eWay bill registration is mandatory to generate eway bills on the official eway bill portal www.ewaybillgst.gov.in/. Registered/unregistered suppliers and registered/unregistered transporters, who are the end users of the eway bill system, must register on the eway bill website to generate eway bills.

Steps for eWay Bill Registration on eWay Bill Website

The e-Way bill registration process for registered suppliers is simple. The prerequisites for the registration include the taxpayer’s GST number and the mobile number registered with the GST system.

- Visit the official e-way bill portal at www.ewaybillgst.gov.in/

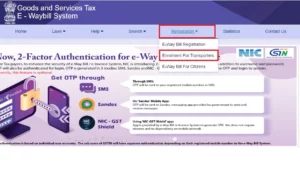

- From the main menu, go to the ‘Registration > E-Way Bill Registration’ option

- You will then be redirected to the ‘e-Way Bill Registration Form’

- Enter the GSTIN number and the displayed captcha and click ‘Go’

- You will then be redirected to the following page where the details of the GSTIN are entered, including the Applicant name, Trade name, Address, e-Mail ID and Mobile Number, are auto-populated.

- If the populated details are incorrect or changed, click ‘Update from GST Common Portal’ to get the latest data from the GST Portal.

- If the details are correct, click on ‘Send OTP’ to get the OTP. Enter the received OTP and click on ‘verify OTP’ to verify the same and validate.

- In the next step, provide a username, which should be about 8 to 15 alphanumeric characters and in the subsequent step, provide a password.

- After validating both the username and password, the system accepts the final registration request.

If there are any errors, the system will display the appropriate error message. If everything is correct, the User ID and Password will be created and the e-way bill registration process will be completed. You can use the same User ID and password to login to the e-way bill portal.

e-Way Bill Registration for Transporters (Un-registered)

GST-registered transporters can use their GST number as Transporter ID to generate e-way bills. They can follow the above process to register themselves on the e-way bill portal.

For unregistered transporters who do not have a GSTIN, the above registration process is not applicable. For such transporters, a separate enrolment process is available on the eway bill portal. Using this method, unregistered transporters can register themselves on the portal, generate transporter ID or TRANSIN and create eway bills on their own. The detailed enrolment process is explained below.

- Visit the official e-way bill portal at www.ewaybillgst.gov.in/

From the main menu, go to the ‘Registration > Enrolment for Transporters’

- You will be redirected to ‘Application for Enrollment u/s 35(2)’

- Fill in all the required fields, including State Name, Legal Name, and PAN number. After entering the PAN number, click on ‘Validate’ so the system can validate your PAN number. Once validated successfully, fill in the subsequent fields.

- Choose the ‘Type of Enrolment’ – Warehouse/Depot, Godown, Cold Storage, and Transport Services.

- Next, select the ‘Constitution of Business’ – Partnership, Proprietorship, or Public/Private Limited.

- Enter the ‘Business Place Details’ and ‘Personal Contact’ in the next fields.

- Enter your mobile phone number and verify it by entering the OTP.

- In the Login Details Column, choose a username and password of your choice.

- In the verification column, check the box and enter the captcha code before clicking on ‘Save’.

- On successful registration, the system generates a 15-digit transaction ID or TRANS ID.

You can provide this TRANSIN to your clients so that they can use it when creating e-way bills.

FAQs on eWay Bill Registration

I have already registered on the GST portal. Do I need to register on the e-way bill portal again?

Yes, every GST-registered individual intending to generate e-way bills must register on the e-way bill portal (www.ewaybillgst.gov.in) using their GSTIN.

Who needs to register for an e-way bill?

Any registered person under GST who transports goods valued over ₹50,000, either as a consignor, consignee, or transporter, needs to generate an e-way bill. Even unregistered transporters who carry such goods are required to register and generate e-way bills.

How do I register for the e-way bill system?

To register for the e-way bill system, visit the official e-way bill portal ewaybillgst.gov.in. Registered GST users can log in with their GSTIN and complete the registration, while unregistered transporters can create an account by following the transporter registration process.

Is there any fee for e-way bill registration?

No, e-way bill registration is free of cost. You only need your GSTIN or, for transporters, the necessary details like business information and vehicle number to complete the process.

Can I generate an e-way bill using my mobile phone?

Yes, the e-way bill can be generated using the mobile-friendly version of the e-way bill portal or through SMS by registering your mobile number on the portal. You can also use the e-way bill mobile app to facilitate this process.