Trusted by 1 Crore+ businesses for Billing, Inventory and Accounting

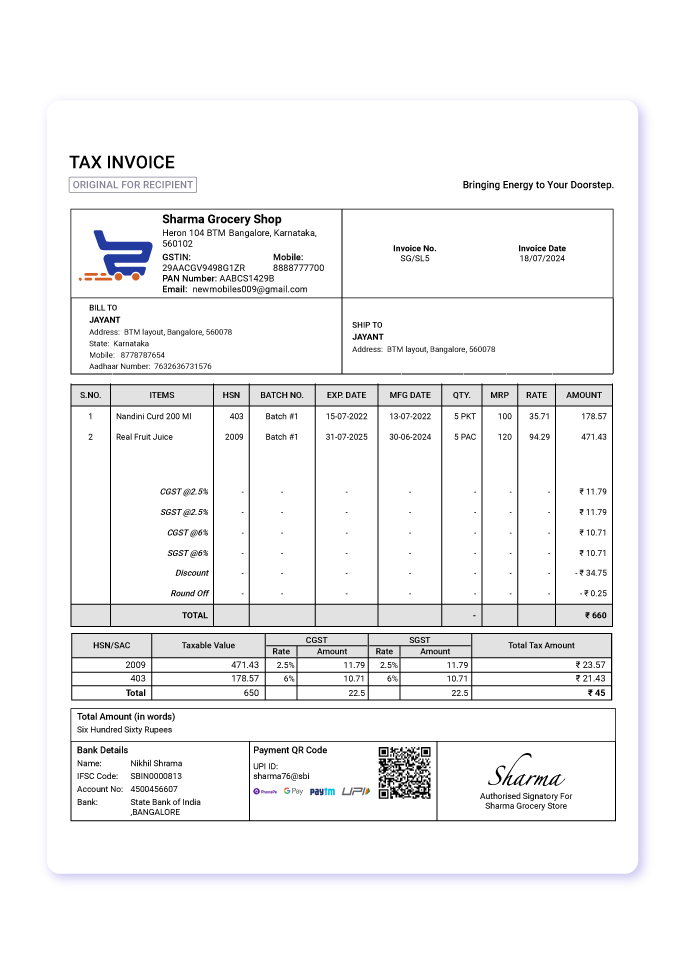

``myBillBook is designed for businesses to generate accurate GST-compliant invoices and automate their entire accounting process.``

“Managing multiple retail outlets and keeping track of stock movement used to be a nightmare. With myBillBook, we can now monitor sales, manage inventory, and generate reports effortlessly. The software’s real-time data sync has significantly improved our operational efficiency.”

Rajesh S

Ravi Sharma, Retail Business Owner

Recommends myBillBook for:

Product Demo of Accounting App for Android

“Superb customer service. Helped me set up my account as required”

Key Features of Accounting App for Android

Mobile-First Accounting for Business Owners

The app is designed for seamless on-the-go accounting, allowing users to create invoices, track payments, and check reports from anywhere.

Cloud-Based Data Backup & Security

All business data is automatically backed up to the cloud, ensuring security and preventing data loss. Users can access their records from any device without worrying about manual backups.

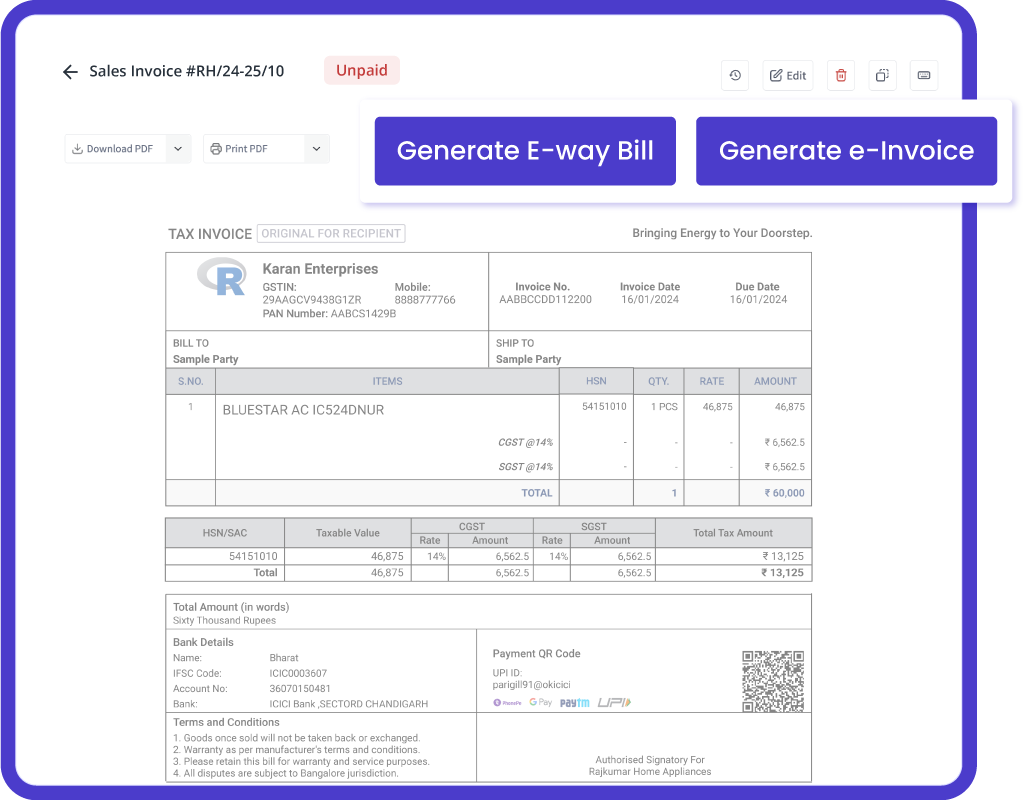

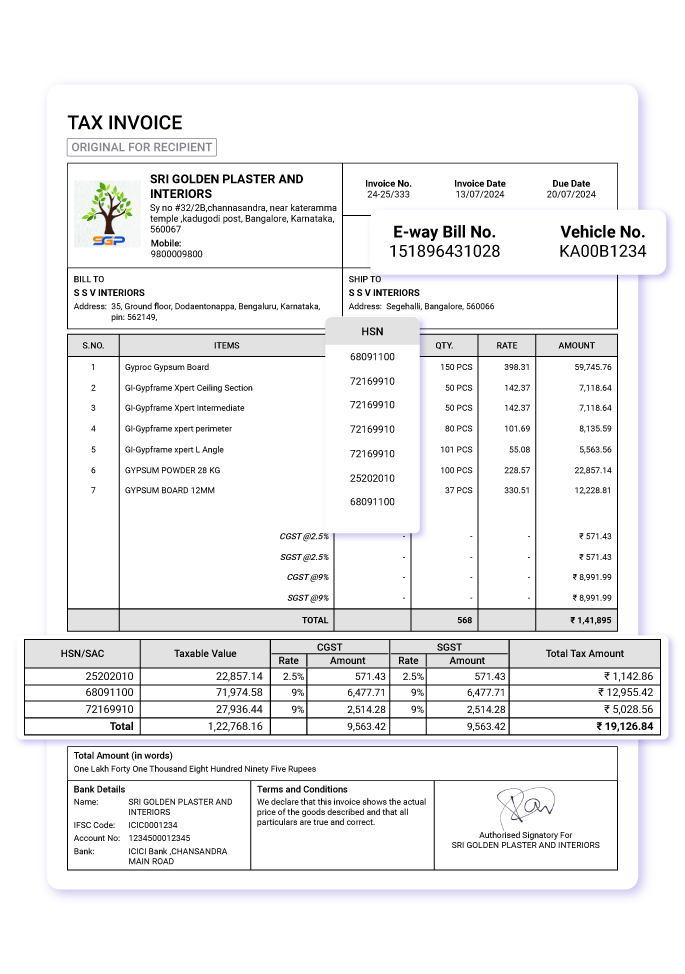

Instant E-Way Bill & E-Invoice Generation

Users can generate e-way bills and e-invoices instantly within the app, avoiding the hassle of switching between multiple platforms.

Touch-Friendly & Gesture-Based Navigation

The app features an intuitive touch interface, making tasks like billing, inventory updates, and payment tracking easy with a tap-and-swipe experience.

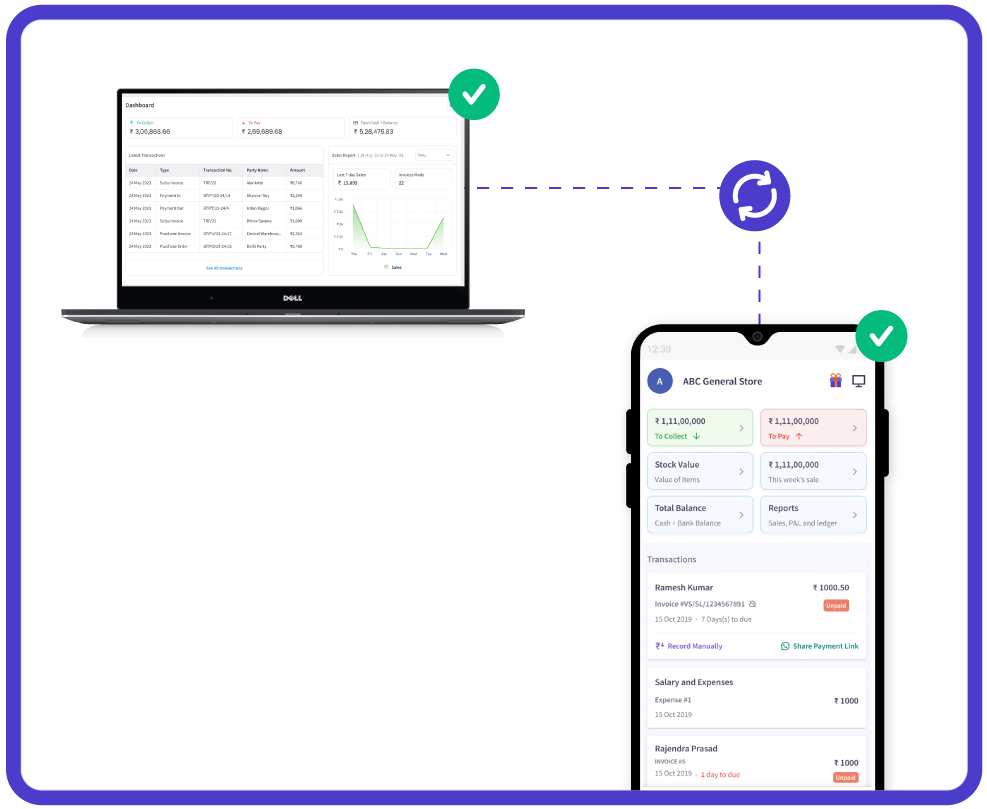

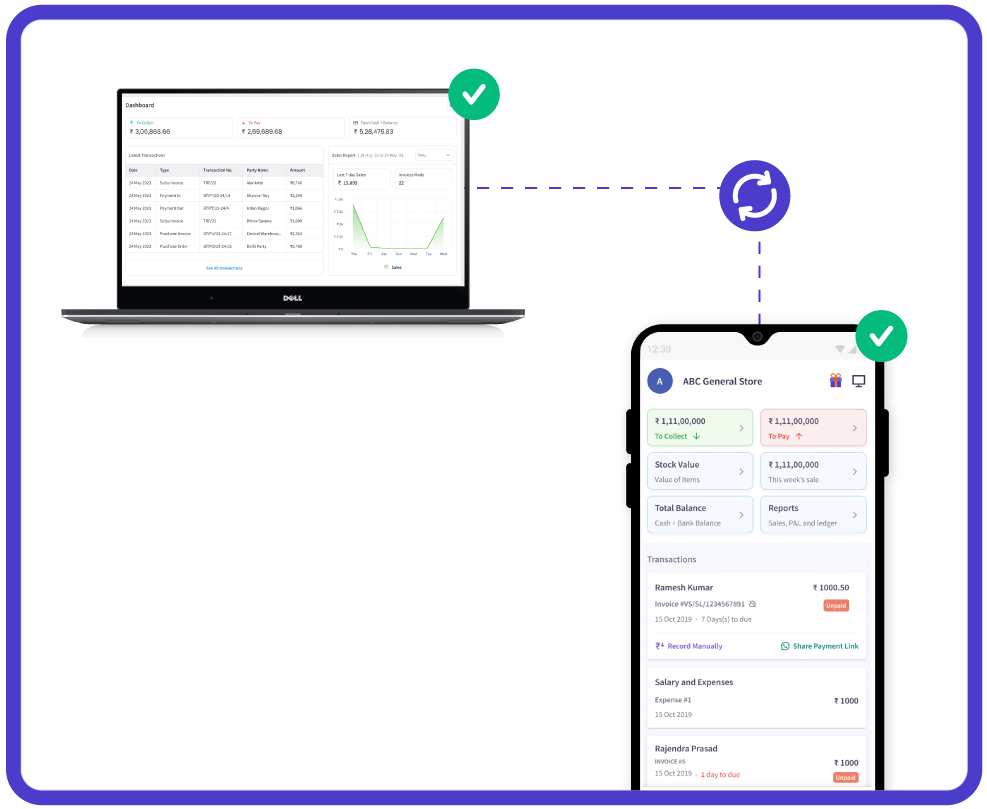

Real-Time Multi-Device Sync

Updates made in the app instantly sync across multiple devices, allowing business owners and employees to collaborate efficiently without manual data entry.

Automatic Updates for Compliance & Features

The app updates automatically to ensure users always have access to the latest GST rules, new features, and security enhancements without manual installations.

myBillBook helps Business succeed

“Tracking sales and inventory across different platforms was a challenge for our e-commerce business. myBillBook’s automation features have made invoicing, expense tracking, and tax compliance seamless. Now, we can focus on growing our business without worrying about accounting complexities.”

Prathik Malhotra,

E-commerce Entrepreneur

“Before using myBillBook, we struggled with maintaining accurate financial records and tax compliance. This software has simplified our bookkeeping with automated GST calculations, real-time financial tracking, and easy return filing, saving us valuable time and effort.”

Rajesh Kumar,

Online Store Owner

“As a small manufacturer, staying on top of financial records and GST compliance was a challenge. myBillBook has transformed our accounting process by automating tax calculations, invoice creation, and financial reporting. Now, we can focus on growing our business without worrying about manual errors.”

Neha Verma,

Marketplace Seller

Pricing plans

Diamond Plan

₹217

Per month. Billed annually. Excl. GST @18%

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

Platinum Plan

₹250

Per month. Billed annually. Excl. GST @18%

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

Enterprise Plan

₹417

Per month. Billed annually. Excl. GST @18%

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills

What is Accounting Software for Android?

Accounting software for Android is a mobile application designed to help businesses and freelancers manage their finances efficiently. It provides features such as invoicing, expense tracking, GST compliance, inventory management, and real-time financial reporting. With cloud-based storage and multi-device syncing, these apps ensure seamless financial management on the go.

Why Your Business Needs an Accounting App for Android

Whether you need bookkeeping software for expense tracking or cloud billing software for secure financial storage, myBillBook has you covered.

- Mobility & Convenience: Access your business finances anytime, anywhere from your Android device. Whether you are in the office or on the go, an app provides seamless financial management.

- Real-Time Updates: Get instant notifications about payments, invoices, and stock levels, ensuring you always have up-to-date information at your fingertips.

- Streamlined Financial Management: Manage all aspects of business accounting, from generating GST invoices to tracking bank transactions and cash flow, all within a single app.

- Error Reduction & Accuracy: Automate calculations, eliminate manual data entry mistakes, and generate precise financial reports to improve accuracy and compliance.

- Efficient Payment Collection: Speed up payment collections with automated reminders and instant invoice sharing through WhatsApp, ensuring customers pay on time.

- Cost-Effective Solution: Reduce expenses associated with hiring accountants or purchasing expensive accounting software by using a free or affordable mobile app.

- Security & Data Backup: With cloud-based storage and encrypted security, your financial data remains safe, backed up, and accessible even in case of device loss or damage.

- Multi-User Access: Allow multiple team members to access and manage financial records securely, ensuring smooth collaboration within your business.

Why Choose myBillBook as Your Accounting App for Android?

Choosing the right accounting app is essential for streamlining business finances. myBillBook stands out as a comprehensive solution designed specifically for small and medium-sized enterprises. Here’s why myBillBook is the preferred accounting app for Android users:

1. Free to Use

myBillBook offers a free version with essential accounting features, making it an affordable option for startups and small businesses. Users can upgrade to premium features as their business grows.

2. Cloud-Based Accessibility

Access your financial data from anywhere with cloud storage. Whether switching between devices or working remotely, your data remains synchronized and updated in real-time.

3. User-Friendly Interface

Designed for small businesses, myBillBook features an intuitive and easy-to-navigate interface. Users with minimal accounting knowledge can easily manage their finances without needing professional expertise.

4. Multi-Device Support

Sync financial data across Android devices, desktops, and tablets. This ensures seamless business operations without the hassle of manually transferring data between devices.

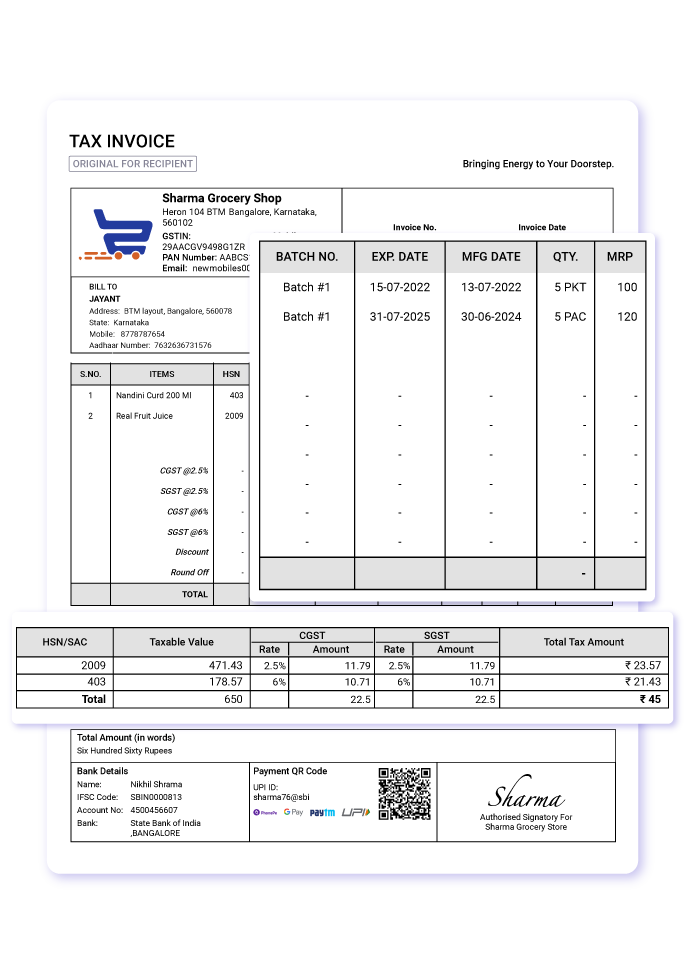

5. GST Compliance & Automated Tax Calculations

Generate GST-compliant invoices, automate tax calculations, and file GST returns with ease. This feature helps businesses remain compliant with government regulations and avoid tax penalties.

6. Secure Data Encryption & Backup

With end-to-end encryption and cloud backups, myBillBook ensures your financial data remains safe and protected against loss or cyber threats.

7. Customizable Invoices & Branding

Create professional invoices with custom branding, including your company logo and colors. Impress clients with personalized invoices that reflect your business identity.

8. Automated Reminders for Payments & Dues

Track pending payments and send automated reminders to customers through WhatsApp, SMS, or email. This improves cash flow and reduces outstanding dues.

9. Multi-Language Support

Operate the app in multiple Indian languages such as Hindi, Tamil, and Telugu, making it accessible for regional business owners.

10. Seamless Integration with Business Tools

myBillBook integrates with other essential business tools like payment

Benefits of Using an Accounting App for Android

1. Increased Efficiency

An accounting app automates repetitive tasks like invoicing, billing, and bookkeeping, significantly reducing manual work. Business owners can allocate more time to growth and strategy rather than managing spreadsheets.

2. Better Financial Tracking

Real-time tracking of receivables, payables, and overall cash flow ensures businesses stay financially sound. Users can generate instant financial reports and analyze profits and expenses without waiting for manual reconciliations.

3. Tax Compliance Made Easy

With built-in GST compliance, accounting apps ensure accurate tax calculations, invoice generation, and GST return filing. This minimizes errors and saves businesses from potential penalties.

4. Secure Data Storage & Backup

Accounting apps provide cloud-based storage with encrypted security, ensuring financial data remains protected. Automated backups prevent data loss, giving businesses peace of mind.

5. Cost-Effective Solution

Using an accounting app eliminates the need for expensive accounting software or hiring professional accountants. Businesses can access essential financial accounting management tools at a fraction of the cost.

6. Improved Cash Flow & Faster Payments

With automated payment reminders and instant invoice sharing via WhatsApp or email, businesses can collect payments faster and reduce outstanding dues. This ensures steady cash flow for business operations.

How myBillBook Helps Businesses with Accounting on Android

myBillBook’s Android app is specifically designed to help businesses manage their accounting efficiently while on the go. Here’s how it benefits Android users:

Mobile-Friendly Invoicing: Create and send GST-compliant invoices directly from your Android device, eliminating the need for a desktop.

WhatsApp Integration for Quick Invoice Sharing: Instantly share invoices, payment reminders, and reports with customers through WhatsApp, enhancing communication and timely payments.

Real-Time Expense & Income Tracking: Log expenses and income on the go, categorize transactions, and monitor financial health in real-time.

Voice Command Support: Use voice commands to add expenses or retrieve reports, making accounting even easier for Android users.

Automated Payment Reminders: Schedule and send automated payment reminders via SMS and WhatsApp to ensure customers pay on time.

Secure Cloud Storage with Auto-Backup: Never lose your financial data with encrypted cloud storage and automatic backups.

Multi-Language Support for Regional Businesses: Use the app in multiple Indian languages, ensuring accessibility for diverse business owners.

FAQs

1. Which is the best free accounting app for Android?

myBillBook is one of the best free accounting apps for Android, offering invoicing, GST compliance, expense tracking, and more.

2. Can I generate GST invoices on my Android device using myBillBook?

Yes, myBillBook allows you to generate GST-compliant invoices directly from your Android phone, with auto-populated tax details for accuracy.

4. How does myBillBook help with payment collection on Android?

myBillBook integrates with WhatsApp and SMS, allowing you to send automated payment reminders and invoices directly to customers, ensuring timely collections.

5. Can I track my business expenses and profits on my Android phone?

Yes, myBillBook offers real-time expense tracking, profit analysis, and detailed financial reports, all accessible on your Android device.