The double-entry system of bookkeeping is a system in which each transaction is recorded in at least two accounts. This system provides a more accurate record of a company’s financial activities.

Each transaction—both credits and debits—has a corresponding entry. Every transaction has two parts and affects two ledger accounts, which forms the foundation of the double-entry bookkeeping system.

For instance, if a business borrows money from a bank, there will be two entries—one for an asset and one for a liability. This is because it will increase the assets for the cash balance account and the liabilities for the loan payable account.

In accounting, there is an equation: Liability + equity equals assets.

For the books to balance out at the end of the day, both sides of every transaction must be accounted for. This means that for every asset increase, there must be an equal increase in liabilities. If the total assets do not equal the total liabilities plus capital, then something has gone wrong and needs to be fixed in the books of accounts.

Principles of Double-Entry System of Bookkeeping

The following guidelines should be followed when using the double-entry bookkeeping system:

- There must be a credit for every debit.

- Credit appears on the right, with a debit to the left.

- The credit provides the benefit, and the debit receives it.

Certain guidelines must be followed when posting double-entry transactions in the bookkeeping process, which are as follows:

- Personal accounts are general ledger accounts for individuals, groups, and businesses.

For Individual Accounts: Debit the recipient, credit the giver

- The Real Accounts are general ledger accounts linked to assets and liabilities distinct from those of specific individuals or groups.

For Real Accounts: If money comes in, it is a debit. If money goes out, then it is a credit.

- All expenses, incomes, gains, and losses are recorded in the Nominal Accounts, general ledger accounts.

For Nominal Account: Debit all expenses and credit all profits.

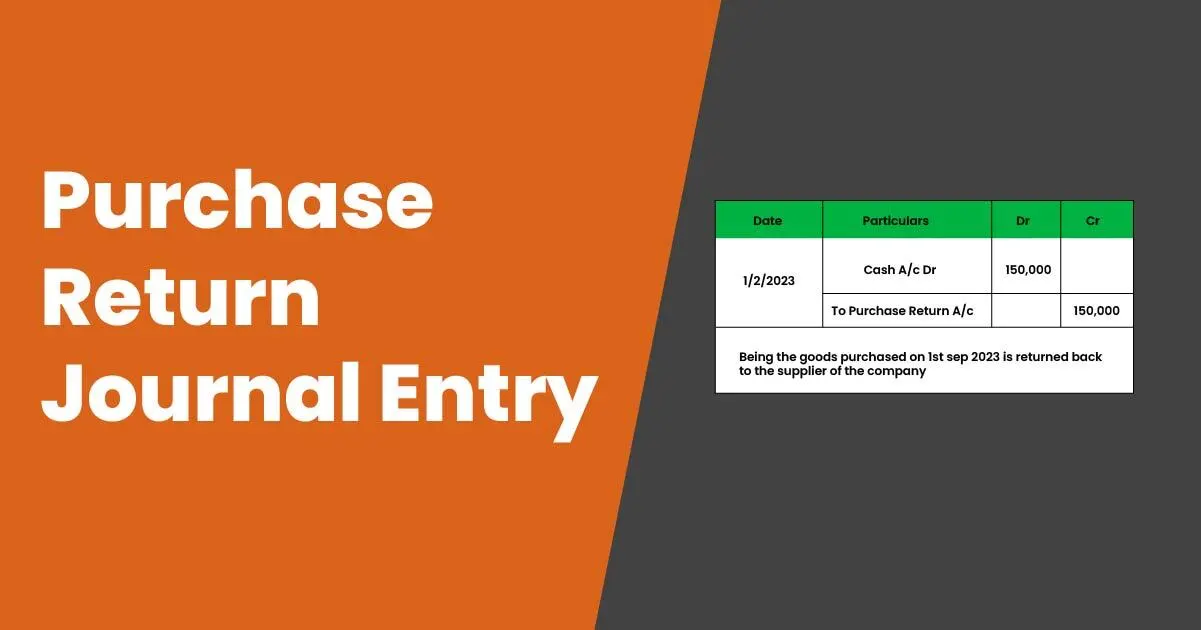

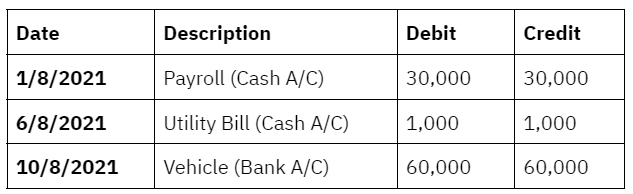

Journal Entries of Double-Entry System of Bookkeeping

Each transaction is noted as credit and debit in a journal. As a result, each transaction must be recorded in two accounts.

The main rule for the double-entry system is that each transaction must have a debit and credit entry. These two entries will be on opposite sides of the general journal. The debit entry will be on the left, while the credit entry will be on the right. The total of debits and credits must be equal to balance the transactions.

The following table shows an example of a double-entry of transactions in a journal:

Advantages of Double-Entry System of Bookkeeping

The double-entry bookkeeping system prevents errors and provides a clear and accurate record of a company’s financial transactions.

There are several advantages of using the double-entry system of bookkeeping such as:

1. Ensures all financial transactions are recorded

The company should continue to use a double-entry bookkeeping system if its transactions are significant. This helps maintain crucial financial reports like an income statement and balance sheet. Moreover, in contrast to the single-entry system, it provides comprehensive information about all transactions because each has a source and a destination.

2. Prevent financial errors

The formula states, Assets= Liability + Equity

This is important because if the information is wrong, it looks like the records have not been well kept, which could hurt the organisation’s reputation. The double-entry system ensures balance sheets and books of accounts are accurate, and being accurate also helps accountants reduce mistakes.

3. Provides a clear and accurate record and helps in decision making process

The double-entry system benefits companies by giving the organisation control over the business. In addition, the system offers valuable information about the profitability and financial stability of different aspects of the business, which can help inform better financial decision-making.

The detailed records help accountants maintain records that can be used for comparison purposes. This way, businesses can compare the details of the previous year with the current year and identify and address any deviations.

4. Supports statutory bodies and banks that rely on them

The double entry system is more reliable than other methods. It makes it easier for businesses to get credit and attract investors.

The double-entry system of bookkeeping is like getting a checkup from the experts. It provides a complete and accurate picture of the company’s financial health, which is why the Income Tax Department prefers it.

This system is also accepted by the statutory organisations overseeing businesses, such as the Registrar of Companies, SEBI, RBI, etc.

FAQs on Double Entry Bookkeeping

What does "double-entry bookkeeping" mean?

The double-entry bookkeeping method records business transactions where there is an entry for each transaction in at least two accounts. In this system, the total debits must equal the total credits.

What types of records are maintained for entries?

A cash register records the transactions' income and expenses in single-entry bookkeeping. On the other hand, the double-entry system begins with a journal, then moves on to a ledger, a trial balance, and then financial statements.

What are double-entry accounting's two rules?

Every transaction must be recorded in two or more accounts, and the total amount debited and credited must be equal.

Single Entry Bookkeeping

Guide To Bookkeeping

Balance Sheet Format