Best Accounting Software for Big Businesses

Streamline Your Finances with a Simple Accounting Solution

Trusted by 1 Crore+ businesses for Billing, Inventory and Accounting

``myBillBook is designed for businesses to generate accurate GST-compliant invoices and automate their entire accounting process.``

“myBillBook has transformed how we manage finances across multiple locations. The automated invoicing and GST compliance features have saved us countless hours. Highly recommended for large businesses!”

Rohit Sharma

Elite Traders Pvt. Ltd.

Recommends myBillBook for:

Product Demo of Accounting Software for Big Businesses

“Superb customer service. Helped me set up my account as required”

Key Features of Accounting Software for Big Business

Handle Large Transaction Volumes with Ease

myBillBook is designed to process thousands of transactions daily without delays, ensuring seamless financial operations for large businesses. The software efficiently manages sales, purchases, and expense records with real-time data updates.

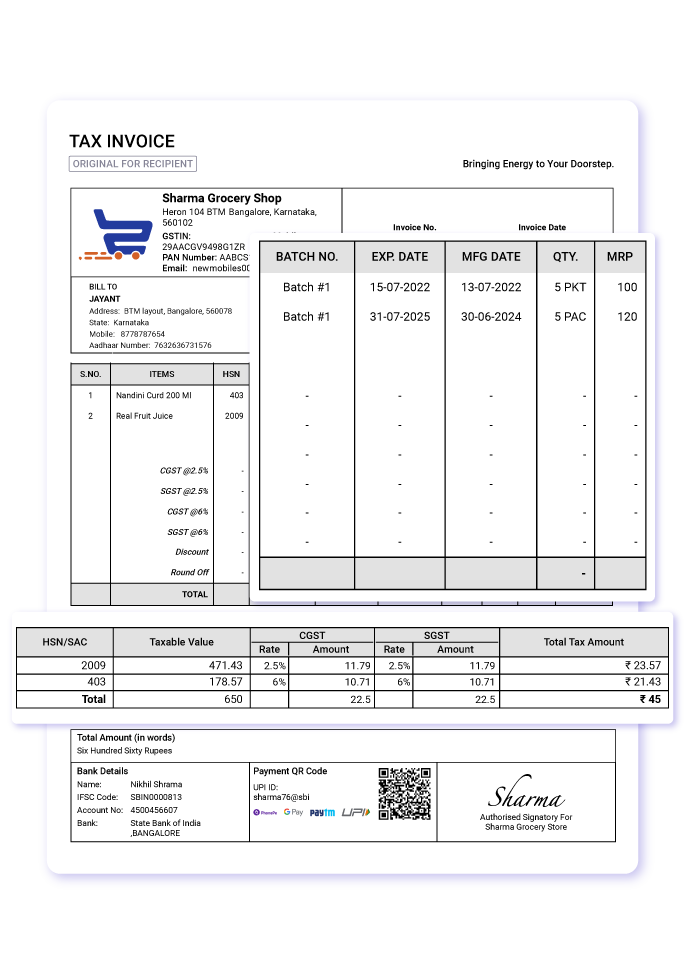

Automated & GST-Compliant Invoicing

myBillBook simplifies the invoicing process by automating invoice generation with GST compliance. It supports bulk invoicing, recurring invoices, and multi-currency transactions, making it ideal for large-scale businesses with extensive billing needs.

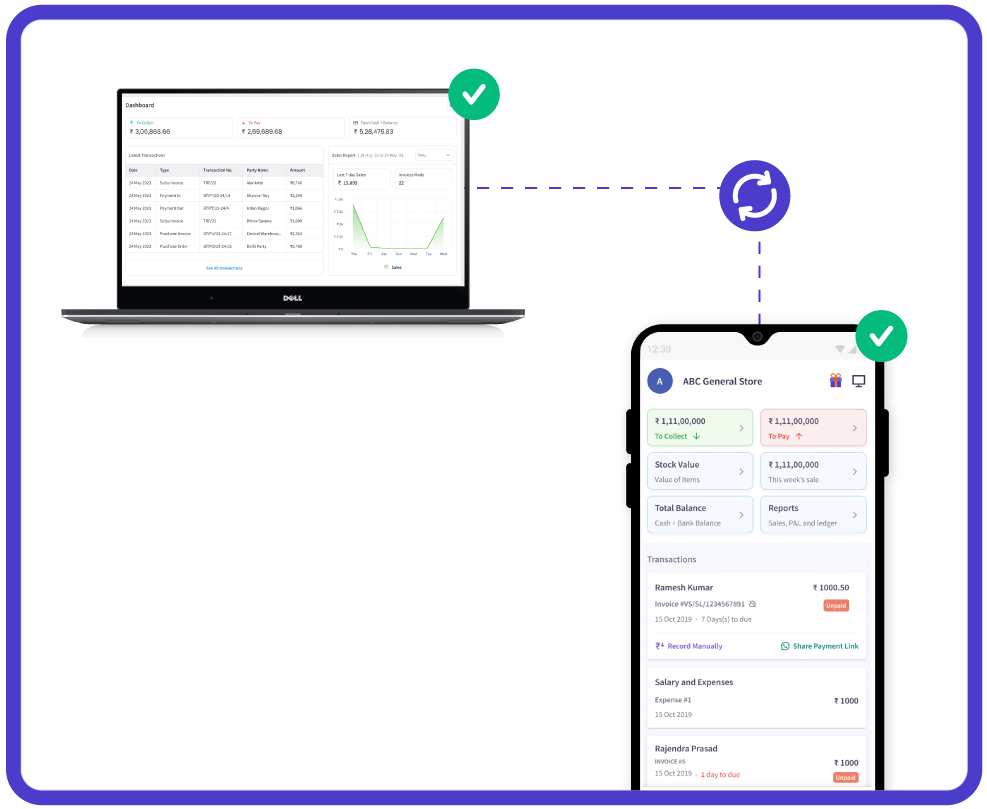

Centralized Financial Management for Multi-Branch Operations

Large businesses often operate across multiple locations. myBillBook provides centralized financial management with real-time syncing across all branches and allows role-based access for multiple users, ensuring secure and efficient collaboration.

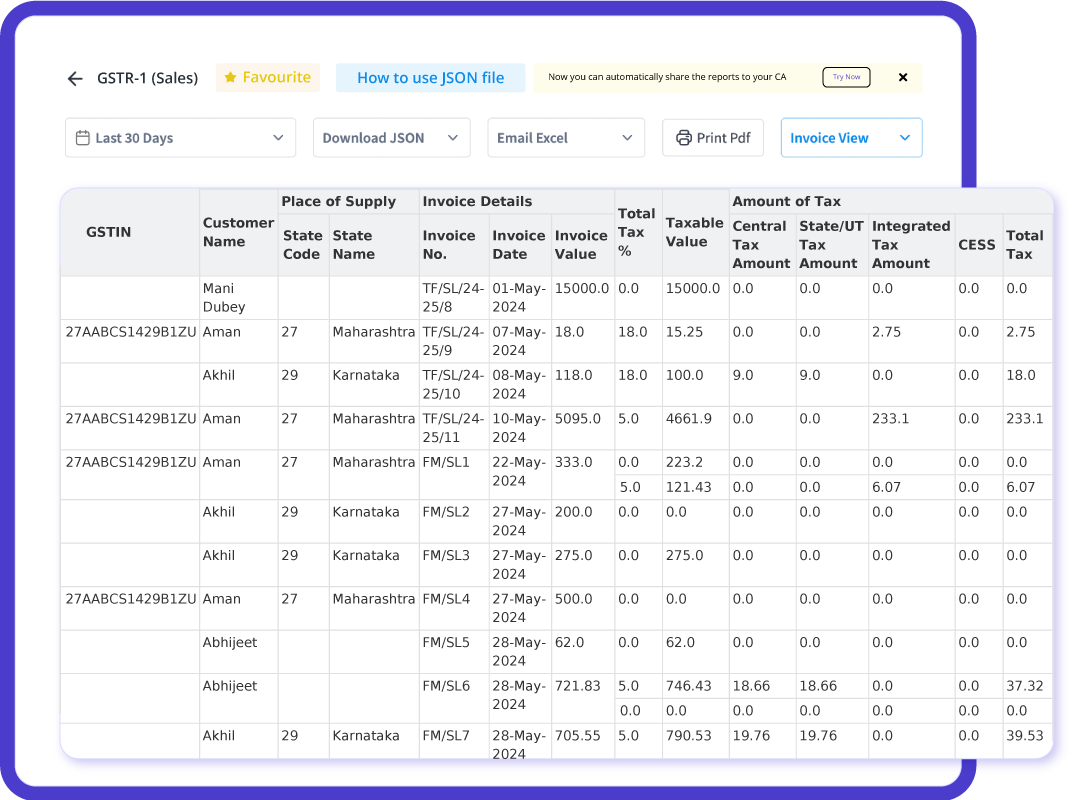

GST & Tax Compliance

myBillBook ensures compliance with GST laws by offering GST-compliant invoicing, automated e-way billing, seamless GST return filing, and tax reports that help businesses stay audit-ready

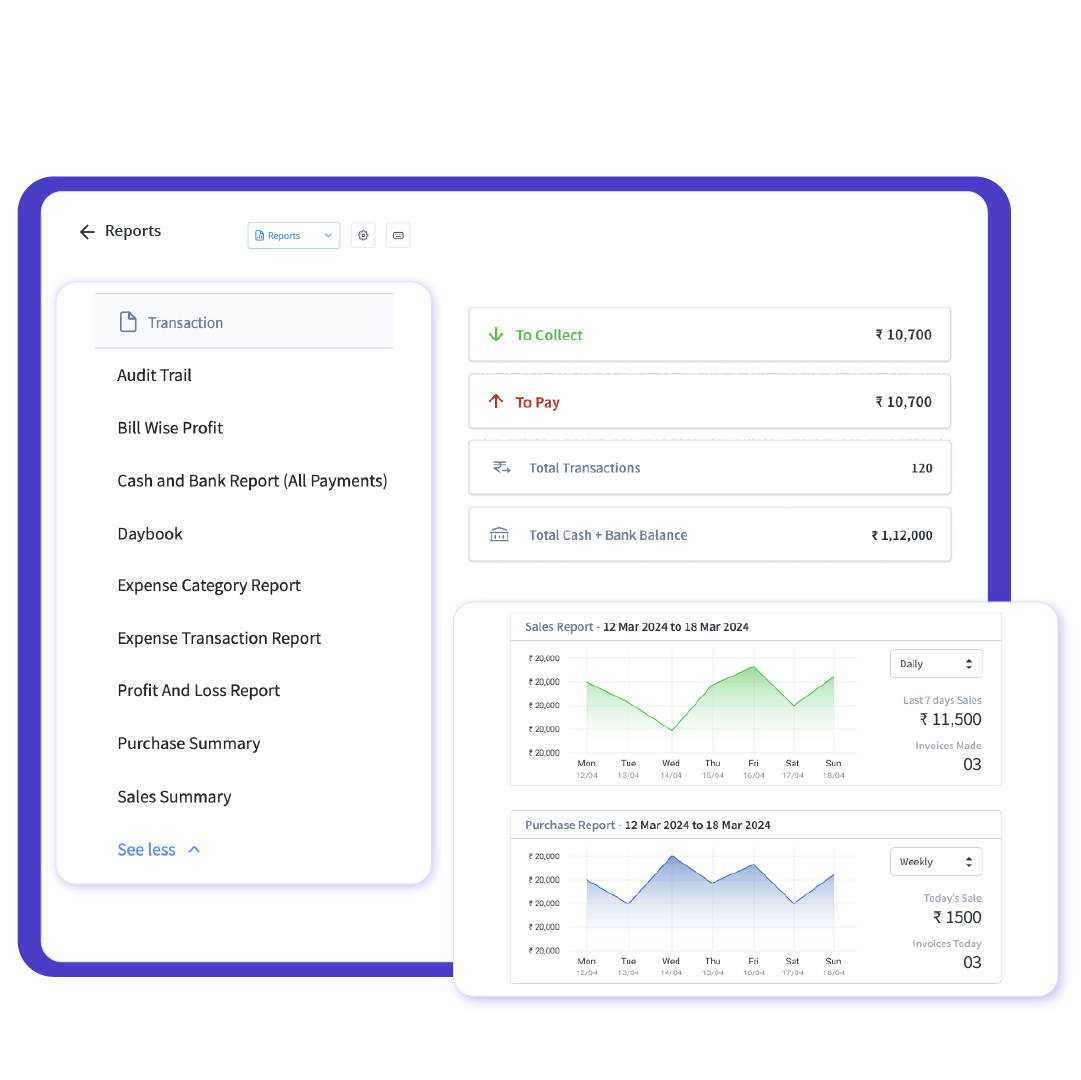

Comprehensive Financial Insights & Reports

The software provides powerful financial insights with detailed reports, including profit & loss statements, balance sheets, and cash flow reports. These reports help business owners and finance teams make data-driven decisions.

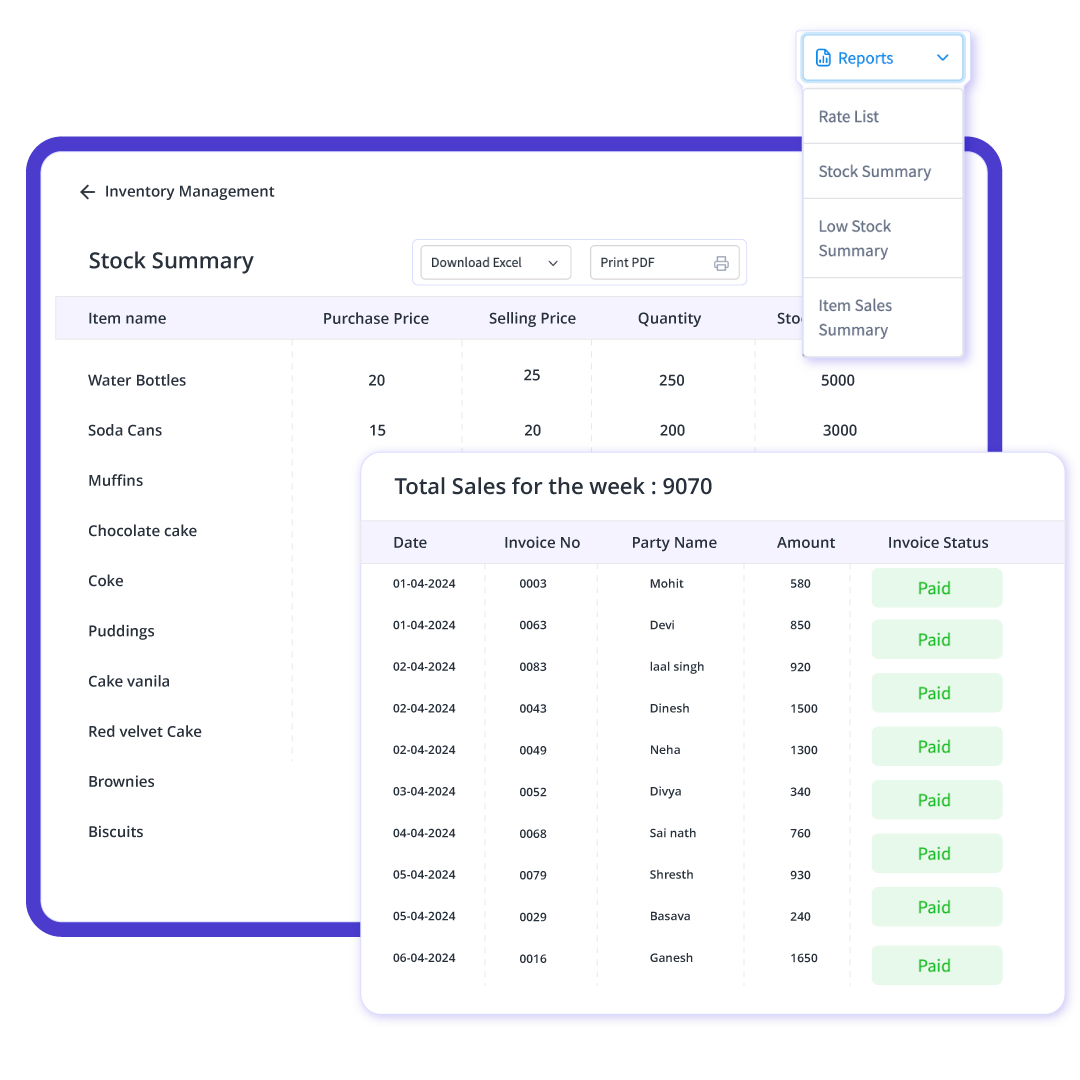

Real-Time Inventory & Expense Tracking

For businesses managing extensive stock, myBillBook offers real-time inventory tracking, low-stock alerts, automated stock updates, and purchase order management. It also tracks business expenses efficiently, categorizing them for better financial planning.

myBillBook helps Business succeed

“Handling thousands of transactions daily used to be a challenge, but with myBillBook, everything is streamlined. From real-time inventory tracking to automated bank reconciliation, this software has everything a big business needs.”

Anita Verma,

Global Distributors Ltd.

“We switched to myBillBook for its scalability, and it has exceeded our expectations. The cloud-based accessibility and detailed financial reports have helped us make better business decisions.”

Vikram Mehta,

Sunrise Enterprises

“myBillBook is an all-in-one solution for our accounting needs. The multi-user access, GST compliance, and integration capabilities make it the perfect software for large companies like ours.”

Neha Agarwal,

TechVision Ltd.

Pricing plans

Diamond Plan

₹217

Per month. Billed annually. Excl. GST @18%

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

Platinum Plan

₹250

Per month. Billed annually. Excl. GST @18%

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

Enterprise Plan

₹417

Per month. Billed annually. Excl. GST @18%

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills

What is Accounting software for big business

Accounting software for big businesses is a digital solution designed to manage complex financial operations, high-volume transactions, multi-branch accounting, and regulatory compliance. It includes features like automated billing, real-time financial reporting, tax compliance, multi-user access, and seamless integration with enterprise tools.

Managing finances in a large-sized business requires robust accounting software that can handle high transaction volumes, automate financial processes, and ensure regulatory compliance.

The best accounting software for big businesses provides features such as automated billing, real-time financial tracking, GST-compliant invoicing, and inventory management. This guide will explore the top features to look for in accounting software for large companies and how myBillBook stands out as an ideal solution.

Why Do Big Businesses Need Advanced Accounting Software

Large businesses operate on a much larger scale than small or medium enterprises, requiring specialized financial management tools. Here’s why advanced accounting software is essential for big businesses:

- Handling High Transaction Volumes: With thousands of daily transactions, businesses need software that can process and store large amounts of financial data without delays.

- Regulatory Compliance: Large companies must comply with various tax laws, including GST, corporate tax, and audit requirements. Accounting software ensures accurate tax calculations and regulatory reporting.

- Multi-Entity and Multi-Branch Management: Many large businesses operate across multiple branches or subsidiaries. Accounting software with centralized data management enables seamless financial consolidation.

- Automation for Efficiency: Manual accounting processes can be time-consuming and error-prone. Advanced accounting software automates invoicing, payroll, and reconciliation, reducing manual workload.

- Financial Insights and Forecasting: Big businesses rely on financial reports for strategic planning. Real-time reporting and data analytics help decision-makers track profitability, manage expenses, and optimize cash flow.

- Data Security and Access Control: Large enterprises handle sensitive financial information. Robust accounting solutions offer encryption, multi-user access control, and audit trails to enhance security.

- Seamless Integration with Other Business Tools: To maintain operational efficiency, accounting software should integrate with ERPs, CRMs, payroll systems, and banking platforms.

How to Choose the Right Accounting Software for Large Companies

Choosing the right accounting software is critical for large businesses. Here are some key factors to consider:

- Scalability: Ensure the software can handle increasing transaction volumes, multiple branches, and growing business needs.

- Automation Features: Look for solutions that automate repetitive tasks like invoicing, tax calculations, and financial reporting to save time and reduce errors.

- Regulatory Compliance: The software should support GST, corporate tax compliance, and audit-ready reports to ensure adherence to legal requirements.

- Integration Capabilities: Choose software that seamlessly integrates with ERP, CRM, payroll, and banking systems to streamline financial processes.

- Multi-User and Role-Based Access: Large businesses need software that allows multiple users with specific roles and permissions to maintain data security.

- Cloud Accessibility vs. On-Premise Solutions: Cloud-based solutions offer flexibility and remote access, while on-premise software provides more control over data security.

- Customization and Reporting: Opt for software that allows customized financial reports, cash flow forecasting, and business performance analytics.

- Customer Support and Training: Reliable customer support and training resources ensure smooth software adoption and efficient problem resolution.

Cloud-Based vs. On-Premise Accounting Software for Big Businesses

Choosing between cloud-based and on-premise accounting software is a crucial decision for large businesses. Here’s a breakdown of the key differences:

Cloud-Based Accounting Software:

- Accessibility: Can be accessed from anywhere with an internet connection, allowing remote work and collaboration.

- Automatic Updates: Software updates and security patches are handled by the provider, ensuring compliance and efficiency.

- Scalability: Easily scales with business growth, accommodating additional users and features without major infrastructure changes.

- Lower Initial Costs: Requires minimal upfront investment, as it operates on a subscription-based model.

- Data Security and Backup: Providers offer robust security measures and automatic backups to protect financial data.

On-Premise Accounting Software:

- Data Control: Businesses have full control over their financial data, which is stored on local servers.

- One-Time Cost: Requires a larger initial investment but may have lower long-term costs compared to recurring cloud subscriptions.

- Customization: Offers greater flexibility in customization, allowing businesses to tailor features to their unique needs.

- IT Infrastructure Requirement: Requires in-house IT teams for maintenance, security, and software updates.

- Limited Remote Access: Access is restricted to on-site computers unless additional remote access solutions are implemented.

Why myBillBook is the Best Accounting Software for Big Businesses

myBillBook offers a comprehensive suite of features designed to streamline financial operations for large companies. Here’s why it stands out:

- End-to-End GST Compliance: myBillBook automates GST invoicing, e-way billing, and return filing, ensuring businesses meet regulatory requirements with ease.

- Advanced Financial Reporting: Businesses get access to real-time financial insights, including profit and loss statements, cash flow analysis, and balance sheets.

- Scalable for Business Growth: myBillBook grows with your business, adapting to increased transaction volumes, additional branches, and complex financial needs.

- Multi-User Access & Role-Based Permissions: Large businesses need collaborative financial management. myBillBook enables secure, role-based access for different teams.

- Seamless Integrations: Sync with ERP, CRM, banking platforms, and inventory management systems for a unified financial ecosystem.

- Inventory & Expense Management: Keep track of stock levels, monitor expenses, and manage supplier transactions effortlessly.

- User-Friendly Interface & Automation: Automate repetitive tasks such as invoicing, payment tracking, and reconciliation while enjoying an intuitive dashboard.

- Cloud-Based Accessibility: Manage financial data anytime, anywhere with secure cloud storage and automatic data backups.

- Cost-Effective & High Performance: Get enterprise-level accounting software features at an affordable price, ensuring efficiency without overspending.

Benefits of Using myBillBook for Large-Sized Businesses

- Improved Efficiency: Automates accounting tasks, reducing manual workload and increasing productivity.

- Better Financial Control: Provides real-time insights into expenses, cash flow, and overall financial health.

- Cost Savings: Eliminates paperwork, minimizes errors, and reduces administrative overhead.

- Scalability: Adapts to growing business needs with flexible features and cloud-based accessibility.

- Enhanced Compliance: Ensures adherence to tax regulations, GST filing, and accurate financial reporting.

- Multi-User Access: Enables collaboration among finance teams with secure, role-based access.

- Inventory & Expense Management: Helps monitor stock levels, track purchases, and manage operational expenses effectively.

- Seamless Integration: Syncs with business applications like ERP, CRM, and banking platforms to streamline workflows.

- Secure Data Management: Provides encryption, automated backups, and fraud detection to safeguard financial information.

With myBillBook, large businesses can achieve higher efficiency, accuracy, and compliance, making financial management seamless and hassle-free.

FAQs

What is the best accounting software for large businesses?

The best accounting software for large businesses offers automation, compliance, financial reporting, and scalability. myBillBook is an excellent choice due to its comprehensive features.

How does myBillBook help with GST compliance?

myBillBook enables businesses to generate GST-compliant invoices, automate tax calculations, and file GST returns seamlessly.

Can multiple users access myBillBook?

Yes, myBillBook allows multi-user access with role-based permissions, ensuring secure collaboration among different teams.

Does myBillBook support inventory management?

Yes, myBillBook provides real-time inventory tracking, low-stock alerts, and bulk item management for efficient stock control.

Is myBillBook suitable for big businesses?

myBillBook is designed to handle high transaction volumes, automate financial processes, and provide real-time business insights, making it ideal for large enterprises.