A B2B transaction is one where both parties involved in a transaction are businesses. An invoice is a document that acts as the proof of that transaction and carries all the details of the transaction like the products, product codes, quantity, date of transaction, etc.

In earlier days, generating an invoice meant using a pen and paper to manually write down the transaction details and handing over the physical paper to the buyer from the seller. However, with the advancement in technology, now you can generate invoices online.

It has become mandatory for businesses in India to file online invoices for all their B2B transactions if their turnover is more than INR 500 crore. Even if it wasn’t mandatory, there are many benefits to filing online invoices.

Steps for Generating a B2B Invoice

Step 1: After signing up and saving your business details on myBillBook, you can go to the invoice section and select a template of your choice. Select a template that meets most of your business requirements.

Step 2: Add themes, colours, and icons or logos to personalise your desired template. You can also choose to add or remove information headers from the templates to ensure all your needs are met.

Step 3: Once the basic structure is ready, you can add the details like the client details, date of transaction, items involved, quantity, amount, and total payable amount, including the taxes. You can also save the client details for repeated use so that you do not have to enter them the next time you are generating any document for the same client.

Step 4: Once all the details are entered, you can generate it and share it with the client online using email and Whatsapp, or you can take a printout of the same. You can track and sort through your documents by month, invoice number, client details etc.

Steps in B2B Transactions

In the case of business-to-business transactions, payment is usually made once the goods and services are delivered. If you are wondering about the steps of generating invoices, they are as follows:

- Set the terms of payments with the business.

- Get a purchase order from the business client.

- Fulfil the delivery of goods and services as per the order.

- Send the invoice for payment.

- Receive payment at the due date.

Advantages of Generating Online Invoices

It makes the process faster: An invoice is issued for the buyer to receive payment for the same. For physical invoices, it becomes hard for a business to keep track of all payments, check with the bank for the credit of payment, and maintain all receivables and payables manually. An online invoice streamlines the payment process and makes it easy to track all transactions in one place.

It shrinks the payment cycle: In case of a physical check being used to make payments, it can sometimes lead to failure in payments or issues because of handwriting, resulting in a delay in payment, causing the payment cycle to expand beyond expectations. With online B2B invoice, you can manage those payments and keep an effective check on the successful and failed transactions, helping your business shrink the payment cycle.

It improves business efficiency: With the process of invoicing becoming faster and smooth, businesses can improve their overall efficiency. As they spend less time generating invoices, writing the transaction details, and collecting payments, they can spend more time on improving the core business processes. This can result in an overall improvement in their business performance.

It is easier for the other businesses as well: The businesses who act as suppliers or customers for your business also generally prefer an online invoice. It helps them manage their expenses and incomes simultaneously while they also enjoy the rewards or benefits offered by their banks.

Why should you use myBillBook for your B2B Invoicing needs?

There are many advantages that come with using myBillBook for all your invoicing needs. Some of them include:

Accounting and bookkeeping: With myBillBook, you can also maintain an online ledger, generate P&Ls and balance sheets online and maintain all your financial documents in the same place. The accounting and bookkeeping business processes become faster and more accurate when done online.

Tax filing: The invoice templates that are available on myBillBook invoicing software are GST compliant. This means that you can use the same invoices to calculate taxes that your business owes to the government. The online documents help you in the filing of taxes and tracking of the relevant documents in time.

Inventory Management: In addition to reducing accounting and bookkeeping errors, myBillBook also helps you keep an instant check on your business inventory. Instantly updating the inventory records after each transaction enables you to place orders for restocking your inventory in time.

Business Analysis: myBillBook can also help you generate business reports relating to your business’s various verticals and processes. You can analyse these reports on the go and keep a regular check on your business performance.

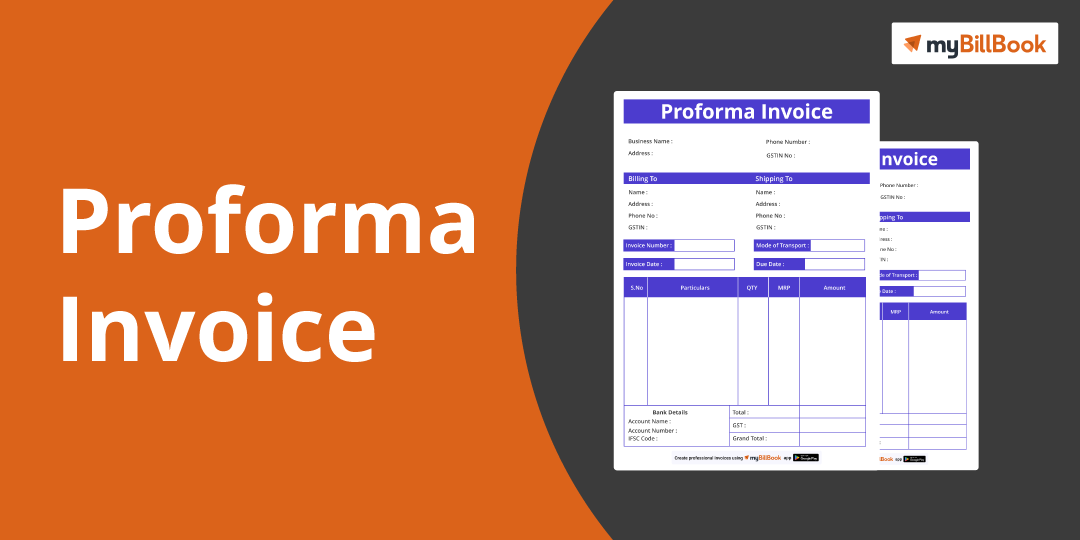

The Best Invoice for B2B transactions

On myBillBook, there are a variety of formats and templates for you to choose from. If you wonder which is the best template for these transactions, you should know that there are no right or wrong templates. Every business has to create a template that works well for them. Depending on the specific requirements of your business, you can create an effective template for all transactions or different templates for different kinds of transactions.

The idea is to create a template that fits your business needs the best. This is why myBillBook offers you the freedom to choose from a wide range of templates.