What is Form 16?

This Form 16 is a certificate issued by your employer. It certifies the details of your salary for the year and the TDS deduction. These are the scenarios when the form showing a TDS deduction is necessary:

- Income from salary for the financial year is more than the basic exemption limit of Rs 2,50,000

- Total income for deduction includes your disclosed income from other sources.

Form 16 means acknowledging that your deducted tax amount deposit is complete with the Income Tax department. The deadline for issuing a form 16 is by the 15th of June.

Every form 16 document has two parts: Part A and Part B.

[adinserter block=”3″] [adinserter block=”4″]

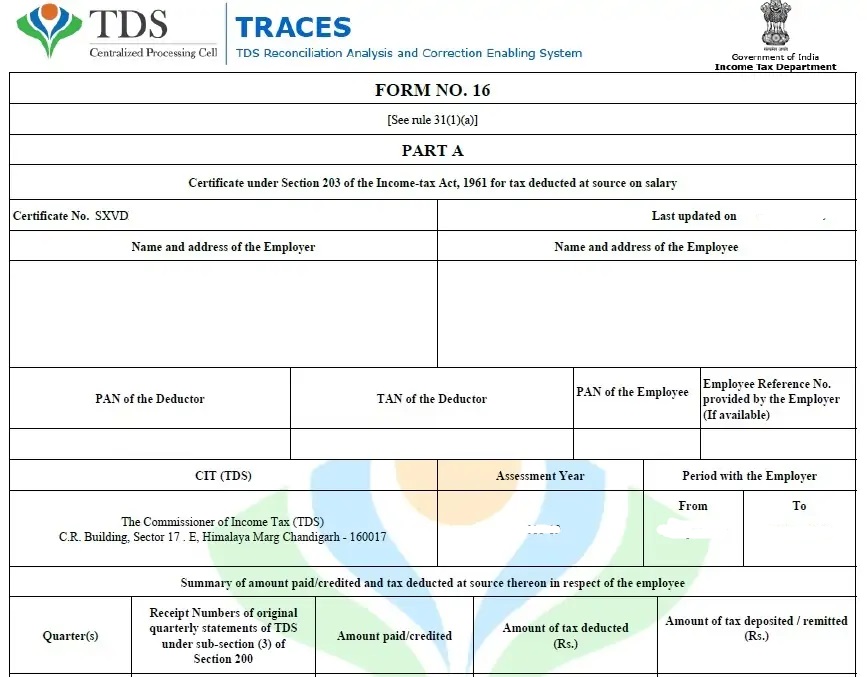

Part A of Form 16

Part A of form 16 contains the following information about the employer and employee:

- Name and address

- PAN and TAN details

- Length of employment

- TDS deductions with the government

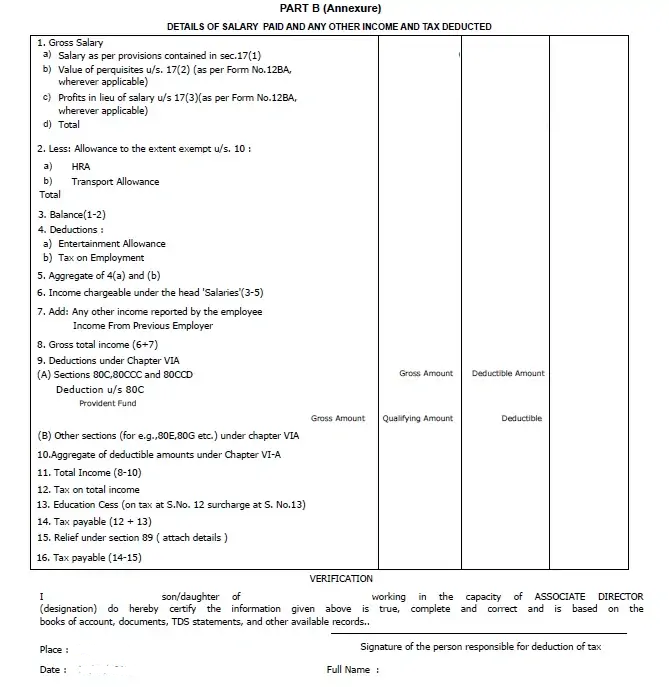

Part B of Form 16

Part B of form 16 includes salary, other income, allowed deductions, and tax payable.

[adinserter block=”3″] [adinserter block=”4″]

How to Download Form 16

You can always download the form 16 document from the Income Tax department’s website https://www.incometax.gov.in/iec/foportal.

Is There an Eligibility Criterion for Form 16?

Yes. Any salaried person with a tax deduction by the employer at the source is eligible to get Form 16. Irrespective of whether your income falls under the tax exemption limit, the employer must issue a Form 16 if they have deducted tax at the source.

How to Check or Verify the Form 16

- Navigate to the official website of the income tax portal.

- Login using a username (your PAN) & password

- Browse to the ‘e-file’ tab and click on ‘View 26AS’ under the ‘Income Tax Returns’ option

- Once you get redirected to the TRACES website, click on the ‘View Tax Credit’ tab.

- Then, click on ‘Verify TDS Certificate.’ Fill in the required details in Form 16 (Part A) except for the source of income.

- Select your source of income from the drop-down menu on the page

- Click on ‘Validate’ to check the authenticity of your Form 16.

- Verify whether the details on the form and those shown on the website will be the same.

- Contact your employer immediately to correct the Form 16 in case the website displays that your Form 16 is invalid.

For the verification of the digital signature of your Form 16

- Open Form 16 in an Adobe reader.

- Right-click on the digital signature on the last page of form 16.

- Then, click on ‘Validate Signature.’

- If it displays valid, then the sign is valid.

Other Things to Know About Form 16

- Your employer cannot deduct any TDS and issue a form 16 if your income is below the basic exemption limit.

- You might have more than one form 16 document if you worked with more than one employer during the tax year.

[adinserter block=”3″] [adinserter block=”4″]

[wp-faq-schema title=”FAQs about Form 16″]