LLP Balance Sheet Format

An LLP balance sheet shows a limited liability partnership’s assets, liabilities, and equity. It is a snapshot of the company’s financial status at a specific time.

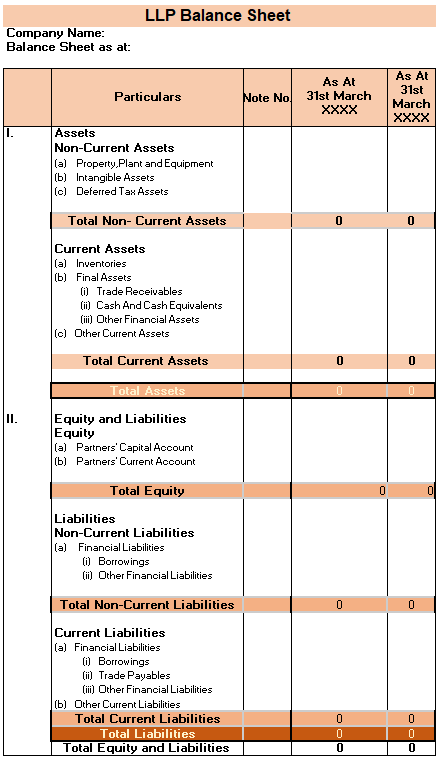

LLP Balance Sheet Format

LLP balance sheet format presents a company’s financial position as of a particular date. The LLP balance sheet format includes categories such as long-term liabilities, short-term liabilities, fixed assets, and current assets. The presentation of this information in a clear and concise format helps in assessing the financial health of an LLP and making informed decisions.

LLP Balance Sheet Format: Details to be Included

To depict an accurate financial state of a limited liability partnership, various particulars must be incorporated in the LLP balance sheet format. Some vital components are as follows:

- LLP name and date of balance sheet

- Assets such as cash, investments, property, and equipment

- Liabilities such as loans, accounts payable, and taxes owed

- Partners’ capital accounts, including contributions and draws

- Totals for each category and the overall balance sheet

- Comparisons with previous periods to show trends and changes

These are the necessary details that should be included in an LLP balance sheet format. It provides a helpful reference for ensuring that all relevant information is included when preparing this financial document.

For hardware businesses looking for efficient financial management solutions, using billing software for hardware shop like myBillBook can help automate tasks, streamline accounting, and keep financial records up to date effortlessly.

Sample LLP Balance Sheet Format

The sample LLP balance sheet format is a customizable template company can use to create their balance sheets. By reviewing the example, companies can better understand the information that should be included and how it should be organized.

LLP Balance Sheet Format in PDF

LLP balance sheet format in PDF is secure and can be easily shared and printed on any device. This customizable format ensures accessibility and protects financial information. You can review the sample provided to understand the necessary data and arrangement for the balance sheet.

LLP Balance Sheet Format in Word

The LLP balance sheet format in Word is a customizable template with user-friendly formatting options to suit company needs, providing easy editing capabilities. The format can be converted to PDF for sharing with stakeholders, and reviewing the sample can help understand the necessary data and arrangement for the balance sheet.

LLP Balance Sheet Format in Excel

LLP balance sheet format in Excel provides easy editing and sharing options with calculation and graphing capabilities. The sample provided can help understand the layout and required information for the balance sheet, with the added benefit of password protection for security.

FAQs on LLP Balance Sheet Format

Including comparisons with previous periods on an LLP balance sheet helps to identify trends and changes in the financial position of the LLP. It allows stakeholders to see if the LLP's financial health improves or declines over time. The partners' capital accounts on an LLP balance sheet show the contributions and draws made by each partner. This is important because it indicates the ownership stake of each partner in the LLP and their share of the profits or losses. LLP balance sheet format can be customized to suit a company's needs. Elements can be added or excluded to make them more relevant. LLP balance sheet analysis can identify financial improvement opportunities, such as reducing liabilities or investing in new equipment. An LLP balance sheet shows a partnership's financial position, while a personal balance sheet shows an individual's. The LLP balance sheet includes assets, liabilities, and equity, while the personal balance sheet includes assets and liabilities.What is the purpose of including comparisons with previous periods on an LLP Balance Sheet?

What is the significance of the partners' capital accounts on an LLP Balance Sheet?

Can an LLP balance sheet format be customized?

How can a company use an LLP balance sheet format to improve its financial position?

What is the difference between an LLP and a personal balance sheet?