MSME means “Micro, Small, and Medium Enterprises.” Registering yourself under MSME can be beneficial in several ways if you are an enterprise. You can register your MSME online and can complete the MSME certificate download.

How to download MSME certificate ?

Follow the steps to download Udyam Certificate online:

Step 1: Navigate to the site at http://udyamregistration.gov.in.

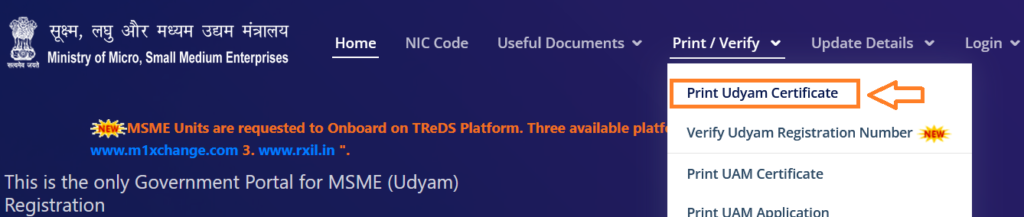

Step 2: Choose “Print/Verify” from the list of options in the upper right corner.

Step 3: Click on “”Print Udyam Certificate””

Step 4: Fill out the required information on the Udyami Login with OTP Option.

Step 5: Enter your 16-digit registered Udyam Registration Number in the format “UDYAM-XX-00-0000000″ into input box 1.

Step 6: Enter your ten-digit mobile number into input box 2 as it appears in the Udyam Aadhaar application data.

Step 7: For “Validate & Generate OTP,” select either OTP on Mobile as filled in application or OTP on Email as filled in the application.

Step 8: Enter the OTP received through mobile number or email address, then select “Verify OTP” and “Print.”

Step 9: View Udyog Aadhaar Certificate Data on the Home Screen.

Step 9: To acquire a copy of the certificate, select Print or Print with Annexure at the top of the page.

Print Option – Only the MSME Certificate will be accessible for printing.

Print with Annexure Option –The application (Udyam Aadhaar Memorandum Application) will be available.

Things to know before MSME Certificate download

- Aadhaar and PAN Card are the only documents required for MSME registration.

- Apply for registration via an online application on the government portal http://udyamregistration.gov.in or the Udyam Registration Portal.

- The portal is linked to the Income Tax and GSTIN systems and is valid for the rest of your life.

- MSME Certificate is also called Udyam/MSME/Udyog Aadhaar Certificate.

Frequently Asked Questions

When does the MSME certificate expire?

The MSME Certificate has no expiration date if an organisation is ethical and financially viable.

Can I renew my MSME registration?

No. You need not renew your registration because it is permanent.

Is the aadhar card mandatory?

Yes, you need an Aadhaar card for registration.

Can I have multiple Udyam Registration Numbers?

No. If your company does manufacturing and service, the Udyam Registration will combine the two.