Plastic money, that is, credit cards and debit cards, has been increasing in use in recent times. Many people prefer to use credit and debit cards instead of cash due to their ease and flexibility. Credit and debit cards also allow you to shop online in a secure manner.

Several security measures are used while using plastic money. Entering the CVV number of a credit or debit card is one of them.

In this article, we discuss what a CVV number of a debit card is and what its significance is. We will also talk about other security aspects related to CVV code on a debit card.

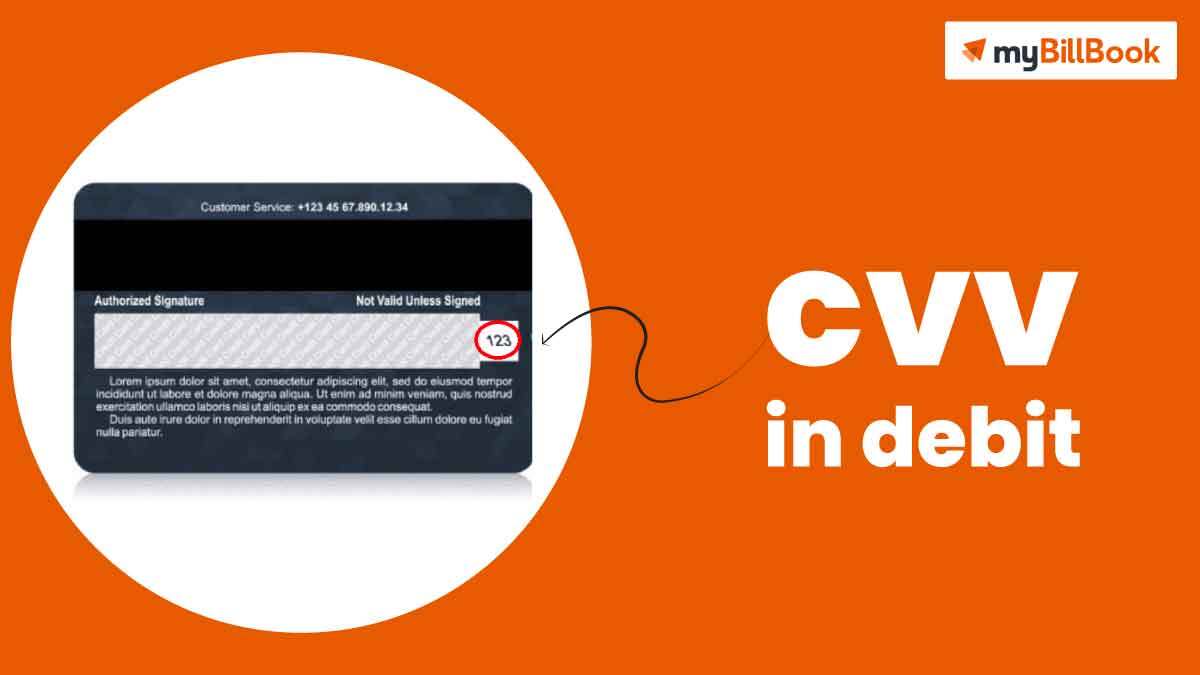

What is a CVV Code on a Debit Card?

Card Verification Value or CVV code is a three- or four-digit code found on the back of your credit card or debit card. Every debit card has a different CVV number, and only the debit card owner knows this number. Debit card CVV is sometimes called Card Verification Code (CVC) or Card Security Code (CSC) as well. It is also called the CVV2 number in some cases as it is generated using second-generation key generators and hence is harder to guess.

The CVV code of a debit card is provided to enable users to perform online and phone transactions in a secure manner. Just like every card number is unique, a unique CVV number gives you an extra degree of protection against fraud while using the debit card. Thus, when you cannot present while making the payment, the CVV code on the debit card will help you establish your identity during an online transaction.

When you swipe your credit or debit card during a transaction, the card reader reads the magnetic stripe at the back of your card. The magnetic stripe is an important component of a credit or debit card because it contains a lot of information about the cardholder. The magnetic stripe and the CVV number provide a dual security level for your transactions.

Where Can I Find My Debit Card’s CVV Number?

On most credit and debit cards, including MasterCard and Visa cards, you will find the CVV code printed on the back of the debit card beside the space provided for your signature.

Parts of CVV on a debit card

A CVV consists of two main components:

- Black magnetic stripe

The black magnetic stripe at the back of your card contains essential information about the cardholder. If it gets scratched or damaged in any manner, a card reader cannot read your card. When you swipe your card through a card reader, it retrieves all the required information about the transaction and the cardholder through the magnetic stripe.

- CVV number

The CVV number on a debit card is a three- or four-digit number that is printed behind your card. Whenever you make an online purchase, you need to enter the CVV number along with the debit card number and expiry date to establish your identity. When you swipe your debit card through a card reader, the reader reads the numbers to ensure that the magnetic stripe information and the debit card number combination match.

Is My Debit Card CVV Code Unique?

Every credit and debit card has a unique CVV code. The bank issuing the card assigns these randomly generated numbers to your card.

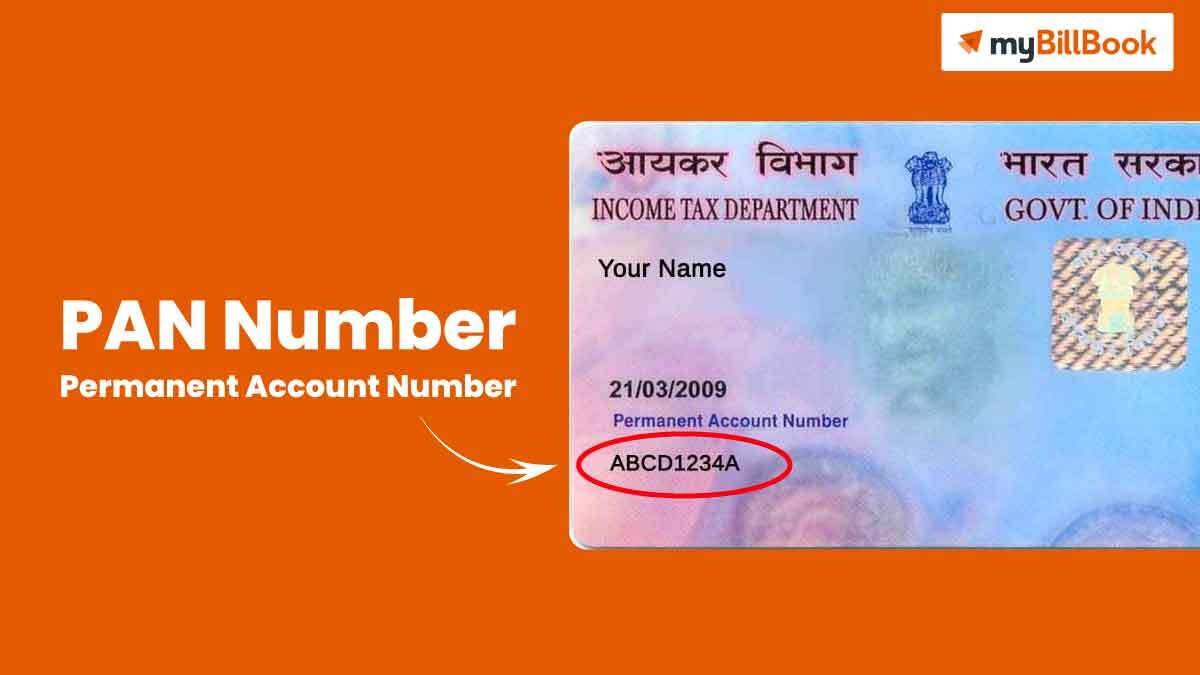

What Other Information Can I Find on My Debit Card?

You can find the following information on your credit or debit card:

- Credit Card or Debit Card Number (usually 12 to 16 digits)

- Service code

- The expiry date of the credit or debit card

- Three-digit unique code generated by the bank. Sometimes, the bank could issue 4-digit codes also.

It is, thus, of utmost importance that you do not share the above information with anybody. They are provided to ensure secure transactions.

How is CVV on Debit Cards Useful?

When used correctly, a CVV code on a debit card can protect you against fraud. If the magnetic stripe is changed, a card reader will be unable to read the data. Every transaction requires the exact magnetic stripe data and CVV code combination. In case of any changes, the reader will declare your debit card as “Damaged” and stop the transaction.

PIN and CVV on Debit Cards – Are They Same?

PIN (Personal Identification Number) and CVVs are different entities. A debit card’s CVV helps a card reader establish the credentials of a cardholder. You are required to enter your PIN while withdrawing money at an ATM, during transactions at a POS system, and during online transactions. While the CVV is present on the debit card and is known by the issuing bank as well, your PIN is completely secret and only you know it.

Just as you must never share your debit card details with anyone, you must also never share your PIN with anyone. When someone asks for a CVV number, do not share its details with them.

How Does a Debit Card’s CVV Number Ensure Secure Transaction?

When you shop on an online e-commerce site, it asks you to enter the CVV number on your credit or debit card when you check out. It does not save your debit card’s CVV information. Every time you make a purchase, you have to enter your CVV number. This step is to ensure additional safety against online fraud.

Similarly, when you swipe your debit card through a card reader, the card reader confirms the debit card data from the magnetic stripe and the CVV number. It does not copy or store the data.

CVV code on credit and debit cards gives you a two-factor authentication facility which improves the scope of secure transactions. You have to enter the debit card number, the expiry date, and the CVV number for online transactions to prove your identity and the fact that you are the cardholder.

If someone sees your credit card or debit card number, they will not be able to find the CVV number from it. It is unique and randomly generated. If someone tries to change the data on your debit card’s magnetic stripe, a card reader will not be able to read the debit card. It will show up as “Damaged”, hence stopping further transactions.

Thus, credit cards and debit cards provide various levels of security to ensure secure transactions. Unlike cash, you need not worry too much if you even lose your credit or debit card. There are multiple authentication steps to cross before someone can access your funds.

Online transactions require you to enter the CVV code on your debit card to authorise your purchase. However, they are legally not allowed to save or copy this information. Even if you have saved your credit or debit card details on an e-commerce site, the site will not be able to read your CVV number. Thus, even if the main server is hacked and your debit card data were stolen, your debit card will be of no use as they won’t have your CVV number.

How to Prevent Online CVV Fraud?

All e-commerce sites ask you to enter the CVV code on your debit card before proceeding with a transaction. This provides an extra layer of security for online transactions. However, expert cyber hackers might steal your CVV code as well and undertake fraudulent activities.

You can prevent such occurrences by following these guidelines:

- Do not save card data on e-commerce sites

Hackers can get the maximum amount of data by hacking an e-commerce site. It is always good to avoid storing credit or debit card information on these websites. Though it is more convenient and makes your shopping experience easier, it may lead to serious consequences later.

- Check for safe sites

Every website comes with an HTTPS or HTTP link. Check the link bar for a lock symbol. If you can see a lock symbol on the extreme left of the link bar, it means the site is safe to browse. Always shop on such sites only.

- Use password managers for unique passwords

One of the most common mistakes people make is setting the same password for multiple websites. Many times, the password is very easy, and anyone can guess it easily. To avoid this problem, you can use free password managers or generators to get unique passwords for different websites.

- Avoid opening phishing content

Phishing is a method of acquiring a user’s important information without divulging the source. Hence, you will get a mail from some unknown user who will ask you to click on a link to proceed. These links are designed to take you to fake websites that can capture all your information. You cannot trace these emails back to a particular person in most cases. It is always better to avoid opening suspicious emails and messages.

- Use a good antivirus

Good antivirus software prevents malicious content from entering your system and stealing your information. It also helps you safely navigate e-commerce websites without the fear of being hacked. Invest in good antivirus software to eliminate external threats.

Future Developments

In recent times, chip-based credit cards and debit cards have increased in number. These cards can change the internal code every time the card is used. Hence, it offers far more security than the usual magnetic stripe.

Upcoming technology also promises to bring changeable CVV codes for online transactions. In this method, the CVV code printed on the back of your card will periodically change after every few months. The card will use a battery which will allow this change. The changed CVV code will be then updated in the bank’s database so that the user faces no problem while making transactions.

However, this card will cost more due to the addition of batteries and the technology needed to update the database often. It is a matter of debate whether the amount of fraudulent activities outweighs the cost of making such a card.

Conclusion

Since the 2000s, the use of credit cards and then debit cards has increased manifold in India. Most people in urban areas carry a credit or debit card at all times. The introduction of huge e-commerce websites in India also promoted the use of plastic money.

While credit and debit cards make our lives easier by dispensing the need to carry cash around, they come with their own set of problems related to security.

Using the CVV on a credit or debit card correctly will help you bring down the amount of fraud significantly.

FAQs on CVV:

Is PIN the same as CVV?

No, PIN (Personal Identification Number) is different from CVV (Card Verification Value) and cannot be used interchangeably.

Do e-commerce sites store my CVV number?

No. According to the Payment Card Industry Data Security Standards, it is forbidden for e-commerce sites to store or copy your CVV number.

My friend saw my debit card and I think he noted my card number. Will he be able to misuse it?

No. Any website needs you to enter your CVV number and PIN to authorise a transaction. So your friend cannot do anything by just noting the card number.

Can I change the CVV number on my card?

No. A card’s CVV number is a unique combination of numbers generated by a key generating software. You cannot change the CVV number. You can, however, get a new card with a new CVV number.

Read more: