Royalty Account Format

myBillBook is your all-in-one solution for managing copyright royalties, patent royalties, mining royalties, and more. Designed to simplify royalty accounting, myBillBook helps you focus more on your business and less on manual paperwork. With easy-to-use, pre-designed royalty account format templates, you can generate professional reports in minutes. Automate calculations, track payments, and stay audit-ready—all from one powerful platform. Start your free 7-day trial today and experience hassle-free royalty management tailored to your industry.

✅ Quick & Easy Royalty Account Generation

✅ Customisable Templates

✅ Professional Look

✅ Unlimited Royalty Account Records

✅ Affordable Plans Starting INR 399/Year

Royalty Account Formats in Word, Excel & PDF | Download Free

Features of myBillBook Royalty Account Format

Income & Expense Tracking

myBillBook is designed to manage royalty income and expense accounts with precision. Whether you’re a publisher tracking book royalties or a franchisor managing brand licensing, the platform helps you maintain a clear view of what’s earned or owed.

Automated Calculations by Usage or Sales

Set up fixed or percentage-based royalty rates, and myBillBook will automatically calculate royalties based on sales volume or usage data. This eliminates the risk of manual errors and ensures transparent billing.

Agreement-Linked Accounting

Each royalty record can be linked to a specific licensing or intellectual property agreement, making it easier to audit and reconcile payments. You can also set timeframes like monthly or quarterly for recurring royalty settlements.

Multi-Period Reporting

Generate reports for multiple periods—monthly, quarterly, or annually—to share with licensors or internal teams. These reports are formatted professionally and include detailed breakdowns for full clarity.

Statement Generation

Once your royalty data is compiled, myBillBook allows you to generate branded, professional-looking royalty statements that can be exported as Excel sheets for analysis or PDFs for distribution.

Notifications & Due Date Tracking

Set up alerts and reminders for royalty payment due dates or reporting deadlines. This feature ensures timely settlements and helps maintain strong relationships with licensors or licensees.

₹217

Per month. Billed annually

Diamond Plan

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

₹250

Per month. Billed annually

Platinum Plan

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

₹417

Per month. Billed annually

Enterprise Plan

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills Popular

₹399 per year

Silver Plan for Android App

✅ For 1 device, 1 business and 1 user

What is a Royalty Account Format?

A Royalty Account Format is a standardized financial record that details the calculation, tracking, and payment of royalties between two parties—typically a licensor (the owner of a product, brand, or intellectual property) and a licensee (the party using it commercially). Royalties are recurring payments made in exchange for the legal right to use intellectual property such as books, music, trademarks, patents, minerals, or software. The royalty account ensures that all such payments are calculated accurately and documented clearly for both accounting and legal compliance.

This format is crucial for industries like publishing, music, franchising, mining, and software licensing, where recurring revenue or payments are tied to the ongoing usage of a valuable asset. It provides a reliable record that can be shared with stakeholders, used in audits, and referenced during reconciliations or disputes.

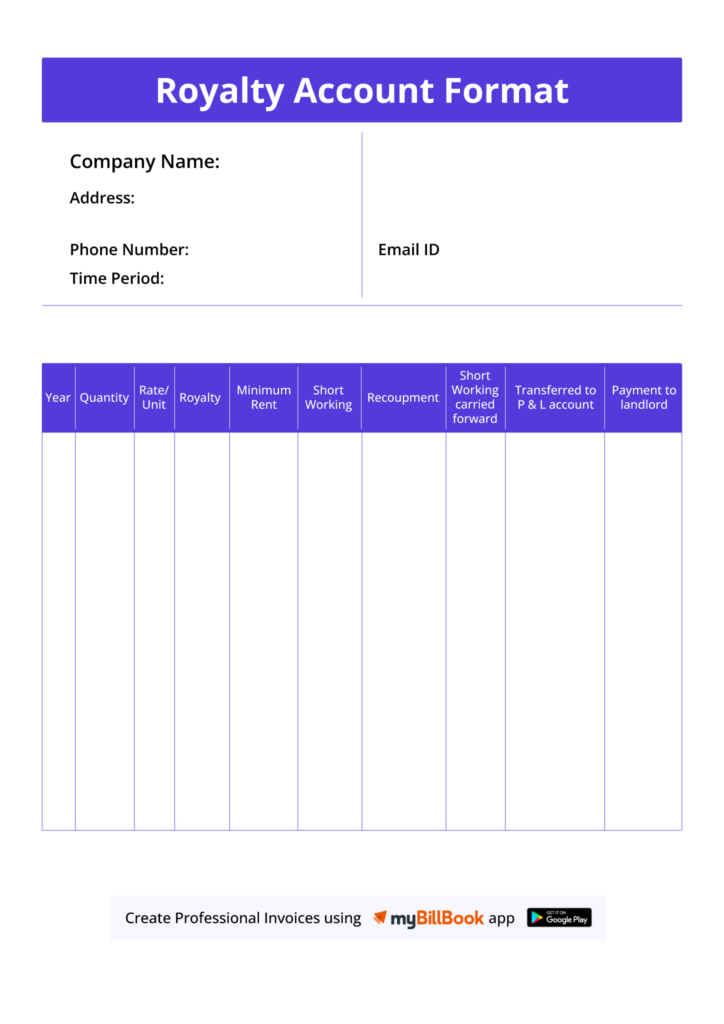

Format of Royalty Account

A standard royalty account format includes the following components:

- Date of Transaction

- Party Name (Licensor/Licensee)

- Description of Asset/Agreement

- Units Sold or Usage Details

- Rate of Royalty (%)

- Gross Royalty Amount

- Deductions/Adjustments

- Net Royalty Payable

- Payment Status/Remarks

This format helps both parties clearly understand the financial implications and track payments efficiently.

Royalty Account Format in Word, Excel & PDF

Managing royalty accounts can be done manually using tools like Microsoft Word, Microsoft Excel, or PDF formats, each offering distinct advantages depending on the purpose and complexity of the royalty arrangement.

Royalty Account Format in Word

Microsoft Word is suitable for creating formal, static royalty account statements, particularly when they are meant to be shared with external stakeholders in a clean, readable layout. Using Word, users can design tables to list key royalty details such as sales data, royalty rates, gross capital, and payment notes. It is commonly used in small-scale royalty dealings where the format does not require complex calculations.

For example, a publishing house might generate a royalty statement for an author at the end of a quarter, using a Word template that includes a summary of sales, the agreed royalty percentage, and the final amount payable. Word is ideal for such documents where visual presentation and formatting are important, but real-time data analysis is not required.

Royalty Account Format in Excel

Excel is the most versatile and powerful option for creating dynamic royalty account formats, especially where data analysis, calculation, and tracking over time are involved. With the help of built-in formulas, conditional formatting, and pivot tables, Excel allows users to automate royalty calculations.

For instance, a music distribution company can use Excel to compute royalties owed to multiple artists based on streams or downloads, applying individual royalty rates and tracking payments over several months. Excel also enables easy scenario analysis—allowing users to test how changes in sales volume or rates affect the final royalty due.

Royalty Account Format in PDF

Once royalty accounts are finalized in Word or Excel, they are often converted to PDF format for official sharing, record-keeping, or archiving. PDFs ensure that the formatting and content remain unchanged, providing a tamper-proof and professional-looking document. They are also widely accepted in legal and financial audits.

PDF royalty statements are especially useful for distribution to licensors, franchisees, or regulatory bodies, as they are easy to access, print, and store. For example, a franchise company may email quarterly royalty statements in PDF to all its branches, ensuring consistency and clarity.

Different Types of Royalties in Royalty Account Format

Royalty accounts vary based on the type of asset being licensed. Here are the most common types of royalties tracked in a royalty account format:

1. Copyright Royalties

Earned from books, music, films, or software. Usually calculated as a percentage of sales or per unit sold.

2. Patent Royalties

Paid for using patented inventions or technology. Often based on sales or usage volume.

3. Trademark Royalties

Common in franchising, where licensees pay for brand use—typically a percentage of gross or net revenue.

4. Mineral or Resource Royalties

Paid per unit extracted (e.g., per ton of coal or barrel of oil). Used in mining and energy sectors.

5. Performance Royalties

Generated from public performances or broadcasts of music and media, usually collected by rights organizations.

6. Mechanical Royalties

Specific to music reproduction, like CDs or digital downloads, paid per copy produced.

7. Franchise Royalties

Ongoing payments by franchisees for brand use, either as a fixed fee or sales-based percentage.

Key Elements of a Royalty Account

A well-structured royalty account is essential for tracking financial transactions arising from royalty agreements. Whether you are managing royalties for publishing rights, music usage, mining extraction, or brand licensing, the following core elements should always be included to ensure accuracy, transparency, and compliance:

1. Transaction Details

This includes the date of each transaction, invoice number, and parties involved (licensor and licensee). Clear documentation of these details allows easy identification and reference of each royalty-related entry, especially when multiple agreements are managed concurrently.

2. Royalty Basis (Usage or Sales Data)

The foundation of royalty calculation is the usage or sales figure. This could refer to the number of books sold, tons of minerals extracted, number of software licenses used, or digital content streamed. Accurate input of this data ensures correct royalty computation and fair compensation.

3. Royalty Rate or Percentage

This refers to the pre-agreed rate defined in the licensing agreement. It can be a fixed percentage, slab-based rate, or per-unit cost. Including this clearly in the royalty account ensures that both parties are aligned on the basis of calculation.

4. Gross Royalty Amount

This is the total royalty amount calculated before applying any deductions or adjustments. It is the result of multiplying the sales or usage figure by the royalty rate. Displaying the gross amount separately gives a transparent view of total earnings or liabilities before any deductions.

5. Deductions or Adjustments

These may include returns, discounts, advance recoveries, withholding taxes, or previous period adjustments. Deducting these accurately ensures that the final payable or receivable amount is correct and justifiable. Detailed breakdowns also help resolve disputes quickly.

6. Net Royalty Payable or Receivable

This is the final amount after all deductions have been applied. It is the actual amount the licensee needs to pay or the licensor is entitled to receive. This figure is critical for financial reporting, taxation, and audit trails.

7. Reporting Period

Every royalty account should mention the time span it covers—monthly, quarterly, or annually. This provides context to the earnings and helps with trend analysis, performance reviews, and forecasting future payouts.

8. Payment Status or Remarks

This section reflects the payment stage—whether the royalty has been paid, is pending, overdue, or under dispute. Additional remarks may include transaction references, bank details, or explanations for deductions.

Best Practices for Creating & Using Royalty Accounts

Effective royalty account management requires clarity, consistency, and the right tools. Following these best practices—alongside using smart accounting software like myBillBook—can help you streamline your process, minimize errors, and stay compliant.

1. Define Clear Agreement Terms

Ensure your royalty agreements clearly state the basis of royalty, rate, payment schedule, and deductions. This avoids disputes and sets a solid foundation for accurate accounting.

2. Use a Standard Royalty Format

Adopt a consistent royalty account layout with essential elements like sales data, royalty rate, gross and net amounts, and payment status for easier reporting and reconciliation.

3. Automate Calculations

Avoid manual errors by using accounting software like myBillBook to automate royalty calculations, especially when handling complex or multi-tiered structures.

4. Maintain Supporting Documents

Keep records such as invoices, usage logs, return reports, and tax slips to back every figure in the royalty account and prepare for audits.

5. Update and Reconcile Regularly

Keep accounts up to date and reconcile them monthly or quarterly to catch discrepancies early and ensure all dues are settled on time.

6. Provide Timely Royalty Statements

Send professional royalty statements in PDF or Excel format to licensors on agreed timelines to build trust and maintain transparency.

7. Track & Analyze Performance

Use royalty data insights to identify high-performing products, forecast earnings, and improve future licensing agreements.

FAQs

Q1. What is a royalty account used for?

A royalty account records income or expenses related to licensing agreements, ensuring accurate financial tracking between licensors and licensees.

Q2. Can I create a royalty account in Excel?

Excel allows you to build a royalty account using formulas, but it requires manual data entry and can be time-consuming for large datasets.

Q3. What industries use royalty accounts?

Publishing, music, mining, franchising, and licensing industries often use royalty accounts to track payments based on asset usage.

Q4. How does myBillBook simplify royalty account creation?

myBillBook offers customizable templates, automated calculations, and real-time reporting, eliminating the need for manual spreadsheets.

Q5. Is the royalty account format GST-compliant?

When using software like myBillBook, yes. It supports GST invoicing and reporting for royalty-based transactions.

Know More About Accounting & Billing Formats