What is TDS?

The term TDS means Tax Deduction at Source. It is a tax deduction that individuals and businesses face at various stages of the business. It helps individuals pay tax at the initiation of the business transaction if it is above a certain threshold level.

Usually, individuals, businesses or corporations need to file for their taxes at the end of the financial year. That is, for the preceding year, you pay the tax later on. But for TDS, you pay the taxable amount at the initiation of the business transaction; hence, the name, the source. So it is a sort of advance tax already paid to the government.

Things to know about TDS

- Individuals making a specific payment type to another individual must deduct and deposit tax at the source at the rates specified in the Income Tax Act.

- The individual making the payment is accountable for deducting the TDS and submitting it to the government before the recipient makes the final payment.

- The individual who deducts the TDS is the deductor, and the individual responsible for paying the tax is known as the deductee.

- Form 26AS shows the amount of income tax deducted and deposited in the name or PAN of an individual in a specific fiscal year.

Applicability of TDS

A TDS deduction is applicable when a taxpayer gets the payment in parts or receives the entire amount at once.

TDS applies to different incomes, like

- Dividends

- Salaries for employees and other individuals

- Professional and consultation fees

- Freelance charges when the amount exceeds the threshold level

- Commissions received

- Clearance of Interest payments

- Rent payments on a commercial level

Note: Some situations could be tricky when it comes to paying TDS or not, such as:

- Paying individual rent to your landlord, where TDS payment is not required.

TDS in Income Tax

In income tax terms, TDS meaning Tax Deducted at Source, is deducting an amount during a payment. Everyone must pay the tax if their income exceeds the set limit, according to the Income Tax Act of India, 1961.

Knowing the deducted TDS amount

The income tax portal can find the TDS amount using Form 26AS. Here are the steps involved.

- Visit the Income Tax Department of India’s official website and choose the option to register as a new user.

- Enter information, such as your PAN number, and create a password.

- Login with your registered ID and password.

- Choose to view your tax credit statement or Form 26AS.

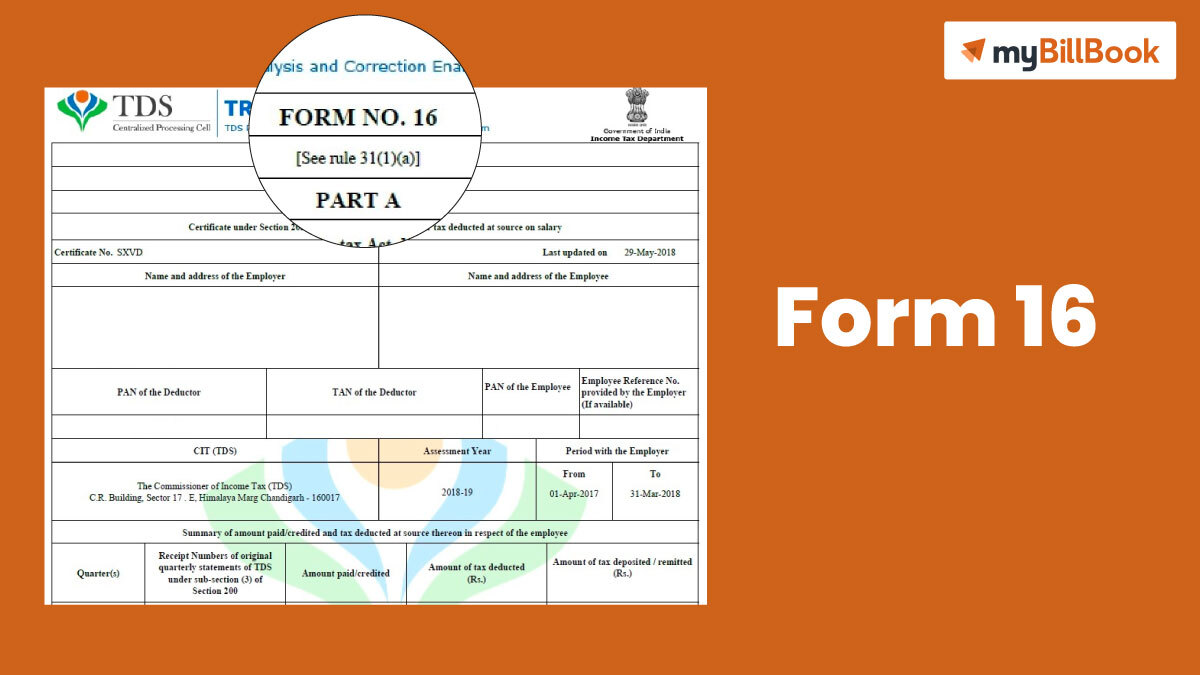

- You will view a new TDS Reconciliation Analysis and Correction Enabling System page. This page displays a taxpayer’s tax responsibilities, including Tax Deducted at Source, advance tax paid, and other pertinent information.

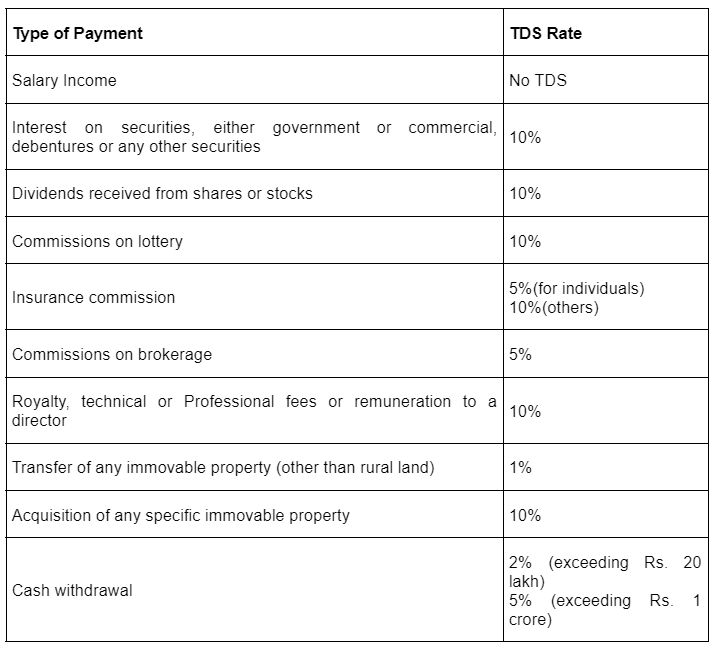

TDS Rates:

Let’s look at the chart representing the TDS rates for the common types of payments.

Rules for TDS

The following are the main TDS rules:

- TDS deduction must happen when the payment becomes due or when you paid the actual amount already, whichever comes first.

- Failure to deduct TDS on time will result in 1% monthly interest until the tax is deducted [2].

- Everyone, whether an employer or not, must credit the tax deducted to the government’s account by the 7th day of the following month.

- In case of non-payment of TDS, you will receive a monthly interest of 1.5% until you deposit the tax.

TDS Online Payment Process

To use the TDS online payment facility, you should have a net banking account with an authorised bank and then follow the below steps:

- Log in to the site: http://www.tin-nsdl.com.

- Navigate to Services-> e-payment ->Pay Taxes Online. Click on the ‘E-Pay Taxes’ tab.

- Select the challan number ITNS 281 you use for paying TDS/TCS.

- Enter credentials like PAN/TAN, address and bank details.

- You can view your full name on the confirmation screen if the PAN/TAN details are valid.

- Then, you will be redirected to the net banking site of the bank and will have to log in using your bank’s net banking user ID /password.

- After this step, a challan counterfoil appears on your screen containing the CIN – Challan Identification Number. It acts as proof and has the payment details, the bank details and the tender of challan-date.

What is TDS Return?

The TDS return is a quarterly statement submitted to the government’s income tax department that mentions all the entries of the TDS amount collected and the TDS amount paid by the individual.

You would need a TDS return when you need to submit your quarterly report mentioning all the transactions that involve TDS. You can prepare it in many ways:

- Manually

- With the help of their accountant,

- Online cloud computing softwares

Now that you know everything about TDS, your knowledge can benefit your business accountings and return filings.

Frequently Asked Questions

What is the full form of TDS?

Tax Deduction at Source is the full form of TDS.

When is the due date for TDS payments?

Every individual or business corporation that deducts TDS must credit the TDS amount to the government’s income tax department. The due date for this is the 7th of the following month. For example, if your TDS is due in July, you must submit the payment on or before August 7th.

Can TDS returns be filed with the help of software?

Yes. While any option is given to the business or individual to file for the returns manually, cloud computing software can do the job just fine and faster without errors.

How often do TDS returns need to be filed?

You should file your TDS returns every quarter. TDS return is a statement that mentions the amount of TDS paid and the amount of TDS received by the individual or the business.

Is there a TDS refund?

Yes. However, a TDS refund should not be confused with Income Tax returns as they both are different and the process to gain a TDS refund is different.

Frequently Asked Questions about TDS

- What is the full form of TDS?

Ans : Tax Deduction at Source is the full form of TDS.

- When is the due date for TDS payments?

Ans: Every individual or business corporation that deducts TDS is required to credit the TDS amount to the government’s income tax department. The due date for this is the 7th of the following month. For example, in case a business needs to pay TDS dues for the month of July, they need to be done on or before the 7th of August.

- Can TDS returns be filed with the help of software?

Ans: Yes. While any option is given to the business or individual to file for the returns manually, a cloud computing software can do the job just fine and faster too, without errors.

- How often do TDS returns need to be filed?

Ans: TDS returns need to be filed every quarter. TDS return is a statement that mentions the amount of TDS paid and the amount of TDS received by the individual or the business.

- Is there a TDS refund?

Ans: Yes. However, a TDS refund should not be confused with Income Tax Return as they both are different and the process to gain a TDS refund is different.