GSTR 1 : Filing, Eligibility, Late fees & Penalty

GSTR 1 filing is a thorough process that necessitates careful consideration on the taxpayer’s part when providing invoice information and other tax-related details.

What is GSTR 1?

GSTR-1 refers to the monthly or quarterly reports of outgoing supplies of goods and services by GST-registered taxpayers. You can file GSTR1 in a quarter or at the end of the year based on the following:

- Quarterly- if annual turnover is up to 1.5 crores

- Monthly if you have an annual turnover of over 1.5 crores.

These are the 13 sections or tables of GSTR-1 return filing.

- 1, 2 and 3: includes GSTIN, legal and trade name, and aggregate turnover in the financial year

- 4: includes taxable outward supplies to registered persons (including UIN-holders) excluding zero-rated stores & deemed exports

- 5: includes taxable outward inter-state supplies to unregistered persons whose invoice value is more than Rs. 2.5 lakh

- 6: includes zero-rated supplies as well as deemed exports

- 7: includes taxable supplies to unregistered persons other than the supplies covered in table 5 (net of debit notes and credit notes)

- 8: includes outward supplies, which are nil rated, exempted and non-GST in nature

- 9: includes amendments to outward supplies that are taxable and reported in tables 4,5 & 6 of the earlier tax periods’ GSTR-1 return

- 10: includes debit notes and credit notes issued to unregistered persons

- 11: includes details of advances received or adjusted in the current tax period or the earlier amendments of the information reported.

- 12: includes outward supplies summary based on HSN codes

- 13: Documents issued during the period

You don’t need the trader to pay tax instantly for GSTR-1 filing. It becomes due after filing GSTR 3B. Furthermore, the 13 sections in the GSTR-1 process are not mandatory for all businesses.

Eligibility for GSTR-1 Filing

According to the GST rule, every registered business or individual must file GSTR 1 even if they make transactions during the period. These are the registered persons who need not file GSTR-1:

- OIDAR Suppliers or (Online information and database access or retrieval services)

- Input Service Distributors

- Non-resident taxable person

- Composition Dealers

- Taxpayer liable for collecting TCS

- Taxpayer liable to deduct TDS

Documents Required for Filing GSTR-1

You must provide the following documents for submitting GSTR-1:

- Goods and Services Tax Identification Number that is current (GSTIN)

- A current certified digital signature (not applicable if you wish to e-sign using Aadhaar)

- An aadhaar number is required if electronically signing the form.

GSTR 1 Filing Process

Pre-requisites for Filing GSTR 1

Here are the pre-requisites:

- You must be a taxpayer registered under the GST regime.

- You should have the 15-digit government-assigned GSTIN.

- You should maintain detailed invoices with unique serial numbers for every sale/purchase transaction. In addition, GSTR 1 consists of any exempted supplies or stock transfers across different addresses.

- You can file returns through DSC (Digital Signature Certificate), EVC (Electronic Verification Code), or Aadhar-based e-sign.

Step-by-step guide to file GSTR 1 on the GST Portal

Step 1: Locate GSTR 1 on the GST Portal

- Use your credentials to log in to the GST Portal.

- On the top menu, select Services > Returns > Returns Dashboard.

You will be directed to the Return filing page. Enter the financial year and month. Press the Search button.

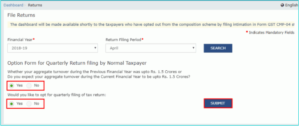

Step 2: Select the quarterly or monthly option form

On the screen, you will find the following text – ‘Option form for quarterly return filing by normal taxpayer page.’

It will be followed by the following question – “Whether your aggregate turnover during the Previous Financial Year was up to Rs. 1.5 Crores or Do you expect your aggregate turnover during the Current Financial Year to be up to Rs. 1.5 Crores?“

There could be two different cases for the above question.

Case I: If your answer to the first question is ‘yes’, select the option Yes.

- If your answer to “would you like to opt for quarterly filing of tax return,” is yes, select Yes again.

- Press the Submit button.

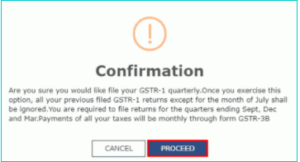

- A message will confirm the quarterly filing option. Press on Proceed.

- This will be followed by a pop-up that will display a success message.

2. If your answer to “would you like to opt for quarterly filing of tax return,” is no, select No.

- Press the Submit button.

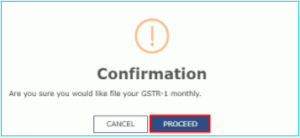

- A message will confirm the monthly filing option. Press on Proceed.

- This will be followed by a pop-up displaying a success message.

Case II: If your answer for the first question is ‘no,’ select the option No.

- Press the Submit button.

- Press on Proceed.

In case you would like to edit the return filing frequency, press on the Edit button, change the preference as applicable, and press on Submit. A confirmation message will be displayed on the screen.

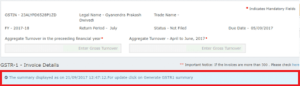

Step 3: Prepare return online

You can either prepare the return online or offline. We’ll be exploring the online procedure of filing returns. Press Prepare Online.

You will be directed to enter the following details regarding the outward supplies of goods or services: 1. Aggregate turnover in the preceding financial year 2. Aggregate turnover – April to June 2021.

Step 4: Edit e-invoice data

- Select the eligible e-invoicing entities to edit as applicable. You can’t cancel an e-invoice after 24 hours of the e-invoice being issued. There is no option for amendment either.

Step 5: Fill up all the details on the current tax period

The following invoice details are required (as applicable):

- 4A, 4B, 4C, 6B, 6C – B2B Invoices

- 5A, 5B – B2C (Large) Invoices

- 9B – Credit / Debit Notes (Registered)

- 9B – Credit / Debit Notes (Unregistered)

- 6A – Exports Invoices

- 9A- Amended B2B invoice

- 9A- Amended B2C large invoice

- 9A- Amended Export invoices

- 9C- Amended Credit/Debit Notes (Registered)

- 9C- Amended Credit/Debit Note (Unregistered)

Here are some of the other details required:

- 7- B2C Others

- 8A, 8B, 8C, 8D – Nil Rated Supplies

- 11A(1), 11A(2) – Tax Liability (Advances Received)

- 11B(1), 11B(2) – Adjustment of Advances

- 12 – HSN-wise-summary of outward supplies

- 13 – Documents Issued during the tax period

- 11A – Amended tax liability (Advance received)

- 11B Amended of Adjustment of Advances

- 10- Amended B2C (Others)

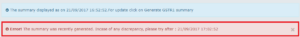

Step 6: Generate the GSTR 1 summary

Once the above details are entered successfully, go to the bottom of the page, you will find a tab ‘Generate GSTR 1 summary’ as shown below:

This will initiate the process of generating summary. It will only take a minute.

On successful generation, a message will be displayed indicating the time and date of generating the summary.

The portal will generate a summary every 30 minutes. You can view it instantly by pressing the Generate GSTR1 Summary button. Wait 10 minutes to view the summary otherwise, it will display an error message.

Step 7: Preview the summary

Press on the Preview button to view the summary. You can review the draft summary and check the various sections before you submit the GSTR-1 application.

Step 8: Submit the GSTR 1

- Click on the declaration checkbox to confirm that you have reviewed the information, and acknowledge that no changes can be made once the return is submitted.

- Following this, press the Submit button.

- Press on Proceed to acknowledge the pop-up message.

- The Submit button will change to Submitted.

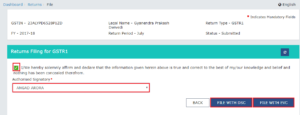

Step 9: File GSTR 1 through DSC or EVC mode

- Press on the File Return button.

- You will be directed to the following window:

- Press on File with DSC or File with EVC accordingly:

- The DSC mode indicates a digital signature.

- The EVC mode indicates an authorised signatory that would require you to enter the OTP sent to your mobile number and email address.

Step 10: Success message and Acknowledgement reference

A success message is displayed on the screen along with an ARN (Acknowledgment Reference Number). A confirmation message will be sent to your registered mobile number and email address. On the dashboard, you can check the status of the return changed to FILED.

In case any step in the filing process confuses you, do not hesitate to contact a GST Practitioner. In the meanwhile, make sure you follow streamlined invoicing and documentation practices while running your business.

How to View GSTR-1 Filing Status?

Visit www.gst.gov.in to access the common portal. On this login page, provide your legitimate credentials. Next, move the pointer over, click on Service, choose Returns, and finally click on Track Return Status.

What is the Due Date for Filing Your GSTR 1?

Businesses with annual sales of up to Rs. 5 crores may file quarterly returns under the QRMP scheme, which are due by the 13th day of the month after the applicable quarter.

If your business turnover exceeds Rs. 5 crore, the due date is as follows:

| For month/ quarter | Due Date |

| Oct 2021 | 11th Nov 2021 |

| Nov 2021 | 11th Nov 2021 |

| Dec 2021 | 11th Jan 2022 |

| Jan 2022 | 26th Feb 2022 |

| Feb 2022 | 11th Mar 2022 |

| Mar 2022 | 11th Apr 2022 |

If your business turnover is up to Rs. 5 crore, the due date is as follows:

| For month/ quarter | Due Date |

| Oct-Dec 2021 | 13th Jan 2022 |

| Jan-Mar 2022 | 13th Jan 2022 |

Penalty and Late fees

As per the GST law and recent notifications, the late fee for filing GSTR 1 is now Rs. 50 per day. In the case of nil returns, the late fee is Rs. 20. Penalty on taxpayers comes into effect after the due date has passed.

Before this, the late fee was Rs. 200 per day after the due date (i.e. Rs. 100 per the CGST Act and Rs. 100 as per the SGST Act).

Latest Updates on GSTR 1 Filing

As per the 42nd GST Council Meeting, the following updates are applicable:

- Small businesses with an annual turnover of up to 5 crores are eligible to file quarterly GSTR-1 and GSTR-3B. The due date for GSTR-1 return filing will be every 13th of the month following the end of the current quarter. However, you can submit invoices monthly from January 1, 2021.

- Effective January 1, 2021, a roadmap for auto-generating GSTR-3B from GSTR-1 will be available.

- Starting from January 1, 2021, monthly filers will have the facility of the auto-population of ITC from suppliers’ GSTR 1 as per the new GSTR 2B form for quarterly taxpayers from 1 April 2021.

- Effective April 1, 2021, Form GSTR-1 filing is compulsory before GSTR-3B to enable the auto-population of tax liability and ITC. However, until March 31, 2021, the previous GSTR-1 and GSTR-3B filing systems will hold.

- Taxpayers can use auto-generated challan to pay 35% of the net cash tax liability incurred in the previous quarter in the current quarter’s first two months.

- GSTR-1 and e-way bills are subject to blockage on the non-filing of GSTR-3B.

FAQs

I’ve made an error in my GSTR-1 filing. How can I correct it?

You cannot rectify any errors in GSTR-1 after it has been filed. However, any mistakes can be corrected in the returns of the subsequent month. To cite an example, a filing mistake in April GSTR-1 can be modified in May GSTR-1.

What is the difference between GSTR-1 and GSTR-2?

GSTR-1 is the monthly or quarterly filing of outward supplies of goods or services. GSTR-2, on the other hand, refers to the purchase details for a month or the inward supplies collected in the prior month.

My business doesn’t have an official email address yet. Can I provide an email address temporarily and update it with the correct one later?

Yes, you can.

Where can I find my Ward/Circle/Sector Number?

The information will be available on your state website. You can also seek a GST Practitioner’s assistance or consult a jurisdictional officer.

How can I save my registration application?

New registration applications are saved on the GST portal for 15 days after the Transaction Reference Number (TRN) is generated. Fill in the required details and press SAVE & CONTINUE below.

Is GST registration free?

Yes, GST registration is free of cost. However, if you are availing of the services of a GST Practitioner, you will be charged a professional fee.

Who is a GST Practitioner?

GST Practitioners prepare returns and other tax-related filings on behalf of taxpayers based on the details provided by them. GST practitioners are usually CMA, CS and CS professionals, or advocates, among other graduates, who also represent taxpayers before tax authorities.

Do I have to register as a GST practitioner to file my client’s tax returns?

Yes, it is recommended for GST Practitioners to register at the GST Portal.

Is GSTR 1 a yearly return?

No. GSTR-1 is a monthly or quarterly return that should be filed by every registered GST taxpayer, except for a few, as given in other sections. It contains details of all outward supplies, i.e. sales.

What happens if you do not file GSTR 1?

If you do not file GSTR 1 on time, your supplier cannot get the ITC. Likewise, if you do not file GSTR 3B of the previous period, you cannot file GSTR 1. If you have declared more tax liability in your GSTR 1, you have no choice but to pay this additional liability.

What is GSTR 1 maximum late fee?

The original late fee was Rs. 100 per day under each CGST Act and respective SGST/ UTGST Act.

The maximum late fee levied if GSTR-1 and GSTR-3B are not filed shall not exceed Rs. 500 per return.

Other than nil filing, the maximum late fee for GSTR-1 and GSTR-3B is set based on an annual turnover slab as follows:

A late fee of no more than Rs. 2,000 per return can only be assessed if the annual turnover in the prior fiscal year was up to Rs. 1.5 crore.

If the turnover is between Rs. 1.5 billion and Rs. 5 billion, only the maximum late fee of Rs. 5,000 per return may be assessed.

A maximum late cost of Rs. 10,000 (i.e., Rs. 5000 for each CGST and SGST) may be assessed if the turnover exceeds Rs. 5 crores.

Should I make a GST payment after filing GSTR-1?

GSTR-1 is a return where you file details of sales with the government. Hence, there is no need to pay tax after filing this return. However, you have to pay the tax due while filing GSTR-3B.

What is the turnover limit for GSTR-1?

1.5 crores annually. The GSTR 1 form is a return form for the regular taxpayers who have to file details of outward supplies every 11th of next month for those who cross the turnover of more than 1.5 crores annually.

I made an error while filing my GSTR-1. Can I correct it?

The GSTR-1 process is the monthly or quarterly filing of outward supplies of goods or services. In contrast, GSTR-2 is the collection of the purchase details or the inward supplies for a month.

My business has no official email address yet. Can I use a temporary email address and update it later?

Yes. You can update it later.

Where do I find my Ward/Circle/Sector Number?

You can either find it on your state website, seek a GST Practitioner’s assistance, or consult a jurisdictional officer.

How can I save my registration application?

You can save your new registration applications on the GST portal for 15 days after generating the Transaction Reference Number (TRN). Then, fill in the required details and press SAVE & CONTINUE below.

Is the GST registration process free?

Yes. The process is free. However, you will have to pay a professional fee if you are a GST Practitioner.