Joint Venture Account Format

Managing joint business ventures becomes effortless with myBillBook – your all-in-one solution for handling joint venture accounts, profit-sharing, partner contributions, and expense tracking. Designed to simplify your accounting tasks, myBillBook helps you focus more on growing your business and less on complex bookkeeping.

✅ Quick & Easy Joint Venture Account Generation

✅ Customisable Templates

✅ Professional Look

✅ Unlimited Joint Venture Account Records

✅ Affordable Plans Starting INR 399/Year

Joint Venture Account Formats in Word, Excel & PDF | Download Free

Features of myBillBook Joint Venture Account Format

Dual-Party Transaction Tracking

myBillBook allows you to record transactions between two or more co-venturers accurately. Each party’s contributions, expenses, and earnings are logged separately for clear financial transparency.

Profit & Loss Sharing Made Simple

The platform automatically calculates and allocates profits or losses according to the pre-defined ratio between partners. No manual calculations or spreadsheets required.

Ledger Integration for Each Co-Venturer

Create individual ledgers for every co-venturer involved in the joint venture. This makes it easy to track dues, payments, and settlement balances at any point.

Joint Venture Project-wise Accounting

Handle multiple joint ventures simultaneously by assigning accounts to individual projects. You can monitor each venture’s financials separately without mix-ups.

Final Settlement Reports

At the end of the venture, generate comprehensive settlement reports that show the final payable or receivable for each party—ready to share in Word, Excel, or PDF formats.

GST-Compliant Invoicing & Expense Logs

For ventures involving taxable supplies or services, myBillBook supports GST-compliant invoicing and keeps detailed expense logs aligned with statutory norms.

₹217

Per month. Billed annually

Diamond Plan

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

₹250

Per month. Billed annually

Platinum Plan

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

₹417

Per month. Billed annually

Enterprise Plan

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills Popular

₹399 per year

Silver Plan for Android App

✅ For 1 device, 1 business and 1 user

What is a Joint Venture Account?

A Joint Venture Account is a temporary partnership account created to record financial transactions undertaken jointly by two or more parties for a specific business activity. It is not a permanent business structure but a project-based collaboration. Each party contributes resources and shares the profits or losses according to a pre-agreed ratio.

This account tracks all transactions such as purchases, sales, expenses, and revenue directly related to the venture. Once the project concludes, the account is settled, and profits or losses are divided accordingly.

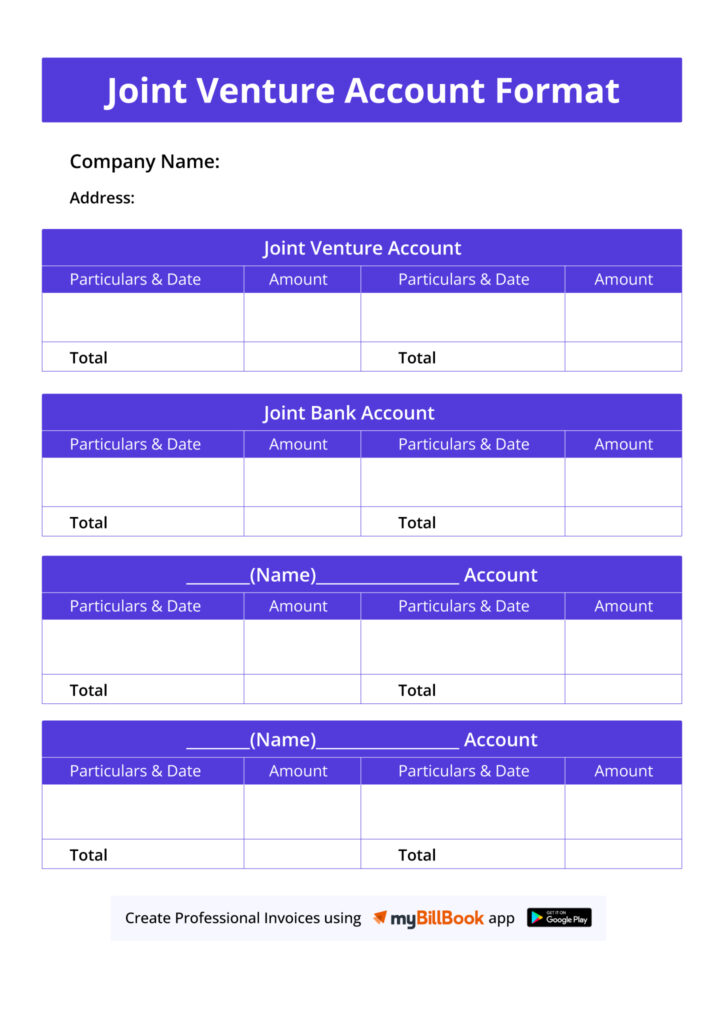

Format of Joint Venture Account

The standard Joint Venture Account format typically includes:

- Date-wise transaction entries

- Names of co-venturers

- Nature of transaction (e.g., purchases, expenses, revenue)

- Debit and Credit columns

- Profit or Loss calculation at the end

- Final settlement summary for each co-venturer

This format ensures transparency and clarity in tracking financial dealings and simplifies the closing of the account post-completion of the venture.

Joint Venture Account Format in Word, Excel, and PDF

Creating a Joint Venture Account manually is commonly done using tools like Microsoft Word, Microsoft Excel, or by exporting final documents as PDFs. While each of these formats serves different purposes, they come with distinct advantages and limitations.

Joint Venture Account Format in Word

Microsoft Word is typically used for creating text-based formats that outline contributions, expenses, and profit-sharing summaries. It allows users to design structured tables and insert content blocks manually. Word is useful for basic documentation or when formatting a formal report for printing or sharing.

However, it lacks automation. Every entry, calculation, and layout has to be done manually, which increases the chance of human error. It also doesn’t offer built-in tools for ledger management or profit distribution.

Joint Venture Account Format in Excel

Excel is a powerful tool for financial documentation, and many accountants use it to create joint venture accounts due to its formula capabilities. You can set up columns for transactions, automate profit/loss calculations, and even track individual partner contributions.

While Excel provides flexibility and accuracy through its calculation functions, it still requires users to create and maintain complex spreadsheets. There’s also the risk of formula errors, duplication, and version control issues when multiple people are involved.

Joint Venture Account Format in PDF

PDF formats are ideal for sharing finalized joint venture accounts in a secure and non-editable format. Most Word or Excel documents are converted into PDFs before being sent to partners or stored for record-keeping. PDF ensures the layout remains intact and tamper-proof.

However, PDFs are not editable unless converted back, and they don’t support live data entry or real-time updates. This format is suitable only for output, not for active record-keeping or collaboration.

Core Components of a Joint Venture Account

A complete Joint Venture Account format must include:

- Title and Date Range: To specify the venture and its duration.

- Names of Co-Venturers: With contribution and share ratios clearly mentioned.

- Transaction Entries: Including purchases, expenses, and incomes with accurate dates.

- Debit and Credit Ledger Columns: For clear classification of financial activities.

- Summary Section: To calculate net profit or loss and share it proportionately.

- Settlement Section: Recording the final distribution to or from each co-venturer.

Essential Guidelines for Joint Venture Account Management

Managing joint ventures requires precision, transparency, and proper documentation to ensure that all parties are aligned financially. While traditional tools like Word or Excel can help create a basic structure, using a dedicated bookkeeping software like myBillBook streamlines the process with automation, custom templates, and simplified reporting. This reduces the risk of errors and saves valuable time, especially during settlements.

Below are some essential best practices to follow when handling joint venture accounts:

1. Clearly Define Roles and Profit-Sharing Ratios

Establishing the responsibilities of each co-venturer and pre-defining the ratio for sharing profits or losses helps prevent disputes. This information should be clearly recorded at the beginning of the venture and referred to consistently during account maintenance.

2. Maintain a Dedicated Account for Each Joint Venture

Keeping separate accounts for different ventures ensures there’s no overlap in financial records. This practice makes it easier to track project-specific transactions and calculate results independently for each joint collaboration.

3. Record Every Transaction Promptly and Accurately

Timely entry of all financial activities, including expenses, purchases, contributions, and receipts, ensures the integrity of the joint venture account. Delayed or missed entries can lead to miscalculations and misunderstandings between partners.

4. Keep Backup Documentation for All Entries

Each transaction should be supported by valid documentation such as invoices, bills, receipts, or bank statements. This strengthens the authenticity of the account and provides evidence during audits or settlement phases.

5. Reconcile Balances Regularly

Periodic reconciliation of the joint venture account helps identify errors early and ensures all records match between the co-venturers. This step builds trust and keeps the financial status transparent throughout the project.

6. Generate Final Settlement Reports on Completion

At the end of the venture, a final report must be prepared showing each partner’s share of profit or loss and the amount owed or due. This report acts as the official closure document of the joint financial relationship.

7. Ensure GST Compliance Where Applicable

If the joint venture involves the supply of goods or services that fall under GST compliance, it’s crucial to maintain proper tax invoices and returns. Following compliance norms not only avoids penalties but also strengthens your legal standing.

FAQs

- What is the purpose of a Joint Venture Account?

It helps track all transactions between co-venturers during a joint project and facilitates transparent profit/loss sharing. - Can I use Excel to create a Joint Venture Account?

Yes, Excel is commonly used, but it requires manual formatting and formulas. myBillBook offers a simpler, more automated solution. - What should be included in a Joint Venture Account?

Details like names of co-venturers, contribution ratios, transaction history, and final settlements should be included. - How is profit shared in a Joint Venture Account?

Profits are shared based on the agreed ratio between co-venturers and are shown in the summary section of the account. - Why choose myBillBook for Joint Venture Accounting?

It saves time, reduces errors, and offers ready-made templates that make account creation quick and professional.

Know More About Accounting & Billing Formats