Accounting is quite possibly the core part of management and organisation in any business. In firms with a few moving parts, an accounting group that precisely tracks the development of assets into and out of the company is fundamental. This guarantees both transparency and profitability. In the construction industry, however, firms and contractors face unique difficulties with regards to accounting.

How is accounting in construction different?

Standard businesses sell items from a fixed area. The business understands the cost of everything it sells, and overhead is generally kept steady.

Interestingly, construction businesses offer customised work in novel areas consistently and are frequently versatile. Along these lines, construction companies should screen very surprising classifications of costs. These incorporate travel time, mobilisation costs like pressing tools and hardware, delivery of materials to the job site, and in any event, clearing the job site of abundance materials once a job is finished. The business has no fixed area, and it is moved to any place the client needs it, alongside the materials fundamental for the job. This can make numerous indirect costs that should be considered when taking a glance at your financial statements.

Construction companies also utilise the Percentage of Completion Method, where revenue is accounted for dependent on the assessed profit of a contract and which level of that undertaking has been finished. With a finished contract, the payment would be made in full, except it isn’t uncommon for contracts to be left incomplete. This makes it much more important for construction firms to execute cost-accounting techniques that allow the exact following of their expenses to precisely project profit and loss.

What is the difference between Regular and Construction accounting?

- Cost of goods sold

Businesses basically record the cost of the item sold. In construction accounting, it is rarely so basic. Each job brings about both immediate and indirect costs that can be categorised into many categories. Monitoring these direct and indirect costs can be muddled, mainly when they come from different categories. Using a software solution that can monitor these costs will help save your time and money.

- Sales

Regular businesses account for sales and typically offer 1-5 categories of products and services. Construction businesses offer a more prominent scope of service categories – service work, consulting, engineering, labour costs, design, physical products and materials, and more. With these service categories, it tends to be harder to monitor each cost or profit coming from every class. Revenue acknowledgement can be interesting too because of the numerous categories and each cost related to each.

- Break-even

In standard businesses, the immediate connection between income and expenses makes breakeven points extremely simple to ascertain. In construction, there are dreadfully numerous categories of things to understand how to break even on a project. Also, most projects are unique custom jobs, with many-sided necessities and an assortment of related costs. Since the connection between income and expenses can be unpredictable, it may help to have software to monitor income and expenses for you.

- Expenses/Overhead

In customary businesses, the qualification between the cost of goods sold and overhead is clear and transparent. However, this isn’t the situation in construction. The different things that supermarkets would call “overhead” fall into the “cost of goods sold” classification in construction since they are directly associated with the client’s project. It is critical to know the qualification between the two regarding construction accounting since it can be difficult.

You may also like to read :

Why do we need software-based accounting for construction businesses?

Improving your construction company accounting strategies begins with the understanding of various kinds of costs you can cause working on a project. The following stage is to classify those costs successfully, understanding the subtleties between expenses/overhead and cost of goods sold and liking the intricacy of the projects that your firm can do. The ideal approach to guarantee exact accounting is to execute a software solution that permits workers at your firm to effortlessly submit data on costing through a platform integrated with your accounting software. This software platform can undoubtedly communicate information, so everybody is educated. This training saves time on paperwork and guarantees that significant data is rarely lost, making your firm more profitable subsequently.

An integrated software platform that permits workers to finish and submit day by day cost and progress reports, time cards, and change orders is a viable method to monitor what costs are being brought about during a construction project. Even better, the reports are immediately digitised and available to the two workers in the field and the accounting office, which empowers fast resolution of any costing issues and precise following to guarantee profitability. The software platform can work to be the line of communication between the field and the accounting office, thereby reducing the possibilities of blunders.

How does myBillBook meet the needs of Construction bookkeeping?

1. Simplify your billing operations

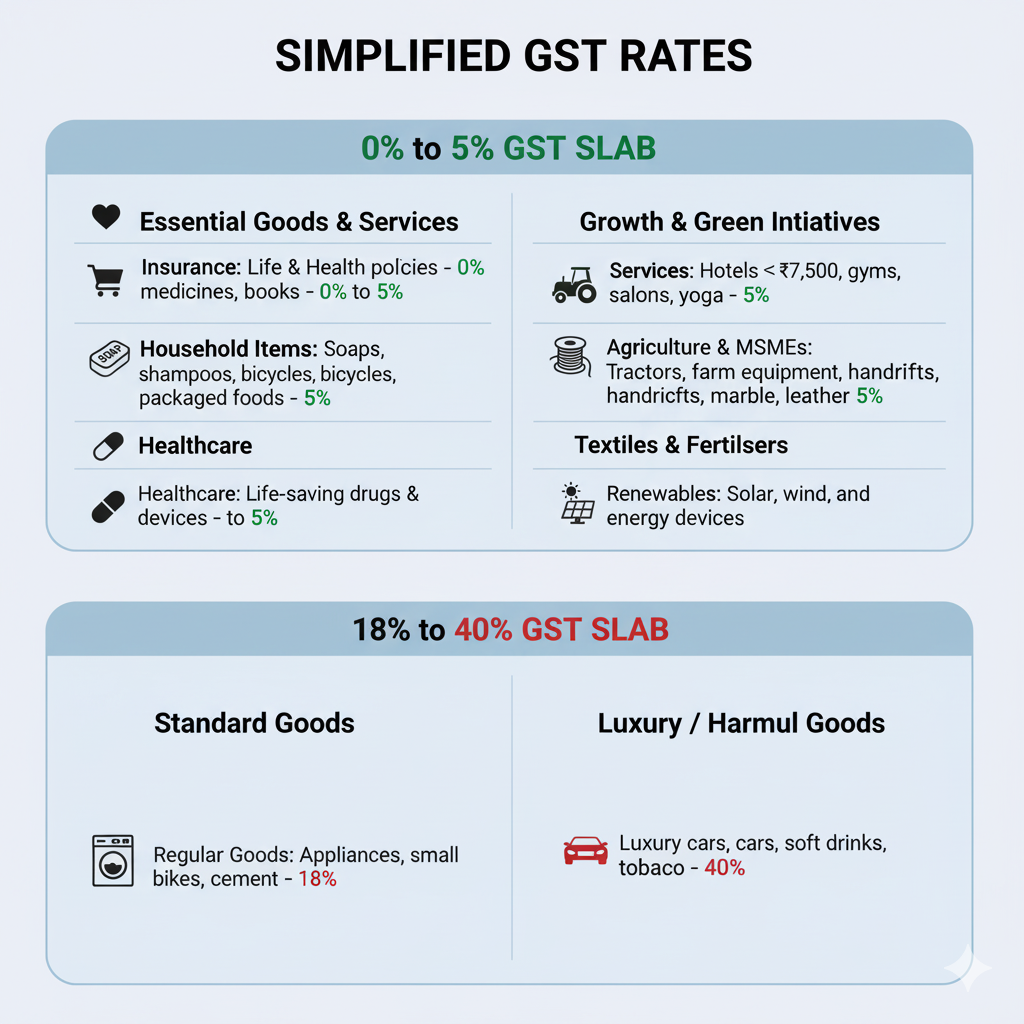

● You can make bills inclusive and exclusive of GST. All you need is:

1. GSTIN of both parties

2. Billing and shipping address of the party

3. Consecutive invoice numbers

4. Date of issuance

5. HSN code of items

6. CGST/SGST/IGST on items (as applicable)

● Customise the contents of the bill in a way that’s suitable to your business and industry.

● Personalised the invoice to your preference using a range of themes and colours available.

● Reduce billing time by using the barcode scanning feature.

● Share the invoice instantly over e-mail or WhatsApp.

● Create vouchers, payment receipts, sale & purchase orders, sale & purchase returns, delivery challans, etc. You can also send a notification to parties whenever a voucher is created in their name.

2. Keep track of your business with timely business reports like:

● Sales summary

● Profit and loss reports

● Party statements

● Stock summary

● GSTR-1 (Sales) [paid feature]

● GSTR-2 (Purchase) [paid feature]

● GSTR-3B [paid feature]

And over ten other kinds of exclusive reports that ensure smooth functioning of the business.

3. 24×7 automatic data sync and backup between the desktop and mobile app

● You may not be able to access your PC at all times. By enabling data sync and backup between mobile and PC, myBillBook ensures that you never lose your work – you can access your work on the go!

4. Keep track of accounts payable and accounts receivable

● myBillBook automatically sends out payment reminders and collects payments with a single click.

● It also notifies you of any overdue payments you need to make.

5. Keeps your data secure

● Data is backed-up automatically

● Your data is 100% secure

● ISO 27001 certified

6. Learn how to use myBillBook from online video tutorials and get answers to your questions and doubts

● Get answers anywhere and anytime you’re stuck, from videos that cover FAQs regarding myBillBook.

7. Add staff members to the app (paid feature)

● Add your salesman, stock manager, delivery boy, accountant, partner to the myBillBook app with assigned permissions for each role.