Taxes come in many forms, and fortunately, now you can use a single copy challan to pay any direct taxes such as income tax, corporate tax, tax deducted at source (TDS), or tax collected at source (TCS) through OLTAS. The Online Tax Accounting System (OLTAS) is a system that helps taxpayers manage their receipts and payments for Direct Taxes.

This feature is essential for those who have deposited TDS and want to know whether it has been received by the Income Tax Department or not. The process is simple, and all one needs is the challan number and the date of deposit.

OLTAS TDS challan status enquiry is a process through which one can check the status of their TDS challan. To pay your taxes, you can either go online or visit an authorised bank branch for OLTAS. After taxes have been paid, the taxpayer is given a section of the counterfoil with a stamp from the collecting bank. In the case of online payment, a challan is generated immediately.

But what is the TDS challan? A TDS challan is a document issued by the income tax department to confirm that a person has paid tax. The Challan has a number on it which is called CIN (Challan Identification Number) and is used for quoting in income tax returns or communication with the income tax department whenever required.

Here are the details present in CIN:

- The RBI assigned 7-digit BSR Code

- The date on which the Challan was presented (DD/MM/YY)

- 5 digits of the Challan’s serial number for that day in that bank branch

Status Inquiry for taxpayers

The OLTAS status feature helps view the status of challans deposited in the bank if you need to confirm that the tax you paid has been correctly recorded in your name.

A person’s CIN or Tax Deduction and Collection Account Number (TAN) of the deductor helps to check the status of a TDS Challan. Once you deposit the challan with the bank, you can see the status of your challan after a week. The procedure listed below makes it easy to check the OLTAS status in both modes:

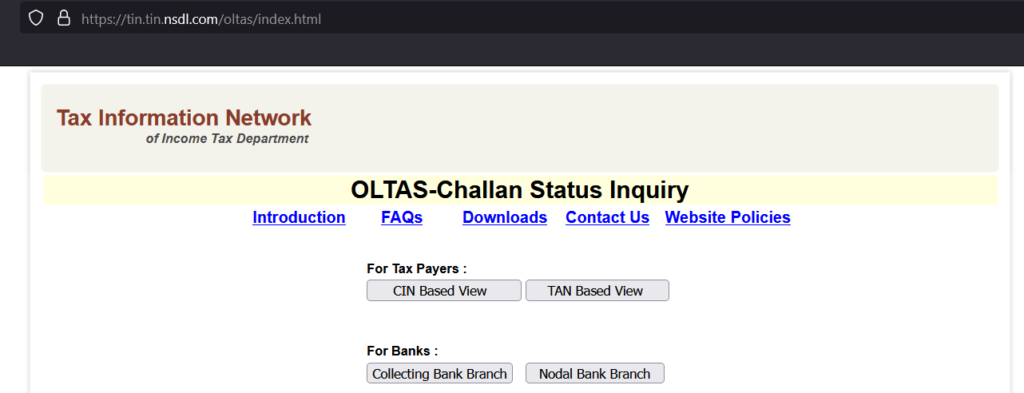

To begin with, you need to visit the NSDL website and follow the instructions:

- Go to https://tin.tin.nsdl.com/oltas/index.html

- Depending on your preference, choose either the TAN-based view or the CIN-based view. The individuals who deduct your TDS implement TAN-based views.

CIN based view

When choosing a CIN-based view, you must enter the amount and the Challan Identification Number (i.e., BSR Code, Challan Tender Date, and Challan Serial No).

Once you’ve provided the information, you can view the following information:

- A BSR Code

- Deposit Date

- Major Head Code with Description for Challan Serial Number

- TAN/PAN

- Taxpayer’s name as it appears on the TIN (i.e. date of receipt by TIN)

- Validation of the entered amount’s accuracy (if the amount is entered)

TAN based view

To view in a TAN-based view, enter the TAN and the range of Challan Tender Dates (the date on which a challan is paid) for a specific financial year. Once done, the following information is viewable:

- Major Head Code for CIN with description

- CIN

- Mode of Payment

- Minor Head Code

Once done, the system will check the amount you enter against the bank’s uploaded information and display a confirmation message.

Status Inquiry for banks

For online challan status tracking, tax collecting branches and nodal branches must log in with their username and password.

Collecting Bank Branch

The tax collecting branch can access the total sum and number of challans for each major head code by providing the branch scroll date and the major head code’s description.

The collecting branch may also view the below information:

- Challan Serial Number

- Tender Date for Challan

- PAN/TAN

- The amount and Taxpayer Name

- The TIN’s date of receipt

Nodal Bank Branch

By entering the nodal scroll date and the major head code description, the nodal branch can view the following details:

- Scroll Date Scroll Date

- Major Head Code with description

- Nodal Branch Scroll Number

- Overall Amount

- Branch count

- Challan count

Furthermore, the below information can be accessed for each Nodal Branch Scroll Number:

- BSR Code

- Branch Scroll Date

- Total Amount Branch

- BSR Code

- Date of TIN’s receipt

- Challan count