In earlier times, tax-paying used to be a manual job. An individual or a company had to pay their taxes at their respective banks, and then the Income Tax Department would collect the taxes through the banks. This process was quite difficult, and there was a lot of cheating involved. Many times, people or companies would pay incorrect taxes. Hence, the government was constantly functioning at a loss.

To overcome this issue, the government introduced the Online Tax Accounting System or OLTAS in 2004. The system is adopted to minimise human intervention, reduce genuine or deliberate errors, and provide online information on taxes collected or deposited.

The OLTAS system made it easy for layperson to fill their taxes and for the government to collect them. The system provides a single copy of a Challan, which helps taxpayers to track the status of the taxes filed online.

3 types of ITNS challans:

- Challan ITNS 280: This challan is issued when income tax, including self-assessment tax, advance tax, and regular assessment tax, is paid.

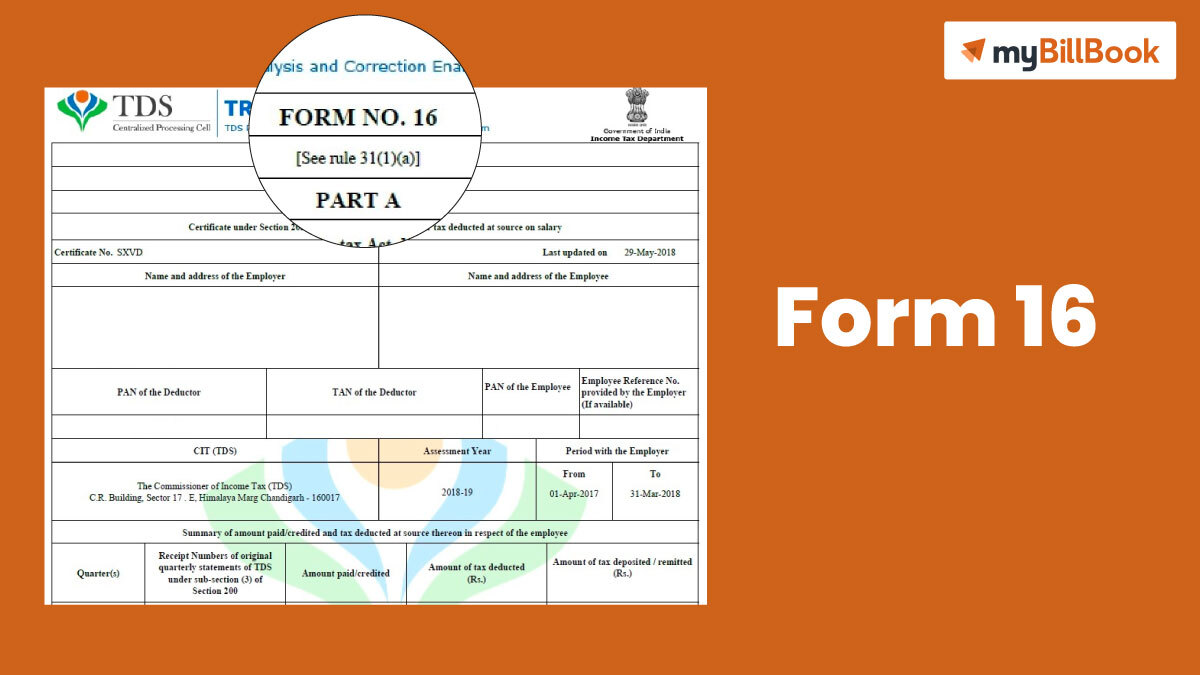

- Challan ITNS 281: This challan is issued when Tax Deducted at Source (TDS) or Tax Collected at Source (TCS) are deposited.

- Challan ITNS 282: This challan is issued for payment of Gift Tax, Wealth Tax, Estate Duty, Expenditure Tax, etc.