How to Print eWay Bill – Different Methods Explained

Printing an e-way bill is an essential step for businesses managing the movement of goods across India under the GST system. To print an eway bill, you can use the official e-way bill portal, third-party software and mobile apps. In this guide, we cover different methods to print an eway bill quickly so that your shipments move without delays.

Print eWay Bill Once Created

The primary method to print an eway bill is to use the ‘Print’ and ‘Detailed Print’ options available after generating it.

Once you log into the official eway bill portal and after creating an eway bill, you will find two options – Print’ and ‘Detailed Print’. You can choose any one option to print the eway bill.

Print eWay Bill Anytime – Login to eWay Bill Portal

If you want to print the eway bill later by logging into the official eway bill portal, you can follow the steps below.

- Login to the eway bill portal.

- From the left side menu, click ‘e-way Bill’ and select ‘Print EWB’

- In the next step, enter the 12-digit e-way bill number and click ‘Go’

- The e-way bill corresponding to the entered number gets displayed, and you can choose either ‘Print’ or ‘Detailed Print’ option to print the eway bill.

Print eWay Bill Without Login

If you want to print an eway bill without logging into the eway bill portal, you can follow the below steps.

- Visit the eWay bill print page at https://ewaybillgst.gov.in/Others/EBPrintnew.aspx

- Enter the eway bill number for which you want to take a printout

- Enter the date on which the eway bill is created

- Enter the name of the person who generated the eway bill

- Enter the document number – which is the invoice number corresponding to the bill

- Enter the Captcha and click on ‘Go’.

If all the entered details are correct, the eway bill associated with the eway bill number will be displayed with an option to ‘Print’. Click on it to take the eway bill printout.

eWay Bill Print Using myBillBook

If you’re using myBillBook to generate your e-invoices and eway bills, the billing software makes it effortless to print eway bills. Here is the detailed guide.

- Login to your myBillBook account

- From the left side menu, click on eWay Bill option

- You will find the list of eway bills that have already been generated.

- Click on the eway bill for which you want the printout.

- The eway bill opens, and click on the ‘Print’ option to take the eway bill print.

Using myBillBook eway billing software to print eway bills is the easiest method compared to the traditional methods, including logging into the eway bill portal. The eway billing software is available on mobile and desktop, enabling businesses to generate and print eway bills from wherever they are

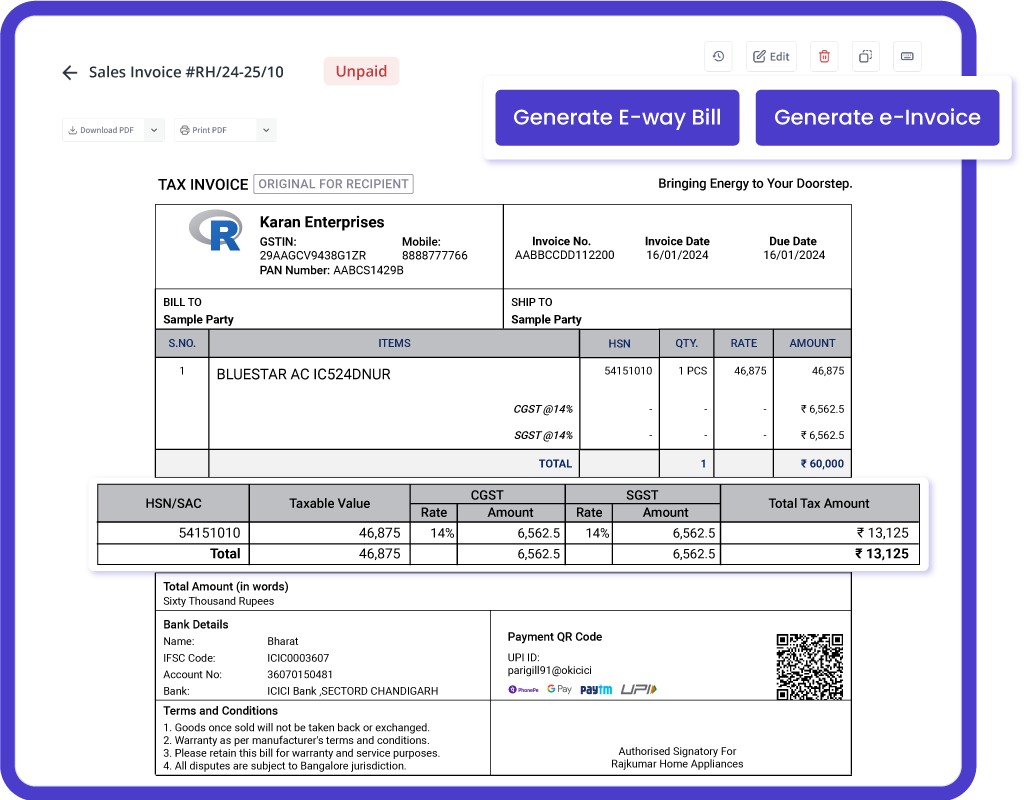

myBillBook eway bill software is India’s No:1 billing and accounting software that helps businesses streamline their billing and accounting processes. With the government mandating e-way bills, myBillBook upgraded the software to support e-way bill generation. myBillBook is powered by Masters India GST Suvidha Provider to simultaneously generate e-invoices and e-way bills. Once you enable the einvoicing option on the myBillBook billing app, you can directly convert all your B2B invoices into e-invoices in a single click. In the same step, you can generate e-way bills for all the applicable invoices.

Top Features of myBillBook e-Way Bill Software

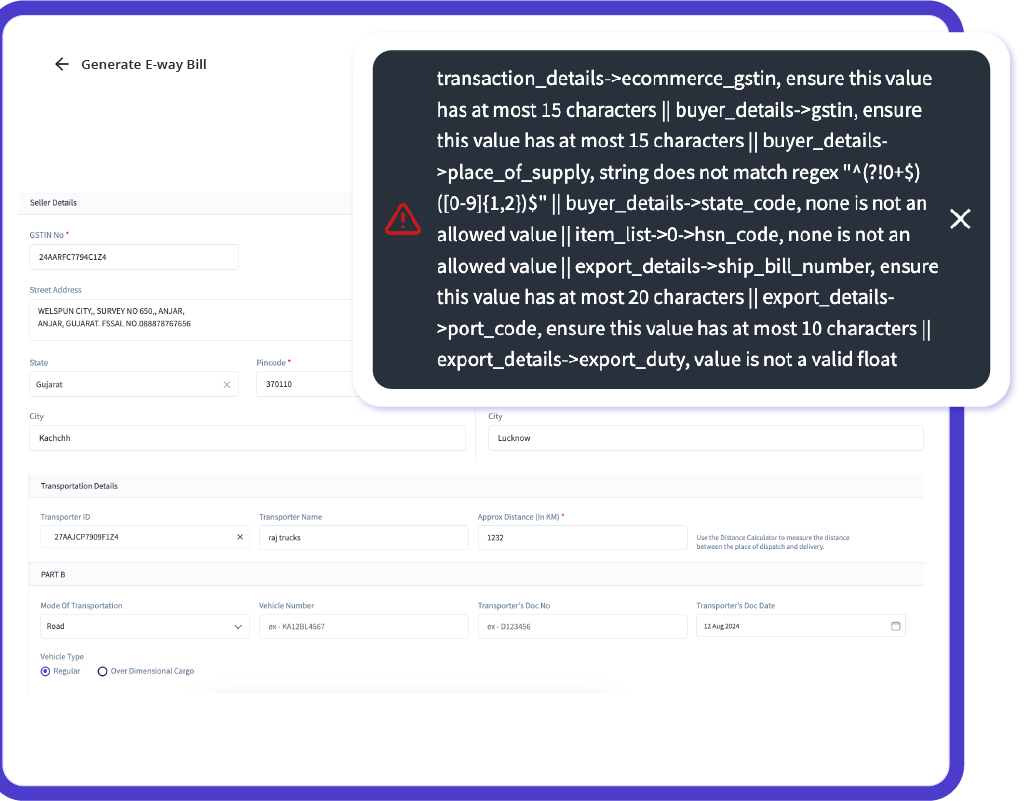

Instant e-Way Bill Generation with Built-in Error Prevention

Generate error-free e-way bills in less than 30 seconds by auto-populating important details like GSTIN, vehicle number, and transporter ID. Leverage 25+ smart error checks to ensure full compliance, avoid penalties, and make your logistics more efficient.

Efficient GST and e-Invoicing Integration

Integrate seamlessly with GST billing and e-invoicing systems. Generate and share e-way bills directly from your invoices, eliminating manual tasks and ensuring a streamlined compliance process.

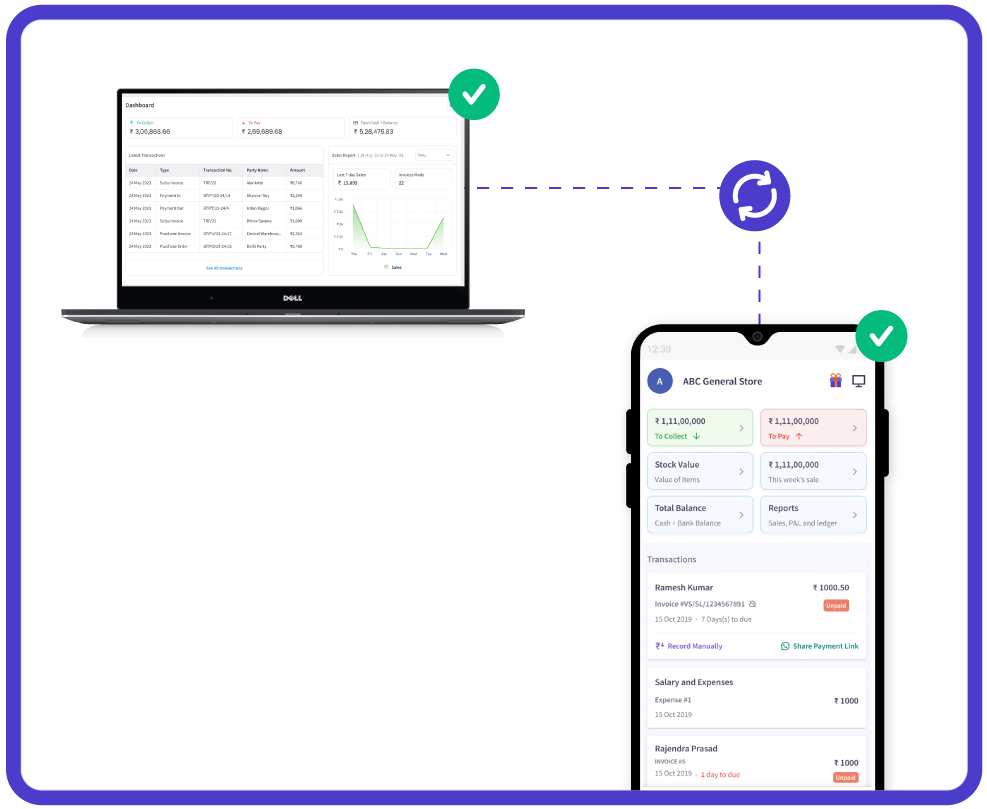

Effortless Multi-Device Access with Real-Time Updates

Easily access your e-way billing transactions from any device (phone, tablet, or computer) with myBillBook’s cloud solution. Real-time synchronization ensures that your data is always accurate and up-to-date across all platforms.

Trusted by 1 Crore+ businesses for Billing, Inventory, e-Way Billing & e-Invoicing

``Generate e-way bills effortlessly with myBillBook, ensuring GST compliance and simplifying your business operations.``

“Generating e-way bills was a hassle for our logistics team. With myBillBook’s instant e-way bill generation and auto-validation, we now create error-free e-way bills in under 30 seconds. The smart error checks ensure compliance, saving us time and avoiding costly penalties.”

Kavish Pawar

Ajay distributors, Hyderabad

Recommends myBillBook for:

myBillBook helps business succeed

“Integrating GST billing and e-invoicing with e-way bills used to be a challenge. Thanks to myBillBook, we now generate and share e-way bills directly from our invoices without manual steps, streamlining compliance.”

Ravish Rathod,

The Craft Store – Chennai

“Data security is critical for our business, and myBillBook delivers. With bank-grade security and compliance support, our data is protected, and any e-way billing issues are resolved swiftly, keeping us fully compliant.”

Ravi Rao,

Rapid Logistics – Bangalore

“Managing e-way bills on the go is seamless with myBillBook’s cloud-based solution. Whether in the office or traveling, I can access, generate, and share e-way bills securely, ensuring our logistics run smoothly wherever I am.”

Arun Rane,

Speedy Auto Parts – Delhi

Pricing plans

Diamond Plan

₹217

Per month. Billed annually. Excl. GST @18%

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

Platinum Plan

₹250

Per month. Billed annually. Excl. GST @18%

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

Enterprise Plan

₹417

Per month. Billed annually. Excl. GST @18%

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills

FAQs on Print eWay Bill

How do I print my e-way bill?

To print from the GST E-Way Bill Portal:

- Log in to the e-Way Bill Portal.

- Go to the “Print EWB” option.

- Enter the e-way bill number or search for it.

- Select the “Print” option.

You can preview and print the document using a connected printer.

Is e-way bill printout mandatory?

While carrying a printout of an e-way bill is recommended, it’s not strictly mandatory. Digital eway bill on mobile devices is acceptable. However, having an eway bill printout can help avoid delays during inspections, especially in areas with limited network access. For high-value goods or interstate movement, keeping a printed copy of an eway bill is advisable.

How do I get a detailed print of my e-way bill?

While taking print put of an eway bill, the system will provide two options, ‘Print’ and ‘Detailed Print’. By clicking on the detailed print option, you can get the print of an eway bill in detail.

What information is required to print an eway bill?

To print an eway bill without logging into the portal, you need to enter the eway bill number, eway bill generation date, and name of the person who generated it.

When printing an eway bill from your eway bill account, you can simply select the eway bill from the list and take a print of the same. No other information needs to be entered.