State GST Codes

State GST codes change as per changes in the status of states and union territories. Under the new GST regime, every registered business is assigned a Goods and Services Tax Identification Number (GSTIN) that is unique to their business. It is a 15-digit provisional ID that helps streamline invoicing to improve efficiency in tax filing.

The 15-digit GSTIN comprises of a 2-digit state code, 10-digit PAN number, 2-digit alphanumeric number signifying the total number of registrations in the state (the second being Z by default), and lastly, a 1-digit checksum value to detect errors (either number of the alphabet).

List of GST State Codes

The GST state code which constitutes the first two digits of the Goods and Services Tax Identification Number is prescribed by the Indian Census of 2011. As of January 26, 2020, it can be any number between 01 to 38.

Here are the GST State Codes for your reference:

| State Name | State Code |

| Jammu and Kashmir | 1 |

| Himachal Pradesh | 2 |

| Punjab | 3 |

| Chandigarh | 4 |

| Uttarakhand | 5 |

| Haryana | 6 |

| Delhi | 7 |

| Rajasthan | 8 |

| Uttar Pradesh | 9 |

| Bihar | 10 |

| Sikkim | 11 |

| Arunachal Pradesh | 12 |

| Nagaland | 13 |

| Manipur | 14 |

| Mizoram | 15 |

| Tripura | 16 |

| Meghalaya | 17 |

| Assam | 18 |

| West Bengal | 19 |

| Jharkhand | 20 |

| Odisha | 21 |

| Chattisgarh | 22 |

| Madhya Pradesh | 23 |

| Gujarat | 24 |

| Dadra and Nagar Haveli & Daman and Diu (after merging) | 26* |

| Maharashtra | 27 |

| Andhra Pradesh (Prior to the division) | 28 |

| Karnataka | 29 |

| Goa | 30 |

| Lakshadweep | 31 |

| Kerala | 32 |

| Tamil Nadu | 33 |

| Puducherry | 34 |

| Andaman and Nicobar Islands | 35 |

| Telangana | 36 |

| Andhra Pradesh (After the division) | 37 |

| Ladakh (Newly Added) | 38 |

*Up until January 26, 2020, the state code of UT of Daman & Diu was 25 and that of Dadra & Nagar Haveli was 26.

All registered businesses must stay aware of updated GST state codes to avail the benefits of the GST regime.

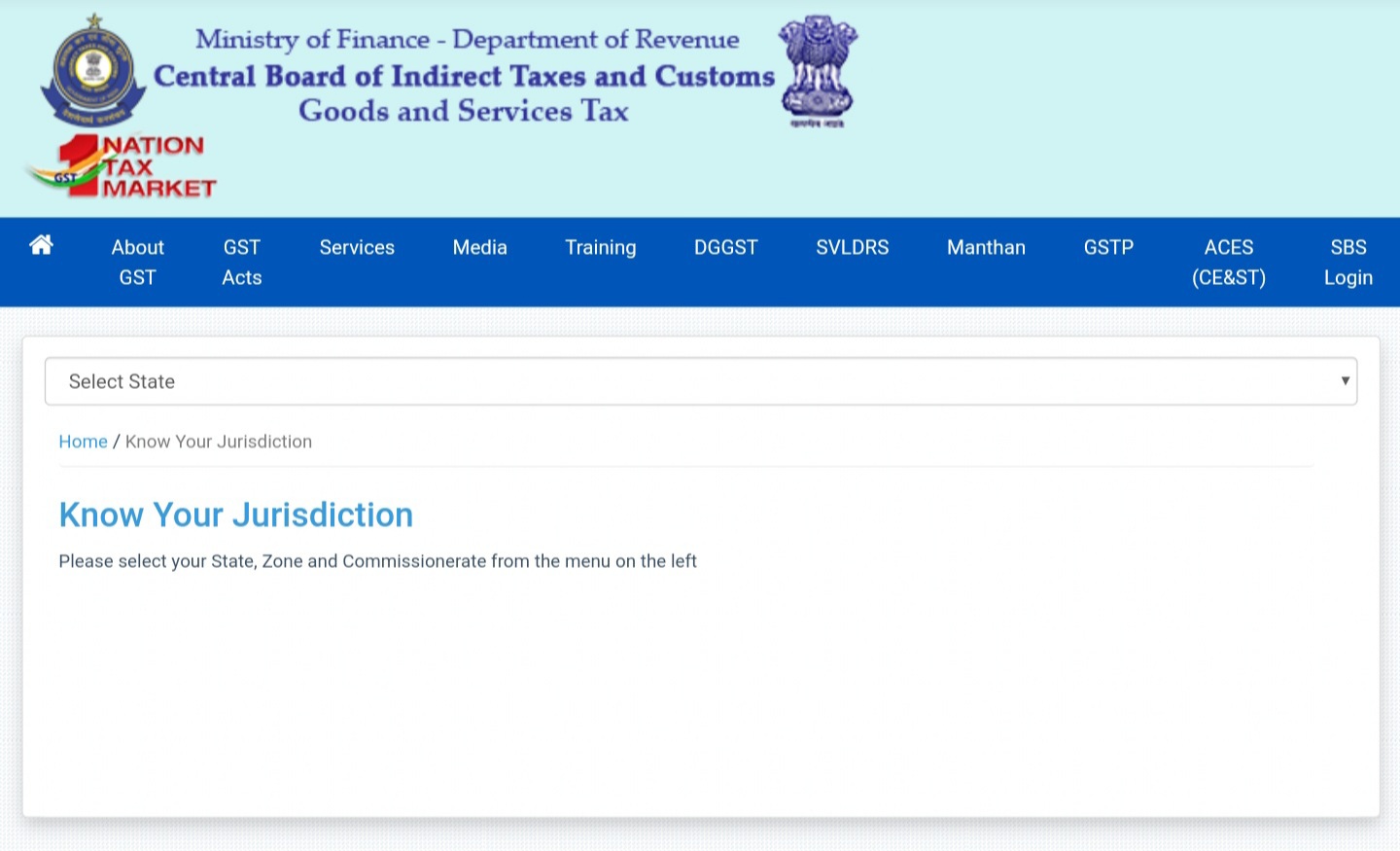

Check your GST jurisdiction on the CBIC

The consolidation of state GST and central GST in India is based on the division of the taxpayer base. This guarantees that taxpayers are liable to a single tax, whether it is state or centre.

Here’s how businesses can check their GST jurisdiction online:

- Visit CBIC GST: Know Your Jurisdiction

- Select your State, Zone, Commissionerate, Division, and Range

FAQ about State GST Codes

Who is eligible to pay GST?

Any business or individual exceeding a turnover of Rs. 40 lakhs in a financial year is eligible to pay GST. The annual aggregate turnover for special category states, which includes North Eastern and hilly states, is Rs. 20 lakhs. This threshold limit was Rs. 20 lakhs and Rs. 10 lakhs respectively.

Who is exempted from paying GST?

Businesses with an annual aggregate turnover of less than Rs. 40 lakhs are exempted from paying GST. Furthermore, there are a variety of items like fruits and vegetables, natural honey, salt, milk, etc on which GST is not applicable.

How much does it cost to obtain GSTIN?

GST registration is free of cost.