Best Accounting Software for Churches

``Smart Church Accounting – Manage Funds & Stay Compliant!``

Trusted by 1 Crore+ businesses for Billing, Inventory and Accounting

``myBillBook is designed for businesses to generate accurate GST-compliant invoices and automate their entire accounting process.``

“Managing church finances used to be a challenge, but with myBillBook, we can easily track donations, expenses, and invoices. The cloud-based access is a game-changer for our team!”

Pastor Samuel R

Grace Community Church

Recommends myBillBook for:

Product Demo of Accounting Software for Church

“Superb customer service. Helped me set up my account as required”

Key Features of Accounting Software for Church

Expense & Budget Tracking

Managing operational costs, including utility bills, maintenance, and outreach programs, is essential. The software provides a clear overview of expenses and allows for budget planning.

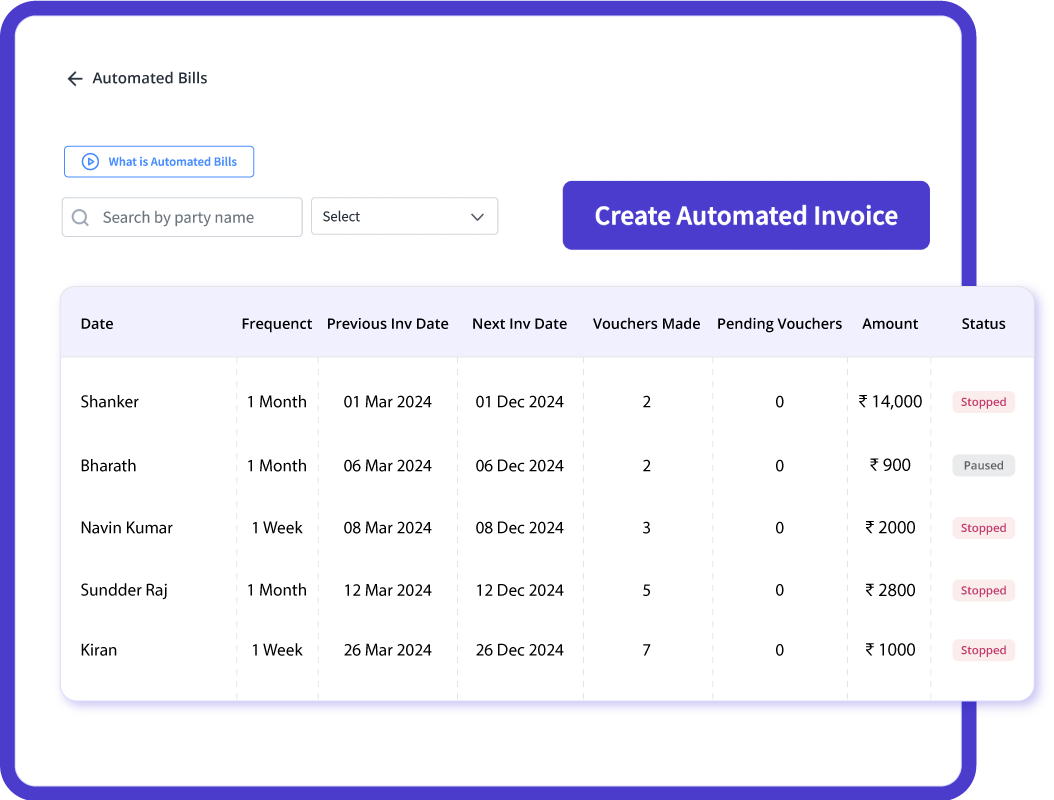

Automated Invoicing & Billing

Churches need to generate invoices for events, hall rentals, and services. An automated invoicing system like myBillBook with GST compliance ensures accurate financial records.

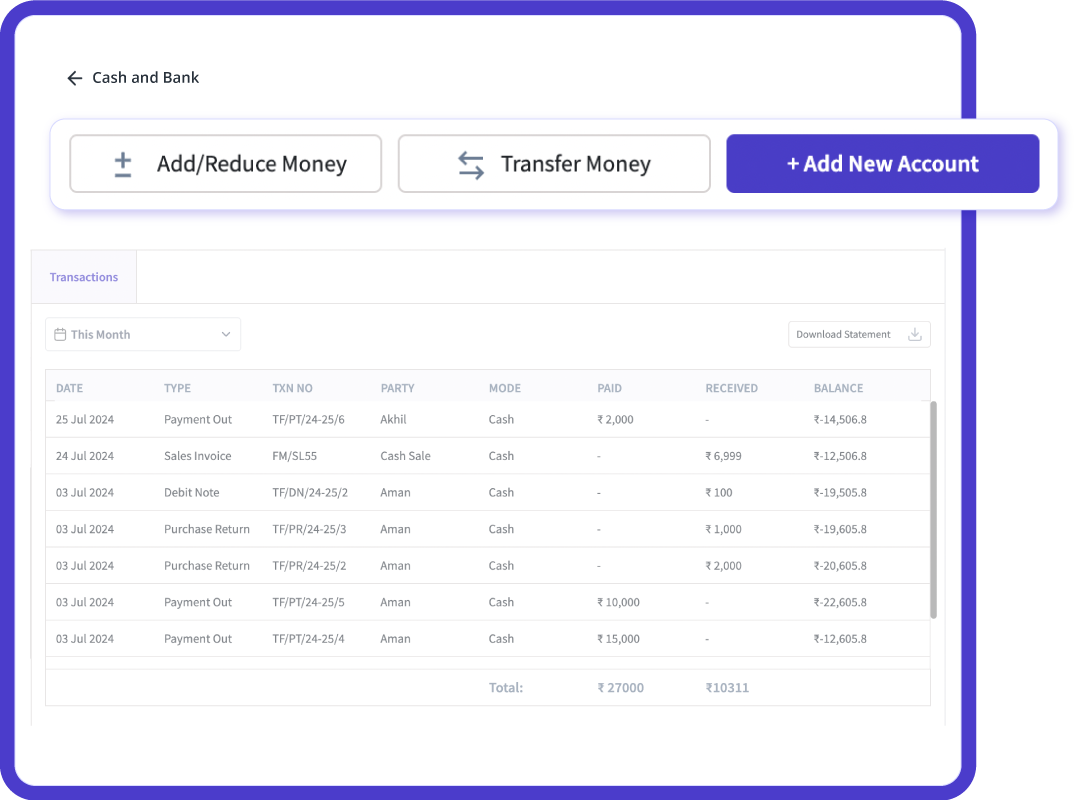

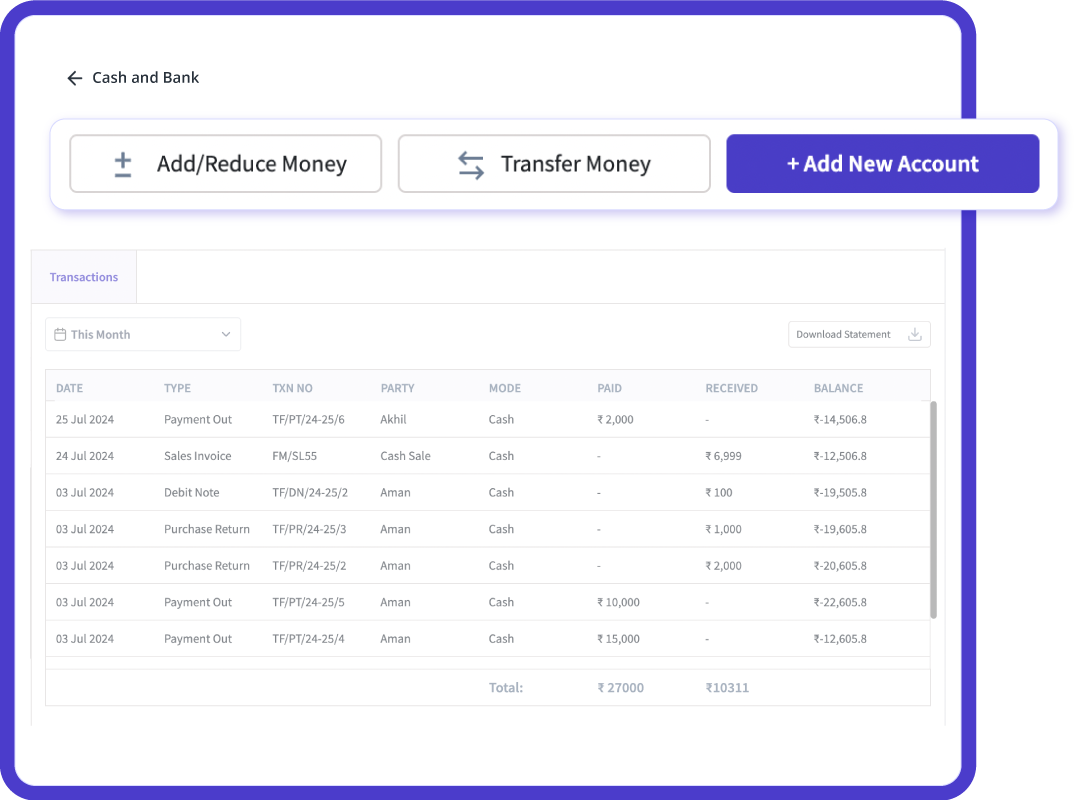

Bank Reconciliation & Cash Flow Management

A church’s financial health depends on effective cash flow management. The software syncs effortlessly with bank accounts, tracks deposits, and reconciles transactions.

Multi-User Access with Role-Based Permissions

Churches often involve multiple personnel in financial management. The software allows role-based access, ensuring security and accountability.

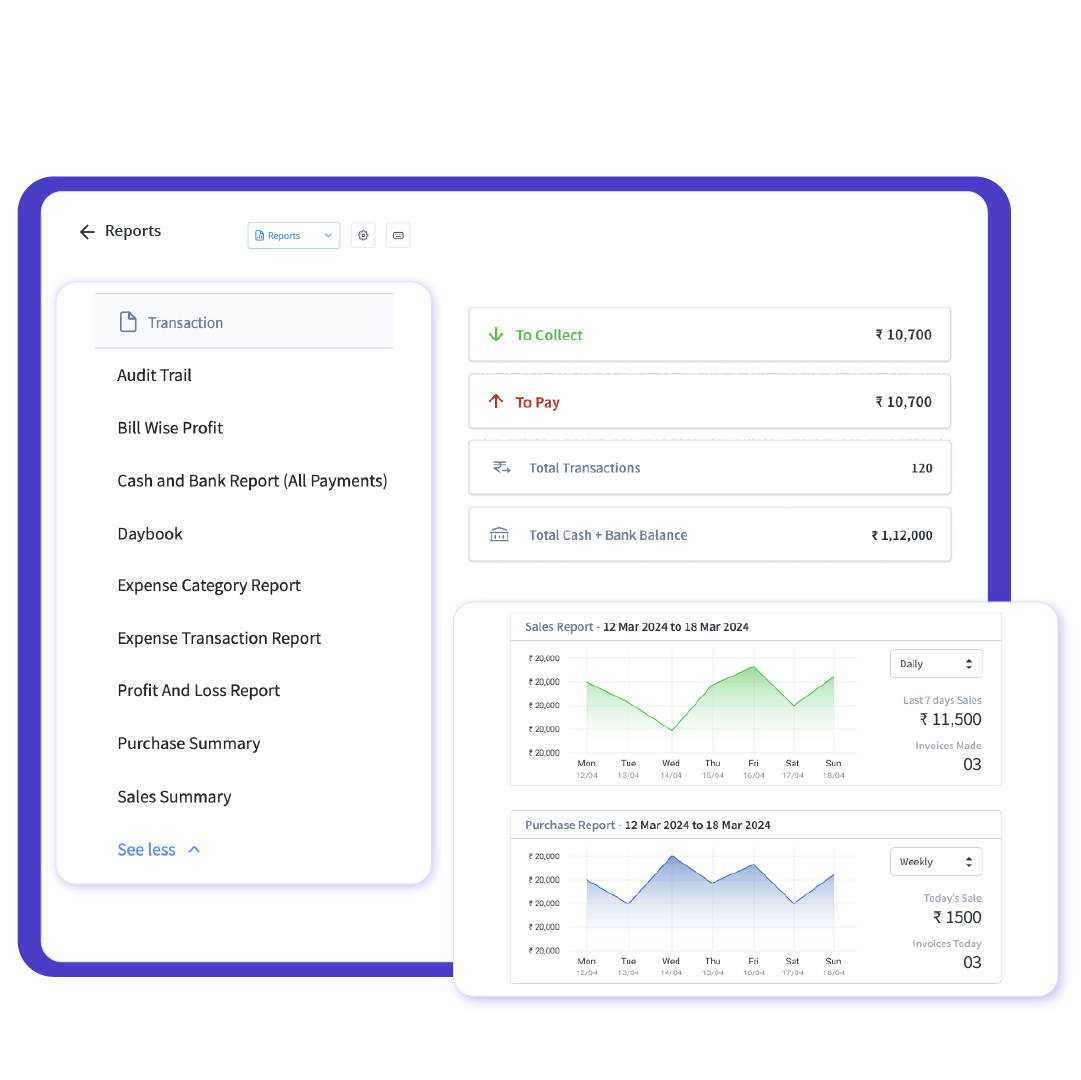

Custom Financial Reports & Audits

Detailed financial reports help in decision-making and audits. The software generates reports like balance sheets, income statements, and donor contribution summaries.

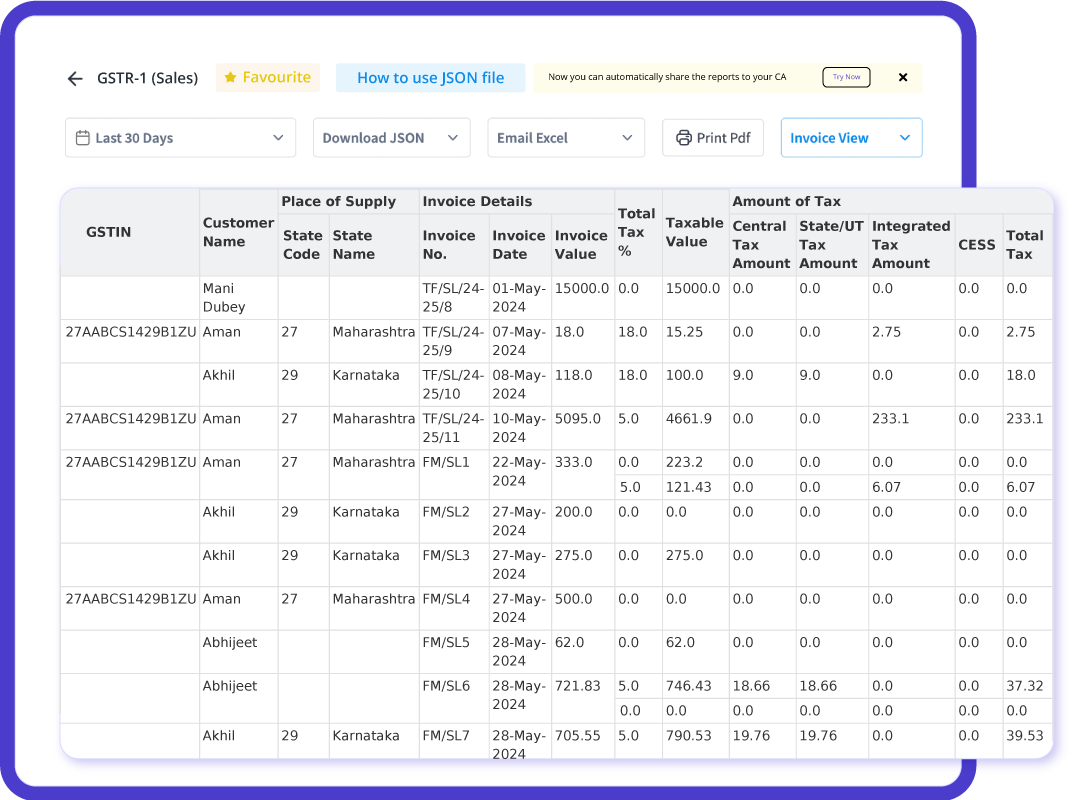

Tax Compliance & GST Reporting

For churches handling taxable services or transactions, GST compliance is essential. Automated GST calculations and return filings using myBillBook simplify tax management.

myBillBook helps Business succeed

“myBillBook has simplified our accounting process tremendously. The automated reports and donor tracking features help us maintain transparency and build trust with our congregation.”

Anna M.,

Church Treasurer

“With myBillBook, we no longer worry about financial mismanagement. The multi-user access and role-based permissions allow our team to handle finances securely and efficiently.”

David K.,

Finance Administrator

“Our church struggled with manual bookkeeping, but myBillBook has automated everything – from invoicing to payroll management. It’s truly a blessing for our operations!”

Reverend Lisa T.,

St. Peter’s Parish

Pricing plans

Diamond Plan

₹217

Per month. Billed annually. Excl. GST @18%

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

Platinum Plan

₹250

Per month. Billed annually. Excl. GST @18%

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

Enterprise Plan

₹417

Per month. Billed annually. Excl. GST @18%

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills

What is Accounting Software for Church

Accounting software for churches is a specialized financial management tool designed to help religious institutions manage donations, expenses, and financial reports efficiently. Unlike business accounting software, it focuses on fund accounting, donor tracking, tax compliance, and multi-user access to ensure transparency and proper financial stewardship. Features such as automated invoicing, budget tracking, and cloud-based access make it easier for churches to streamline their financial operations.

Why Churches Need Specialized Accounting Software

Churches have unique financial structures compared to businesses, requiring software that caters to their specific needs. Unlike traditional businesses that focus on profit generation, churches manage funds from donations, tithes, and grants, making it crucial to have an accounting system designed for transparency and stewardship.

A specialized accounting system ensures accurate fund tracking, categorizing donations properly and ensuring they are allocated for designated purposes such as charity programs, maintenance, and outreach activities. Since churches often have tax-exempt status but must still adhere to financial regulations, dedicated software simplifies tax filings and compliance with reporting standards.

Financial transparency is essential for churches, as donors and members expect clear insights into fund utilization. Church-specific accounting software generates detailed financial reports, allowing churches to share financial statements with their congregation, auditors, and regulatory bodies.

Additionally, church finances are often managed by multiple individuals, such as treasurers, accountants, and volunteers. Role-based access control ensures that different personnel can handle financial tasks securely while maintaining accountability.

How to Choose the Right Accounting Software for Your Church

Choosing the right accounting software requires a clear understanding of the church’s financial management needs. Start by assessing the size of the church, the number of transactions, and the complexity of financial tracking required. Look for software that offers essential features such as donation tracking, fund management, and expense monitoring to ensure smooth financial operations.

Comparing different software options is crucial. Evaluate pricing, scalability, and ease of use to find a solution that fits both the budget and the church’s long-term requirements. Cloud accessibility and multi-user support are also key factors to consider, as church administrators, treasurers, and other staff may need to access financial records from different locations.

Tax compliance is another vital aspect. The software should simplify tax reporting, particularly for churches that deal with GST or other regulatory requirements. Automated tax calculations and report generation reduce the risk of errors and ensure compliance.

Lastly, automation features such as recurring billing, payroll management, and financial reporting can significantly enhance efficiency and reduce manual work. Choosing a software solution that integrates with existing church management tools can also streamline overall operations and improve financial oversight.

How myBillBook Helps Churches with Accounting

- Automated Donation Tracking: myBillBook simplifies donation management by categorizing contributions, generating receipts, and maintaining donor records, ensuring accuracy and transparency in financial reports.

- Expense Management: The software enables churches to monitor operational costs such as maintenance, outreach programs, and utility bills, helping them stay within budget and manage funds effectively.

- GST-Compliant Invoicing: Churches that offer hall rentals, event services, or any taxable transactions can generate GST-compliant invoices quickly, ensuring regulatory compliance.

- Multi-User Access with Role-Based Permissions: Allows church treasurers, accountants, and administrators to access relevant financial data securely while maintaining accountability.

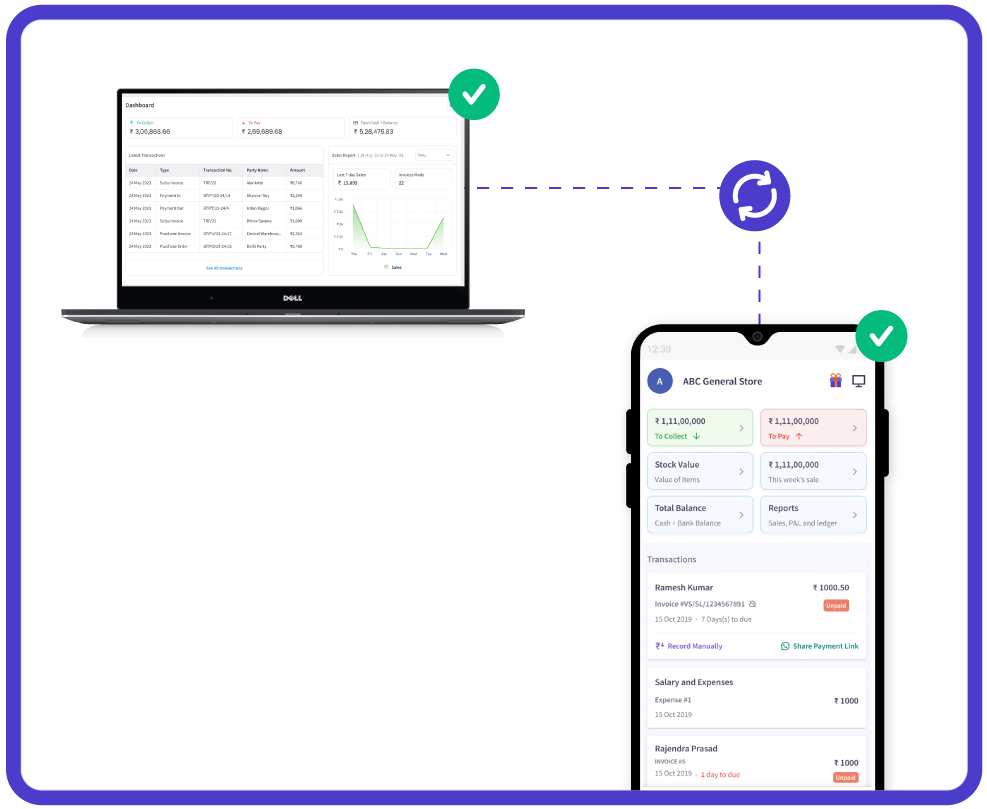

- Cloud-Based Accessibility: Enables real-time access to financial records from any location, making financial management convenient for churches with distributed teams.

- Custom Financial Reporting: Generates detailed reports such as balance sheets, income statements, and donor contribution summaries, aiding transparency and informed decision-making.

- Bank Reconciliation & Cash Flow Management: Syncs with bank accounts to track deposits, expenses, and overall cash flow, ensuring financial stability.

- Automated Payroll Management: Churches can process payroll for clergy, staff, and volunteers efficiently with automated salary calculations, deductions, and direct deposits.

Benefits of Using myBillBook Accounting Software for Churches

- Improved Financial Accuracy: Automates calculations and minimizes errors in donation tracking, expense management, and tax filings.

- Enhanced Transparency: Provides detailed financial reports, allowing churches to maintain trust with donors and stakeholders.

- Time-Saving Automation: Reduces manual bookkeeping tasks with features like automated invoicing, payroll processing, and real-time bank reconciliation.

- Easy GST Compliance: Helps churches that handle taxable services stay compliant with GST regulations through automated tax calculations and return filings.

- Cloud-Based Accessibility: Enables church administrators, treasurers, and pastors to access financial records anytime, anywhere.

- Secure Multi-User Access: Grants role-based permissions to different church personnel for better security and accountability.

- Seamless Donation Management: Tracks donor contributions and generates receipts efficiently, improving fundraising efforts.

- Budgeting and Expense Control: Allows for effective budget planning and helps prevent financial overspending.

- Integration with Church Operations: Works seamlessly with other church management tools for an all-in-one administrative solution.

FAQs

What is the best accounting software for churches?

The best accounting software for churches should include donation tracking, expense management, automated invoicing, and financial reporting. myBillBook is a great option for churches looking for an easy-to-use and compliant accounting solution.

How can accounting software help churches with donations?

It helps track donations, generate receipts, and maintain donor records efficiently, ensuring transparency and accountability.

Is church accounting software different from business accounting software?

Yes, church accounting software focuses on donation tracking, fund accounting, and non-profit compliance, whereas business software primarily tracks sales, profits, and taxes.

Can myBillBook help with tax compliance for churches?

myBillBook automates tax calculations, GST invoicing, and return filings, making compliance easy for churches handling taxable transactions.

Is cloud-based accounting software necessary for churches?

Cloud-based software allows remote access, real-time updates, and secure data storage, which is beneficial for church administrators and treasurers