Best Financial Reporting Software

Simplify Financial Reporting with Automation and Accuracy

Trusted by 1 Crore+ businesses for Billing, Inventory and Accounting

``myBillBook is designed for businesses to generate accurate GST-compliant invoices and automate their entire accounting process.``

Using financial reporting software has transformed the way we manage our business finances. The automated reports and real-time insights have saved us countless hours.

Ramesh Patel

Business Owner

Recommends myBillBook for:

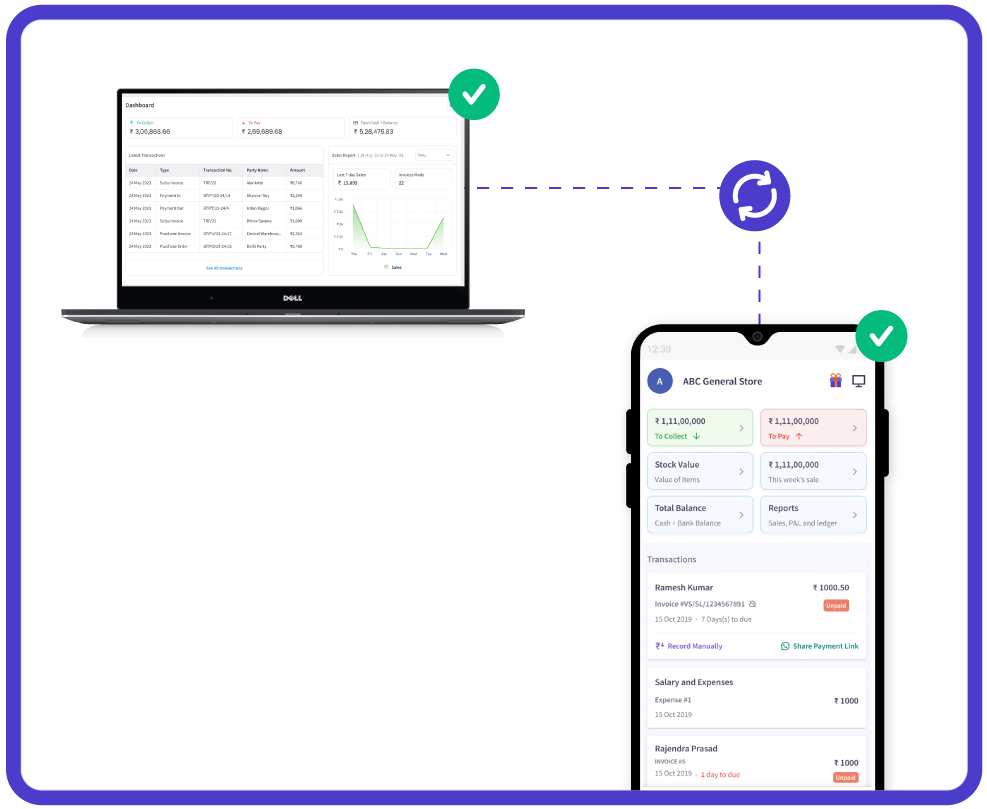

Product Demo of Financial Reporting Software

“Superb customer service. Helped me set up my account as required”

Key Features of of Financial Reporting Software

Automated Financial Statements

Financial reporting automation helps generate balance sheets, profit and loss statements, and cash flow statements without manual intervention. This feature ensures accuracy and saves time.

Customizable Report Templates

Most financial reporting tools provide customizable templates to suit different business needs. Users can modify layouts, add specific data points, and generate reports in various formats.

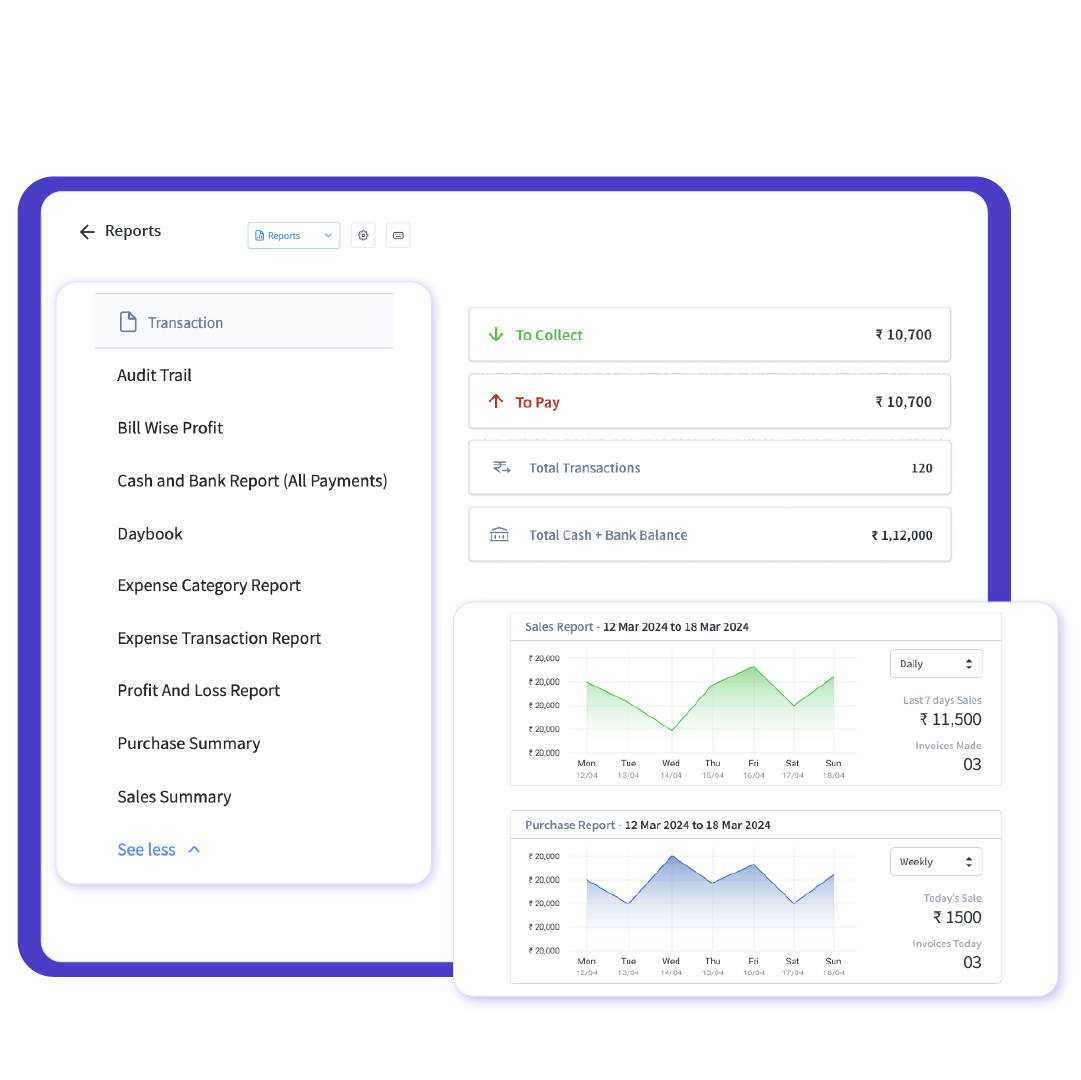

Real-Time Data Analytics

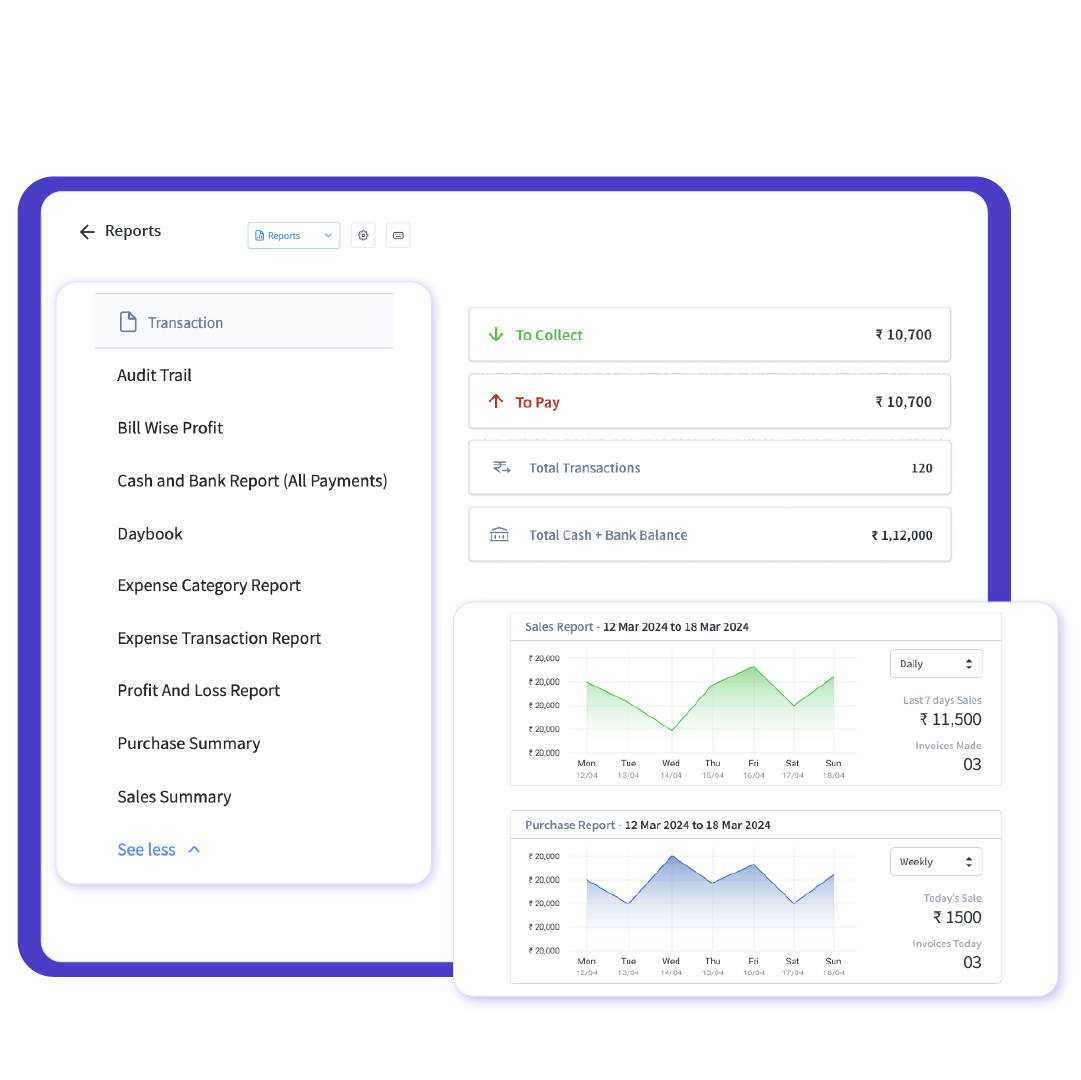

With real-time data tracking, businesses can monitor financial performance on demand. Interactive dashboards present insights through graphs and charts, making complex data easy to understand.

Compliance and Regulatory Reporting

Financial statement reporting software helps businesses comply with tax regulations, IFRS, GAAP, and other financial standards. It reduces the risk of penalties and simplifies audit preparations.

Multi-User Access and Collaboration

Cloud-based financial reporting software allows multiple users to access financial data securely from different locations. This promotes collaboration among teams and ensures data integrity.

Integration with Accounting Software

Seamless integration with accounting and ERP systems ensures that financial data flows smoothly between platforms, reducing manual entry errors and improving efficiency.

myBillBook helps Business succeed

“myBillBook has been a game-changer for our accounting team. Generating GST-compliant financial reports is now quick and hassle-free!”

Sneha Mehta,

Chartered Accountant

“With financial reporting automation, we can now track cash flow and profitability effortlessly. The integration with our accounting tools makes financial management seamless!”

Vikram Sharma

Business Owner

“I highly recommend myBillBook for small businesses. The ease of use, compliance support, and accurate financial statements make it a must-have tool!”

Vikram Desai,

Wholesale Distributor

Pricing plans

Diamond Plan

₹217

Per month. Billed annually. Excl. GST @18%

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

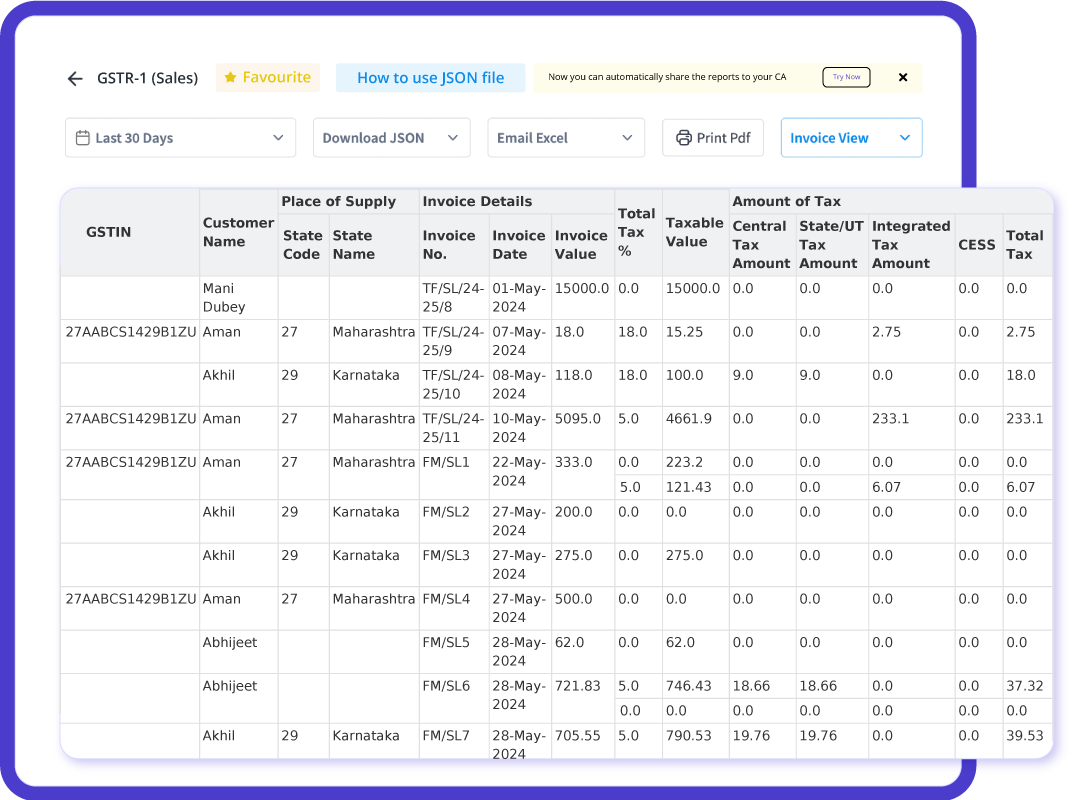

✅ GSTR reports in JSON format Popular

Platinum Plan

₹250

Per month. Billed annually. Excl. GST @18%

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

Enterprise Plan

₹417

Per month. Billed annually. Excl. GST @18%

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills

What is Financial Reporting Software

Financial reporting software is a tool that automates the generation of financial statements, such as balance sheets, profit and loss statements, and cash flow reports. It helps businesses track financial performance, ensure compliance with regulations, and gain real-time insights for better decision-making. By integrating with accounting systems, it reduces manual errors, enhances accuracy, and simplifies financial analysis.

Why Choose Financial Reporting Software?

Financial reporting software plays a crucial role in modern business management by automating financial documentation, reducing errors, and ensuring data consistency. Companies of all sizes can benefit from these tools by eliminating the need for manual data entry, which often leads to discrepancies and inefficiencies. With real-time data tracking, businesses can analyze financial trends and make proactive decisions instead of reacting to outdated reports.

One of the biggest advantages of financial reporting software is its ability to improve financial transparency. Businesses can generate detailed reports on revenue, expenses, and cash flow, ensuring that management, investors, and stakeholders have a clear picture of the company’s financial health. This transparency is essential for securing investments, loans, and partnerships, as financial stability is a key factor for external entities considering business collaborations.

Another major benefit is improved regulatory compliance. Governments and tax authorities require businesses to maintain accurate financial records for tax filing and auditing purposes. Financial reporting software ensures that companies adhere to these requirements by automating compliance reports, reducing the risk of penalties, and making audits easier to manage.

Additionally, these tools contribute to enhanced operational efficiency by integrating with accounting software, ERP systems, and other business applications. This integration allows businesses to consolidate financial data from multiple sources, ensuring a comprehensive overview of financial performance without the need for manual data consolidation.

How Financial Reporting Tools Improve Decision-Making

By providing real-time analytics, financial reporting software helps business owners and finance teams make data-driven decisions. With up-to-date financial reports, companies can better plan their budgets and investments. Graphical dashboards and trend analyses allow businesses to identify financial strengths and weaknesses, ensuring more strategic financial planning. Having access to historical and predictive analytics enables businesses to create more accurate revenue forecasts and financial projections.

Financial Reporting Automation for Small Businesses

Small businesses can benefit from financial reporting automation by reducing manual work and ensuring accuracy in financial documentation. Automated software also simplifies tax filing and regulatory compliance. Small businesses can generate GST-compliant reports, track outstanding invoices, and streamline financial audits without needing extensive accounting expertise. Additionally, automated financial reporting helps small business owners focus more on growth strategies rather than spending excessive time on manual accounting tasks.

Choosing the Right Financial Reporting Software

When selecting financial reporting software, businesses should consider features such as automation, integration capabilities, data security, and ease of use. A user-friendly interface and real-time reporting tools are crucial for effective financial management. Businesses should also look for customization options, scalability, and cloud-based accessibility to meet their growing needs. The ability to integrate with third-party applications like banking services, ERP systems, and tax filing software can further enhance the software’s utility. A robust financial reporting tool should also provide extensive support and training options to ensure seamless adoption within an organization.

Benefits of Financial Reporting Software

- Time-Saving: Automates report generation, reducing manual effort and allowing businesses to focus on growth rather than financial paperwork.

- Improved Accuracy: Eliminates human errors in financial calculations, ensuring reports are reliable and precise for business analysis and compliance purposes.

- Better Decision-Making: Provides real-time insights through analytics, enabling companies to identify opportunities, cut costs, and allocate resources effectively.

- Regulatory Compliance: Ensures businesses adhere to financial laws, tax regulations, and accounting standards like IFRS and GAAP, reducing compliance risks and penalties.

- Scalability: Adapts to the growing needs of a business, making it suitable for startups, SMEs, and large enterprises as they expand operations and financial complexities increase.

- Cost Efficiency: Reduces the need for extensive manual accounting processes, cutting down on labor costs and increasing the overall efficiency of financial operations.

- Transparency: Provides clear, detailed, and easily accessible financial reports, ensuring stakeholders, investors, and auditors have accurate insights into the company’s financial health.

- Data Security: Protects sensitive financial data with encryption, multi-level authentication, role-based access controls, and secure cloud storage, minimizing risks of data breaches and fraud.

- Integration with Other Business Tools: Connects seamlessly with accounting software, ERP systems, tax filing platforms, and banking systems for a unified financial management experience.

- Automated Forecasting and Budgeting: Helps businesses predict financial trends, allocate budgets, and plan for future growth based on historical data and market conditions.

How myBillBook Helps with Financial Reporting

myBillBook simplifies financial management by offering a suite of features designed for efficient and accurate reporting.

- Comprehensive Financial Reports: Generate detailed profit and loss formats, balance sheets, and cash flow reports automatically, helping businesses track their financial health with precision.

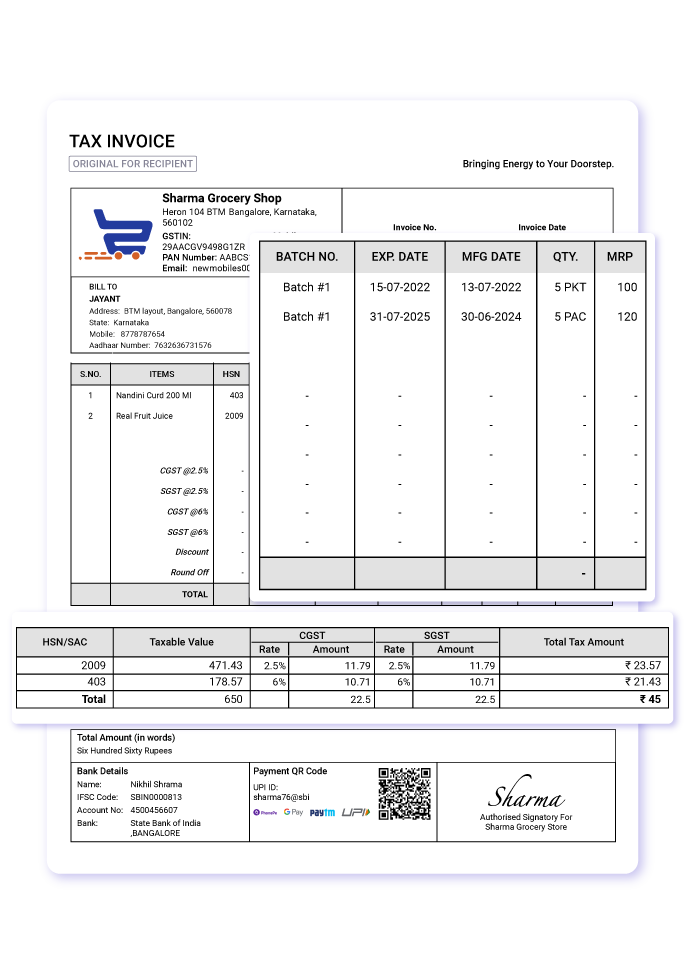

- Automated GST-Compliant Reports: Easily create and file GSTR-1, GSTR-2, and GSTR-3B to ensure tax compliance, reducing the risk of filing errors and penalties.

- Accounts Receivables & Payables Tracking: Keep track of outstanding payments, monitor due dates, and manage supplier obligations efficiently, improving cash flow management.

- Bank & Cash Management: Monitor all financial transactions, reconcile bank statements, and manage multiple accounts in a single platform for seamless financial operations.

- Customizable Financial Statements: Tailor reports according to specific business needs, ensuring relevance for decision-making, audits, and financial planning.

- Seamless Integration: Connects with invoicing, inventory management, and accounting tools, allowing businesses to manage all financial aspects in one unified system.

- Data Security: Ensures financial data protection through cloud-based storage, encryption, and access control, keeping sensitive information safe from breaches and unauthorized access.

With myBillBook, businesses can streamline their financial processes, reduce manual effort, and gain deeper insights into their financial health, enabling smarter business decisions.

FAQs

What is financial reporting software?

Financial reporting software is a tool that automates financial statement generation, helping businesses track and analyze financial performance with accuracy.

Why is financial reporting important?

Financial reporting is crucial for monitoring business performance, ensuring compliance with regulations, making informed decisions, and providing transparency to stakeholders.

What are the key features to look for in financial reporting software?

When choosing financial reporting software, look for features such as automated financial statements, real-time data analytics, customizable reports, compliance support, integration with accounting tools, multi-user access, and strong data security measures.

Can financial reporting software integrate with other business tools?

Most financial reporting tools integrate with accounting, ERP, and invoicing software to ensure seamless financial management.

How does myBillBook help with financial reporting?

myBillBook provides automated financial statements, GST compliance, accounts tracking, and cash flow management to simplify financial reporting for businesses.