Account Formats

Account formats are structured representations of financial transactions, helping businesses and individuals maintain clear financial records. Proper account formats are essential for accuracy and compliance in bookkeeping, financial statements, and internal reports. You can create account formats using Word, Excel, or PDF, but using myBillBook simplifies the process significantly.

✅ Quick & Easy Account Format Creation

✅ Customisable Templates

✅ Professional Look

✅ Unlimited Financial Documents

✅ Affordable Plans Starting at INR 399/Year

Account Format in Word, Excel & PDF | Download Free

Features of myBillBook Account Format

Pre-Designed Templates

Get access to professionally designed account formats that align with industry standards. These templates reduce manual effort and provide a structured approach to financial documentation.

Customizable Fields

Modify the structure, add company details, and adjust transaction columns as per business needs. This flexibility allows personalized financial reports suited to different industries.

Automated Calculations

Eliminate human errors with built-in formulas that automatically compute balances, credits, and debits. This feature enhances financial accuracy and saves valuable time.

Cloud Storage & Backup

Secure all account records with cloud-based storage, ensuring that financial data is never lost. Access your account formats from anywhere and keep them safe from accidental deletions or system failures.

Multi-Device Accessibility

Create, view, and edit account formats seamlessly across mobile, tablet, and desktop devices. This feature ensures convenience and productivity, no matter where you are working from.

GST & Compliance Integration

Ensure your financial reports adhere to tax laws and regulatory standards with built-in GST compliance. This helps businesses maintain legally accurate records without manual intervention.

₹217

Per month. Billed annually

Diamond Plan

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

₹250

Per month. Billed annually

Platinum Plan

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

₹417

Per month. Billed annually

Enterprise Plan

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills Popular

₹399 per year

Silver Plan for Android App

✅ For 1 device, 1 business and 1 user

What is an Account Format?

An account format is a structured framework used in accounting to systematically record financial transactions. It serves as a foundation for businesses, organizations, and individuals to maintain transparency in their financial activities. Account formats help in tracking income, expenses, liabilities, and assets, ensuring that financial data is accurately represented for analysis and decision-making.

A well-structured account format typically consists of various financial statements, including the balance sheet, which showcases a company’s financial position, and the profit and loss statement, which details revenue and expenditures over a given period. Additionally, the ledger accounts offer an organized classification of financial transactions under different headings such as sales, purchases, salaries, and operational costs.

Using an account format provides businesses with a systematic approach to financial management, ensuring compliance with accounting principles and regulatory requirements. Whether used manually in books or digitally through bookkeeping software, an account format simplifies financial tracking and enhances accuracy in reporting.

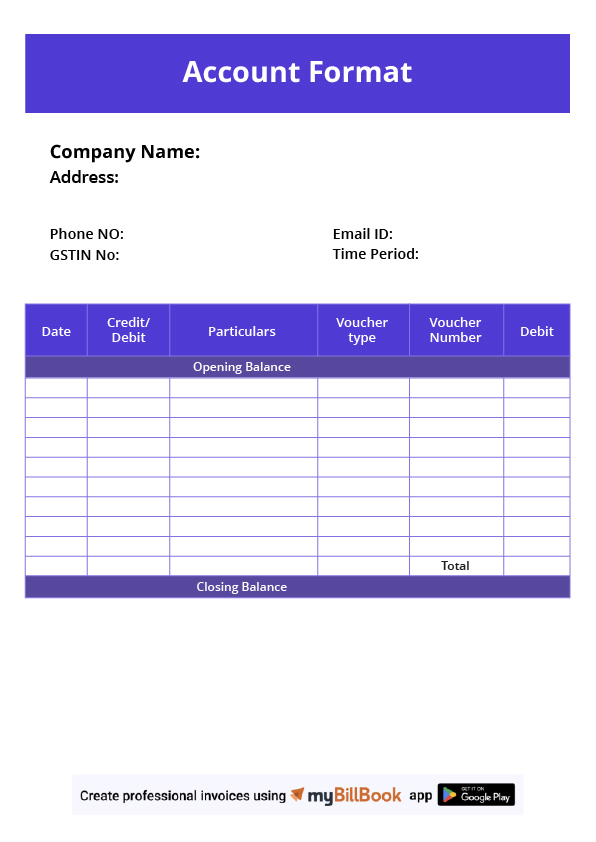

Format of an Account

The standard account format consists of multiple sections that help structure financial records effectively. These sections provide a clear representation of all monetary transactions within a specified period. The key components of an account format include:

- Title – This is the heading that defines the type of financial statement or ledger. It typically includes the account name, such as “Sales Account,” “Cash Account,” or “Profit and Loss Statement.”

- Date & Period – Every account format must specify the time frame for which the financial transactions are recorded. This ensures clarity in financial reporting and helps businesses analyze trends over a given period.

- Particulars – This section describes each financial transaction in detail, including purchases, sales, payments, and receipts. A proper description of transactions ensures that records are easy to track and verify.

- Debit & Credit Columns – Every transaction in accounting affects at least two accounts, following the double-entry bookkeeping principle. The debit column records money going out (expenses or asset acquisition), while the credit column records money coming in (income or liability reduction).

- Balance Column – This column keeps a running total of the account’s balance after every transaction. It helps businesses monitor cash flow and financial position in real time.

Account Format in Word, Excel, & PDF

Account Format in Word:

Word documents allow for customizable and professional-looking account formats. You can create structured financial reports, balance sheets, or ledgers using tables and formatting tools. Word is suitable for textual explanations accompanying financial data and is often used for final presentations or reports.

Account Format in Excel:

Excel is widely used for account formatting due to its built-in calculation capabilities. You can create automated financial statements with formulas, pivot tables, and filters, making it easier to analyze data. Excel is ideal for managing large sets of transactions, calculating totals, and generating reports dynamically.

Account Format in PDF:

PDF formats are best for preserving the integrity of financial documents. Once an account format is finalized, saving it as a PDF ensures that it remains unaltered and professional. PDFs are commonly used for official reporting and document sharing since they provide a fixed layout that cannot be easily edited.

Key Elements of an Account Format

- Header Information – This section contains essential details such as the business name, financial period, and the title of the financial document. It helps identify the nature of the account format and ensures proper documentation.

- Ledger Details – The ledger details include systematic entries of financial transactions categorized under specific accounts. These help businesses track different income sources, expenses, liabilities, and assets effectively.

- Transaction Details – Every financial entry needs a proper description of the transaction, including date, parties involved, and nature of the transaction (e.g., sale, purchase, loan, or investment). This ensures transparency and accuracy in bookkeeping.

- Balance Computation – This section records running balances after each transaction is entered. It ensures that businesses can monitor financial standing in real time and track outstanding amounts.

- Notes & Disclosures – Notes and disclosures provide additional explanations regarding specific transactions or accounting treatments. They help clarify complex entries and ensure compliance with accounting standards.

- Approval Signatures – Official financial records often require approval from authorized personnel such as accountants, managers, or auditors. This section adds authenticity and validity to the account format, ensuring accountability.

Best Practices for Creating & Using Account Formats

- Maintain a Consistent Format – Keeping a uniform structure across all financial records helps ensure clarity and accuracy.

- Use Accounting Software – Automating financial record-keeping enhances accuracy, reduces errors, and saves time.

- Ensure Compliance with Accounting Standards – Adhering to regulatory and tax requirements prevents legal complications and financial misstatements.

- Regularly Update Records – Frequent updates ensure that financial statements reflect real-time business performance.

- Secure Digital Backups – Storing records in cloud-based or secure digital systems prevents data loss due to unforeseen circumstances.

- Conduct Periodic Audits – Regular reviews and audits help identify discrepancies and maintain financial transparency

Understanding Different Types of Accounting Formats

Accounting formats provide structured ways to record, summarize, and analyze financial data across various business scenarios. Whether you’re tracking daily expenses, calculating manufacturing costs, or managing joint venture accounts, each format serves a unique purpose. This guide gives you a quick overview of the most commonly used accounting formats—what they are, how they help, and why they matter—so you can choose the right one for your specific business or reporting needs.

Profit and Loss Account Format

The profit and loss account format offers a structured view of a business’s revenues and expenses over a period. It helps users assess financial health by breaking down income sources and operational costs. This format is key for determining net profit and guiding future business decisions.

Manufacturing Account Format

The manufacturing account format outlines the cost of producing goods, helping manufacturers calculate factory overheads, raw material usage, and work-in-progress. It provides transparency into production efficiency and cost control, making it vital for pricing and profitability analysis.

Receipt and Payment Account Format

The receipt and payment account format simplifies the recording of actual cash inflows and outflows. Commonly used by non-profits and clubs, this format provides a clear snapshot of liquidity without detailing accruals, supporting basic financial tracking and audit readiness.

Capital Account Format

The capital account format tracks the inflow and outflow of capital in a business, reflecting owner contributions, withdrawals, and retained earnings. It is crucial for understanding changes in ownership equity and supports long-term strategic planning.

Depreciation Account Format

The depreciation account format systematically captures asset value reduction over time. This format ensures compliance with accounting standards while helping businesses allocate costs fairly and maintain accurate net book values.

Journal Account Format

The journal account format serves as the foundational record for all financial transactions, arranged in chronological order. It promotes clarity, audit trail accuracy, and helps businesses maintain proper double-entry accounting practices.

Contract Account Format

The contract account format is tailored for businesses handling construction or service contracts. It details expenses, revenues, and work completion stages, allowing accurate profit recognition and project-level cost tracking.

Debtors Account Format

The debtors account format organizes information on customer dues, payment timelines, and outstanding balances. It aids in efficient receivables management and ensures better control over cash flow and credit policies.

Cost Accounting Format

The cost accounting format categorizes direct and indirect costs associated with production or services. It helps businesses analyze unit costs, identify inefficiencies, and set optimal pricing strategies for sustainable profitability.

Royalty Account Format

The royalty account format records periodic payments for intellectual property use or resource extraction. It ensures accurate calculation of royalties due, helping both licensors and licensees maintain transparent financial records.

Profit and Loss Adjustment Account Format

The profit and loss adjustment account format reconciles discrepancies from previous financial years, incorporating adjustments like accrued expenses or errors. It ensures that final accounts reflect true and fair financial positions.

Bills Payable Account Format

The bills payable account format tracks amounts owed through promissory notes or accepted bills. It supports timely payments, maintains good supplier relations, and helps manage short-term liabilities effectively.

Joint Venture Account Format

The joint venture account format is used when two or more parties collaborate on a project, outlining shared costs, revenues, and profits. It ensures fair reporting and transparency between partners throughout the venture.

Total Creditors Account Format

The total creditors account format consolidates all supplier payables into one comprehensive record. It enables businesses to manage obligations efficiently, plan cash flows, and ensure timely settlements.

FAQs

- What is the importance of an account format?

It ensures systematic recording of financial data, making bookkeeping and financial analysis easier. - Can I create an account format in Excel?

Yes, Excel is widely used for account formatting due to its formula-based structure and automation features. - How does myBillBook help in account formatting?

myBillBook provides pre-designed templates, automated calculations, and cloud-based storage for easy financial documentation. - Is a digital account format better than a manual one?

Yes, digital formats offer better accuracy, efficiency, and security compared to manual record-keeping.

Know More About Accounting & Billing Formats