Upload JSON file GST portal

Do you need help downloading an offline programme to convert your GSTR1 excel files to JSON?

Are you still relying on your CA to accept invoices from your users, make entries, and then generate JSON files to post to the GST portal?

You may avoid the time-consuming process by downloading and emailing your GSTR1 files in JSON format for easy upload to the GST site using myBillBook. This article explains how to upload JSON files to the GST portal simply.

What is a JSON File?

A JSON file is a JAVA-based computer file. It’s an open-standard file format that sends data objects of attribute-value pairs and array data types using human-readable text. In addition, it features a simple format to read and write.

JSON replaces XML because you can use it to send structured data from a server to a web application.

What is a JSON File in GST?

The JSON file is utilised for GST compliance to transmit invoice data on multiple government portals. It comprises the creation of e-way bills and the filing of GST reports. In addition, you can utilise it to create an e-invoice in its most recent application.

How to Upload JSON File in the Gst Portal

The GSTN prepares and files GST returns using JSON files. You can use JSON files on the GST Portal to submit GST returns.

An offline tool for preparing GST returns has been made available by the government, and it creates JSON files that you can submit via the GST Portal. In addition, to conveniently file all GST returns, myBillBook offers JSON-format GST returns that you can upload to the GST system.

Uploading JSON File to GST Portal

Before learning how to create a JSON file for gstr 1 and how to create a JSON file for gstr 1, you must know the following:

Once you have downloaded the JSON file, upload it to the GST portal by following the instructions below.

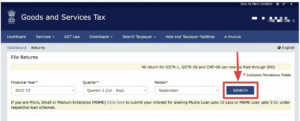

Step 1: Access your GST returns dashboard

Log into the GST site and go to the GST return dashboard after downloading the GST return in JSON format from myBillBook or the offline GST return tool.

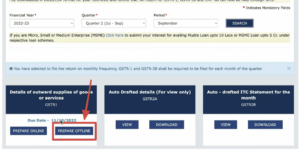

Step 2: Select the month for which you should file the GST return

Choose the month you want to file your GST return and click “Search” in the GST return dashboard. Next, choose the type of GST return from the list of options, then click “Prepare Offline.”

Step 3: Upload JSON file to GSTN

Click “Choose file” and navigate to the JSON file you downloaded from myBillBook on your hard drive. When you pick a file, the JSON file is automatically posted to GSTN.

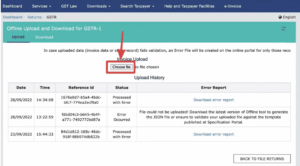

Step 4: Ensure the JSON file is uploaded successfully

A confirmation message will be displayed if the JSON file is successfully uploaded. If the JSON format or structure is incorrect, there will be an error message, as mentioned below. The Error Report will be “NA” if the JSON file is correct.

After uploading a JSON file, you can view the data or invoices on the GST portal in 15 to 30 minutes. Therefore, do not upload several times.

If the data still needs to be visible on the GST Portal after 30 minutes, you can attempt re-uploading the JSON file. The data will be rewritten or appended if the JSON file is uploaded more than once.

Step 5: Verify data on GST Portal

The data is added to the taxpayer’s GST portal after confirmation by the GSTN-> returns dashboard after 15 – 30 minutes of uploading a JSON file. You can view the data and invoices uploaded via the JSON file by clicking on various parts.

Invoices that were successfully posted without issues are displayed individually. You can also modify or delete the data.

If additional information is required, it is displayed individually in the returns dashboard for further input, editing, or deletion.

How to Download the JSON File for GST Return Filing

Access the GSTR-1 Filing page in myBillBook via the top menu. GST Registration -> GSTR-1 -> Overview: Choose the month you want to file the GSTR1 return from the drop-down option. Once the data has been loaded, click the “Download B2B JSON” button, as shown below. In myBillBook, you can download a single JSON file that contains all of the sections of a GSTR1 return, or you can download the JSON files individually. JSON files can also be downloaded and uploaded in areas to the GST Portal. For GSTR1 filing, you can download the JSON files separately:

- JSON for B2B invoices

- JSON for B2C large invoices

- JSON for B2C small invoices

- JSON for Export invoices

- JSON for HSN summary

- JSON for Invoice Amendments

- JSON for GSTR1 Return (Entire return must be in JSON Format)