Best GST Billing Software for Small Business in India

-

Create GST bill in 8 seconds

-

Increase stock rotation 2.8x faster

-

Collect 97% payments on time

Quick answers to all the questions you may have on Billing Software, Best Billing Software In India, GST invoicing, E-Invoicing, E-Way billing, and GST Billing Software.

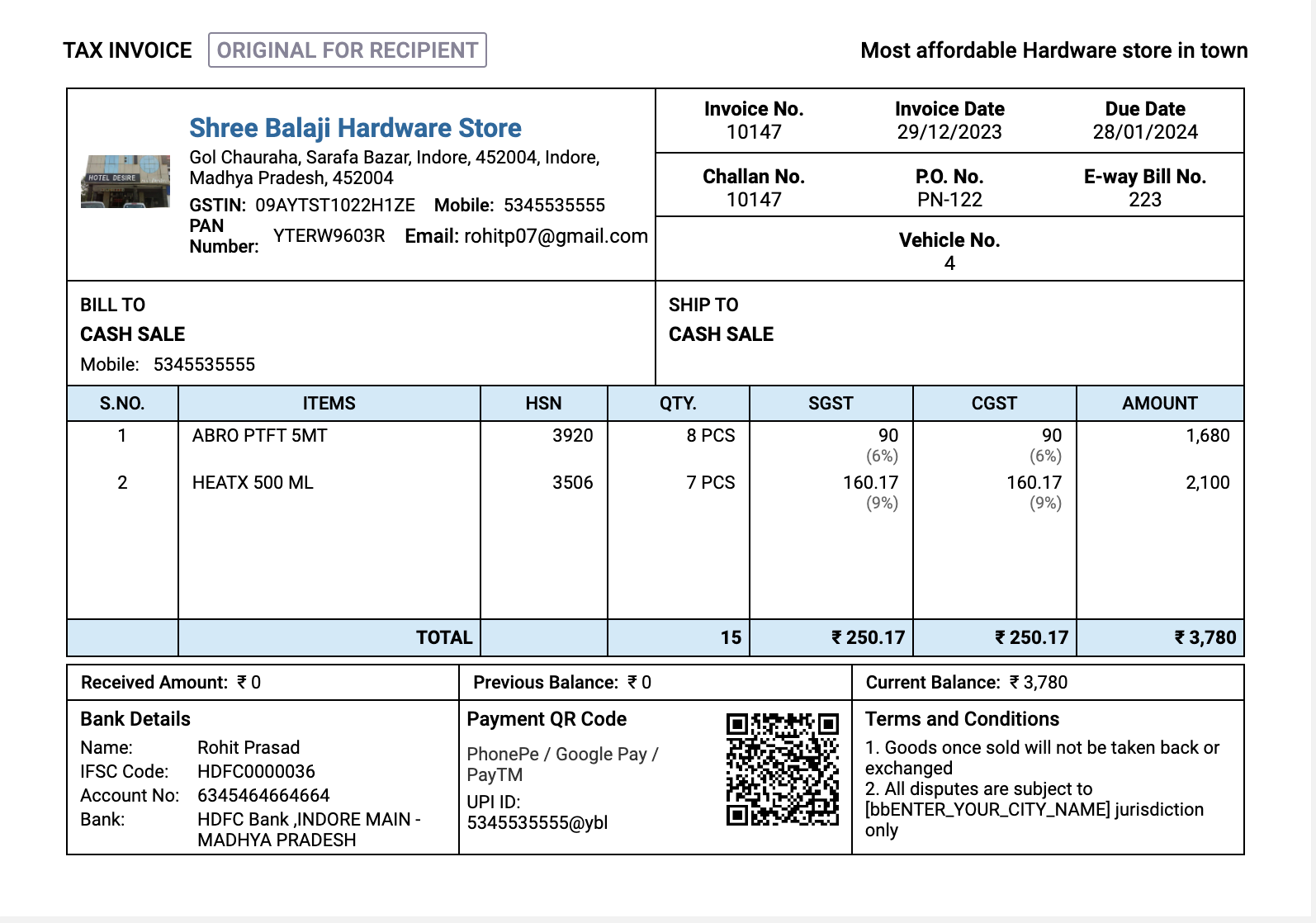

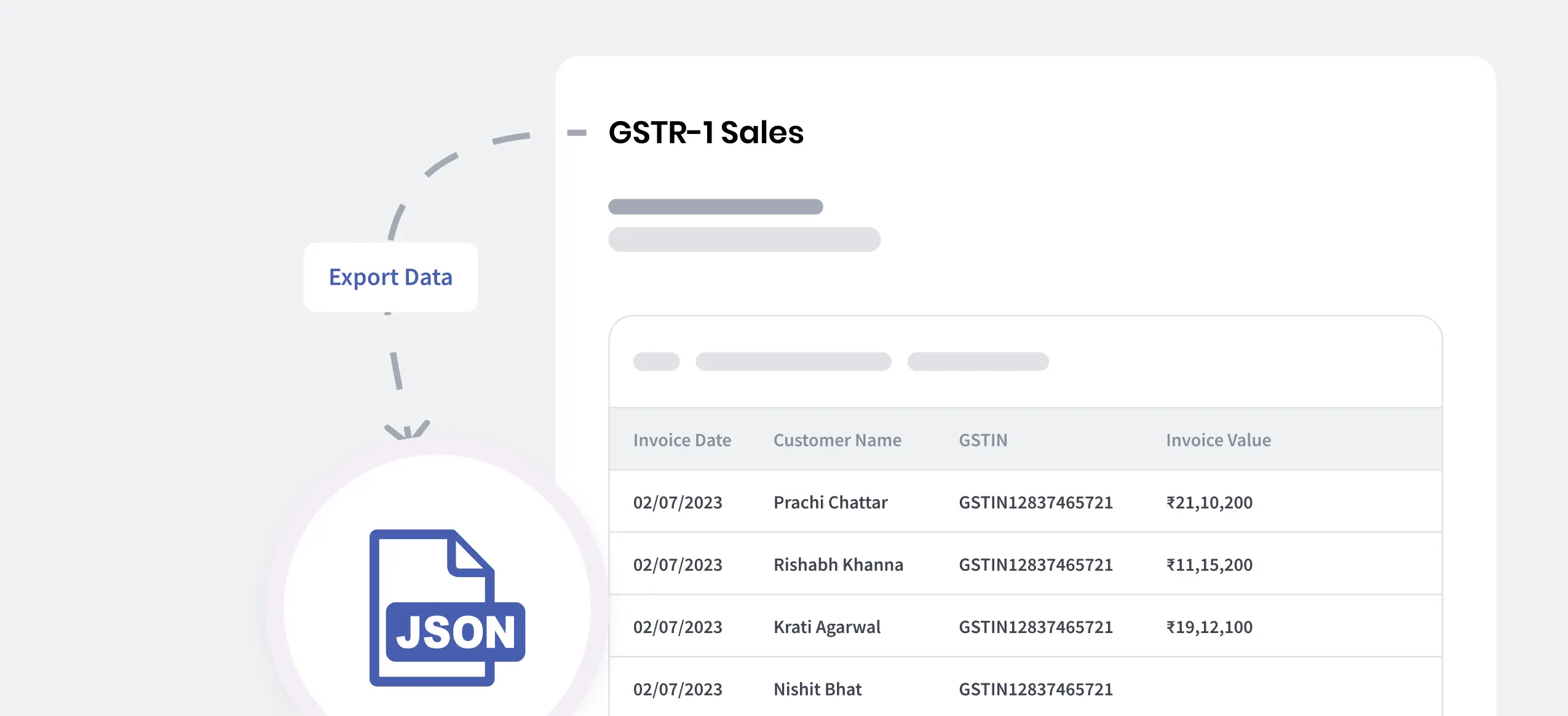

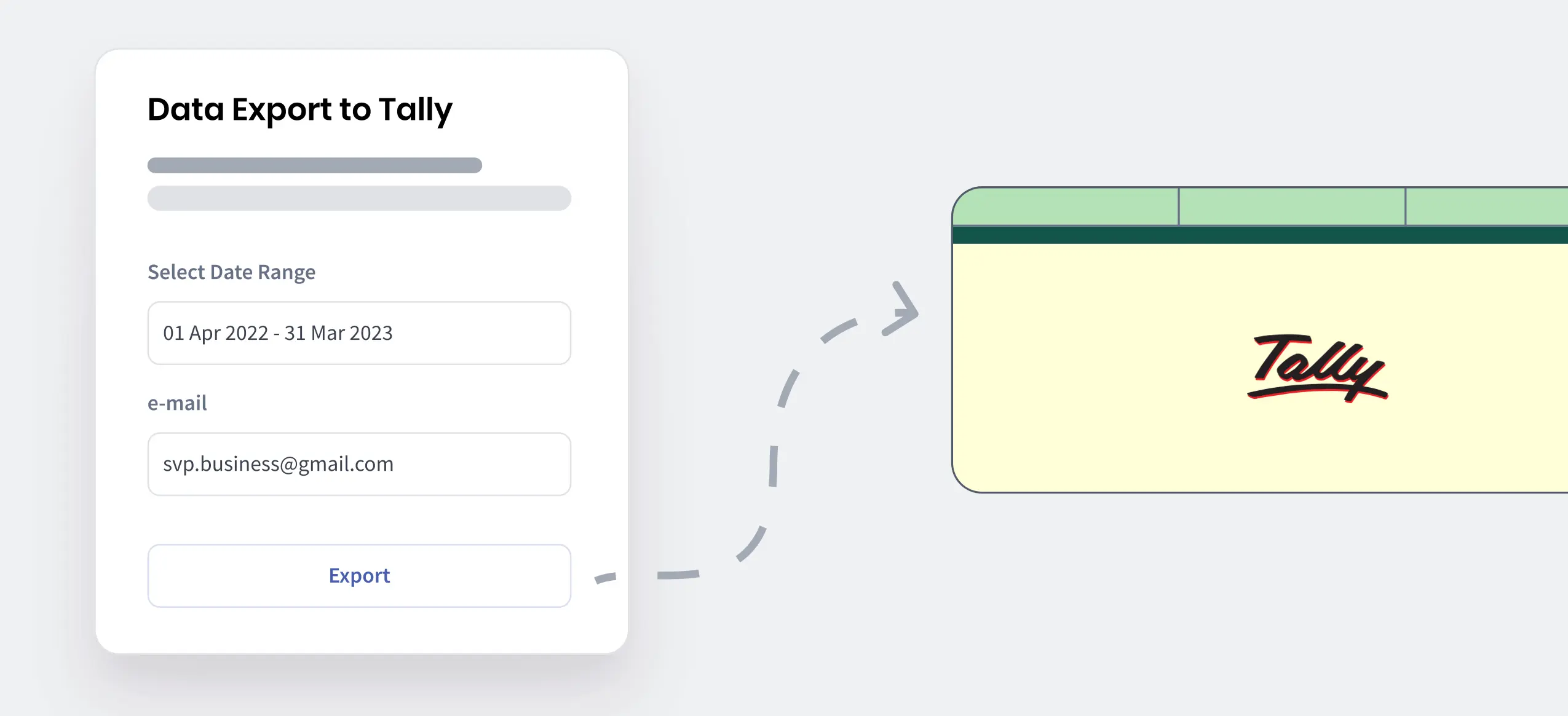

Billing software is a digital tool that helps businesses to automate and streamline their billing and invoicing processes. Also called as GST invoicing software, it is available as an on-premise and cloud-based application. Typical billing software features include invoice generation,inventory management, godown management, payment tracking, e-invoicing, e-way billing and report generation. Billing software helps businesses save time, reduce errors, and improve efficiency in their billing processes.

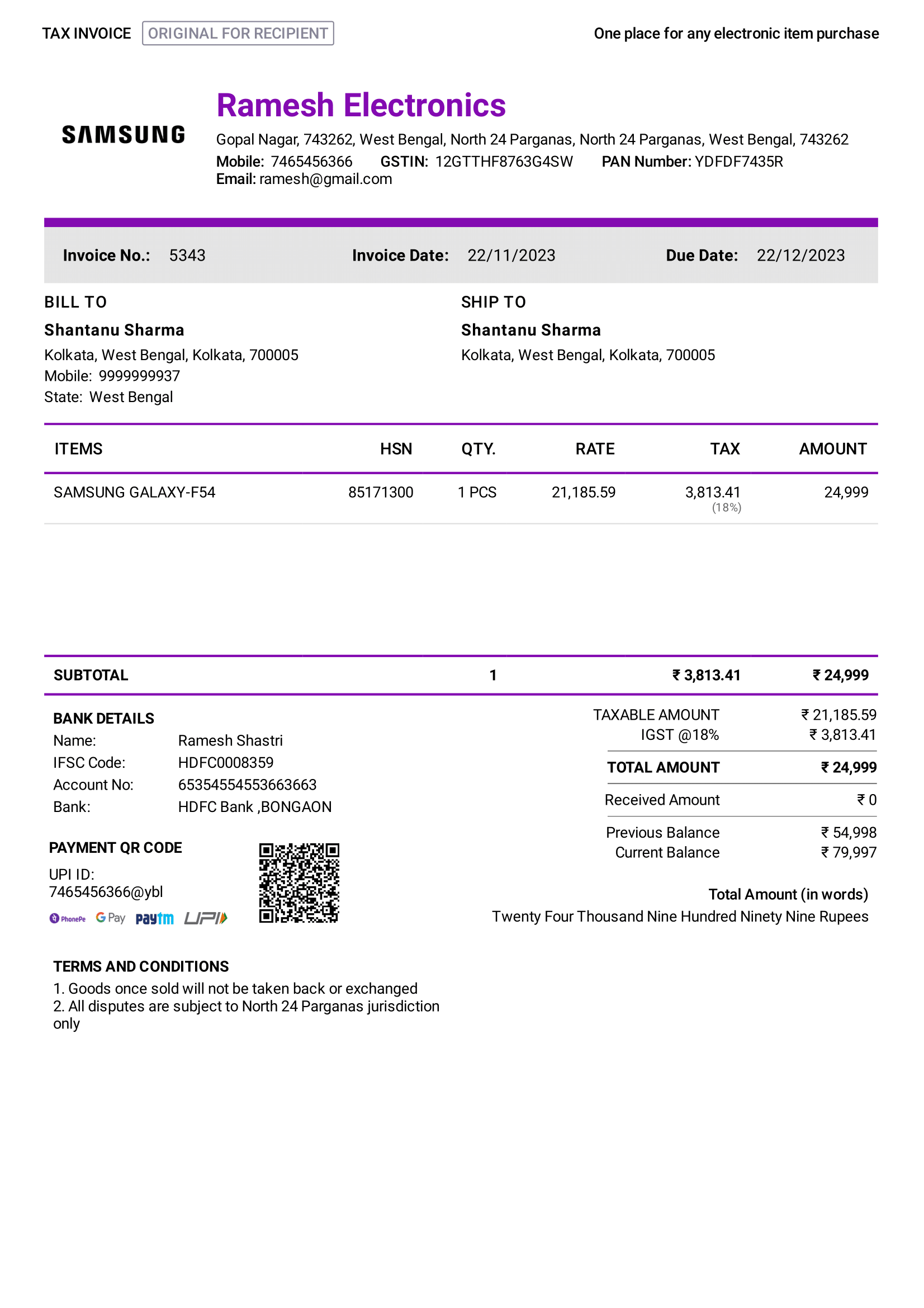

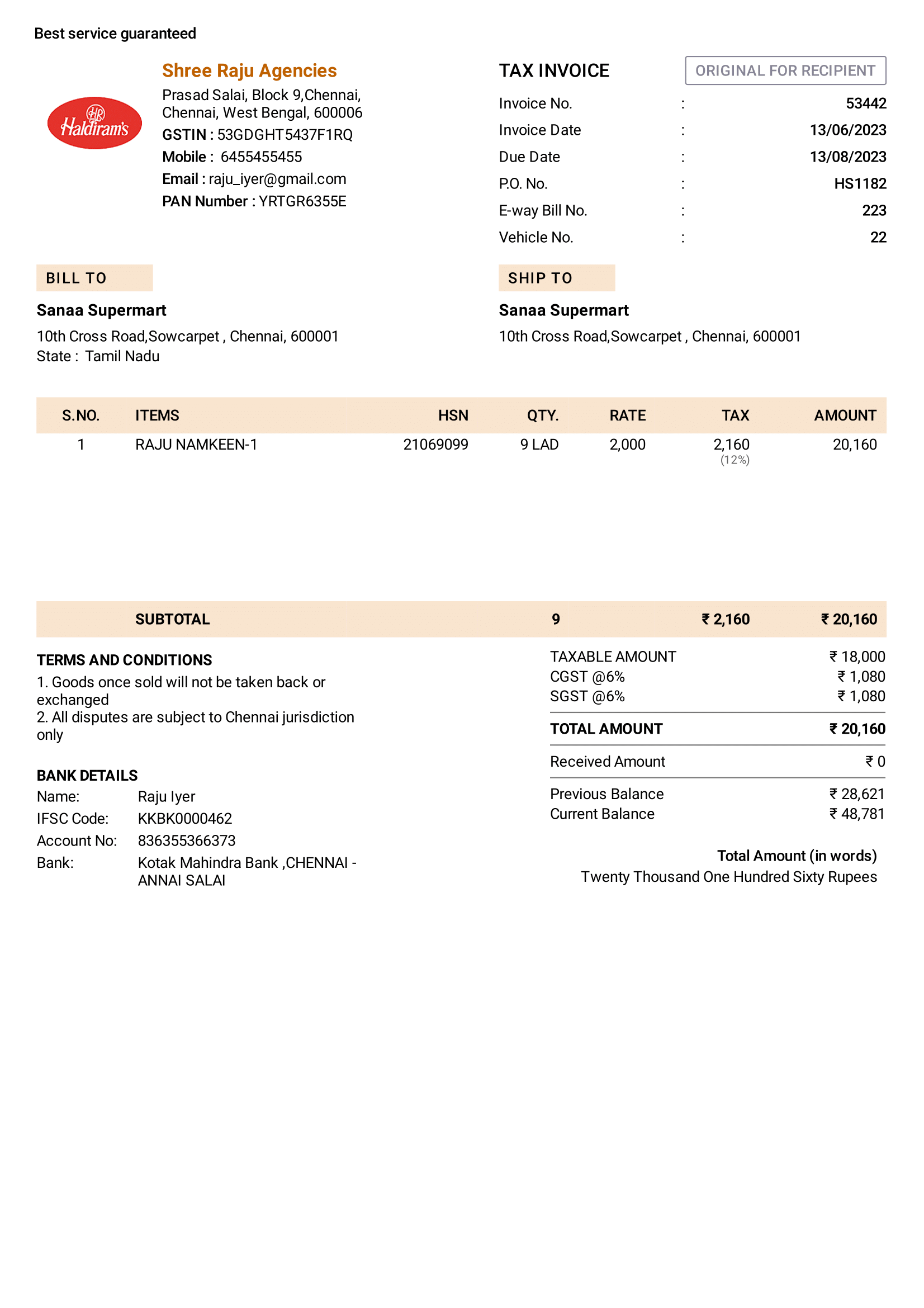

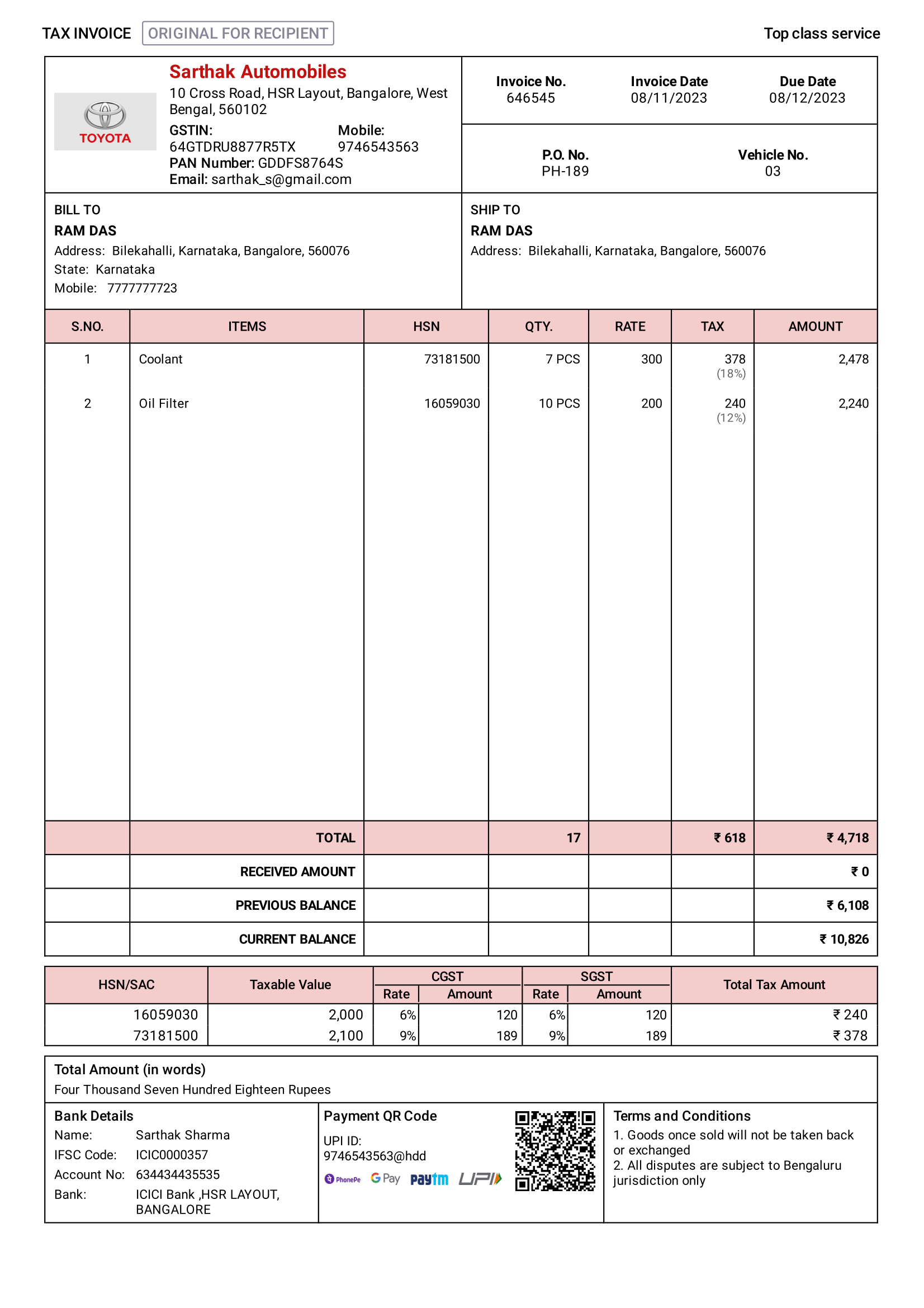

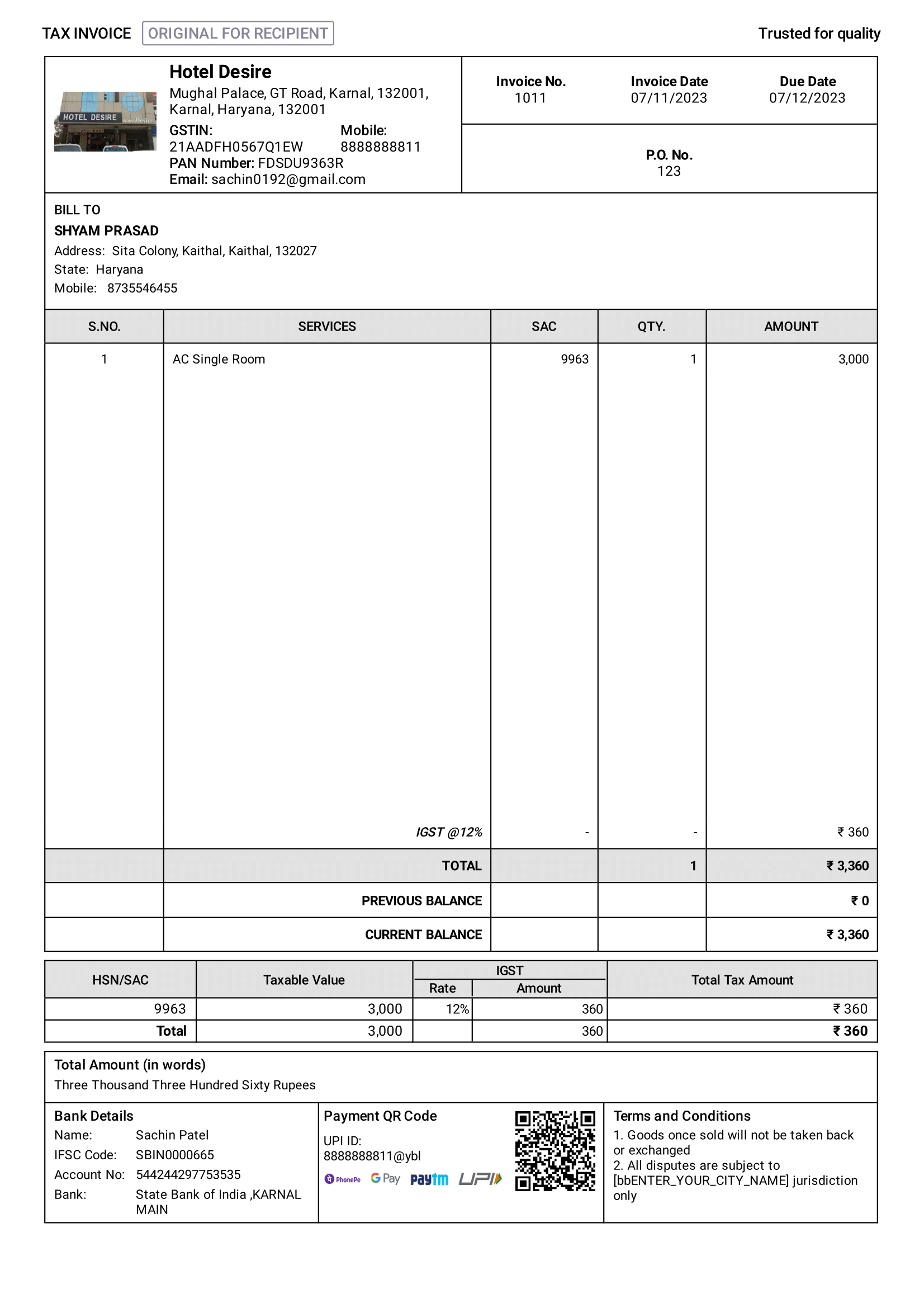

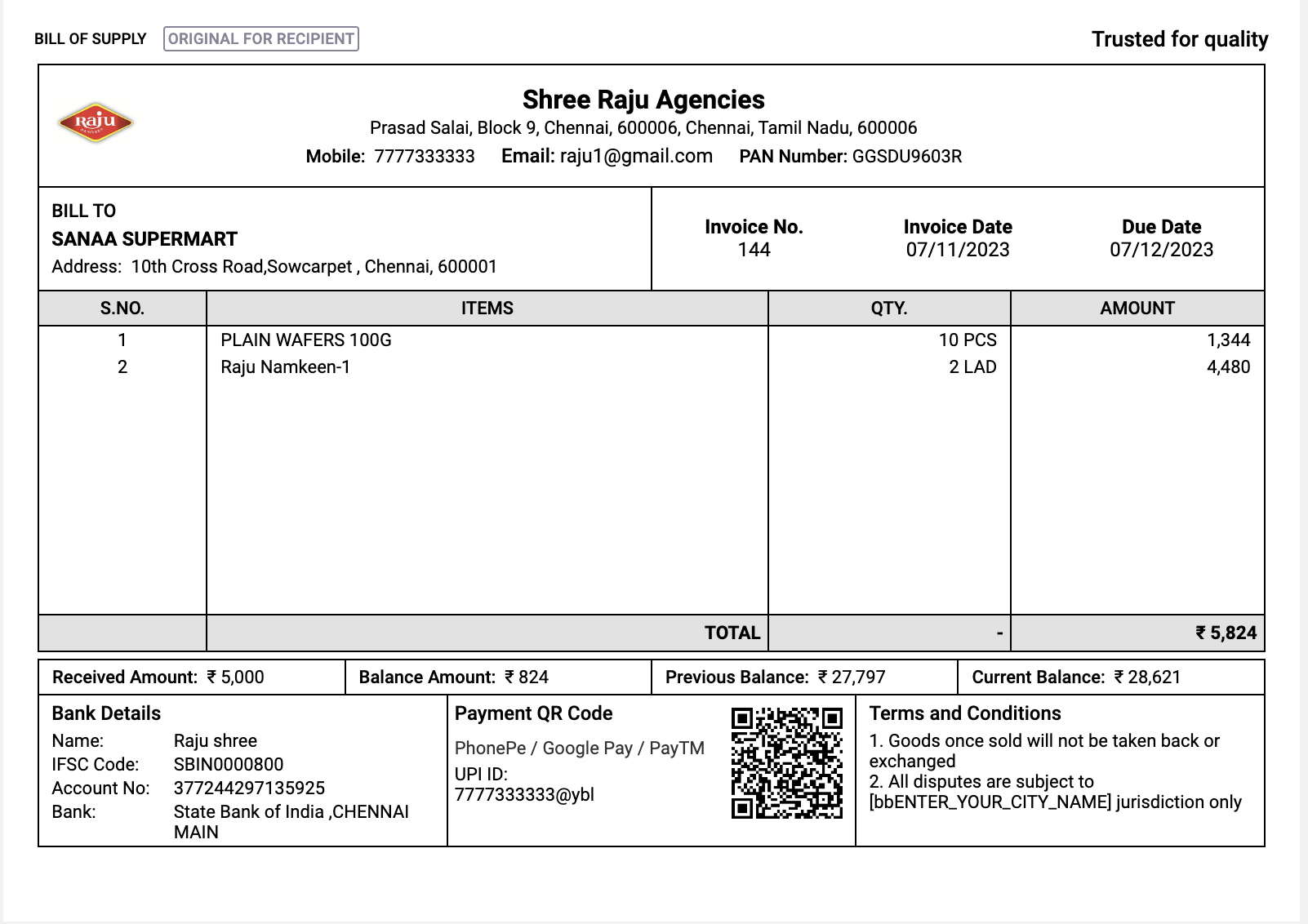

An invoice is a document issued by a seller to a buyer when a sale is made. It contains detailed information about the products or services and their respective costs. Unlike a bill, which is paid on the spot, an invoice is a request for payment after the order has been delivered. It is more detailed than a bill as it outlines the obligations of both parties regarding payment, due date, and other important details.

Invoicing software is the same as billing software. When installed on your PC or mobile, it generates invoices for the goods or services sold. myBillBook is one such invoicing software that helps SMBs create personalised invoices in seconds.

Who understands the billing and accounting needs of small businesses better than another small business that has designed India's No.1 billing and accounting? Yes, myBillBook was designed & developed by an Indian SMB to make billing and accounting easy for all the SMB owners in India. With a user base of more than 1 Crore customers, the GST invoicing software has been rated the best billing software for small businesses in India.

A bill and an invoice contain almost similar information. However, technically, they're used for different purposes. A bill is used when the payment is instant, just like a bill issued in a supermarket. On the other hand, an invoice is typically used for payments with a due date, like your internet bill, which has a grace period for bill payment. Sellers typically issue invoices to request payments from clients.

A tax invoice is a legally binding document created in accordance with tax regulations. To qualify as a tax invoice, it must include all the mandatory information, like the invoice number, GSTIN, etc. On the other hand, an invoice does not necessarily need to contain all the information. It typically contains the amount due for the goods or services sold.

Online billing software is a cloud-based application that can be downloaded on any compatible smart device like a smartphone, tablet, PC, etc. A unique mobile number is required to log in and access the online billing software app, which stores all the information in cloud servers. The billing app with the same login credentials can be used from anywhere and from any device.

An invoice is generated to request payment, whereas receipts are provided as proof of payment. Invoices are generated before the payment, and receipts are provided upon receiving the payment.

A proforma invoice outlines the estimated cost of the transaction and is generated to provide a rough estimate to the buyer. A proforma invoice is generated even before a sale is made.

An invoice number is a unique 16-digit alpha-numeric number assigned to each invoice generated by a seller. As per GST norms, the series needs to be changed for every financial year. A billing software generates a unique invoice number for every invoice based on the series you set.

myBillBook offers different plans to suite businesses of different sizes. Do check our Pricing Page to know all the plans available.

We are currently offering plans on an annual subscription basis.

Yes, if you haven't used your mobile number to register with the myBillBook billing app, you can enjoy a free trial.

Yes, you can contact our customer service team to get tailor-made subscription plans based on your business needs.

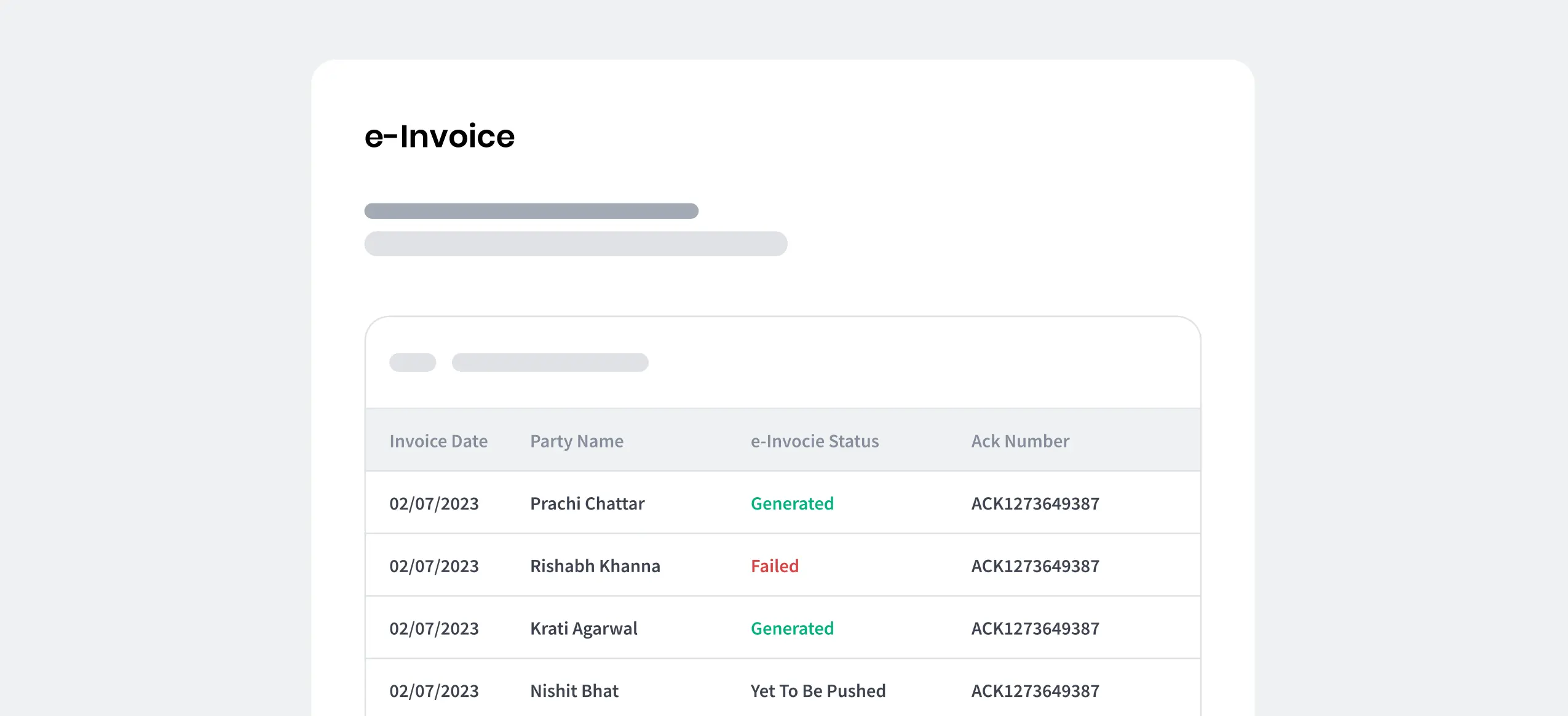

An e-invoicing software enables the creation of e-invoices quickly and easily in adherence to regulatory standards. It reduces the steps required to generate e-invoices and makes the e-invoice generation effortless. It integrates with accounting systems for seamless data flow, ensures accuracy, and provides secure transmission methods.

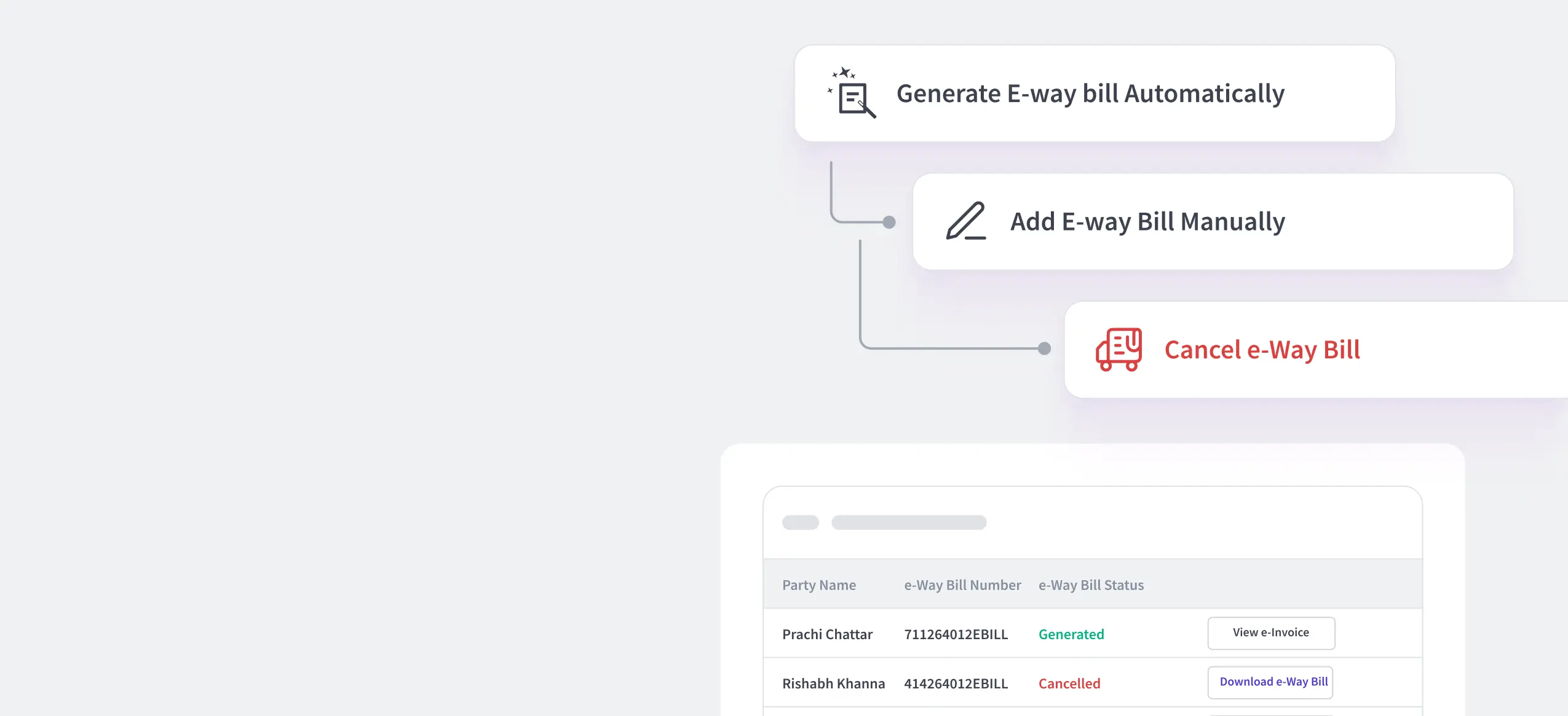

An e-way billing software enables the creation of e-way bills quickly and easily in adherence to regulatory standards. It facilitates the creation of e-way bills for the movement of goods, ensuring adherence to specified thresholds and legal requirements.

Businesses from various industries can use billing software. Different types of billing software are available, including restaurant billing software, medical billing software, hotel billing software, and retail shop billing software.

Yes, myBillBook supports single-click generation of e-invoices and e-way bills. While e-invoicing, you will find an option to generate e-way bills. You can use the same to initiate your e-way billing process.