Purchase orders and purchase invoices are commonly used across businesses. Just like their names, they are confusing to use. There is a major difference between a purchase order and a purchase invoice. A purchase order is a buyer’s official request for goods or services from the supplier, which includes details like quantity, price, and delivery terms. A purchase invoice is a document from the seller requesting payment from the buyer for goods delivered or services rendered, showing amounts due for purchases. Let’s delve into the key differences between purchase order and purchase invoice (po vs pi).

What is a Purchase Order or PO?

A purchase order (PO) is a document the buyer uses to make an order stating the needed goods, delivery date, price and other terms and conditions. When the vendor agrees on a PO, it becomes a contract containing the commodity type, value, delivery date and payment method.

Why is a Purchase Order (PO) Important?

Whether you’re a small business or a large company, there are many reasons why purchase orders are important:

Legally binding

A purchase order (PO) is an official agreement between company owners. Any PO does not require signing another contract. By making a PO, both parties agree on all the stipulated points, such as quantity, price, and due date, for the ordered goods or services. It helps bring transparency to transactions and protects each party from possible disputes arising from contradictions or misunderstandings.

Tracking and management of expenses

A purchase order can be referred to throughout a transaction using its purchase order number. Organisations could set budgets, allot funds, and monitor their expenditures so that spending remains within the limit by issuing purchase orders before purchasing. This reduces overspending while allowing for better future financial planning for the firms.

Proof of purchase

A purchase order acts as proof of purchase for both the buyer and the seller. A seller can use the purchase order as a reference to supply goods and details of each transaction. The buyer can also use it to ensure they have received what they ordered and resolve any discrepancies that may arise accordingly.

Manage inventory effectively

Inventory stockouts are common in most organisations due to insufficient inventory visibility. The purchase order system helps you determine your stock levels and replenishment periods, streamlining your operations and improving inventory management. Using software to manage your POs can give you better control over inventory.

Improve budgeting

When issuing POs for large projects, you must calculate the required quantities and their costs before starting the project. It should show you how much money it would take for such projects. When companies indicate the price and quantity of goods or services they want to procure, they ensure they keep within their budgets without overspending. Such an approach can be quite helpful in businesses with limited financial resources or aiming at reducing expenses.

What is included in a purchase order (PO)?

The following information should be on a purchase order:

- Buyer and Seller Information

- PO Number

- Order Date

- Payment Terms

- Item Description

- Quantity of goods and services

- Price of goods and services

- Terms and Conditions

- Total Amount and tax

What is a Purchase Invoice or PI?

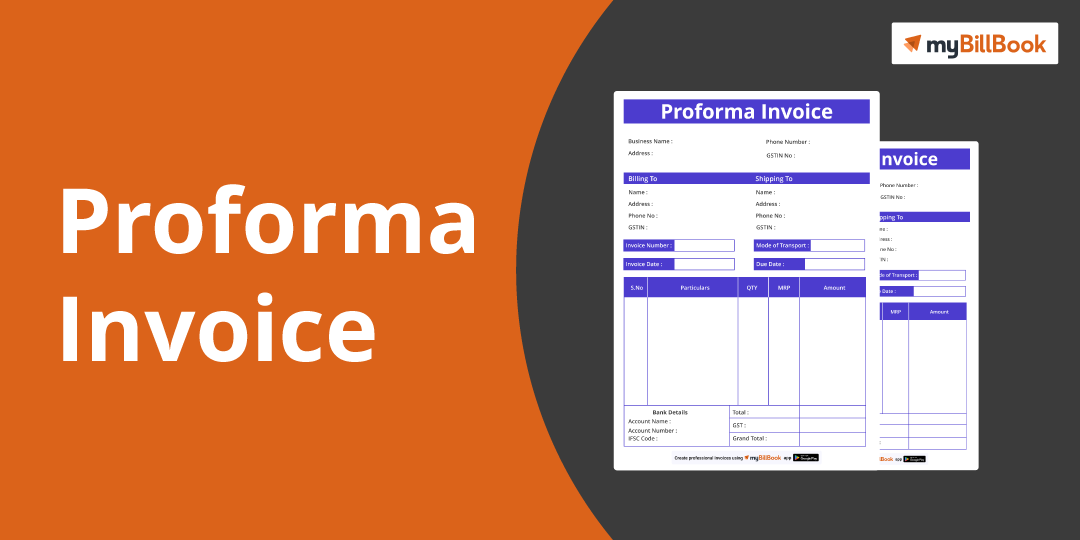

A purchase invoice is an invoice issued by the buyer of goods. It is a financial document that indicates the details of a purchase that has been made, including the items, amount, date of payment, etc. While its contents are similar to that of a sales invoice, it indicates that a purchase has been made for a particular amount. A purchase invoice is usually issued after the purchase order. This means that you can generate a purchase invoice for the purchases you make from your supplier once the transaction is complete.

Components of Purchase Invoice or PI

- Invoice number

- Purchase order number

- Date of issue

- Vendor/Supplier details

- Items Description

- Total and tax

Difference between a Purchase Order (PO) and a Purchase Invoice (PI)

Here are the key differences between purchase orders and purchase invoices to help clarify their roles in the business world.

A purchase order (PO) is a document the buyer submits to request goods or services from the seller. It contains information about what is being bought, such as quantity, delivery terms, and price. The PO is an agreement that binds together the procurement process between buyers and sellers.

Whereas, a Purchase Invoice (PI) refers to a legal paper given by the seller to get paid for any good or service provided. It states what has been sold, how much of each item was sold, the cost per unit, and payment conditions. When this happens, it means that both parties’ transaction history has been recorded, and at that point, it will serve as a reference during their previous business dealings.

In a purchase order, the transaction moves from buyer to seller. A purchase order is prepared by the buyer and sent to the supplier; however, a purchase invoice is issued after the vendor delivers goods or services.

A purchase order is issued before goods or services are delivered to buyers. Thus, it works as an official request for delivery of an item in line with the conditions set out in this document. Conversely, the seller always sends invoices once he has delivered the products purchased, and they want their cash back as required by law. For instance, PI acts as an account statement showing the total amount owed by the buyer.

A purchase order has specific products and descriptions for products and services. Its main purpose is to ensure that both parties have agreed to trade under conditions specified by it. A purchase invoice, on the other hand, states the amount of money owed by the buyer as well as taxes or deductions due. It gives a quick summary of transactions and assists customers in making payments.

What is an Invoice?

An invoice is a document prepared by sellers to record sales and demand payments. Sellers make invoices for sold goods. It should clearly state what kind of goods have been sold, how much money the purchaser will pay and when it would be paid. Sellers send out invoices once terms in a PO are fulfilled through a finished physical product or a completed service provision.

Importance of Invoices

Invoices are essential documents in business transactions for various reasons:

Legal Compliance:

Invoices are legal documents that indicate the details of goods sold such as prices charged for goods provided and conditions of trading. Also, they help in tax compliance and meet financial reporting standards.

Proof of Transaction:

Invoices prove that a transaction took place between a seller and a buyer. They display what was delivered, amounts sent, costs quoted, and payment details to avoid misunderstandings and disputes.

Payment Request:

Invoices are legal documents from buyers to sellers requesting them to pay. It includes how much is due, when it should be paid, and how it should be paid so that processing can be done on time and more accurately.

Financial Records:

Invoices are important for financial records, keeping sales records, generating revenue, and showing accounts receivable. This budgeting tool aids in making projections about the future of any business enterprise and appraising its performance.

Customer Communication:

Moreover, consumers may learn about products purchased by them through invoices having their billing information. In essence this promotes transparency among businesses thereby giving room for professionalism.

Cash Flow Management:

Cash flow management relies heavily upon invoicing; this means it has to deal with unpaid receipts whereas it also predicts revenue from other sources. It protects organisations against unfavorable financial positions regarding anticipated liabilities.

Inventory Management:

Invoices include items or services sold, quantities, or pricing to permit inventory control and restocking processes. They enable firms to follow shifts in sales patterns and adjust their stock levels.

Difference between a Purchase Order and an Invoice?

The two main documents, purchase orders (POs) and invoices are important in ensuring smooth transactions between buyers and sellers. Here are the key differences between a purchase order and an invoice:

A purchase order is a formal communication through which a purchaser asks a seller to sell goods or provide services at agreed prices and quantities. This is a formal offer for goods and services by an offeror who becomes bound when the other party accepts it, hence leading to the transaction. Such information includes delivery dates, payment terms among others in the document. Also, this purchase order serves as an acknowledgement of what has already been ordered.

Invoice, on the other hand, refers to documents issued by suppliers demanding payments after good are delivered or services rendered. This signifies a proper end of contract between buyer and seller. The tax invoice should be given once the goods have been delivered or services rendered.

A purchase order and an invoice differ in respect to the time they are issued. The buyer issues a purchase order before goods or services are delivered and this functions as a contract between the two parties involved. On the other hand, an invoice is issued after goods or services have been given out, where it requests payment for the rendered goods or services from the buyer.

Another difference between a purchase order and an invoice is that of their legal implications. A sales order is a legally binding document that specifies the terms and conditions of a transaction, serving as a formal agreement between the buyer and seller. Conversely, an invoice is simply a payment request and does not hold any legal significance. However, a tax invoice generated by a registered sellers becomes a legal document.

Similarities between a Purchase Order (PO) and a Purchase (PI) Invoice

Purchase orders and invoices also have similarities. For instance, these two pieces mostly mention the same products or services and include details such as the buyer and seller’s business names, contacts, and mailing addresses.

POs and invoices are also important documents because they are legally binding in your business. Therefore, once either one is sent and received, then such goods or services must be readied and paid for according to the agreement made by both parties.

Why do businesses need a Purchase order (PO) and purchase Invoice (PI)?

Your business may use both documents at one point because the nature of business requires you to order goods and services. Even if your business mainly deals with products or services (and thus mostly sends out bills), there might be a time when you need to buy something. A purchase order will help you track these expenditures.

For a business to have efficient and organised buying, it should have the Purchase Order (PO) and Purchase Invoice (PI) documents as necessary.

Managing Your Company’s Purchase Orders and Invoices

Managing purchase orders and invoices is easy to begin with when a small business has few purchases. However, as the business grows, so does the quantity of purchases.

Knowing the differences and similarities between purchase orders and invoices will not help you much here. Manually creating many such documents, even using an invoice template, can be time-consuming and prone to errors. Moreover, manual records tend to become chaotic—or worse, misplaced—which creates problems during disputes or audits.

Digital purchase orders and invoicing can help eliminate tedious paper-based processes. The need to photocopy them no longer exists because this could be expensive when large numbers of POs and invoices are sent daily.

Good billing software should eliminate tedious tasks such as ensuring that each invoice is valid.

How to Generate Purchase Invoice using myBillBook?

Every enterprise frequently restocks its inventory by placing many orders. However, you must issue a purchase invoice for each purchase order that your business fulfils. Nevertheless, it is time-consuming. You can make this process highly efficient and easy for yourself with myBillBook billing software.

Below are the steps that you could follow to generate a purchase invoice:

Choose a format: myBillBook software has different formats for purchase invoices. Choose a format that you will use to issue a purchase invoice based on the needs of your business. Additionally, one may edit the format to indicate various requirements needed to generate a Purchase Invoice.

Enter the relevant details: Once you have selected a format template for your purchase invoice, fill in the details such as seller details, item purchased and amount due, among others. Also, you may save these details regarding sellers and items ordered so as to be able to quickly form a future Purchase Invoice whenever there is a recurring order.

Calculate taxes: Once the details and taxes are entered, tax amounts are calculated automatically, and your purchase invoice is generated.

Personalise your invoice: Furthermore, myBillBook billing software offers several themes and colours, which you can choose from depending on your preference, thereby giving your Purchase Invoice a personal touch.