Generation of the E-way Bill by End-Consumer

As you already know, for every consignment with a value exceeding ₹ 50,000, the person in charge of the conveyance/vehicle must carry an e-way bill. However, in certain circumstances, the end consumer may also have to generate an e-way bill.

This article brings you all the details you need to know about when end consumers should generate an e-way bill and the steps.

When Should an End Consumer Generate an E-way Bill?

If you are an end consumer of goods, you must generate an e-way bill under the following scenario.

The value of the goods transported to you on a vehicle exceeds Rs. 50,000 (assuming you are unregistered).

In this scenario, you must fill in the vehicle number in Part B of Form GST EWB-01. Suppose the person transporting the goods is an unregistered or ordinary citizen, and he wonders how to generate e way bill for an unregistered person. In that case, he can generate the bill in two ways:

- Request his supplier to generate an e-way bill.

- Log in to the e-way bill for citizens portal and generate his e-way bill.

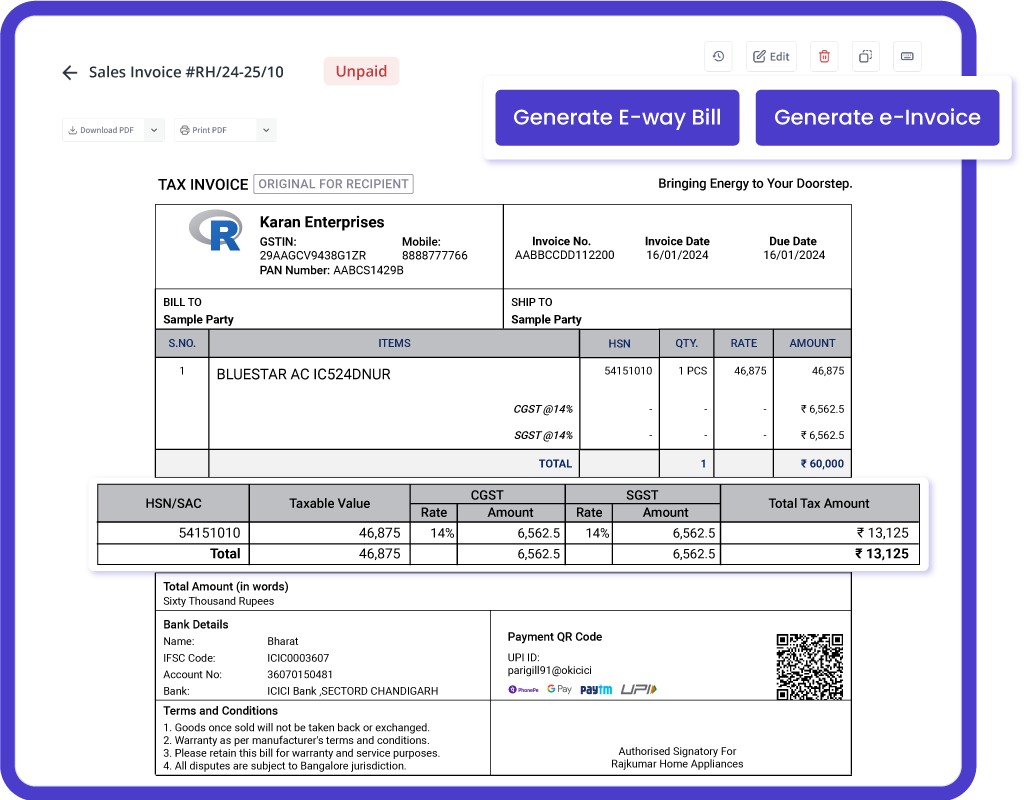

myBillBook eway bill software is India’s No:1 billing and accounting software that helps businesses streamline their billing and accounting processes. With the government mandating e-way bills, myBillBook upgraded the software to support e-way bill generation. myBillBook is powered by Masters India GST Suvidha Provider to simultaneously generate e-invoices and e-way bills. Once you enable the einvoicing option on the myBillBook billing app, you can directly convert all your B2B invoices into e-invoices in a single click. In the same step, you can generate e-way bills for all the applicable invoices.

Top Features of myBillBook e-Way Bill Software

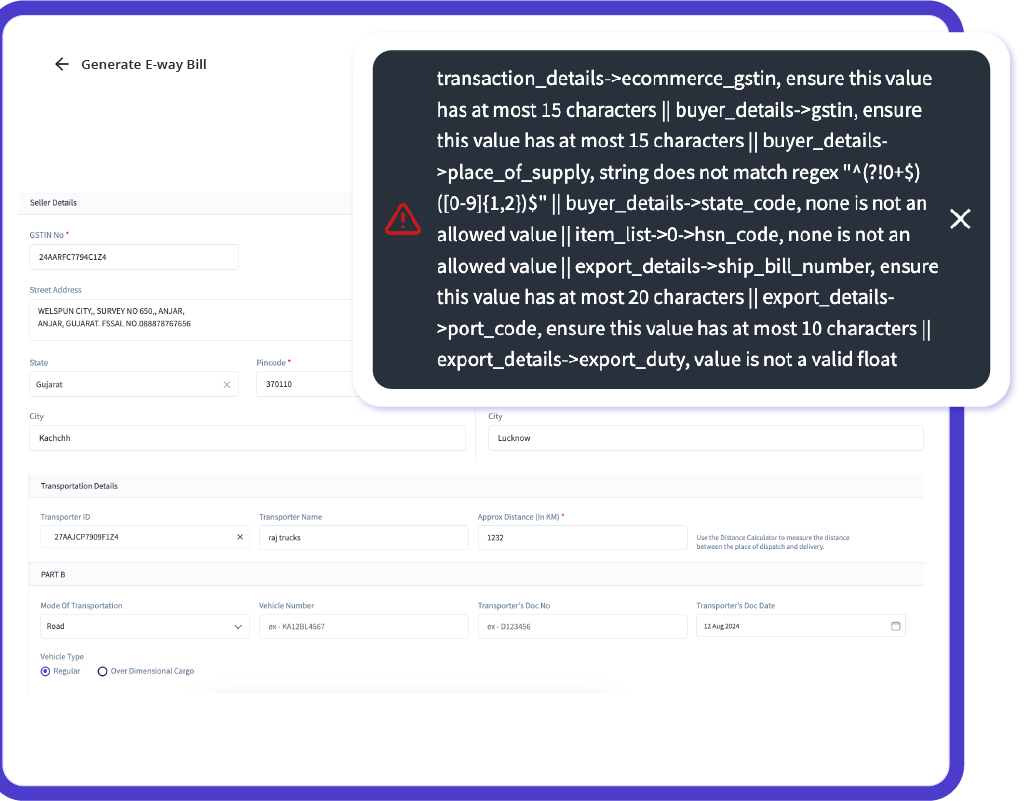

Quick and Accurate E-Way Bill Generation with Auto-Validation

Streamline your logistics with e-way bills generated in less than 30 seconds, featuring auto-filled details like GSTIN, vehicle number, and transporter ID. Leverage over 25 smart error checks to ensure compliance, minimize errors, and avoid penalties, making your operations seamless and efficient.

Effortless Integration with GST and e-Invoicing

Easily integrate your GST billing with e-invoicing systems. Generate and share e-way bills directly from invoices without manual intervention, streamlining compliance and boosting operational efficiency.

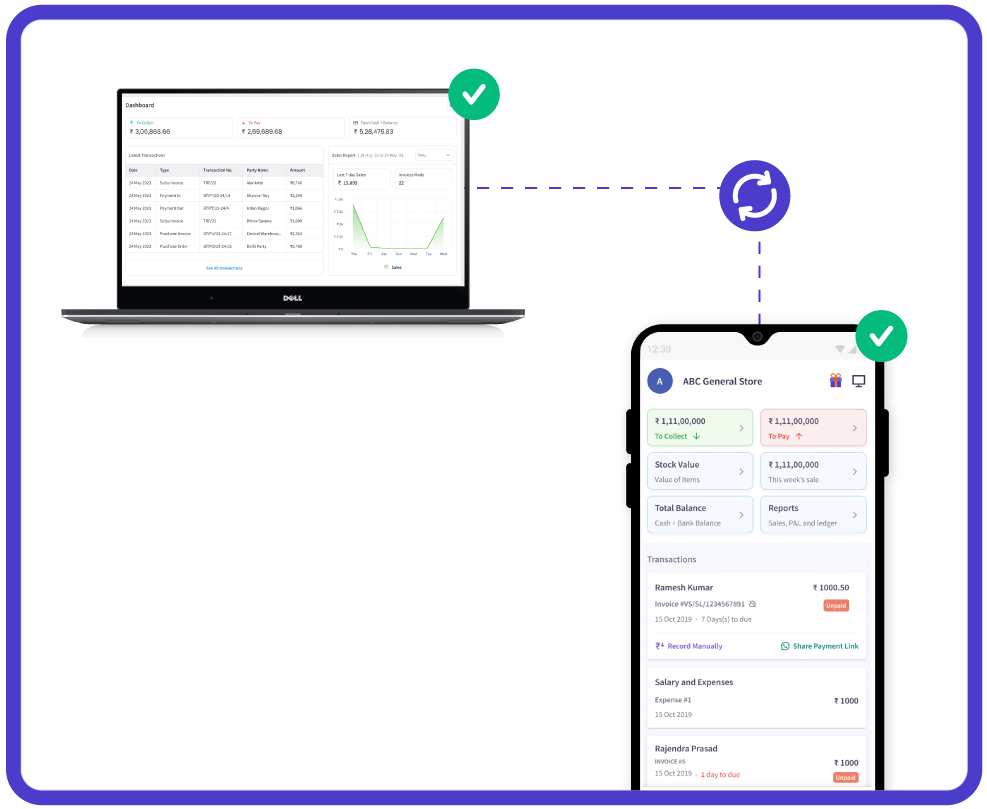

Sync Your Data in Real-Time with Multi-Device Support

myBillBook ensures secure access to your e-way billing transactions from any location on your phone, tablet, or computer. The cloud-based solution syncs your data in real-time across all devices, keeping you always in the loop with the latest updates.

Trusted by 1 Crore+ businesses for Billing, Inventory, e-Way Billing & e-Invoicing

``Generate e-way bills effortlessly with myBillBook, ensuring GST compliance and simplifying your business operations.``

“Generating e-way bills was a hassle for our logistics team. With myBillBook’s instant e-way bill generation and auto-validation, we now create error-free e-way bills in under 30 seconds. The smart error checks ensure compliance, saving us time and avoiding costly penalties.”

Kavish Pawar

Ajay distributors, Hyderabad

Recommends myBillBook for:

myBillBook helps business succeed

“Integrating GST billing and e-invoicing with e-way bills used to be a challenge. Thanks to myBillBook, we now generate and share e-way bills directly from our invoices without manual steps, streamlining compliance.”

Ravish Rathod,

The Craft Store – Chennai

“Data security is critical for our business, and myBillBook delivers. With bank-grade security and compliance support, our data is protected, and any e-way billing issues are resolved swiftly, keeping us fully compliant.”

Ravi Rao,

Rapid Logistics – Bangalore

“Managing e-way bills on the go is seamless with myBillBook’s cloud-based solution. Whether in the office or traveling, I can access, generate, and share e-way bills securely, ensuring our logistics run smoothly wherever I am.”

Arun Rane,

Speedy Auto Parts – Delhi

Pricing plans

Diamond Plan

₹217

Per month. Billed annually. Excl. GST @18%

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

Platinum Plan

₹250

Per month. Billed annually. Excl. GST @18%

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

Enterprise Plan

₹417

Per month. Billed annually. Excl. GST @18%

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills