Cost Accounting Format

Cost accounting is essential for businesses to track, analyse, and manage costs effectively. A well-structured cost accounting format ensures proper documentation of expenses, enabling better financial decision-making. You can create cost accounting formats in Word, Excel, or PDF. However, myBillBook simplifies the process with automated templates that provide accuracy and efficiency.

✅ Quick & Easy Cost Accounting Report Generation

✅ Customisable Templates

✅ Professional Look

✅ Unlimited Cost Accounting Reports

✅ Affordable Plans Starting INR 399/Year

Cost Accounting Formats in Word, Excel & PDF | Download Free

Features of myBillBook Cost Accounting Format

Industry-Specific Templates

myBillBook provides industry-tailored templates that help businesses in manufacturing, retail, and services generate cost reports with predefined structures, reducing manual work and increasing accuracy.

Advanced Customisation Options

myBillBook allows users to modify cost formats by adding custom cost categories, adjusting cost calculations, and incorporating business-specific financial elements, ensuring reports are fully aligned with company needs.

Automated Cost Calculation

Businesses can eliminate manual errors through automated cost computations, ensuring precise calculations of direct costs, indirect costs, and overheads without manual intervention.

Intuitive Dashboard & Reporting

The myBillBook dashboard presents cost data in a structured and visually appealing manner, with interactive charts and graphs that help businesses analyze and optimize costs efficiently.

Cloud-Based Storage & Accessibility

All cost reports are stored securely on the cloud, ensuring businesses can access, edit, and retrieve financial data anytime without worrying about data loss or system failures.

₹217

Per month. Billed annually

Diamond Plan

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

₹250

Per month. Billed annually

Platinum Plan

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

₹417

Per month. Billed annually

Enterprise Plan

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills Popular

₹399 per year

Silver Plan for Android App

✅ For 1 device, 1 business and 1 user

What is a Cost Accounting Format?

A cost accounting format is a structured framework used to record, categorize, and analyze business costs in a systematic manner. It serves as a financial blueprint for tracking expenses related to production, operations, and services. This format allows businesses to break down costs into various components such as direct costs (raw materials, labor), indirect costs (administrative expenses, utilities), and overheads.

By utilizing a cost accounting format, businesses can assess cost efficiency, identify cost-saving opportunities, and make informed financial decisions. The format varies based on business needs and can be maintained in different forms, including spreadsheets, business accounting software, and manual records. A well-structured cost accounting format ensures accurate documentation, easy comparison of financial data, and improved cost control strategies

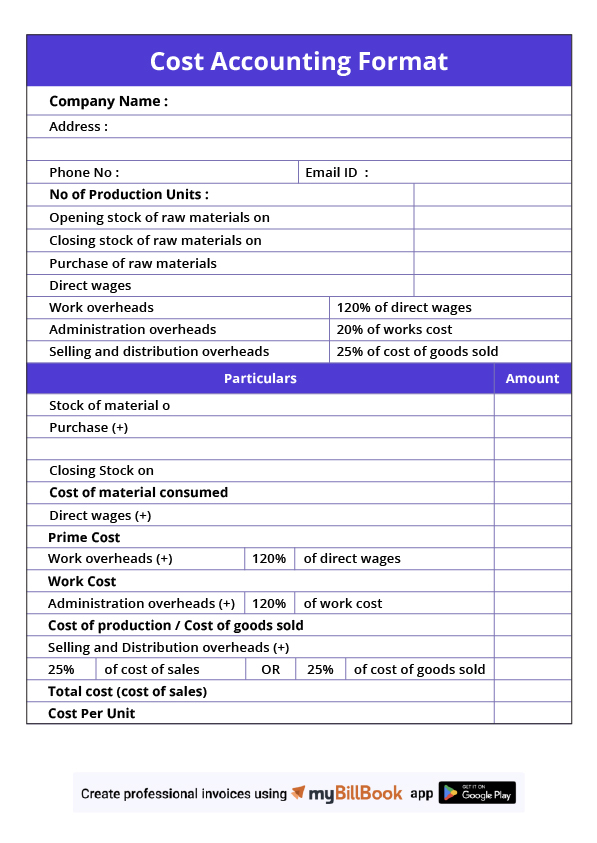

Format of Cost Accounting

A cost accounting format consists of detailed sections that help businesses systematically record and analyze costs. The structure typically includes:

- Cost Elements: This section classifies costs into direct costs (raw materials, direct labor) and indirect costs (rent, utilities, administrative expenses). It also includes overhead costs associated with production and operations.

- Cost Categories: Costs are further broken down into fixed costs (constant expenses like salaries and rent), variable costs (expenses that change with production volume, such as raw materials), semi-variable costs (costs that have both fixed and variable components), and sunk costs (irrecoverable past expenses).

- Expense Breakdown: This section provides a detailed breakdown of expenses into categories such as material costs (purchasing raw materials), labor costs (salaries, wages, and benefits), and operational expenses (machinery maintenance, transportation, energy consumption).

- Total Cost Calculation: This portion consolidates all expenses and calculates the total cost incurred in production or operations. It often includes a cost per unit calculation to determine profitability.

- Comparative Analysis: This section compares the current period’s costs with previous periods, enabling businesses to track trends, detect inefficiencies, and identify areas for cost reduction.

- Profitability & Decision Insights: Businesses can analyze the impact of different cost components on overall profit, helping in decision-making related to pricing, budgeting, and resource allocation.

Cost Accounting Format in Word, Excel, & PDF

Cost Accounting Format in Word:

Cost accounting formats in Word are useful for businesses that need detailed, narrative-based financial reports. Word documents allow users to structure cost reports with headings, subheadings, and explanations. Companies can include charts, tables, and footnotes to support cost analysis, making it a great format for presenting financial summaries to stakeholders and auditors.

Cost Accounting Format in Excel:

Excel is widely used for cost accounting due to its powerful calculation capabilities. Businesses can use built-in formulas to automate cost calculations, create detailed financial models, and conduct real-time data analysis. Pivot tables, charts, and conditional formatting allow for better visualization and comparison of costs over time, making Excel the preferred choice for accountants and financial analysts.

Cost Accounting Format in PDF:

A cost accounting report in PDF format ensures that the document remains unaltered and secure. It is the best option for sharing finalized reports with investors, management, or regulatory authorities. PDF files maintain formatting consistency across different devices and prevent unauthorized modifications, making them ideal for official cost documentation.

Key Elements of a Cost Accounting Format

- Heading: This section includes the business name, date of the report, and title. It sets the context for the report and ensures clarity in record-keeping.

- Cost Components: It classifies costs into different categories such as direct costs (raw materials, labor) and indirect costs (overheads like rent and electricity). This categorization helps businesses track specific cost drivers.

- Expense Details: This section provides an itemized breakdown of all costs, helping in a granular analysis of different expenses. Each expense is recorded along with its corresponding category and cost amount.

- Total Costs: This section consolidates all recorded expenses and provides a summary of the total costs incurred. It often includes a comparison with previous financial periods to highlight cost trends.

- Remarks & Insights: Businesses use this section to document observations, trends, and financial insights derived from the cost accounting report. It helps management make informed strategic decisions regarding cost control and efficiency improvements.

Best Practices for Creating & Using Cost Accounting Formats

- Ensure Accuracy: Always double-check cost entries to avoid miscalculations that could impact financial analysis and decision-making.

- Maintain Consistency: Use a standardized cost categorization system across all reports to ensure uniformity and ease of comparison.

- Leverage Automation: Utilize cost accounting software like myBillBook to automate calculations, reducing the risk of errors and saving time.

- Regularly Update Records: Keep cost accounting reports updated to reflect the latest financial data, ensuring relevant insights for strategic planning.

- Perform Comparative Analysis: Analyze historical cost data to identify trends, inefficiencies, and potential areas for cost optimization.

- Ensure Data Security: Use cloud-based solutions like myBillBook to securely store financial records, preventing data loss and unauthorized access.

FAQs

Why is cost accounting important for businesses?

It helps in cost control, profit maximization, and informed decision-making.

Can I create a cost accounting format manually?

Yes,but using automated tools like myBillBook ensures efficiency and accuracy.

What is the best format for cost accounting?

Excel is best for calculations, while Word and PDF are ideal for reporting.

How does myBillBook simplify cost accounting?

It provides pre-designed templates, automated calculations, and cloud storage for easy management.

Know More About Accounting & Billing Formats