Contract Account Format

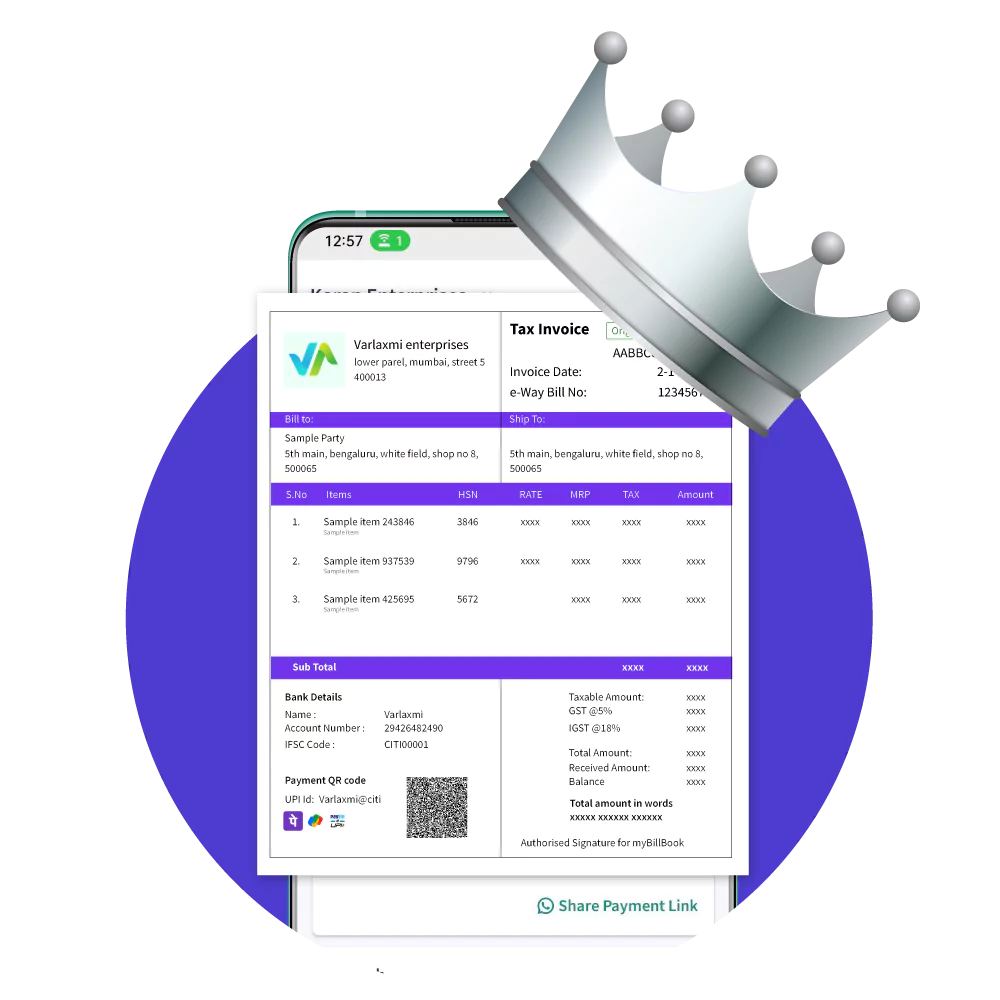

A contract account is a systematic record of financial transactions related to a specific contract. It helps businesses maintain transparency, monitor costs, and ensure accurate billing. You can create a contract account in Word, Excel, or PDF formats. However, using myBillBook simplifies the process by offering customizable templates with automation features.

✅ Quick & Easy Contract Account Generation

✅ Customisable Templates

✅ Professional Look

✅ Unlimited Contract Account Entries

✅ Affordable Plans Starting INR 399/Year

Contract Account Formats in Word, Excel & PDF | Download Free

Features of myBillBook Contract Account Format

Automated Contract Cost Tracking

myBillBook enables automated tracking of all expenses and revenues related to a contract. With minimal manual entry, businesses can ensure accurate financial records, reducing errors and improving efficiency.

Customizable Contract Templates

Users can select from pre-built contract account templates tailored for different industries. These templates ensure consistency and compliance, making contract financial management seamless and professional.

Real-Time Contract Profitability Analysis

With myBillBook, businesses can monitor the profitability of their contracts in real time. The system provides insights into revenue, expenses, and net earnings, helping managers make informed decisions.

GST & Tax Compliance for Contracts

myBillBook automatically calculates GST and other applicable taxes, ensuring compliance with tax regulations. This eliminates the risk of miscalculations and tax penalties while streamlining financial reporting.

Seamless Integration with Accounting Systems

The contract account generator seamlessly integrates with existing accounting software. This helps businesses maintain consistency across financial records and avoid duplication of work.

Multi-Format Export & Secure Cloud Storage

Users can export contract accounts in Excel, Word, or PDF formats for easy sharing. Additionally, cloud storage ensures that contract financial data is securely backed up and accessible anytime, anywhere.

₹217

Per month. Billed annually

Diamond Plan

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

₹250

Per month. Billed annually

Platinum Plan

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

₹417

Per month. Billed annually

Enterprise Plan

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills Popular

₹399 per year

Silver Plan for Android App

✅ For 1 device, 1 business and 1 user

What is a Contract Account?

A contract account is a financial record maintained by businesses, contractors, or organizations to document the revenues, expenses, and payments related to a specific contract. It ensures systematic tracking of costs associated with a contract, facilitating accurate financial reporting.

The contract account acts as a sub-ledger within the main accounting system, where each contract is treated as an individual accounting unit. This approach provides businesses with a structured method to assess the financial progress of each contract, compare expected and actual costs, and calculate profit margins.

A contract account is widely used in industries such as construction, project-based consulting, manufacturing, and large-scale service providers. It helps in managing cash flows efficiently, keeping financial records transparent, and meeting regulatory compliance requirements. The format of a contract account can vary depending on the nature of the contract, but it generally includes details about contract revenues, costs, advances, and completion milestones.

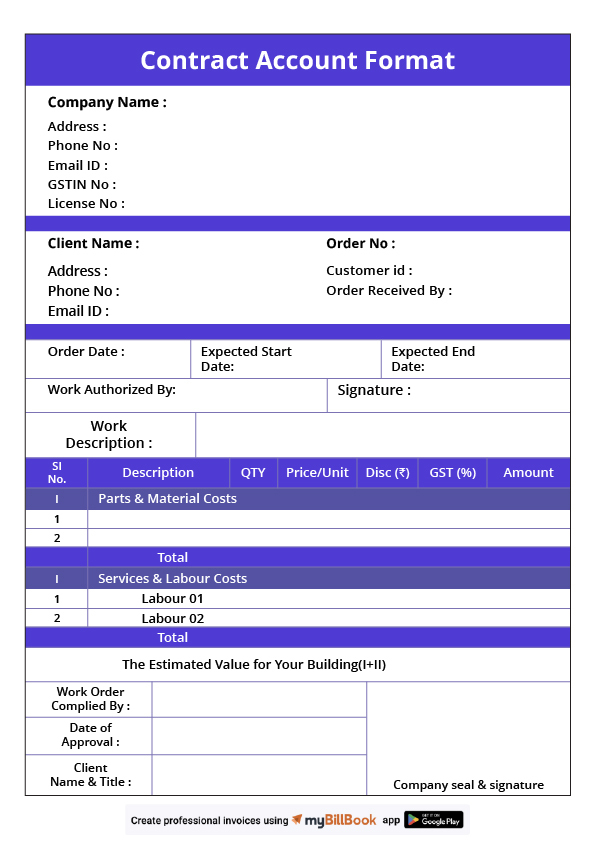

Format of a Contract Account

A contract account follows a structured format to ensure comprehensive tracking of all financial transactions related to a contract. It typically consists of the following key sections:

- Contractor and Client Details

This section includes essential information such as the name, address, and contact details of the contractor and the client. It also records the contract reference number and date of agreement. - Contract Description

A brief overview of the contract, including project specifications, scope of work, contract duration, and key deliverables. - Cost Accumulation Section

This section records all costs incurred throughout the contract period, such as labor, raw materials, subcontractor payments, equipment costs, and overhead expenses. It helps in determining the total expenditure at different stages of the contract. - Revenue Entries

Payments received from the client at various stages of the contract are recorded here. This includes advance payments, milestone-based payments, and final settlement upon contract completion. - Progress Billing and Work-in-Progress Records

Details of invoices raised for completed work stages, showing how much work has been billed and the remaining balance due from the client. - Retention Money and Advances

Any retention money held back as a security deposit until project completion is recorded here. Similarly, any advance payments received from the client are noted to ensure proper adjustments in the final settlement. - Profit & Loss Computation

A summary of the net profit or loss derived from the contract, obtained by subtracting total costs from total revenue. This section helps businesses evaluate the financial performance of a contract. - Closing Balance and Final Settlement

The final section of the contract account records the total contract amount, final payments received, deductions, and the closing balance after contract completion.

Contract Account Format in Word, Excel & PDF

Contract Account Word Format

A contract account in Word is typically created using a structured document with headings, tables, and sections for contract details, cost tracking, and revenue entries. This format allows for customization, making it suitable for detailed documentation and professional presentation. However, it requires manual calculations, which can be time-consuming and prone to errors.

Contract Account Excel Format

Excel is a preferred format for contract accounts due to its automation capabilities. Businesses can use formulas to automate cost calculations, revenue tracking, and profit analysis. Pre-designed templates allow for quick data entry, ensuring accuracy and efficiency. The ability to generate financial reports and visualize contract performance through charts makes Excel highly beneficial.

Contract Account PDF Format

A PDF format provides a secure, non-editable version of the contract account, making it ideal for sharing final reports with stakeholders. It ensures document integrity and prevents unauthorized modifications. Businesses often generate PDF versions of contract accounts from Word or Excel for official records and compliance purposes.

Key Elements of a Contract Account

- Opening Balance

This represents the initial allocated amount for the contract before work begins. It helps in budgeting and tracking the financial progress of the contract. - Cost Accumulation

This includes all direct and indirect costs related to the contract, such as materials, labor, subcontractor payments, equipment rentals, and administrative overheads. Keeping track of these costs ensures accurate expense management. - Revenue Recognition

This records the payments received from the client at different project milestones or as per the agreed contract terms. Revenue recognition ensures accurate financial reporting and cash flow management. - Progress Billing

As work progresses, invoices are raised for completed work stages. Progress billing helps in maintaining steady cash inflow and ensures that payments are received in line with project completion. - Profit & Loss Statement

This section calculates the net profitability of the contract by deducting total costs from total revenue. Analyzing the profit and loss statement helps businesses measure contract performance and take corrective actions if necessary. - Closing Balance

The final amount after deducting all expenses and accounting for all revenue received. The closing balance determines whether the contract has resulted in a profit, loss, or break-even outcome.

Best Practices for Creating & Using a Contract Account

- Maintain Comprehensive Records

Keep track of every financial transaction, including expenses, payments, and invoices. Detailed records help in auditing and financial analysis. - Use Standardized Templates

Adopting a structured contract account template ensures consistency and makes financial tracking easier. - Automate Calculations

Utilize accounting software or Excel formulas to minimize human errors and enhance efficiency in financial computations. - Regularly Update Entries

Ensure that all contract-related transactions are updated in real time to avoid discrepancies and ensure accurate financial reporting. - Ensure Regulatory Compliance

Follow all legal and tax regulations, including GST compliance, to prevent financial or legal issues. - Monitor Cash Flow & Profitability

Regularly assess financial performance by analyzing cost trends, revenue streams, and profit margins.

FAQs

Why is a contract account important?

A contract account helps businesses monitor contract-related finances, ensuring cost control and profitability.

Can I create a contract account manually?

Yes, but using digital tools like myBillBook or Excel makes the process faster and error-free.

What industries use contract accounts?

Construction, IT services, manufacturing, and consulting firms commonly use contract accounts.

How does myBillBook help with contract accounts?

myBillBook automates contract account management, offering templates, tax calculations, and real-time tracking.

Can I generate a GST-compliant contract account?

myBillBook provides GST-compliant templates to ensure tax accuracy.

Know More About Accounting & Billing Formats