Udyogini Scheme

What is Udyogini Scheme?

The Women Development Corporation’s Udyogini Scheme provides subsidised loans to budding women entrepreneurs from rural and impoverished areas.

Udyogini, “Women Entrepreneur,” is a recognised non-profit organisation dedicated to women’s economic empowerment. Udyogini Scheme spreads over 200 villages throughout five states: Rajasthan, Chhattisgarh, Jharkhand, Madhya Pradesh, and Uttarakhand.

The program encourages women’s entrepreneurship, financial empowerment, and self-sufficiency by providing financial support.

The initiative intends to promote more micro-firms to emerge and contribute to the country’s overall growth.

The Udyogini Scheme’s primary goals are as follows:

- Encouragement of women to obtain loans from banks and other financial organisations to engage in income-generating activities

- Reduce the cost of financial assistance for women from the SC/ST or special category.

- To make interest-free loans to qualified female beneficiaries without discrimination or bias.

- Ensure the skill development of women beneficiaries through EDP Training.

- Prevent women from contacting private money lenders or other financial organisations for high-interest loans.

For women looking to start retail businesses, opting for billing software for retail shops can streamline operations by offering automated invoicing, inventory management, and easy financial tracking, making the entrepreneurial journey smoother and more efficient.

What is the purpose of the Udyogini Scheme?

Karnataka State Women’s Development Corporation (KSWDC), Punjab and Sind Bank, Saraswat Bank and a few more private and public sector banks offer the Udyogini Scheme:

- Providing loans with no interest to qualified women entrepreneurs in agribusiness, retail, and small business.

- Offering three days of EDP training for the beneficiary ladies before disbursal of the loan.

Eligibility criteria for loans under the Udyogini Scheme

Loans under the Udyogini scheme are available to ambitious female entrepreneurs that meet the following criteria:

- Age range: 25 to 65 years

- Family income: 1.5 lakhs

The Udyogini scheme excludes women who fall into special categories such as being disabled, widowed, or poor from fulfilling the upper-income requirement.

Documents needed for Udyogini Scheme

- Aadhar or BPL card

- Income and Birth Certificates

- Bank Passbook’s photocopy- with details like account number, name of the account holder, name of the bank, branch, IFSC and MICR codes

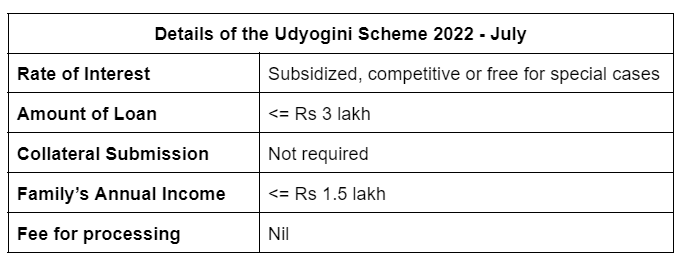

Udyogini Scheme – July 2022

Let’s have a look at the Udyogini scheme interest rates for July 2022:

Karnataka State Women’s Development Corporation (KSWDC), Punjab and Sind Bank, Saraswat Bank, several other private and public sector banks, and top NBFCs are the primary providers of the Udyogini Scheme. This programme focuses on planning and implementing skill development training programmes for women and providing financial help.

How to use the Udyogini Yojana

To apply for a business loan under the Udyogini Yojana Scheme, applicants should go to their nearest bank with all the necessary documents and fill out an application form before proceeding with the bank formalities. Applicants can also apply for loans online by visiting banks’ official websites participating in the Udyogini Yojana Scheme.

List of enterprises participating in the Udyogini Yojana

Loans under the Udyogini Yojana are made available at competitive interest rates by various financial institutions, including cooperative banks, Regional Rural Banks (RRBs), and commercial banks. Only female entrepreneurs are eligible for corporation subsidies to manage their businesses. The application form for the Udyogini Yojana Scheme is available on the bank’s official website.

The following is a comprehensive list of the 88 company types available through the Udyogini Scheme:

- Agarbatti Manufacturing

- Audio & Video Cassette Parlour

- Bakeries

- Banana Tender Leaf

- Bangles

- Beauty Parlour

- Bedsheet & Towel Manufacturing

- Book Binding And Note Books Manufacturing

- Bottle Cap Manufacturing

- Cane & Bamboo Articles Manufacturing

- Canteen & Catering

- Chalk Crayon Manufacturing

- Chappal Manufacturing

- Cleaning Powder

- Clinic

- Coffee & Tea Powder

- Condiments

- Corrugated Box Manufacturing

- Cotton Thread Manufacturing

- Crèche

- Cut Piece Cloth Trade

- Dairy & Poultry Related Trade

- Diagnostic Lab

- Dry Cleaning

- Dry Fish Trade

- Eat-Outs

- Edible Oil Shop

- Energy Food

- Fair-Price Shop

- Fax Paper Manufacturing

- Fish Stalls

- Flour Mills

- Flower Shops

- Footwear Manufacturing

- Fuel Wood

- Gift Articles

- Gym Centre

- Handicrafts Manufacturing

- Household Articles Retail

- Ice Cream Parlour

- Ink Manufacture

- Jam, Jelly & Pickles Manufacturing

- Job Typing & Photocopying Service

- Jute Carpet Manufacturing

- Leaf Cups Manufacturing

- Library

- Mat Weaving

- Match Box Manufacturing

- Milk Booth

- Mutton Stalls

- Newspaper, Weekly & Monthly Magazine Vending

- Nylon Button Manufacturing

- Old Paper Marts

- Pan & Cigarette Shop

- Pan Leaf or Chewing Leaf Shop

- Papad Making

- Phenyl & Naphthalene Ball Manufacturing

- Photo Studio

- Plastic Articles Trade

- Pottery

- Printing & Dyeing of Clothes

- Quilt & Bed Manufacturing

- Radio & TV Servicing Stations

- Ragi Powder Shop

- Readymade Garments Trade

- Real Estate Agency

- Ribbon Making

- Sari & Embroidery Works

- Security Service

- Shikakai Powder Manufacturing

- Shops & Establishments

- Silk Thread Manufacturing

- Silk Weaving

- Silk Worm Rearing

- Soap Oil, Soap Powder & Detergent Cake Manufacturing

- Stationery Shop

- STD Booths

- Sweets Shop

- Tailoring

- Tea Stall

- Tender Coconut

- Travel Agency

- Tutorials

- Typing Institute

- Vegetable & Fruit Vending

- Vermicelli Manufacturing

- Wet Grinding

- Woollen Garments Manufacturing

FAQs about Udyogini Scheme

The maximum credit amount available to a female entrepreneur under the Udyogini Scheme is Rs. 3 lakh. Leading banking institutions provide business loans through Udyogini Scheme. Bajaj Finserv, Saraswat Bank, Punjab and Sind Bank, and Karnataka State Women's Development Corporation (KSWDC) are among the banks and NBFCs offering business loans under the Udyogini Scheme. The Government launched the Udyogini Scheme for the care and growth of Indian Women Entrepreneurs. This programme motivates female entrepreneurship among the underprivileged by providing financial assistance to women who want to start a business. The scheme funds and assists women in rural and underserved communities. The Udyogini Scheme allows you a maximum grant of Rs. 3 lakhs. This loan is available to women aged 18 to 55. No, this loan related to the Udyogini Scheme is available to women of all income levels. The Udyogini Scheme can help up to 88 distinct enterprises. Loans are available to enterprises in the SSI sector, retailers, manufacturers, self-employed professionals, traders, etc.How much money can I borrow through the Udyogini scheme?

Where can I apply for a loan through the Udyogini Scheme?

What exactly is the goal of the Udyogini Scheme?

What is the limit of money I can borrow under the Udyogini scheme?

What is the minimum age to apply for the Udyogini scheme?

Is the Udyogini Scheme loan only for people who fall into the SC/ST category?

Which companies are eligible for this loan?