Accounting Software for Attorneys

Leading Accounting Software for Attorneys & Law Firms

Trusted by 1 Crore+ businesses for Billing, Inventory and Accounting

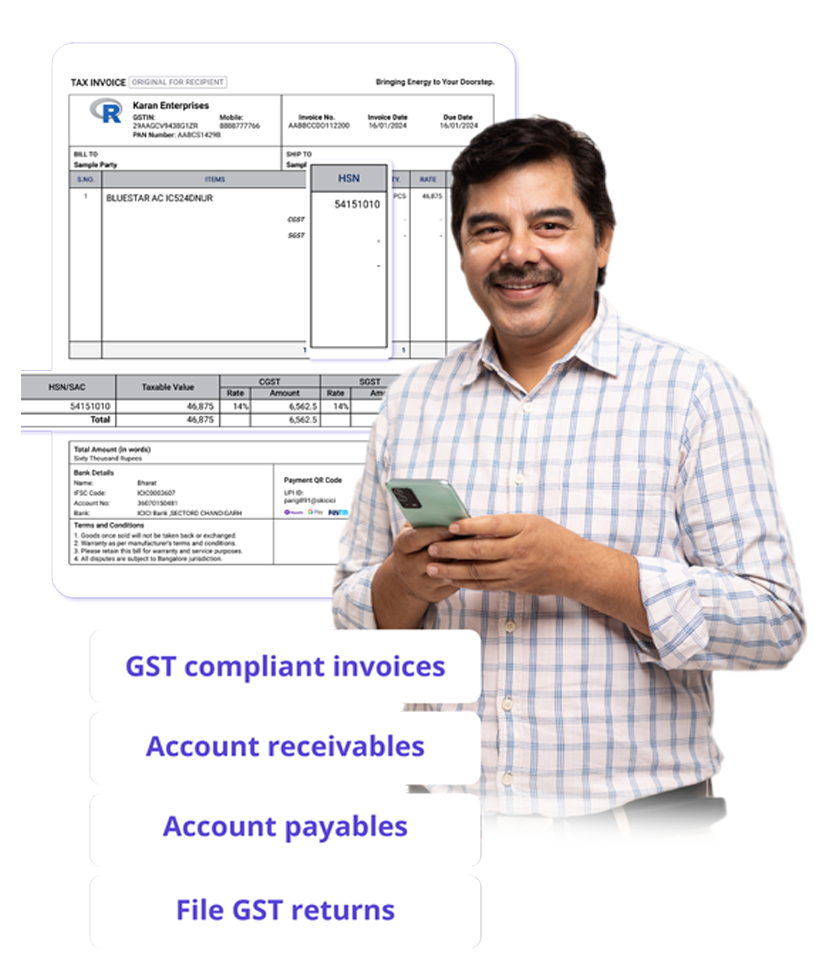

``myBillBook is designed for businesses to generate accurate GST-compliant invoices and automate their entire accounting process.``

“Managing account receivables and payables was overwhelming for our Travel Agency business. With myBillBook, we now view all account payables and receivables in real-time with 100% cloud access with real-time data sync across all devices. This has streamlined our accounting process and improved our cash flow management.”

Ramesh Jain

Ram Travels, Hyderabad

Recommends myBillBook for:

Product Demo of Accounting Software for Attorneys

“Superb customer service. Helped me set up my account as required”

Key Features of Accounting Software for Real Estate

Customizable Invoicing

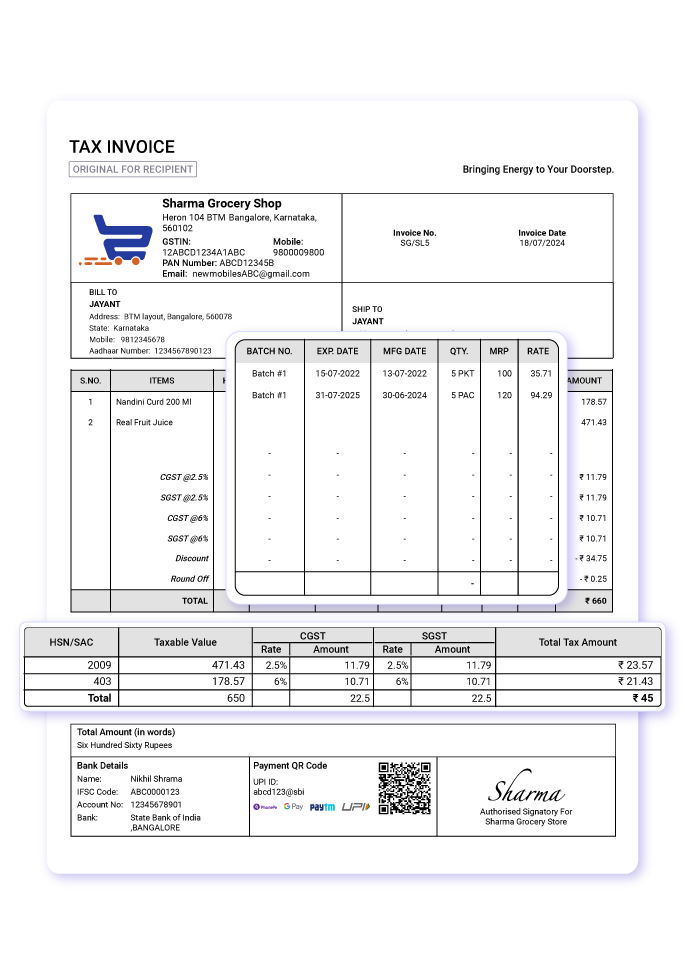

Generate professional, GST-compliant invoices tailored for legal services. Whether billing by retainer, hourly rates, or itemized services, myBillBook simplifies the process.

Trust Account Management

Manage client trust accounts effortlessly with tools to reconcile balances, track deposits, and ensure compliance with legal standards.

Expense and Time Tracking

Keep a detailed record of billable hours and case-related expenses. These can be linked directly to invoices, ensuring transparent billing for clients.

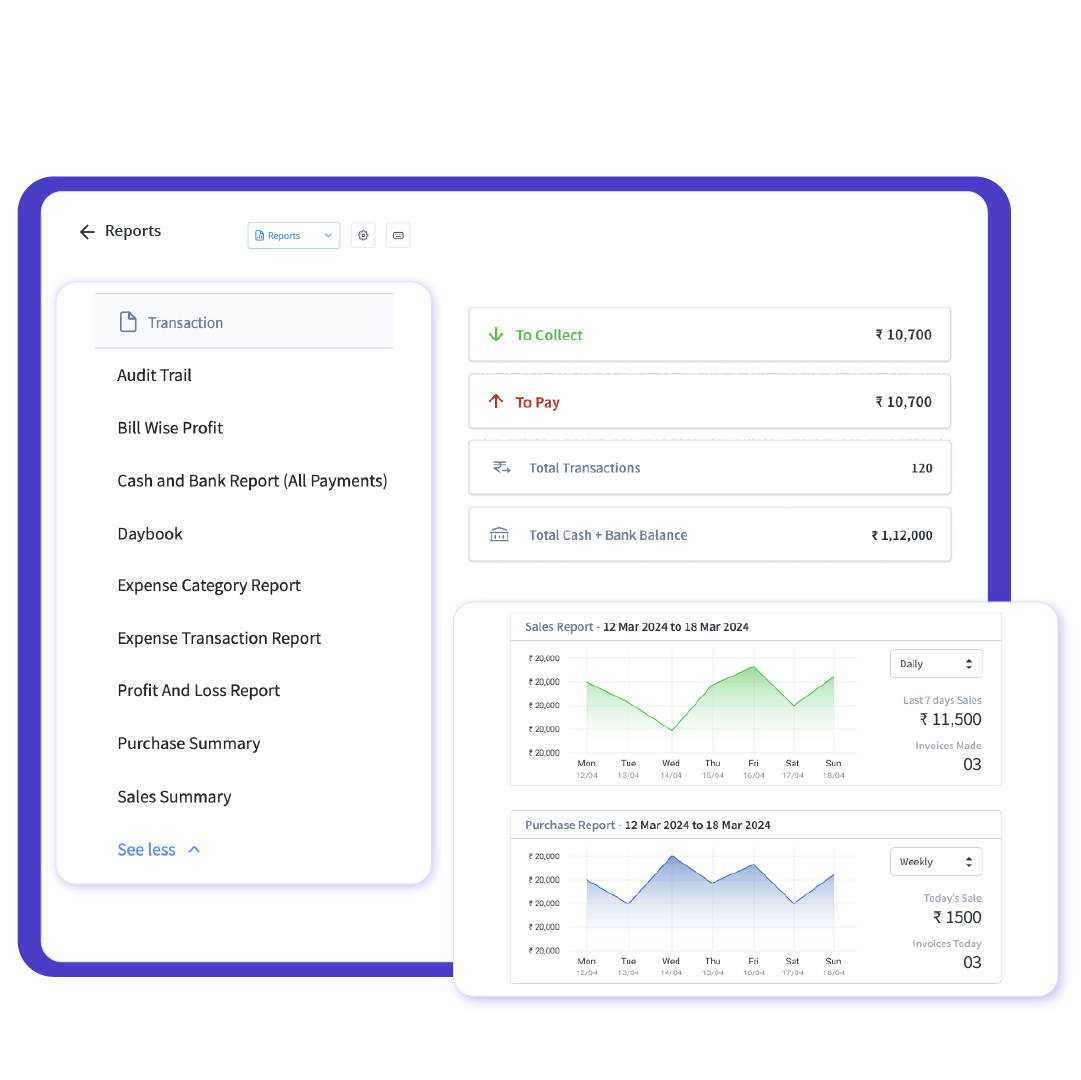

Real-Time Financial Insights

Generate detailed reports on client payments, cash flow, and case profitability. These insights enable attorneys to make informed business decisions.

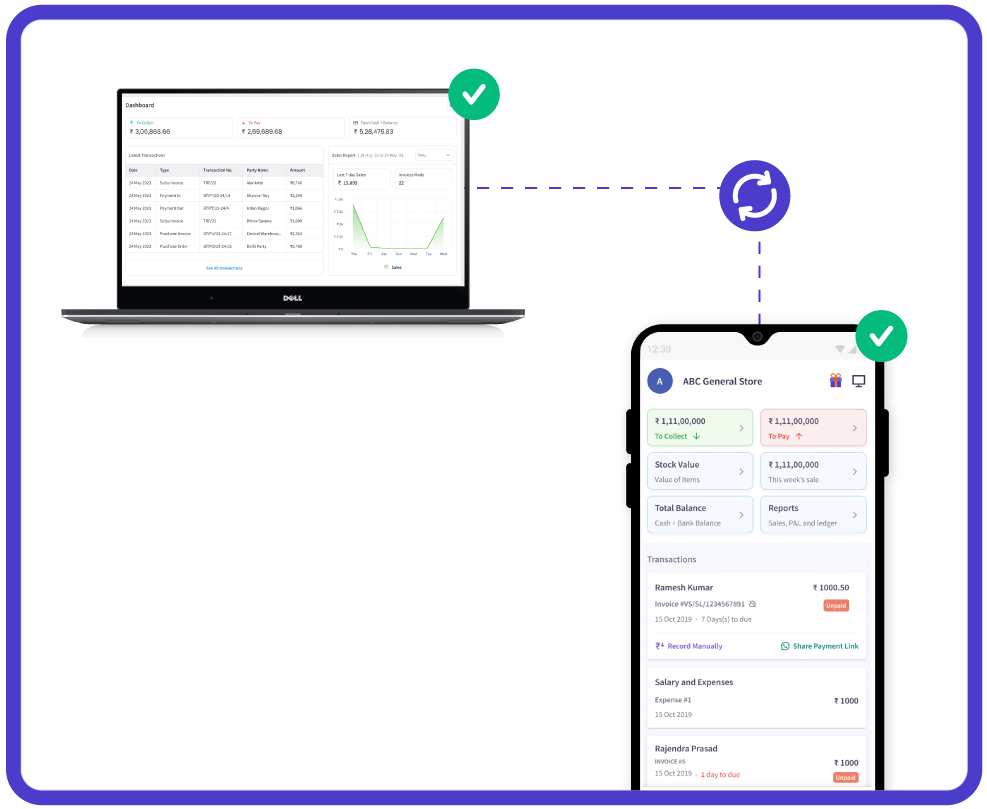

Cloud-Based Flexibility

Access your firm’s financial data securely from anywhere. myBillBook’s cloud-based platform ensures you’re always in control, even on the go.

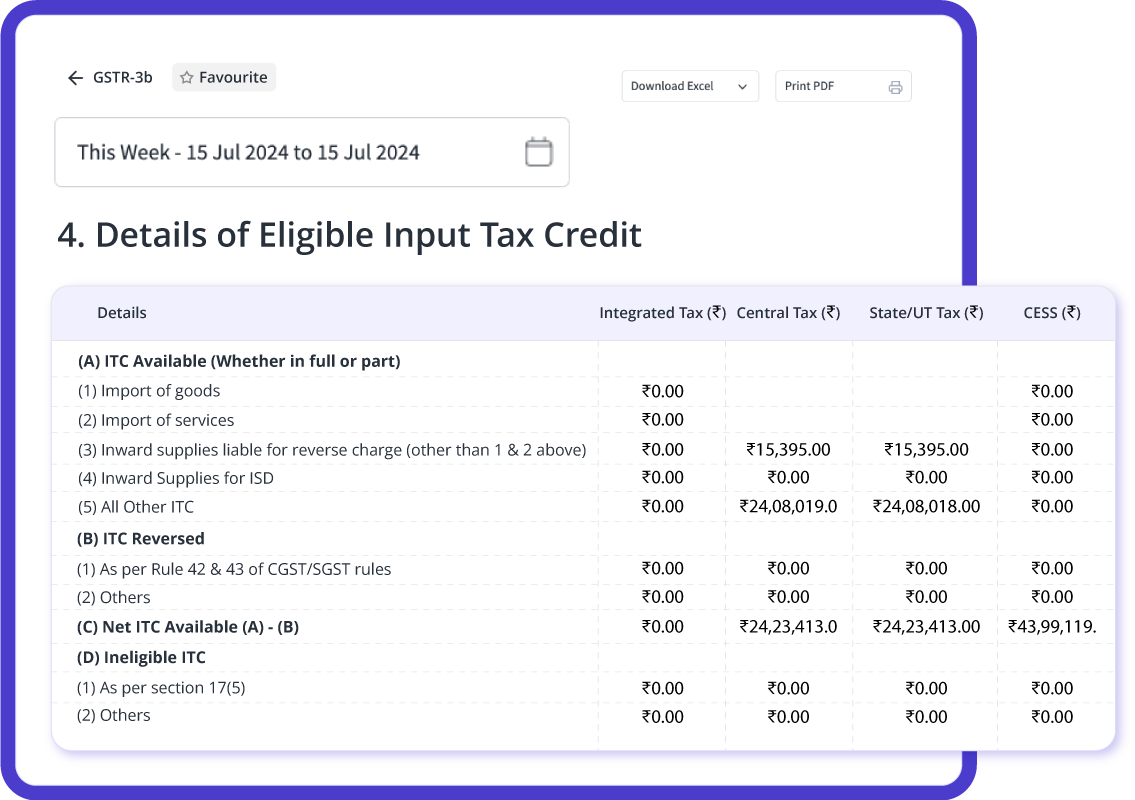

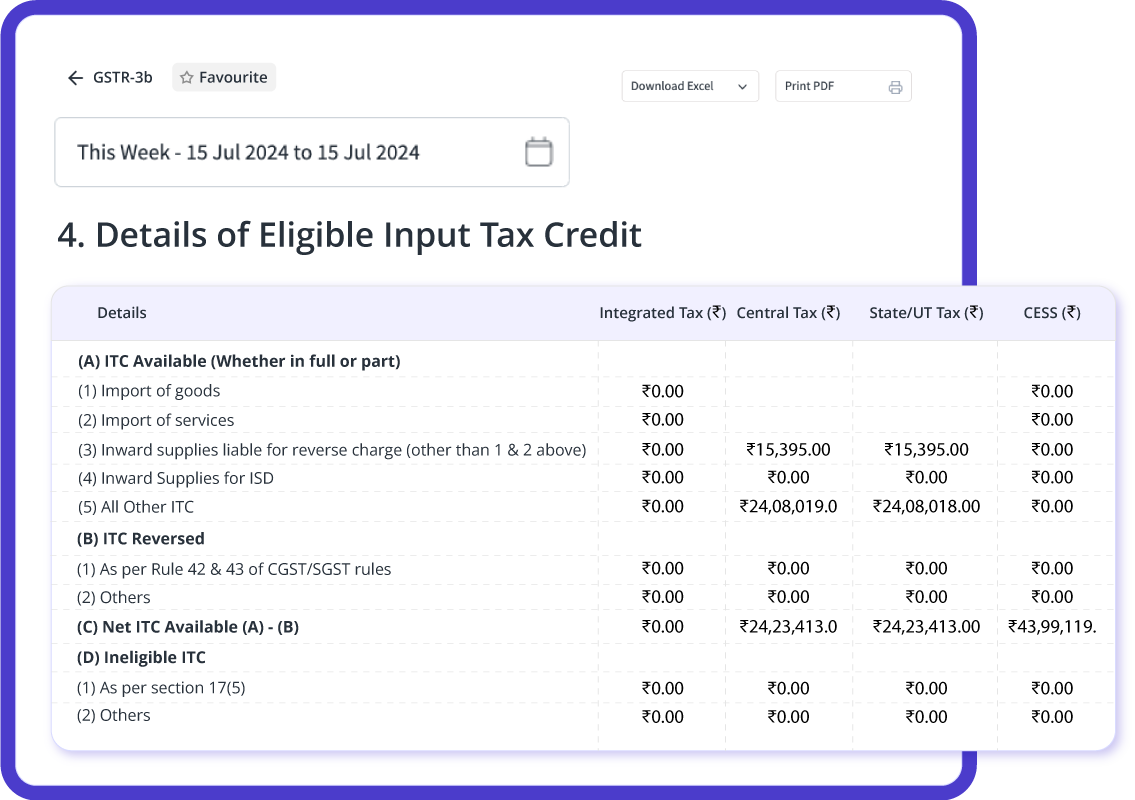

GST Filing Made Easy

Automate GST filings with features like pre-filled GSTIN, HSN/SAC codes, and accurate tax calculations, ensuring compliance with ease .

myBillBook helps Business succeed

“myBillBook’s ledger management capabilities have revolutionized our transaction monitoring. Accessing detailed party statements and ledger reports is now seamless, enabling us to manage cash flow with precision and confidence.”

Harish J

Infinite travels – Chennai

“myBillBook has made audit and compliance assurance seamless. The built-in audit trails and comprehensive reports provide us with the tools we need to stay compliant, ensuring our financial activities are tracked accurately and efficiently.”

Sandesh Gupta,

Memorable voyage – Banglore

“Filing GST returns has never been easier than with myBillBook. It provides error-free GSTR-1 and GSTR-3b reports, and the reconciliation of GSTR-2 is seamless, ensuring we stay compliant and focus more on growing our business.”

Mahesh Rao,

Epic escapes – Delhi

Pricing plans

Diamond Plan

₹217

Per month. Billed annually. Excl. GST @18%

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

Platinum Plan

₹250

Per month. Billed annually. Excl. GST @18%

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

Enterprise Plan

₹417

Per month. Billed annually. Excl. GST @18%

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills

Educational Guide: Mastering Legal Accounting

What is Legal Accounting?

Legal accounting involves managing the financial activities of attorneys and law firms. From tracking client payments to managing trust funds, legal accounting is essential for maintaining compliance, building trust with clients, and ensuring a firm’s profitability.

5 Legal Accounting Tips for Attorneys

1. Understand Trust Accounting Rules

Attorneys must keep client trust funds separate from operating accounts to comply with regulations. Use accounting software for lawyers/law firms like myBillBook to ensure compliance.

2. Implement Transparent Billing Practices

Clients value clarity in billing. Ensure that invoices are itemized and reflect accurate time logs, expenses, and legal fees.

3. Track Case Expenses Accurately

Law firms incur various expenses, such as court fees and travel costs. An effective accounting system helps track these expenses and ensures proper reimbursement or deductions.

4. Automate Tax Compliance

Legal professionals are required to comply with GST regulations. Using accounting software for attorneys ensures GST-compliant invoicing and tax filing, saving time and reducing the risk of penalties.

5. Reconcile Accounts Regularly

Regular account reconciliation prevents discrepancies and ensures that trust accounts remain compliant with legal standards.

Common Legal Accounting Challenges

- Trust Account Mismanagement:

Mismanaging client trust funds can lead to compliance violations. Automating trust account reconciliation ensures accuracy. - Delayed Payments:

Late invoicing or payment follow-ups can disrupt cash flow. Use automated reminders in accounting software for lawyers/law firms to ensure timely collections. - Manual Errors:

Errors in billing or expense tracking can lead to financial losses. Automating these processes reduces the likelihood of mistakes. - Tax Filing Errors:

Filing incorrect GST returns can result in penalties. GST-ready accounting tools like myBillBook simplify tax compliance and ensure accuracy.

Why Attorneys Need Accounting Software

Managing finances in a law firm comes with unique challenges, including trust account management, tracking billable hours, and ensuring compliance with financial regulations. Without the right tools, these tasks can be time-consuming and error-prone. This is where accounting software for attorneys becomes indispensable. Tailored specifically for lawyers and law firms, this software simplifies financial tasks, improves accuracy, and helps ensure compliance.

myBillBook Accounting Software for Attorneys

myBillBook is one of the leading accounting software for attorneys and lawyers/law firms, offering tailored solutions to simplify legal financial management. Designed with the specific needs of legal professionals in mind, myBillBook integrates powerful features like invoicing, payment tracking, and trust account management to streamline day-to-day operations.

How myBillBook Helps Attorneys

myBillBook simplifies accounting for attorneys by offering:

- GST-Compliant Invoicing: Generate legal-compliant invoices with party GSTIN, HSN/SAC codes, and tax components auto-populated.

- E-Way Billing and E-Invoicing: Create authenticated e-invoices and e-way bills for smooth compliance processes.

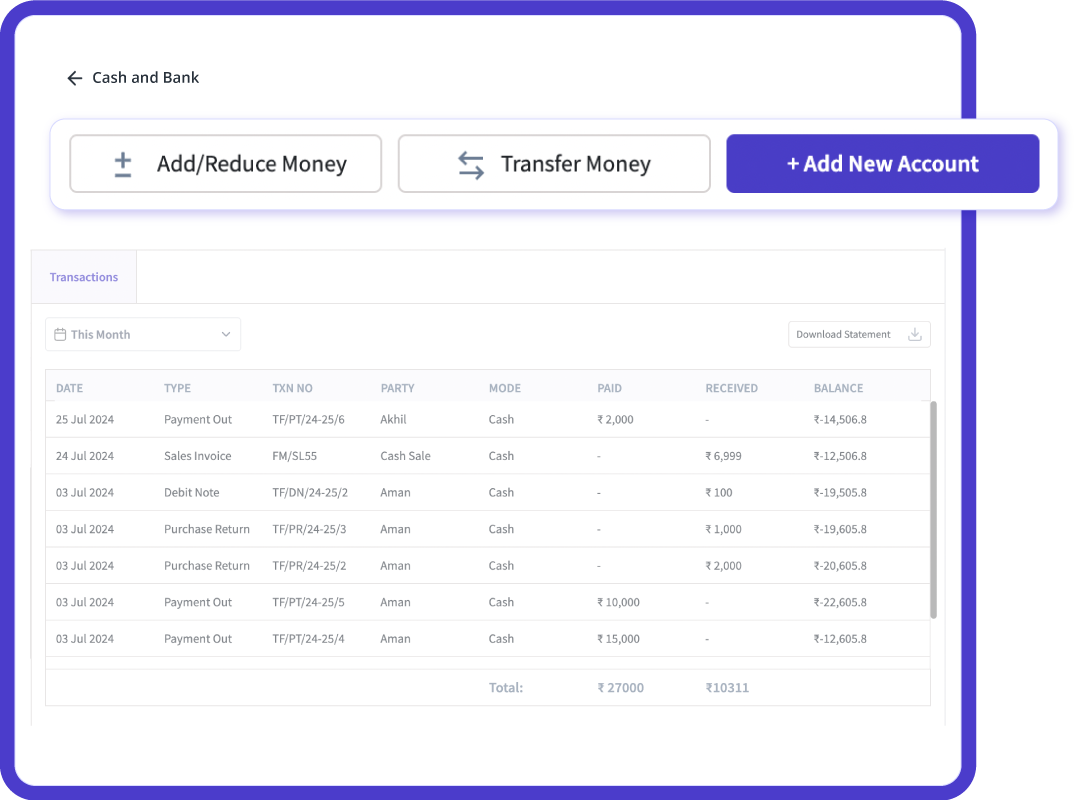

- Expense and Payment Tracking: Track case-specific expenses and manage real-time payments seamlessly.

- Inventory and Document Management: Attach case-related documents and manage necessary inventory (e.g., office supplies).

Benefits of Using myBillBook for Lawyers/Law Firms

- Save Time: Automate repetitive financial tasks like invoicing, expense tracking, and payment reminders.

- Improve Accuracy: Reduce manual errors in billing, trust account reconciliation, and tax filing.

- Enhance Client Relationships: Transparent billing improves trust and strengthens client relationships.

- Ensure Compliance: Meet all tax and financial regulations, including GST compliance, effortlessly.

- Scale with Growth: myBillBook grows with your law firm, offering advanced features as your practice expands.

With myBillBook, law firms can streamline their accounting processes, ensure compliance, and focus more on delivering exceptional legal services. myBillBook accounting software stands out as an ideal solution for legal professionals, offering features designed to meet the specific needs of attorneys and law firms.

FAQS – Accounting Software for Attorneys

What makes accounting software for attorneys different?

Accounting software for attorneys is designed to meet the unique financial needs of law firms, including trust account management, case-based billing, and legal compliance.

Is myBillBook suitable for small law firms?

Yes, myBillBook is ideal for small law firms as it offers scalable features to grow with your practice.

How does myBillBook handle trust accounting?

myBillBook includes tools to manage trust funds, ensuring accurate reconciliation and compliance with legal regulations.

Does myBillBook support GST-compliant invoicing?

Yes, myBillBook automates GST-compliant invoicing, including pre-filled GSTIN, HSN/SAC codes, and accurate tax calculations.

Is myBillBook accessible on mobile devices?

Yes, myBillBook is cloud-based and accessible on mobile devices, making it convenient for attorneys to manage finances from anywhere.