Consolidated Balance Sheet Format

A consolidated balance sheet is a financial statement that combines the assets, liabilities, and equity of a parent company and its subsidiaries to provide a comprehensive view of its financial position.

Consolidated Balance Sheet Format

A consolidated balance sheet format presents the financial position of a parent company and its subsidiaries clearly and concisely. It includes categories such as long-term, short-term, fixed, and current liabilities. It provides an overview of the consolidated entity’s assets, liabilities, and equity. This format helps stakeholders make informed decisions and assess the company’s financial health.

Consolidated Balance Sheet Format: Details to be Included

When creating a Consolidated balance sheet format, several details must be included to represent a company’s financial position accurately. Some key elements should be included:

| S.No | Details |

| 1 | Name and date of the consolidated balance sheet |

| 2 | Assets such as cash, investments, property, and equipment |

| 3 | Liabilities such as loans, accounts payable, and taxes owed |

| 4 | Equity, including the parent company’s and subsidiary’s equity |

| 5 | Totals for each category and the overall balance sheet |

| 6 | Comparisons with previous periods to show trends and changes |

| 7 | Notes to the financial statements explaining significant accounting policies and other disclosures |

The table provides a list of the essential details that should be included in a consolidated balance sheet format. It is a helpful reference for preparing and ensuring that all relevant information is included in this financial document.

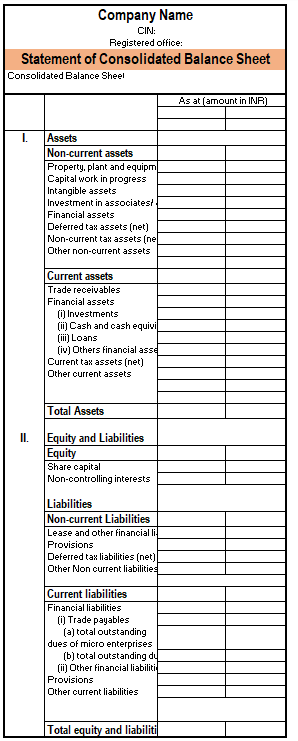

Sample Consolidated Balance Sheet Format

A sample Consolidated balance sheet format is a reference point for creating a personalized balance sheet that fits a company’s specific needs. Reviewing the sample provides an understanding of the layout and information that should be included.

Consolidated Balance Sheet Format in PDF

The customizable Consolidated balance sheet format in PDF is a secure and easily shareable document that can be accessed on any device. Review the provided sample to understand how to arrange necessary data and protect financial information.

Consolidated Balance Sheet Format in Word

The Consolidated balance sheet format in Excel is a template that can be customized by a company for its specific needs, with user-friendly editing capabilities. The format can be converted to PDF for effortless sharing. Analyzing the provided sample can assist in understanding the necessary data and organization of the balance sheet.

Consolidated Balance Sheet Format in Excel

The format of Consolidated balance sheets in Excel offers the ability to calculate and create graphs and convenient editing and sharing options. The sheet is secured with password protection. Analyzing the sample version assists in comprehending the required data and layout for the balance sheet.

FAQs on Consolidated Balance Sheet Format

Choose a customizable format like PDF, Excel, or Word for a consolidated balance sheet. Provided samples to help with the arrangement. Consolidated balance sheets show a parent company's and subsidiaries' financial information, giving a comprehensive view of financial health. Manual preparation of a consolidated balance sheet is time-consuming and complex. Use automation tools to avoid errors. Consolidated balance sheets can't evaluate the performance of individual subsidiaries. Separate financial statements for each subsidiary are required. Common errors to avoid include incorrect consolidation of subsidiaries, asset/liability valuation, and errors in eliminating intercompany transactions.What are the different formats available for a consolidated balance sheet?

What is the difference between consolidated and regular balance sheets?

Can a consolidated balance sheet be prepared manually?

Can a consolidated balance sheet be used to evaluate the performance of individual subsidiaries?

What are some common errors to avoid when preparing a consolidated balance sheet?