What is Section 194A?

Deduction of TDS on interest on items other than securities, such as interest on fixed deposits, loans, and advances from non-bank sources, is covered by Section 194A.

This section applies only to residents. Thus, the limitations of section 194A do not apply when paying interest to a non-resident. The TDS method also applies to payments made to non-residents. However, tax in this situation must be subtracted following Section 195.

When must TDS under Section 194A be deducted?

The person who pays/deducts taxes shall do so if the amount of interest being paid or credited in a financial year is likely to exceed 40,000, and the payer is:

- A banking corporation, a bank, or another financial institution

- A cooperative society that does banking business

- Postal Service (on deposit under a scheme framed and notified by the Central Government).

- 5,000 in any other circumstance.

No TDS would be taken from older adults’ interest earnings up to INR 50,000 starting in FY 2018-19. The following sources should yield the required amount of interest:

- Regular deposit schemes

- Bank deposits

- Postal service deposits

- Fixed-deposit plans

When is Tax deducted at NIL rate or lower rate?

This happens under the following scenarios:

When a declaration is submitted using form 15G or 15H, per section 197A

No tax is deductible if the following criteria are met, and a Section 197A declaration is provided to the payer by the receiver along with their PAN:

- Recipient is a person rather than a business or organisation.

- The entire amount of tax for the prior year (PY) is NIL.

- Total income is below the exemption threshold (i.e. for AY 2020-21, Rs.2,50,000 or Rs.3,00,000 or Rs.5,00,000, as applicable). If the receiver is a local elderly citizen, this condition does not apply.

- This declaration must be made in duplicate using form 15G. (15H for senior citizens). Investors may submit the Senior Citizens Savings Scheme (SCSS) declaration, established in 2004.

- The declaration may also be presented by nominees of SCSS investors when the depositor’s death is being paid following.

- Banks are not allowed to deduct taxes from interest payments upon submission of a declaration (under certain conditions).

When a Section 197 application is presented in Form 13,

- According to Section 197’s requirements, the recipient may submit an application in Form No. 13 to the Assessing Officer to get a certificate allowing the payer to withhold tax at a lesser rate (or deduct no tax if certain conditions are satisfied).

- There is no deadline for submitting an application, which may be done whenever the tax is deducted. The recipient cannot apply for the certificate if he does not have a PAN.

- The certificate must be given on plain paper with a warning to the applicant directly to the person in charge of paying income.

- Retrospective issuance of the certificate is not permitted.

- In exchange for a lesser or no source tax deduction, the beneficiary may give a copy of this certificate to the person responsible for collecting the income.

What is the rate of TDS?

The applicable tax rates are as follows:

- 10% at the time the PAN is provided (7.5% for interest credited between 14 May 2020 and 31 March 2021 as a COVID-19 relief mechanism);

- 20% is deducted if the PAN is missing.

- The previous rates shall not be subject to any additional fee, education cess, or SHEC. Tax will therefore be taken out at the source at the basic rate.

What is the time limit for depositing TDS?

Taxes deducted from paychecks between April and February must be deposited by the 7th of the month, at the latest. Taxes withheld in March must be deposited by April 30 at the latest.

For instance, tax deducted on April 25 must be deposited by May 7 and tax deducted on March 15 must be deposited by April 30.

FAQs about Section 194a of Income Tax Act

Is TDS deducted on interest against a loan paid to a bank?

No. If the interest is paid to a bank by an individual or a company against the loan, the TDS provisions will not be applicable.

What will happen if the TDS is not paid?

If you are an employee and if your employer has not paid the TDS, then you will receive a notice from the income tax department that says there is a mismatch in the TDS claimed and taxes paid. Only when the TDS is paid, it will reflect against your PAN.

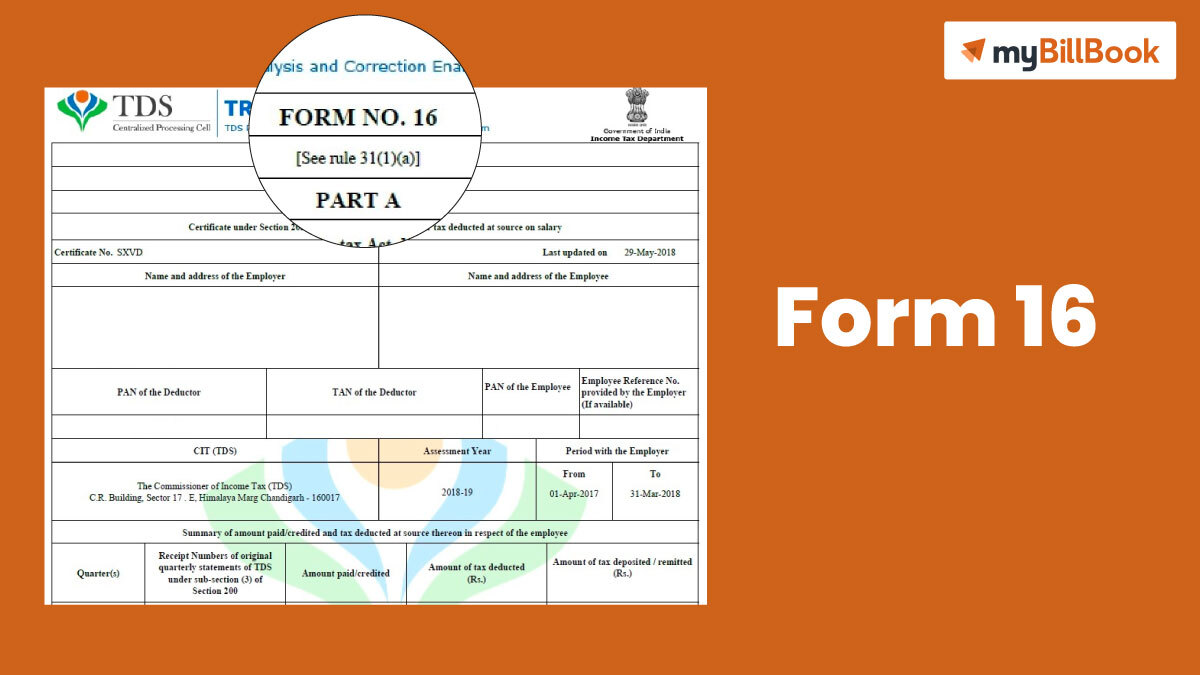

How do I know how much TDS amount is deducted from an account?

You can check online by visiting the official website of the Income Tax Department of India. You should register as a new user and enter the details of PAN and generate a password. After logging in to your account, you must select the View Tax Credit Statement option or the Form 26AS. You will now see a page for TDS Reconciliation Analysis and Correction Enabling System. This will have all the details regarding the taxpayer’s tax liabilities, including the information of TDS, advance tax paid, and other required details.

What is the meaning of 194A?

The TDS deduction on interest on non-securities is covered by Section 194A. This indicates that it includes interest on fixed deposits, recurring deposits, unsecured loans and advances, etc.

What is the 194A TDS rate?

When the payee provides the PAN, the TDS rate is 10%.

What is the limit of TDS on interest?

Section 194A states that no tax will be deducted if the total interest paid during the financial year is less than Rs. 5,000. Once the interest payment surpasses Rs. 5,000, the total amount must be taxed.

Is it mandatory to pay interest on an unsecured loan?

No, paying interest is not necessary.

Can we claim TDS u/s 194a?

To download the appropriate income tax refund form, go to the income tax portal and log in. Complete the form, then send it in. You can claim the money if your employer withheld taxes from your pay while you weren't entitled to them by completing income tax returns (ITR).

What is the TDS limit for FD interest 2021-22?

For Indian citizens: The TDS on interest earned by Indian residents on fixed deposits will be 10% in 2021–2022. 2. For NRIs: On interest earned on fixed deposits, NRIs must pay a TDS of 30% plus any surcharges and taxes.

How is TDS interest calculated?

The calculation is as follows: Average income tax rate is determined by dividing the amount of income tax due (determined using slab rates) by the employee's anticipated annual income.

What is the TDS rate for 50000?

The TDS rate is 10% if your income limit exceeds Rs. 40000. For senior citizens, this income threshold is Rs. 50000.