit, credit, and balance. Word allows for easy manual customization, making it suitable for businesses that prefer simple record-keeping. Formatting options such as borders, colours, and shading help enhance readability and presentation. Businesses can use templates to maintain consistency in documentation and easily update transaction details when required.

Excel Format

Excel provides a more dynamic approach to managing debtor accounts by supporting automated calculations. With built-in formulas like SUM(), IF(), and VLOOKUP(), businesses can automate outstanding balance calculations and generate financial summaries. Excel also enables businesses to create pivot tables and charts for better financial analysis. It is ideal for organizations that require real-time tracking of payments, overdue balances, and trend analysis to improve their credit policies.

PDF Format

A debtors account in PDF format ensures a professional and non-editable financial record that can be shared with clients and stakeholders. PDFs provide a secure and tamper-proof way of maintaining financial documents, making them ideal for sending official debtor statements and reports. Businesses can generate PDFs from Word or Excel files, ensuring that financial documents remain structured and unaltered. This format is widely used for final reports, client records, and compliance documentation.

Key Elements of a Debtors Account

- Customer Name & Details – The debtor’s name, contact details, and any relevant identification for easy reference.

- Invoice Number & Date – The unique identifier for each credit transaction and its corresponding date.

- Amount Owed – The total outstanding balance that the debtor must pay.

- Payment Terms – Agreed-upon credit period, due dates, and any penalties for late payments.

- Transactions History – A chronological record of invoices issued, payments received, and outstanding balances.

- Balance Due – The final amount payable after considering all transactions and adjustments.

- Notes/Remarks – Additional comments such as payment follow-ups, disputes, or special conditions.

Best Practices for Creating & Using a Debtors Account

1. Maintain Regular Updates

Updating the debtors account frequently ensures that all transactions, including sales, payments, and adjustments, are recorded accurately. This helps prevent errors, missing payments, or outdated balances.

2. Set Automated Payment Reminders

Automated tools like myBillBook allow businesses to send timely payment reminders to customers. This reduces overdue payments and enhances cash flow management.

3. Reconcile Periodically

Regular reconciliation of the debtors account with bank statements and other financial records helps identify discrepancies and prevents financial mismanagement.

4. Follow Up on Overdue Payments

Establish a structured process for following up on overdue payments. Sending reminder emails, making phone calls, or implementing penalties for late payments can encourage timely settlements.

5. Use Digital Accounting Tools

Leveraging accounting software like myBillBook simplifies debtor management by automating data entry, generating reports, and providing real-time financial insights. This reduces human errors and improves efficiency.

6. Establish Clear Credit Policies

Defining credit terms, setting payment deadlines, and performing creditworthiness checks on customers help mitigate risks associated with bad debts and ensure smooth financial transactions

FAQs

What is the purpose of a debtors account?

A debtors account is used to track outstanding amounts that customers owe to a business, ensuring timely collection and proper financial management.

How is a debtors account different from a creditors account?

A debtors account records amounts receivable from customers, while a creditors account tracks amounts payable to suppliers.

Can a debtors account be automated?

Yes, accounting software like myBillBook automates debtor tracking, payment reminders, and report generation to streamline the process.

What happens if a debtor fails to pay?

If a debtor fails to pay, businesses may charge penalties, send legal notices, or write off the debt as a bad debt if recovery is unlikely.

How frequently should a debtor’s account be updated?

It is best to update a debtors account daily or weekly to ensure accuracy and effective credit management.

Know More About Accounting & Billing Formats