Capital Account Format

A Capital Account records the owner’s investment, withdrawals, and retained earnings in a business. You can create a capital account format using Word, Excel, or PDF, but using an automated tool like myBillBook accounting software simplifies the process with customisable templates.

✅ Quick & Easy Capital Account Generation

✅ Customisable Templates

✅ Professional Look

✅ Unlimited Capital Account Statements

✅ Affordable Plans Starting INR 399/Year

Capital Account Format in Word, Excel & PDF | Download Free

Features of myBillBook Capital Account Format

Automated Calculations

Eliminates manual computation by automatically calculating capital balances, reducing errors and ensuring accuracy.

Customisable Templates

Offers pre-designed formats that can be tailored to suit individual business needs, including adding or removing fields as required.

Multiple Account Management

Enables businesses to maintain and track the capital accounts of multiple partners effortlessly in a single system.

Secure Cloud Storage

Provides encrypted cloud-based storage, ensuring that capital account records are protected and can be accessed anytime, anywhere.

Professional Format

Generates reports in compliance with accounting standards, making financial statements look polished and audit-ready.

Export Options

Supports multiple file formats, allowing users to save and print capital account statements in Excel, Word, or PDF for easy sharing and documentation.

₹217

Per month. Billed annually

Diamond Plan

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

₹250

Per month. Billed annually

Platinum Plan

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

₹417

Per month. Billed annually

Enterprise Plan

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills Popular

₹399 per year

Silver Plan for Android App

✅ For 1 device, 1 business and 1 user

What is a Capital Account?

A capital account tracks the investments and financial contributions of an owner or partners in a business. It shows the net worth of the individual or entity within the firm. For partnerships, each partner has a separate capital account detailing their share of ownership and financial activities.

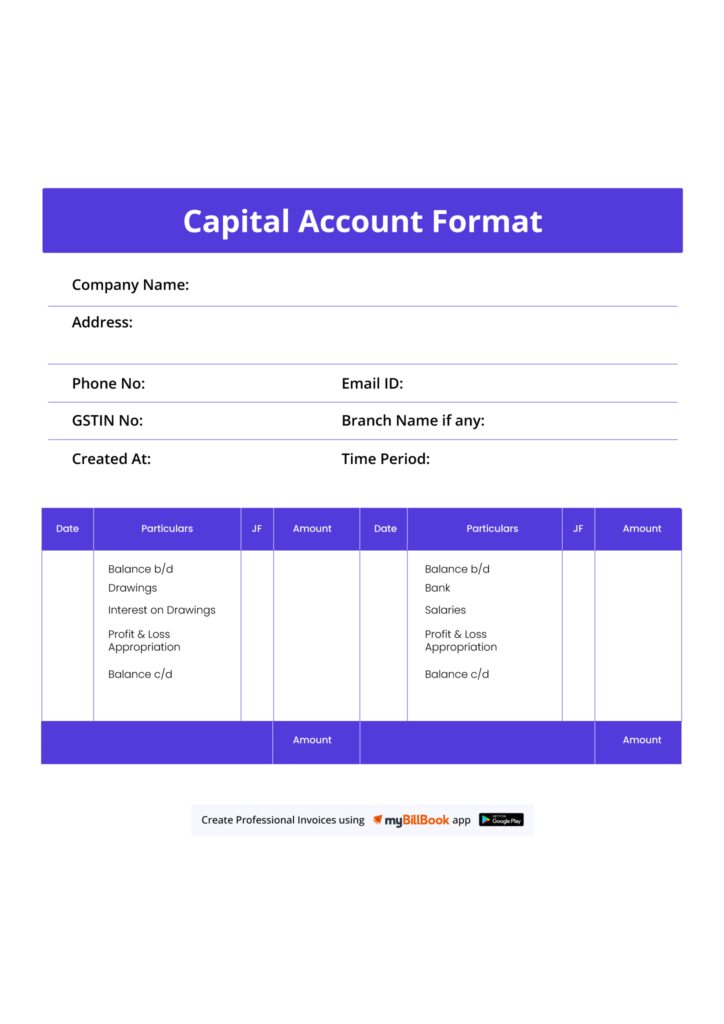

Format of Capital Account

A capital account follows a T-format or ledger format, listing credits (investments, profits, interest on capital) on the right and debits (withdrawals, losses, drawings) on the left.

Example Format:

| Particulars | Debit (₹) | Credit (₹) |

| Opening Balance | – | X,XXX |

| Additional Capital Introduced | – | X,XXX |

| Share of Profit | – | X,XXX |

| Drawings | X,XXX | – |

| Interest on Capital | – | X,XXX |

| Closing Balance | – | X,XXX |

Capital Account Format for Different Entities

1. Capital Account Format for Individuals

For individual businesses, a capital account format for individuals typically consists of:

- Initial capital investment

- Additional capital introduced

- Withdrawals or drawings

- Net profit or loss for the period

Example Capital Account Format for Individuals

| Particulars | Amount (₹) |

| Opening Balance | XXXX |

| Add: Additional Capital | XXXX |

| Add: Net Profit | XXXX |

| Less: Withdrawals | (XXXX) |

| Closing Balance | XXXX |

2. Capital Account Format for Partnership

Each partner has a separate capital account with their respective investments, withdrawals, and share of profits or losses. Hence, a capital account partnership format maintains records for each partner separately, as shown below:

| Particulars | Partner A (₹) | Partner B (₹) | Total (₹) |

| Opening Balance | XXXX | XXXX | XXXX |

| Add: New Investment | XXXX | XXXX | XXXX |

| Add: Profit Share | XXXX | XXXX | XXXX |

| Less: Withdrawals | (XXXX) | (XXXX) | (XXXX) |

| Closing Balance | XXXX | XXXX | XXXX |

3. Partners’ Capital Account Format in Excel

Using partners’ capital account format in Excel helps automate calculations and maintain financial clarity. A well-designed Excel sheet includes:

- Auto-sum functions for partner balances.

- Separate columns for capital introduction, withdrawals, and profit sharing.

- Charts to visualize partner contributions.

Steps to Create Capital Account Format in Excel:

- Open Excel and create column headers: Particulars, Partner A, Partner B, Total.

- Use formulas for automatic balance updates (e.g., =SUM(B2:B5) for totals).

- Apply conditional formatting for clear data visualization.

- Save as a template for future use

Best Practices for Maintaining a Capital Account

- Regularly update capital contributions and withdrawals.

- Maintain clear documentation for every financial transaction.

- Use digital tools like myBillBook to automate calculations and avoid errors.

- Ensure transparency in partnership firms by maintaining separate accounts for each partner.

- Comply with taxation norms to avoid financial discrepancies.

How myBillBook Helps in Capital Account Management

- Automated Entries: Reduces manual effort by automating capital additions and deductions.

- Customizable Formats: Generate capital account partnership format statements as per business needs.

- Multi-User Access: Partnership firms can allow partners to view and update partners’ capital account format in Excel records.

- Seamless Integration: Sync with accounting software to manage finances efficiently.

- Export Options: Download capital account format for individual reports in Excel, PDF, or Word formats.

- Secure Cloud Storage: Access data anytime, anywhere.

FAQs

1. What is the purpose of a capital account?

A capital account tracks an owner’s or partner’s equity, recording contributions, withdrawals, and retained earnings.

2. How do you maintain a capital account in a partnership firm?

Each partner should have a separate capital account partnership format recording their contributions, withdrawals, and share of profits/losses.

3. What is the difference between fixed and fluctuating capital accounts?

- Fixed Capital Account: The principal investment remains unchanged; only profits and withdrawals affect a separate current account.

- Fluctuating Capital Account: All transactions (capital, profit, withdrawals) are recorded in a single account.

4. Can I prepare a capital account in Excel?

Yes, partners’ capital account format in Excel can be used to create a structured capital account format for individuals with automated calculations and financial analysis.

5. Why should I use myBillBook for capital account management?

myBillBook simplifies capital account management by offering automated calculations, downloadable reports, and seamless financial tracking.