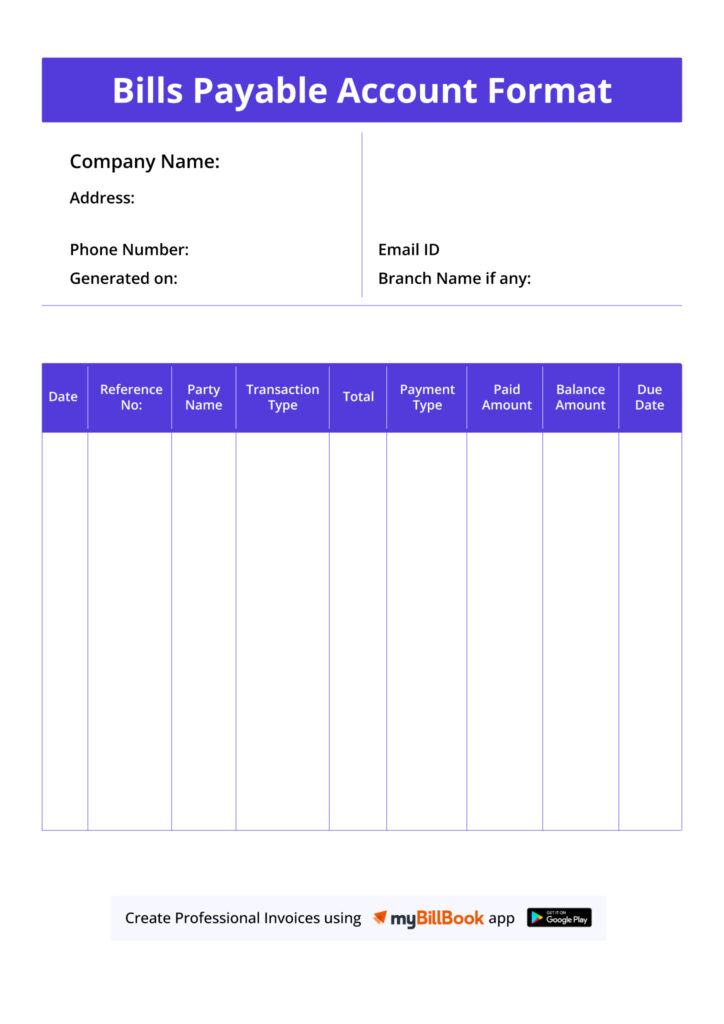

Bills Payable Account Format

A well-organised bills payable account format is essential for businesses to track and manage their outstanding liabilities efficiently. myBillBook is the ideal solution for handling all your credit purchases, supplier payments, and outstanding bills in one place.

✅ Quick & Easy Bills Payable Account Generation

✅ Customisable Templates

✅ Professional Look

✅ Unlimited Bills Payable Records

✅ Affordable Plans Starting INR 399/Year

Bills Payable Account Formats in Word, Excel & PDF | Download Free

Features of myBillBook Bills Payable Account Format

Smart Bills Payable Tracking

myBillBook allows you to manage all your bills payable entries in a structured format. You can record bill numbers, due dates, supplier names, and payment statuses—making it easy to stay on top of what you owe and when it’s due.

Real-Time Payment Reminders

Never miss a due date again. myBillBook sends automatic reminders for upcoming bill payments, helping you maintain healthy supplier relationships and avoid late payment penalties.

Integrated Purchase & Bill Management

Each bill payable entry can be directly linked to its corresponding purchase invoice. This ensures consistency and accuracy across your books and eliminates manual cross-referencing.

GST-Compliant & Customisable Templates

Generate GST-ready bills payable records with pre-defined fields that can be customised as per your business needs. Add your logo, edit column headers, or adjust formats without breaking compliance.

Easy Downloads

Create, export, and share your bills payable accounts in multiple formats ensuring flexibility and professional presentation for audits, vendor communication, or internal use.

Centralised Dashboard for All Payables

Access a consolidated view of all outstanding bills, sorted by due date, amount, or vendor. The intuitive dashboard makes it simple to prioritise and manage payments efficiently.

₹217

Per month. Billed annually

Diamond Plan

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

₹250

Per month. Billed annually

Platinum Plan

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

₹417

Per month. Billed annually

Enterprise Plan

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills Popular

₹399 per year

Silver Plan for Android App

✅ For 1 device, 1 business and 1 user

What is the Bills Payable Account format?

The Bills Payable Account format is a structured layout used in accounting to record and manage the bills a business is obligated to pay to its creditors or suppliers. These are usually formal agreements, such as promissory notes or accepted bills of exchange, where the business commits to paying a certain amount on or before a specific due date.

The format typically includes details such as the date of the bill, the bill number, the creditor’s name, the amount payable, the due date, and the payment status. This layout helps businesses maintain a clear record of their short-term liabilities and ensures timely payments, contributing to better cash flow management and strong vendor relationships. By using a consistent format, businesses can avoid confusion, reduce errors, and make financial reporting more transparent and accurate.

Format and Contents of a Bills Payable Format

The standard format of a bills payable account includes the following columns:

- Date of Issue and Due Date: Indicates when the bill was generated and when it is due.

- Creditor Information: Name and contact of the party to whom payment is due.

- Bill Number or Reference: Unique ID for tracking.

- Amount Payable: The amount the business owes.

- Status: Shows whether the bill is unpaid, partially paid, or settled.

- Remarks: Notes such as payment terms or special conditions.

This format ensures clear visibility of each liability and its corresponding details. In double-entry accounting, every bill payable is recorded as a credit in the bills payable account and a debit in the related purchase or expense account.

Bills Payable Format in Word, Excel, and PDF

Creating a Bills Payable Format in Word, Excel, or PDF gives businesses flexibility in how they document and manage outstanding payables. Each format serves a different purpose based on the business size, complexity, and preference. Here’s how each version works:

Bills Payable Format in Word

Using Microsoft Word to create a bills payable format is ideal for businesses looking for a simple, printable layout. In Word, users can manually create a table with headers like Date, Bill Number, Supplier Name, Amount Payable, Due Date, Status, and Remarks. It offers flexibility in design and layout, allowing businesses to brand the document with logos and headers. However, since Word lacks automation, calculations like total outstanding amounts or highlighting overdue bills must be done manually. Word formats are best suited for smaller businesses or for preparing printable reports and summaries.

Bills Payable Format in Excel

Excel is the most commonly used tool for creating a dynamic and functional bills payable format. It allows users to use formulas, conditional formatting, data validation, and filters to make tracking and managing bills more efficient. Excel templates can auto-calculate totals, flag due or overdue payments, and sort records by supplier, amount, or due date. Businesses can create monthly or quarterly reports and analyse payable trends. Excel also supports easy integration with accounting software or import/export functions, making it ideal for medium to large businesses handling high volumes of transactions.

Bills Payable Format in PDF

A PDF bills payable format is often used for sharing or archiving finalized records. Once a Word or Excel sheet is completed, exporting it to PDF locks the data from further edits, ensuring document integrity and professionalism. PDFs are especially useful when submitting records to auditors, vendors, or financial institutions. While PDFs are not editable like Excel or Word, they offer a clean and tamper-proof format for secure storage and distribution. Many businesses maintain bills payable summaries in PDF as part of their monthly or yearly financial documentation.

Smart Accounting Practices for Bills Payable Accounts

Creating and maintaining an accurate bill payable account is vital for smooth business operations. It not only ensures timely payments to suppliers but also contributes to maintaining a healthy credit profile, avoiding penalties, and improving overall financial discipline.

While traditional tools like Word and Excel help in maintaining basic records, small business accounting software like myBillBook elevates this process by offering automation, error-free calculations, payment reminders, and seamless integration with other financial records. It ensures your bills payable system is not only well-documented but also strategically managed.

Here are some of the best practices to follow when creating and managing bills payable accounts:

1. Record Bills Immediately Upon Receipt

Delaying the entry of a bill into your payable system can result in missed payments and disorganised records. Whether you’re receiving bills via email, post, or digitally, they should be logged in your bills payable account format as soon as they are received.

2. Set Clear Due Dates and Monitor Regularly

Every bill’s payable entry should include an accurate due date to help plan payments efficiently. Regularly reviewing due dates can help prioritise which bills need attention first. With myBillBook, due dates are automatically tracked, and the dashboard provides a visual overview of upcoming obligations.

3. Categorise Bills Based on Vendor, Amount, or Priority

Segmenting your bills based on criteria such as vendor names, total amount, or urgency can make the review process easier and help with budgeting,to sort and filter bills, enabling faster decision-making when funds are limited.

4. Automate Payment Reminders

Relying on manual tracking can result in missed payments, leading to late fees or strained vendor relationships. myBillBook’s built-in reminder system notifies you ahead of due dates, helping maintain timely payments and preserving business goodwill.

5. Reconcile Bills Payable with Bank Statements

Regular reconciliation between your bills payable account and actual bank payments is crucial for accuracy. It ensures that all entries are valid, paid bills are marked as such, and no duplicate or fraudulent entries exist.

6. Maintain Digital Backups and Audit Trails

Keeping digital records and maintaining a proper audit trail is critical, especially during financial reviews or audits. myBillBook automatically stores bills, links them with invoices, and maintains a chronological history of edits or payments—making audits smoother and more transparent.

7. Review and Update the Bills Payable Account Periodically

Stale entries or outdated bills can clutter your records. Periodic reviews help in cleaning up old entries, identifying pending dues, and making informed financial decisions. It makes this process easy with filters, status labels, and custom views that help assess your liabilities at any point in time.

FAQs

Q1. What is the difference between bills payable and accounts payable?

Bills payable are formal written agreements with specific payment dates, while accounts payable include all amounts due to suppliers, often without formal promissory notes.

Q2. Can I create bills payable format manually?

Yes, you can create it in Word or Excel, but using accounting software like myBillBook ensures better accuracy, tracking, and automation.

Q3. How can I track due dates for bills payable?

With myBillBook, due dates are automatically tracked, and reminders are sent so you never miss a payment.

Q4. Is there a standard template for bills payable?

While formats may vary, a typical template includes date, bill number, payee, amount, due date, and status.

Q5. How does myBillBook help manage payable bills?

It automates record-keeping, offers customizable templates, calculates totals, and integrates with other financial records for complete control.

Know More About Accounting & Billing Formats