Donation Receipt Format

A donation receipt is a document that serves as proof of a charitable contribution made by an individual or organisation. It is used for tax purposes and helps track donations to a charity or non-profit organisation. The donation receipt format outlines the essential information that must be included in the receipt to make it legally valid.

Donation Receipt Format

A donation receipt format is a standardised template used by charities and non-profits to document donations. A standard receipt format for donation includes a statement acknowledging the gift and a charity representative’s signature.

Additionally, when making a donation and utilising an 80g donation receipt format, it’s important to note that under the Income Tax Act, deductions on donations made through Section 80G are limited to 10% of the taxpayer’s Adjusted Gross Total Income.

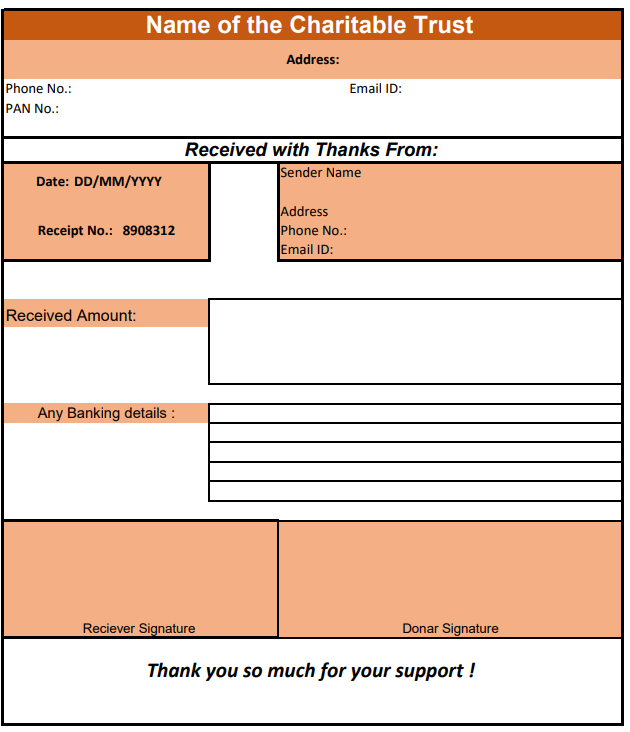

Sample Donation Receipt Format

A sample donation receipt format is attached below. It can help you understand the information that must be included in a donation receipt.

Also Check : Billing Software for NGOs & Charities

Donation Receipt Format: Details to be Included

When creating a donation receipt, it’s essential to include all the necessary donation receipt format details to make it valid. The receipt format for donation requirements is as follows:

- Donor Information: The name, address, and phone number of the donor

- Date of Donation: The date on which you donated

- Description of the Donation: A description of the type of donation (monetary or non-monetary)

- Value of the Donation: The value of the donation in monetary terms

- Charity Information: The name, address, and tax ID number of the charity

- Gift: A statement confirming that the donation is a gift and not a purchase or exchange

- Signature of a Representative from the Charity: The signature of a representative from the charity to acknowledge the receipt of the donation

Donation Receipt Format in Excel

A donation receipt in Excel format is a good choice for organisations that need to keep track of multiple donations. Excel format allows the organisation to create a spreadsheet that can be quickly sorted and filtered, making it easier to manage numerous donations.

Donation Receipt Format in PDF

A donation receipt in PDF format is popular because it is easy to create, share, and store. PDF format is also accessible to print, which makes it a good choice for organisations that need to create a physical copy of the receipt.

Donation Receipt Format in Word

A donation receipt in Word format is a good choice for organisations that need to change the receipt after it has been created. Word format is also easy to share, making it a good choice for organisations that need to send the receipt to the donor.

FAQs about Donation Receipt Format

There is no specific receipt format for donation receipts. Still, it should include all the necessary information for the donor to claim a tax deduction and for the charity to keep a record of the donation. Most non-profit organisations provide a non-profit receipt format for donations. If a donor does not receive a receipt for their donation, they should request one from the charity. In most countries, a donation receipt is not required by law. Still, you must use a donation receipt as it serves as proof of the donation for tax purposes. Deductions on donations made to eligible relief funds and charitable organisations are permitted under Section 80G of the Income Tax Act. Individuals, businesses, and other entities can claim this deduction. Including the charity's tax ID number on a donation receipt is necessary. This information helps the donor claim a tax deduction for the donation. A charity should record donation receipts for at least seven years so that the donor or the tax authorities can see the donation receipt for verification purposes.Is it necessary for a donation receipt to be in a specific format?

Do all non-profit organisations provide donation receipts?

Does the law require a donation receipt?

What are the benefits of using an 80G donation receipt format for tax purposes?

Is it necessary to include the charity's tax ID number on a donation receipt?

How long should a charity keep a record of donation receipts?