Unblocking an eway bill is crucial to continue transporting goods from the seller to the buyer. A blocked GSTIN or a blocked eway bill service would negatively impact any business if not taken care of immediately.

This page discusses what eway bill blocking is, the reasons why an eway bill is blocked, different ways to unblock an eway bill, the effects of eway bill blocking on the taxpayer, and other relevant topics.

What is eWay Bill Blocking?

Blocking an eway bill means not allowing the registered person or the transporter to generate an eway bill on a specific GSTIN.

The e-way bill system has launched a new feature that blocks/unblocks a taxpayer’s GSTIN. A GSTIN or GST number can be blocked for various reasons, and once blocked, no eway bill can be generated on the GST number. None of the eway bill end users, including the consignee, consignor, or transporter, can generate an eway bill on that GSTIN.

Why is eWay Bill Generation Blocked?

eWay bill generation is blocked, or a GSTIN is blocked only when a taxpayer fails to file a GSTR-3B return or Statement in FORM CMP-08 for the last two successive months.

There will be a standstill if a taxpayer fails to file GSTR-3B for two or more consecutive months since they cannot create e-way bills to dispatch and receive goods. The e-way bill generation will not be unblocked until a taxpayer files GSTR-3B.

For instance, taxpayers’ GSTIN will be barred from the e-way bill site starting in March if they haven’t submitted their GSTR-3B for January and February. The primary goal behind this blocking/unblocking is to find the non-filers of GST returns and bring them into compliance.

Identifying a Blocked eWay Bill

The taxpayer whose GSTIN is blocked for eway bill generation will be notified about the same on the registered mobile number.

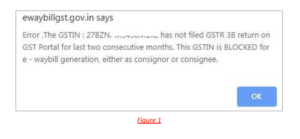

When trying to generate an eway bill, if the user sees the following pop-up error message, it indicates that the eway billing is blocked for the user.

How to Unblock e-Way Bill?

1.File GSTR-3B Returns to Unblock e-Way Bill

Unblock eway bill generation by filing GSTR-3B returns for the defaulting period. Once the returns are filed on the GST common portal, the eway bill will be unblocked within a day. Users can start generating an e-way bill from the following day.

2.Unblock eWay Bill Immediately

While the first method takes atleast 12-24 hours to unblock an eway bill, users who wish to unblock an eway bill immediately after filing GSTR-3B returns can follow the below process.

- Visit eway bill official website at https://ewaybillgst.gov.in/

- From the main menu, go to the ‘Search’ option.

- Select the ‘Update Block Status’ option.

- Enter the blocked ‘GSTIN’ in the field

- Enter the captcha and click on ‘Go.’

- The GSTIN and the blocked status will appear.

- Click on the ‘Update Unblock Status From GST Common Portal’ Button

This will fetch the GST filing information from the GST portal, and if the returns are filed accurately, the same status will be updated in the eway bill system.

If none of these helps, a taxpayer can contact the GST Help Desk to unblock the eway bill.

3.Unblock eWay Bill through the online application

If GSTR-3B was not filed for a valid reason, EWB-05 might be filed instead. Such a request cannot be denied without a reasonable chance to be heard.

Here’s how you can do that:

- Enter your login information into the GST portal.

- Go to Services > User Services > My Applications on the dashboard.

- The ‘My Applications’ page appears. From the drop-down selection in the “Application Type” field, choose “Application for unblocking e-way bill.” Select the “New Application” button.

- Make your selection for the “Expected date for submission of returns of the default periods.”

- From the drop-down option, choose “Reason of Unblocking by Taxpayer.”

- To upload the application’s required documents, click the “Choose File” option.

- Choose the checkbox at the bottom of the page. To continue, click the person’s name who signed the application.

- Click “Submit with DSC” or “Submit with EVC” from the “Submit Application” menu.

e-Way Bill Blocking – Impact on Taxpayers

If a GSTIN is blocked, businesses cannot send or receive goods as they cannot generate an eway bill. Transporting goods without an eway bill might result in the authorities imposing fines or seizing the vehicles.

Businesses dealing with goods transported from one location must have an eway bill. Therefore, business owners must understand the significance of unblocking an e-Way Bill for efficient operations.

FAQs on eWay Bill Blocking

Why was my eway bill blocked?

Your eway bill was blocked because you failed to file GSTR-3B returns for two consecutive tax periods.

How can I unblock my e-way bill or GSTIN?

File the pending GSTR-3B returns. The eway bill system will automatically unblock your GSTIN within a day.

Can I generate an e-way bill while my GSTIN is blocked?

No, you cannot generate new e-way bills if your GSTIN is blocked. However, others can still generate e-way bills for goods sent to you.

What should I do if my GSTIN is not unblocked automatically after filing returns?

You can manually request unblocking by visiting the GST portal and using the ‘Unblock E-Way Bill Generation’ option.

Can I avoid e-way bill blocking?

Yes, by ensuring that you file your GSTR-3B returns on time for every tax period, you can avoid eway bill blocking.