Everyone is aware of what a TDS or Tax Deducted on Source is. But some people may not be aware of how it is calculated on the salary and when TDS is deducted from their salary. This guide is all about Tax Deducted at Source on Salary, which means you will get a clear understanding of who will have to pay TDS on salary, who can deduct TDS, and how TDS is calculated.

What is Section 192 of Income Tax?

Section 192 of the Income Tax Act says about the TDS deduction on salary. Usually, the TDS (Tax Deducted at Source) on salary is deducted from your salary by the employer and they pay it to the government. The TDS on salary will be deducted on an average rate of income tax which will be according to the present slab rate during the appropriate financial year. This will be done by considering the estimated income of an employee.

When is TDS Deducted under Section 192?

Now let us see when this TDS is deducted from the employee and what is the salary slab to consider an employee to pay TDS. If an employee is receiving salary every month, then the TDS will be deducted by the employer before paying the salary to the employee. But if the employer is paying the salary to the employee every 4 months or 6months depending on the nature of the business, then the TDS will be deducted according to that.

The employer must deduct the TDS from an employee who comes under that certain income slab. In case if the employer does not take away the TDS and deposit on time, then he/she will have to face the consequences and will also be liable to pay the penalty along with the interest. In another case, if the employee is receiving salary in advance from the employer, the TDS will be deducted from the advance salary paid by the employer.

Who can deduct and how to deduct TDS on salary monthly for example?

Employers such as partnership firms, co-operative societies, trusts, HUF, individuals, and both private and public companies can deduct TDS on salary. These employers must deduct TDS on salary at the precise time and the amount should be paid to the government. To deduct the TDS on salary, there should be an employer-employee connection. When it comes to deducting the TDS on salary certain factors should be considered. Some of these points are given below.

- TDS is deducted not only on salary. If the employer has given rent for the employee, then it should also be considered while calculating the TDS on salary.

- If there is a home loan and if the interest on such loans is only up to Rs.2,00,000, then it will be set off from the salary income to get the estimated incomes for the TDS calculation. This will be done only if the evidence is provided by the employee in the form 12BB.

- In some cases, employees might make investments to get more tax benefits. This means investments are made to reduce the tax liability. But if the employee does not inform the employer regarding these investments, then the TDS amount will increase than what the employee is liable for. If an employee has made tax-saving investments, it should be declared in form 12BB and submit the same to the employer. Only then the employer will consider the employee’s investments when calculating the TDS on salary.

Let us check an example here that explains the TDS deduction.

| Particulars | Amount |

| Estimated Salary Income of Mr. A | 9,60,000 |

| Standard Deduction on Salary | 50,000 |

| Estimated Gross Total Income of Mr. A | 9,10,000 |

| Tax Saving Investments | 1,50,000(this is maximum allowed amount) |

| Estimated Total Income of Mr. A | 7,60,000 |

| Approx. Tax Liability of Mr. A | 64,500 |

| Health and Education cess @ 4 % on Rs.64.500 (to be added) | 2,580 |

| Expected Total Tax Liability | 67,080 |

| TDS per month (67,080/12) | 5,590 |

So the monthly salary for Mr. A is Rs.80, 000. But, after deducting the TDS of Rs 5,590, Mr. A will receive Rs. 74,410.

How to Calculate TDS on Salary?

The first step to calculate TDS on salary starts with calculation an employee’s total earnings, including commission, bonus, perks, etc. Then the employer should collect declarations from the employees regarding the investment plans (if any). The proof of such investment should be collected during the end of the year. Then the total amount which is eligible for tax exemption should be calculated by the employer by deducting the allowable exemptions from the gross salary of the employee in a year. Then the employer should deduct the TDS from the taxable income and deposit the TDS collection to the central government within the stipulated time.

Ways to claim TDS on salary?

Employees can claim a TDS refund online by registering

on https://www.incometax.gov.in/iec/foportal. After registering yourself, download the accurate ITR form to file your tax return. You must fill in the necessary information asked in the form and upload the same and click on submit button. You will receive an acknowledgement after submitting the ITR and you should verify it by adding a digital signature, OTP based on Aadhaar or using your net banking account.

Exemption from TDS on salary

There is an exemption limit for TDS on salary and if an employee’s salary does not exceed the basic exemption limit, then the employer will not deduct the TDS. The basic exemption limit according to the age is given below for your reference. A resident in India who is below 60 years of age and if his annual minimum income is Rs.2.5 lakh, then TDS will not be deducted from his salary. But, in the case of senior citizens between 60 years and below 80 years and if their minimum income per annum is Rs. 3 lakh, the TDS will not be deducted. In the case of super seniors (age above 80 years) whose minimum income is Rs.5 lakh annually; the TDS will not be deducted.

The Time Limit for Depositing the Tax Under Section 192

When a government employer is deducting the TDS from the employees, then the amount should be paid on the same day itself. But in the case of a non-government employer, if the TDS is deducted from the employee’s salary in March, then it should be deposited on or before April 30th. Now when the TDS is deducted during any other month of March, then the amount should be deposited seven days before the end of every month.

FAQs related to TDS on Salary

- Does TDS have to deduct every month?

Yes. TDS on salary must be deducted every month by the employer if the salary is paid every month.

- Is the TDS deducted from my salary refundable?

TDS amount will only be refunded if the amount deducted is more than the amount the employee is liable for.

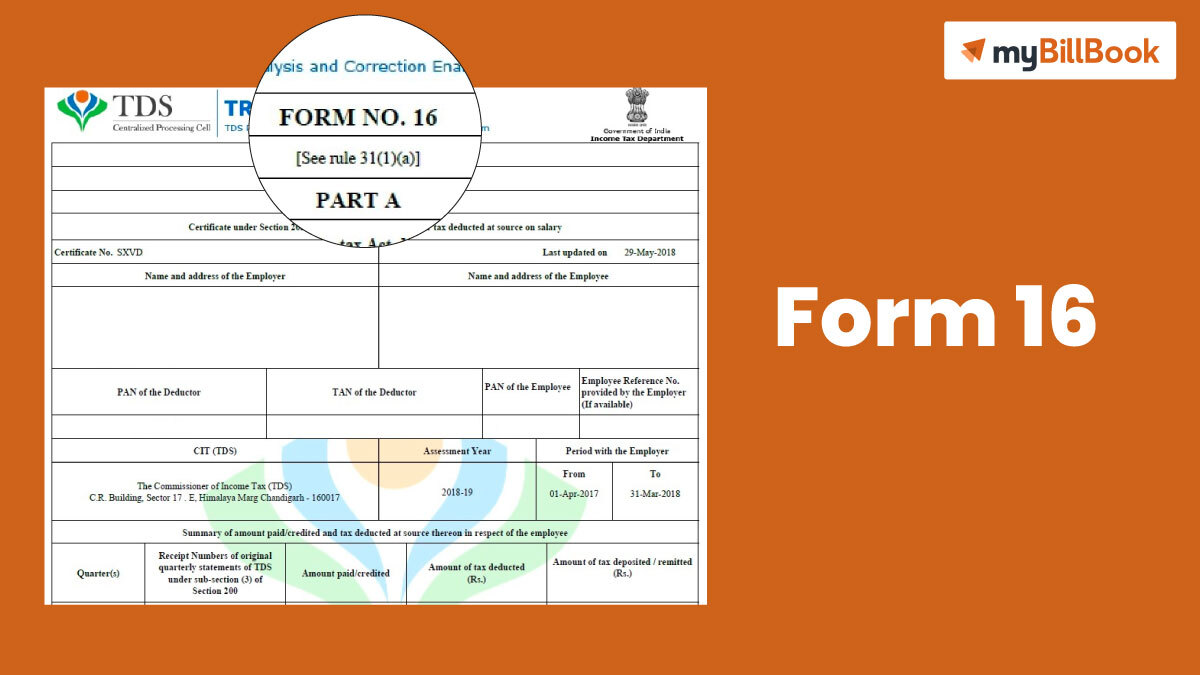

- What is form 16 and 16A?

Form 16 is a TDS certificate type that is issued by the employer to employees and it will include the details regarding the TDS on salary. Whereas Form 16 A is another type of TDS certificate in which the details regarding the TDS deductions other than that on salary are mentioned.