Sales Bill Format

Effortlessly create customised sales bill formats in seconds with myBillBook billing software. Our user-friendly interface allows you to generate professional bill format quickly and easily. Personalise sales invoice formats by adding your brand logo, watermark, custom fields, and much more. Unlock more billing and accounting features within the same plan.

✅ Free Sales Bill Templates

✅ Customise Sales Invoices to match your brand

✅ Add/Remove Fields as per your business requirement

✅ Choose Invoice Prefix & Sequence Number

✅ Both Normal and Thermal Prints Available

✅ Pricing Starts at INR 399/Year

Download Free Sales Bill Formats in Excel, Word, & PDF

Features of myBillBook Sales Bill Generator

Ready-to-Use Sales Bill Templates

With myBillBook, you don’t have to search for sales bill formats online.

Read more

The billing application provides ready-to-use bill templates from which you can choose the ones that suit your business image.

Choose from a variety of eight bill format themes in myBillBook, including Stylish, Advanced GST, Modern, Simple, and more. Select your preferred theme, customise the colour, choose the fields to display or delete, and ‘Save’ the changes you make. You’ll be ready to generate invoices in your chosen sales invoice format tailored to your business’s unique style.

Custom Invoice Themes

If the existing sales bill templates do not suit your business requirements, you can choose our ‘Custom Invoice’ option to further customise the bill formats.

Read more

With this feature, you can design your own sales invoice templates in a Canva-like interface.

You can choose a font style, size, and invoice colour, adjust printer margins, customise the header and footer section, add watermarks & logos, add/remove fields, include/exclude terms & conditions, display bank a/c number, signature, and more.

Assign Invoice Numbers

With new GST regulations in place, assigning invoice numbers to sales bill formats as per the standards is a task for all business owners.

Read more

Using a manually created invoice number with a random series might not work when the volume of billing increases. myBilBook saves your business from the hassle of generating unique invoice numbers.

You decide on the prefix and sequence of your invoice numbers once, and the billing software takes care of generating invoice numbers in the same order. Even without a preset prefix or sequence, the software can generate invoice numbers in a certain order.

GST-Complaint Sales Bill Templates

The software offers GST-compliant sales bill templates for GST-registered businesses. These templates help companies generate GST sales invoices easily.

Read more

You just need to choose the GST-specific sales bill template choose your GST tax slab in the invoice settings, and the tax rates are auto-generated for all the invoices. The total amounts will also be auto-calculated based on the applicable tax rate.

Different Types of Bill Formats Available

If you use an online invoice generator to create sales bill formats, you get only those.

Read more

But if you use billing software like myBillBook, you can access multiple invoice or bill formats like quotation format, credit note format, proforma invoice format, debit note format, and many other invoice formats. All the formats are professionally designed and are easy to create with user-friendly interface.

Dual Printing Option

Whatever sales bill format you choose, the software allows you to print it in both normal and thermal printer billing options.

Read more

Again, in thermal printing, you will have the option to choose 2 inch and 3 inch prints based on your hardware or other requirements. In the custom theme, you will find the option to choose 5-inch or 10-inch margins on four sides of the page.

₹217

Per month. Billed annually

Diamond Plan

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

₹250

Per month. Billed annually

Platinum Plan

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

₹417

Per month. Billed annually

Enterprise Plan

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills Popular

₹399 per year

Silver Plan for Android App

✅ For 1 device, 1 business and 1 user

What is Sales Bill Format or Sales Invoice Format?

A sales bill format or a sales invoice format is a document used to record a sale transaction. It includes details such as the date, customer information, item descriptions, prices, and payment terms.

A sales invoice format is a standardised document to record and track sales transactions between a seller and a buyer. The format typically includes specific details such as the date of sale, the seller and buyer’s names and addresses, the products or services sold, and the total cost of the transaction. It is a legally binding agreement and a useful financial management and record-keeping tool.

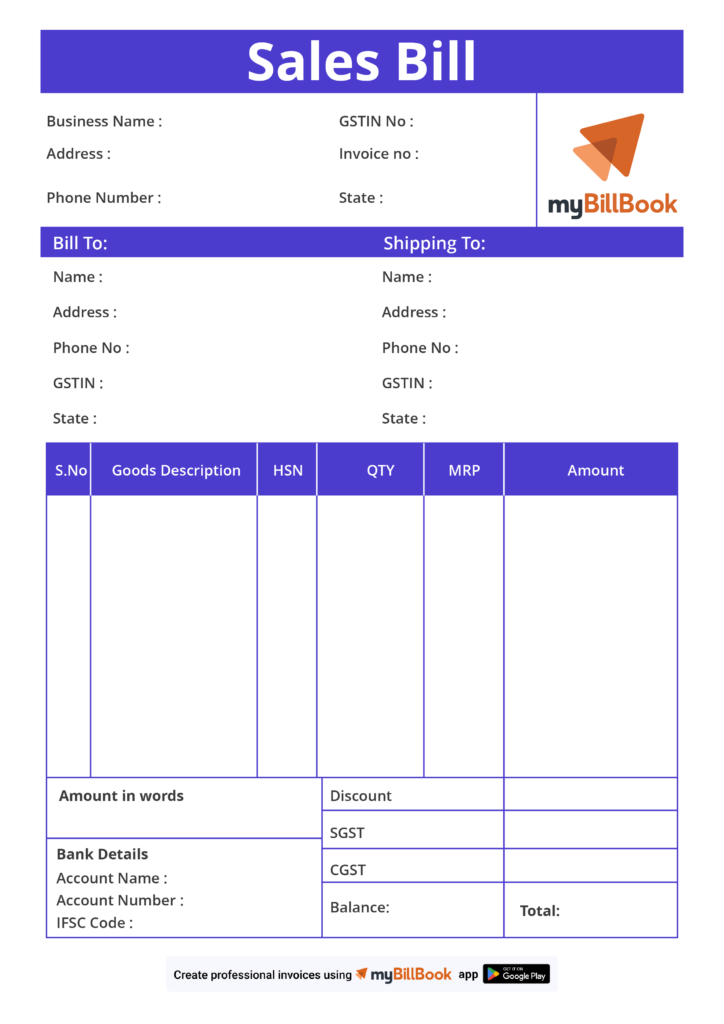

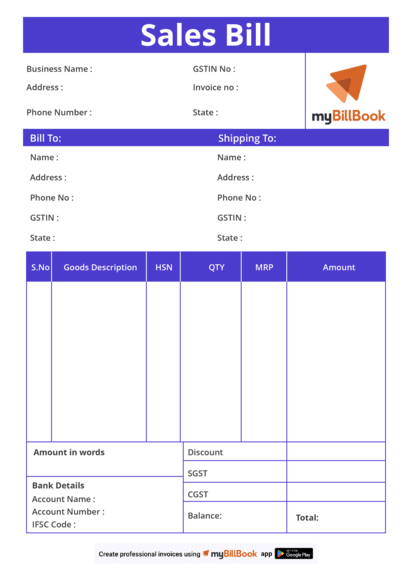

Sales Bill Format: Details to be Included

Sales invoice format must include specific details to achieve precision.

- Name and address of the seller

- Name and address of the buyer

- Date of the invoice

- Unique invoice number

- Description of the goods or services provided

- Quantity of goods or services provided

- Price per unit of goods or services

- Total prices of goods or services provided

- Taxes, discounts, and other charges, if applicable

- Payment terms, including due date and acceptable forms

This comprehensive list of important information should be included in a sales bill format. This table can be a useful guide for businesses to create a clear and accurate sales bill that facilitates smooth financial transactions. However, the contents of a GST Sales Invoice would differ from those of a normal invoice.

Sample Sales Bill Format

A sample sales invoice format is a pre-designed template that can be tailored to fit the specific requirements of a business. This example is a reference guide to ensure all relevant information is included, arranged correctly, and presented professionally in a sales bill.

Sales Bill Format in Excel

Sales bill format in Excel is one of the best ways to create bill formats. Compared to other options, Excel provides the benefits of calculation and auto generation abilities. It further provides easy editing and sharing options. The Excel sales invoice format also includes password protection for added security. Reviewing the provided sample bill template in Excel can help understand the necessary information and layout for the invoice.

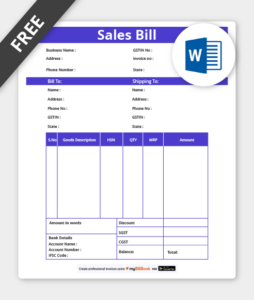

Sales Bill Format in Word

The sales invoice format in Word is a flexible template that can be customised to meet a business’s specific needs. Word bill format with intuitive formatting options is easy to edit. It can be converted to PDF for sharing with stakeholders. The below sample of sales invoice format in Word helps understand the necessary data and arrangement for the bill format.

Sales Bill Format in PDF

The sales invoice format in PDF provides a secure and convenient way to share and print sales invoices on any device. This customisable bill format in PDF ensures the accessibility and confidentiality of sensitive information. Reviewing the sales invoice format in the PDF sample provided can help understand the necessary data and arrangement required.

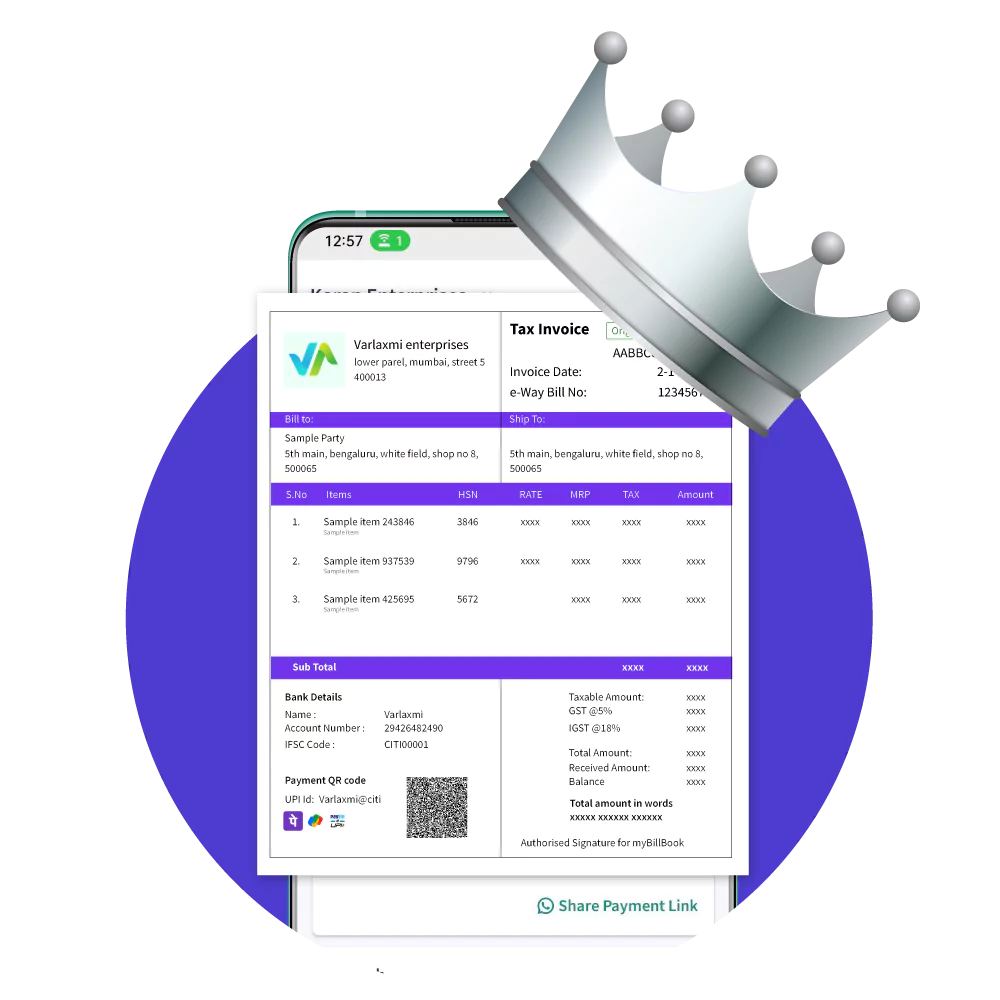

Using Billing Software to Generate Sales Bill Format

If you find creating a sales bill format difficult using Word, Excel or any other online tools, you can try using a billing and accounting software like myBillBook.

myBillBook is a billing software designed to simplify the billing and accounting needs of small and medium businesses in India. Here are the benefits of using myBillBook to generate sales invoice formats.

- Automates bill creation, reducing manual data entry and speeds up customer transactions.

- Minimizes human errors, ensures accurate calculations for taxes and discounts.

- Offers professionally designed templates that can be customized with your business branding.

- Tracks stock levels in real-time, prevents stockouts or overstocking and streamlines reordering.

- Digitally stores billing and transaction data, simplifying retrieval, auditing, and financial analysis.

- Includes features like payment reminders and tracking of outstanding invoices, ensuring timely payments and better management of receivables.

myBillBook also supports various business types, such as laundry billing software, offering industry-specific features to meet unique billing needs.

FAQs on Sales Bill Format

How to make a sales bill format in Excel?

To create a simple and professional sales bill template in Excel, follow the steps below.

Open Excel and start a new blank workbook.

Create a header by entering your company name, address, and contact information at the top.

Create columns for Date, Invoice Number, Customer Name, Item Description, Quantity, Unit Price, and Total.

Insert formulas to calculate totals (e.g., =Quantity*Unit Price) and sum up the total amount (e.g., =SUM(Total)).

Format cells for currency, add borders and use bold text for headings.

Save your workbook as a sales bill template for future use.

How to make bill format in Word?

You can create a professional bill format in Word using the below steps.

Open a new blank document in MS Word.

Create header by add your company name, logo, address, and contact info.

Add billing details by including fields for Bill Number, Date, and Customer Details.

Insert a table for Item Description, Quantity, Unit Price, and Total.

Include sections for Subtotal, Taxes, and Grand Total.

Add payment terms and methods.

Save as a sales bill template for future use.

Why is it important to have a sample sales bill format?

Having a standardized sales invoice format is crucial to ensure accurate information, proper organization, and a professional presentation. Customizing the format can also meet specific business needs.

What are the advantages of using a sales bill format in Excel?

Sales bill template in Excel offers calculation and graphing abilities, making cost calculation and trend analysis easier. It also provides password protection for security and easy editing and sharing options.

How can sales bill format in PDF benefit a business?

The sales bill template in PDF offers a secure and convenient method for sharing and printing sales invoices on any device. This ensures the confidentiality of sensitive information and allows for easy accessibility and review of the necessary data for bill preparation.

How can businesses customise a sales bill format to suit their needs?

A sales bill template can be easily customized to suit a business's specific requirements. This can include adding or removing fields, changing font styles or colours, and adding a company logo or branding.

Are there any legal requirements for the sales bill format?

Yes, there are legal requirements for sales bill template if it is generated by a registered seller. The format should include all the details as prescribed by GST laws.