Profit and Loss Adjustment Account Format

myBillBook is your all-in-one solution for managing profit and loss adjustments with complete accuracy and zero hassle. Whether you’re handling partner reconstitution, correcting past accounting errors, or redistributing profits fairly, myBillBook streamlines the entire process. With custom-built, ready-to-use Profit and Loss Adjustment Account formats, you can save time and avoid manual mistakes. Focus more on growing your business—leave the adjustments to us. Try myBillBook free for 7 days and experience effortless financial management.

✅ Quick & Easy Profit and Loss Adjustment Account Generation

✅ Customisable Templates

✅ Professional Look

✅ Unlimited Adjustment Account Entries

✅ Affordable Plans Starting INR 399/Year

Profit and Loss Adjustment Account Formats in Word, Excel & PDF | Download Free

Features of myBillBook Profit and Loss Adjustment Account Format

Smart Adjustment Entry Interface

myBillBook provides a dedicated interface to enter adjustment transactions such as omitted expenses, additional income, or correction of previous errors. This ensures all necessary entries are systematically recorded and properly classified.

Automatic Profit Recalculation and Distribution

Once adjustments are entered, myBillBook recalculates the adjusted profit or loss automatically. It also redistributes the revised profit among partners based on the predefined profit-sharing ratio, saving time and reducing manual calculation errors.

Real-Time Partner Capital Account Integration

The system syncs updated profit/loss adjustments directly with each partner’s capital account, keeping all records aligned and updated across the books.

Historical Adjustment Tracking

You can easily track all past adjustments made in earlier periods with a detailed audit trail. This is especially useful during audits or legal verifications.

Preformatted Ledger View for Adjustment Accounts

The software displays the Profit and Loss Adjustment Account in a traditional debit-credit ledger format, giving it a professional appearance and making it ready for internal reviews or partner meetings.

Export-Ready and Compliant Reporting

Once finalized, the adjustment account can be downloaded. These reports are formatted to meet standard accounting presentation styles, making them ideal for sharing with stakeholders or auditors.

₹217

Per month. Billed annually

Diamond Plan

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

₹250

Per month. Billed annually

Platinum Plan

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

₹417

Per month. Billed annually

Enterprise Plan

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills Popular

₹399 per year

Silver Plan for Android App

✅ For 1 device, 1 business and 1 user

What is a Profit and Loss Adjustment Account?

A Profit and Loss Adjustment Account is a specialized ledger used to correct errors, omissions, or misstatements in the profit or loss figures of a previous accounting period. It plays a vital role in partnership firms, particularly during events like the admission, retirement, or death of a partner, or when a change occurs in the profit-sharing ratio among partners. This account ensures that any discrepancies related to income or expenses—whether overlooked or inaccurately recorded—are properly adjusted before finalizing the profit distribution.

By recording these adjustments separately, the firm maintains transparency and accuracy in its financial statements without altering the original profit and loss account. The adjusted balance from this account is then transferred to the capital accounts of partners in the correct proportion. Essentially, the Profit and Loss Adjustment Account helps uphold the integrity of financial reporting by reflecting a fair and updated view of the firm’s profitability after incorporating necessary corrections.

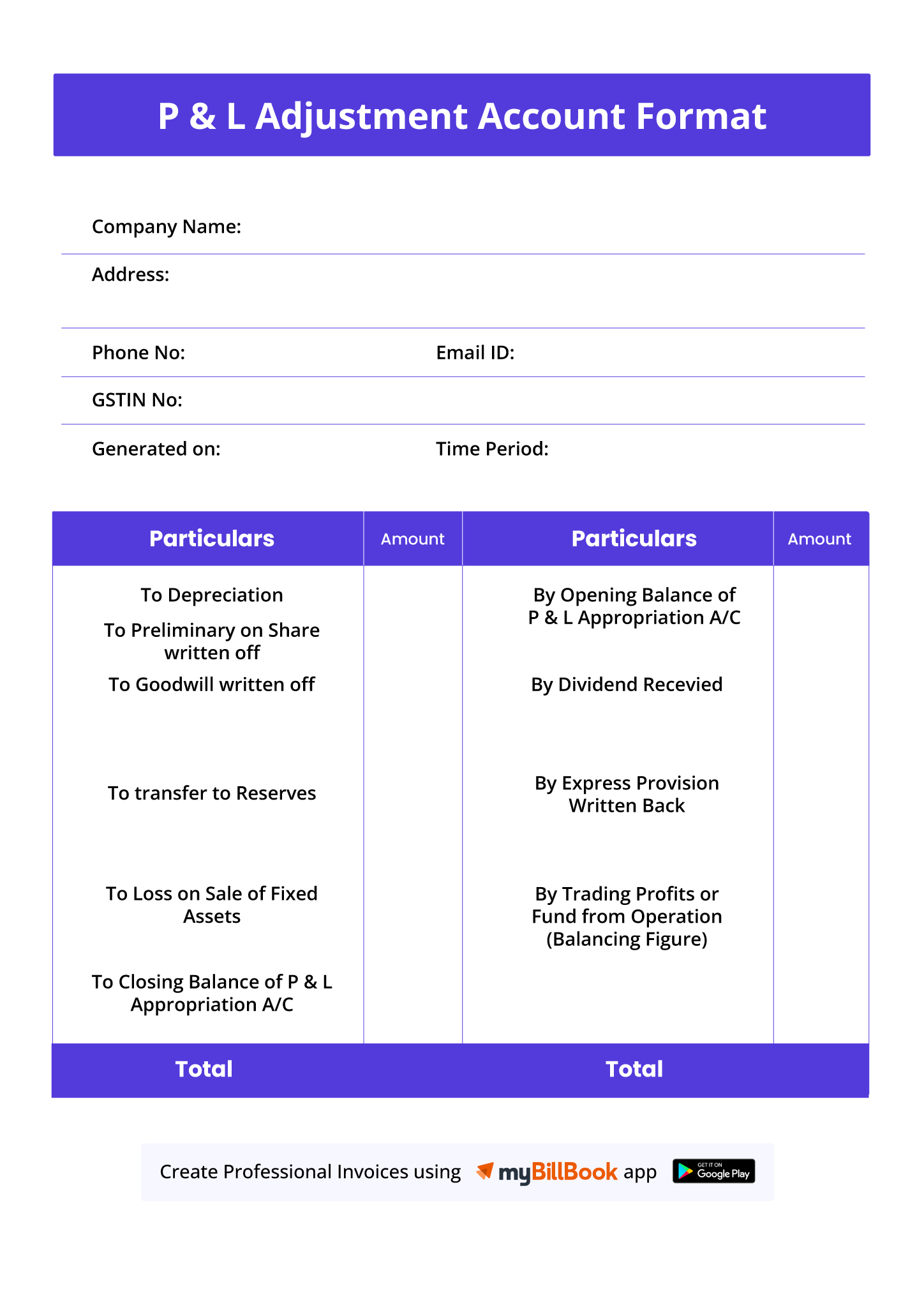

Format of Profit and Loss Adjustment Account

The format typically includes a debit and credit side, just like a standard ledger account. The debit side includes over-credited income or under-debited expenses, while the credit side includes under-credited income or over-debited expenses. The balancing figure represents either profit or loss due to adjustments, which is then distributed among partners in their profit-sharing ratio.

Profit and Loss Adjustment Account Format in Word, Excel & PDF

Creating a Profit and Loss Adjustment Account in Word, Excel, or PDF involves using structured tables or templates that reflect the traditional ledger format, with distinct debit and credit sides. Each format offers unique benefits depending on the complexity of adjustments and the user’s preference for documentation.

Profit and Loss Adjustment Account Format in Word

The format typically consists of a simple table where you manually enter particulars under debit and credit columns. This is useful for small firms or for those who need a basic, printable version. However, Word does not support automatic calculations, so users must manually compute totals and ensure accuracy in partner-wise profit or loss distribution. While it offers aesthetic flexibility, it lacks the functionality required for frequent or complex adjustments.

Profit and Loss Adjustment Account Format in Excel

The Profit and Loss Adjustment Account becomes much more dynamic. Excel’s formula capabilities allow for automatic calculations of adjusted profits, partner-wise allocation based on ratios, and real-time error detection. You can use cell references and conditional formatting to highlight discrepancies or automate recurring calculations. This format is highly beneficial for firms dealing with regular adjustments or having multiple partners, as it minimizes human error and improves efficiency.

Profit and Loss Adjustment Account Format in PDF

The format is most often used for final documentation or sharing with external stakeholders such as auditors, investors, or partners. While PDFs are not editable, they provide a fixed and professional layout that maintains the integrity of the report. Users typically prepare the account in Word or Excel first and then convert it into a PDF for official use.

Why Are Adjustments Necessary In The Profit And Loss Account Format?

Adjustments are necessary in the Profit and Loss Account format to ensure that the financial results of a business accurately reflect its true income and expenses for a given period. In real-world accounting, errors, omissions, or misclassifications can occur—such as forgetting to record certain expenses, overstating income, or applying incorrect profit-sharing ratios among partners. If left uncorrected, these issues can distort the firm’s profitability and lead to unfair distribution of profits or incorrect financial reporting.

In the context of partnership firms, adjustments are especially important during events like reconstitution of the firm (admission, retirement, or death of a partner), where past profits may need to be recalculated to reflect revised agreements. Adjustments also become necessary when new information arises after books are closed, such as late expense invoices or discovered calculation mistakes.

By making these adjustments in a separate Profit and Loss Adjustment Account, businesses can maintain the integrity of their original profit and loss account while transparently correcting previous inaccuracies. This not only promotes fairness among partners but also ensures compliance with accounting standards and better decision-making based on accurate financial data.

Key Elements of a Profit and Loss Adjustment Account

The account typically includes the following elements:

- Opening Balance (if any)

- Adjustment Entries (expenses/incomes that were omitted or wrongly posted)

- Rectification of Errors

- Partner-wise Profit/Loss Distribution

- Closing Balance

Best Practices for Creating & Using a Profit and Loss Adjustment Account

With myBillBook accounting software, managing adjustments becomes simple, accurate, and audit-ready. Follow these best practices to create a flawless Profit and Loss Adjustment Account with ease.

- Review Prior Period Entries Thoroughly

Before creating the adjustment account, carefully examine previous accounting records to identify any errors, omissions, or misclassifications.

- Document Every Adjustment Clearly

Maintain detailed descriptions for each adjustment entry, specifying the reason, date, and the accounts affected. This ensures transparency and simplifies future audits.

- Use Correct Profit-Sharing Ratios

When distributing the adjusted profit or loss among partners, always apply the correct profit-sharing ratio, especially if it has changed due to reconstitution

- Avoid Altering Original Financial Statements

Never modify the original Profit and Loss Account. Use the adjustment account to correct past errors, preserving the integrity of previously reported figures.

- Sync Adjustments with Partner Capital Accounts

After calculating the final adjustment amount, update each partner’s capital account to reflect their share of the revised profit or loss.

- Utilize Accounting Software for Accuracy

Use digital tools like myBillBook to automate calculations, maintain records, and generate reports in Word, Excel, or PDF formats, minimizing the risk of manual errors.

- Audit Trail Maintenance

Ensure there’s a clear and accessible audit trail for all adjustments made, which is critical for compliance, especially during audits or legal evaluations.

- Consult Professionals for Complex Adjustments

In cases involving tax implications, significant errors, or legal restructuring, it’s advisable to consult an accountant or auditor to avoid complications.

- Back-Up Records Regularly

Keep digital and physical backups of the adjustment account and related documents to prevent data loss and support future references.

- Communicate with Partners Transparently

Always inform all partners about the nature and impact of each adjustment to maintain trust and consensus within the partnership.

FAQs

- What is the purpose of a Profit and Loss Adjustment Account?

It is used to make corrections to past profit or loss statements, especially during reconstitution of partnership firms or when errors are discovered post audit. - Is it mandatory for all businesses to prepare this account?

No, it is mainly used by partnership firms or entities undergoing revaluation or correction in financial statements. - Can I prepare this account manually?

Yes, but using tools like myBillBook offers accuracy, speed, and efficiency with built-in templates. - What kind of adjustments are recorded here?

Adjustments like omitted income/expenses, incorrect partner salary, interest on capital, or incorrect allocations from previous periods. - How does myBillBook simplify this process?

It offers customizable templates, automated partner calculations, real-time updates, and export-ready formats in Word, Excel, or PDF.

Know More About Accounting & Billing Formats