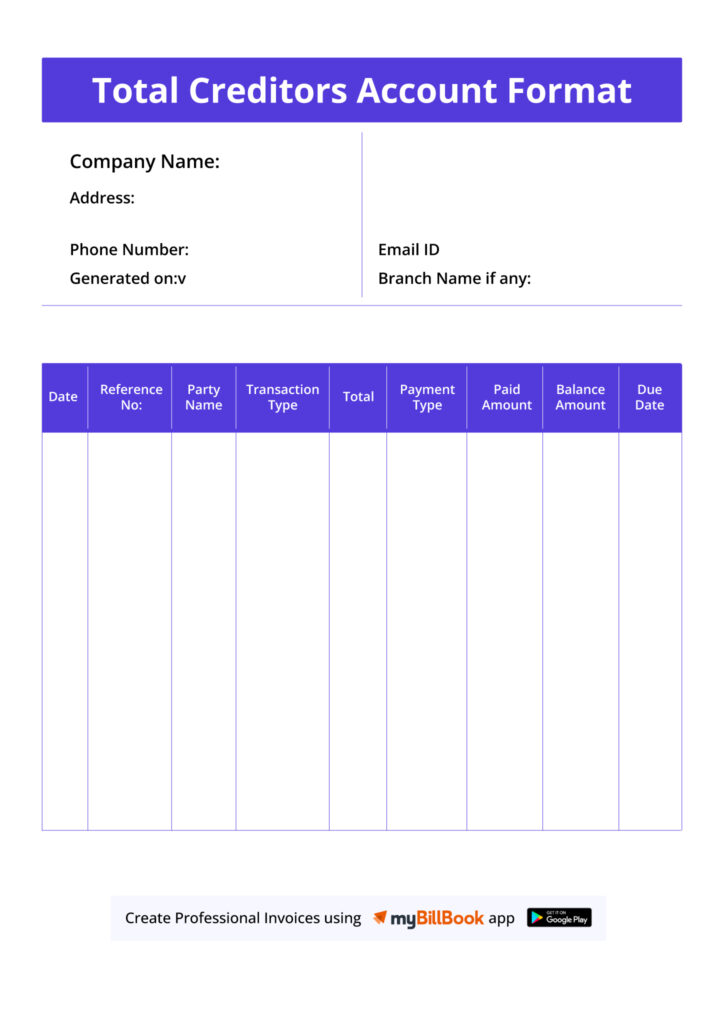

Total Creditors Account Format

Managing trade payables and vendor balances becomes effortless with myBillBook – your all-in-one solution for tracking outstanding dues, credit purchases, and supplier payments. Designed to simplify your accounting tasks, myBillBook helps you stay focused on growing your business instead of dealing with manual bookkeeping.

✅ Quick & Easy Total Creditors Account Generation

✅ Customisable Templates

✅ Professional Look

✅ Unlimited Creditor Ledger Entries

✅ Affordable Plans Starting INR 399/Year

Total Creditors Account Formats in Word, Excel & PDF | Download Free

Features of myBillBook Total Creditors Account Format

Centralised Vendor Payable Tracking

myBillBook consolidates all outstanding dues across suppliers into one easy-to-navigate Total Creditors Account. Businesses can track how much they owe, to whom, and by when, helping avoid missed or delayed payments.

Automated Ledger Posting

Each time a purchase is recorded or a payment is made, the ledger updates automatically. This ensures that the Total Creditors Account always reflects real-time data without manual intervention.

Detailed Supplier-wise Breakdown

While the Total Creditors Account offers a summary view, myBillBook also provides individual supplier accounts. This dual-view approach allows businesses to monitor both aggregate and specific payables efficiently.

Invoice & Payment Linking

myBillBook intelligently links every supplier invoice to its respective payment. This reduces reconciliation errors and helps maintain a clean audit trail, especially during GST filing or financial year-end closing.

Custom Date Filters for Reporting

Generate Total Creditors reports for any date range to analyze trends, detect overdue payments, and manage cash flow better. These reports can be shared or downloaded instantly in PDF, Excel, or Word formats.

GST-Enabled Transactions & Reports

Every entry in the Total Creditors Account can include GST breakdowns, making it easier to track input tax credits and ensure compliance with Indian accounting standards and government filings.

₹217

Per month. Billed annually

Diamond Plan

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

₹250

Per month. Billed annually

Platinum Plan

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

₹417

Per month. Billed annually

Enterprise Plan

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills Popular

₹399 per year

Silver Plan for Android App

✅ For 1 device, 1 business and 1 user

What is a Total Creditors Account?

A Total Creditors Account is a summarised ledger that records the cumulative amount a business owes to all its suppliers or vendors at any given time. It acts as a control account under the accounts payable system, consolidating individual creditor balances into a single account within the general ledger.

This account is crucial for businesses that purchase goods or services on credit, as it helps maintain an accurate record of all outstanding payables. Each time a credit purchase is made or a payment is issued, the corresponding amounts are recorded in the creditor’s individual account and reflected in the total creditors control account.

Format of Total Creditors Account

The general format includes the following columns:

- Date: The transaction date

- Particulars: Description of the transaction (e.g., invoice, payment)

- Invoice Number: Reference for purchase invoices

- Debit: Any payment made to the creditor

- Credit: Amount owed from purchases

- Balance: Running total of the amount payable

Total Creditors Account Format in Word, Excel, & PDF

The Total Creditors Account Format can be created using tools like Microsoft Word, Excel, or exported as a PDF, depending on your business requirements.

In Microsoft Word

The format is typically presented in a basic table layout, listing key details such as the date, particulars, invoice number, debit, credit, and balance. While Word is suitable for creating formal and printable documents, it lacks automation and requires manual calculations, making it ideal only for small businesses with fewer transactions.

In Microsoft Excel

The format offers greater flexibility and functionality. Businesses can set up formulas to automatically calculate balances, apply filters to sort data by vendor or date, and use pivot tables for analyzing payables. Excel allows users to manage large datasets and perform real-time updates, which is especially useful for businesses dealing with multiple creditors. However, manual data entry and regular supervision are still required to avoid formula errors or discrepancies.

In PDF format

The Total Creditors Account is typically exported or saved once the data is finalized. This format is widely used for sharing professional reports with stakeholders, auditors, or for compliance documentation. Since PDFs are non-editable, they ensure the integrity of the data and prevent unauthorized changes. However, any update to a PDF requires editing the original Word or Excel file and generating a new document.

Essential Elements in a Total Creditors Account

- Opening Balance: Total unpaid amount carried forward from the previous period

- Invoice Entries: New purchases added to the account

- Payment Entries: Amounts paid to reduce the liability

- Closing Balance: Outstanding amount payable at the end of the period

- Creditor Name/ID: Each transaction is tagged to a specific vendor for clarity

- GST Details (if applicable): Ensures tax compliance and input credit tracking

Tips to Keep Your Total Creditors Account Error-Free

Maintaining an accurate and up-to-date Total Creditors Account is crucial for smooth financial operations, and using an intelligent account software like myBillBook makes this task significantly easier. myBillBook automates ledger entries, tracks outstanding dues in real-time, links purchase invoices with payment records, and provides timely reports—all of which align with the best practices for creditor account management. By using myBillBook, businesses can ensure data accuracy, reduce manual errors, and focus more on strategic decision-making rather than routine bookkeeping.

- Reconcile creditor balances regularly to ensure your ledger accurately matches supplier statements and reflects true outstanding amounts.

- Record all credit transactions promptly and accurately, including partial payments, discounts, and invoice adjustments, to maintain transparency and prevent data loss.

- Monitor ageing reports of payables to identify overdue bills and prioritize payments accordingly, avoiding late fees and maintaining good supplier relationships.

- Maintain comprehensive documentation such as invoices, receipts, and credit notes for every transaction to support audits and internal reviews.

- Separate and categorize GST components correctly to ensure input tax credit claims are accurate and compliant with tax regulations.

- Generate periodic reports (monthly or quarterly) for internal financial analysis, budgeting, and external audits, ensuring your payable records remain audit-ready.

By consistently following these best practices, businesses can gain better control over their liabilities, improve cash flow planning, and build stronger supplier trust.

FAQs

- What is the purpose of a total creditors account?

It helps businesses track the total amount payable to all suppliers, manage payment cycles, and ensure accurate financial reporting. - Can I create a total creditors account in Excel?

Yes, but it requires manual data entry and formula setup. myBillBook automates this process and reduces errors. - Is GST included in the creditors account format?

Yes, GST should be recorded for each transaction to ensure proper compliance and input tax credit tracking. - How does myBillBook help with creditor account management?

It automates entries, links purchases and payments, generates real-time reports, and ensures tax compliance. - What’s the difference between individual and total creditors accounts?

Individual accounts track specific vendors, while the total creditors account is a summary control account showing the cumulative payable.

Know More About Accounting & Billing Formats