RCM Invoice Format

An RCM invoice format is a type of invoice that requires the recipient to pay the tax instead of the supplier. This is applicable for specific supplies as per tax laws.

RCM Invoice Format

The RCM invoice format is mandatory for certain transactions under GST regulations in India. It requires specific information to be included, such as the recipient’s name and GST number and the tax amount to be paid. The format is designed to ensure compliance with tax laws and facilitate the smooth processing of invoices.

RCM Invoice Format: Details to be Included

Including various details is crucial when creating an RCM invoice format to represent a company’s financial position accurately. Incorporating essential components, such as specific details, in the invoice format is necessary to ensure accuracy.

| S.No | Details |

| 1 | Name, address, and GSTIN of the supplier |

| 2 | Invoice number and date |

| 3 | Name, address, and GSTIN of the recipient |

| 4 | Description of goods or services supplied |

| 5 | HSN or SAC code |

| 6 | Quantity and unit of measure |

| 7 | Taxable value and rate of tax |

| 8 | Amount of tax payable by the recipient |

| 9 | Signature of the supplier or authorised representative |

The table above outlines the necessary information that must be included in an RCM Invoice Format, including details such as the supplier and recipient’s name, address, and GSTIN, as well as the taxable value and rate of tax. This table can be a valuable reference for ensuring compliance with GST regulations and creating accurate RCM invoices.

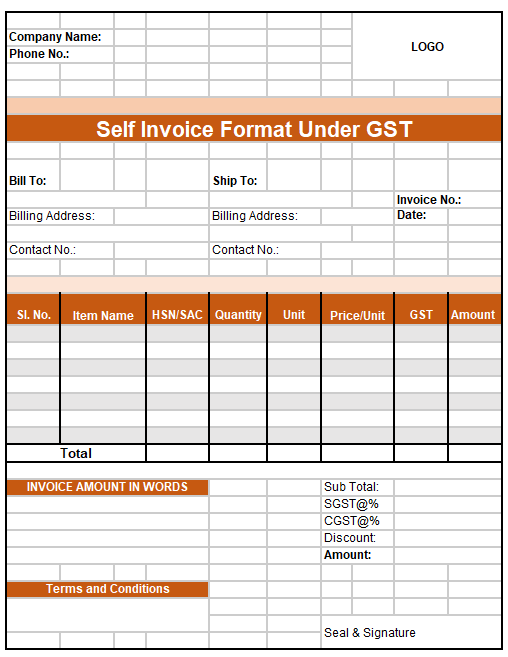

Sample RCM Invoice Format

Sample RCM invoice formats are valuable reference points for creating personalised balance sheets that meet a company’s specific requirements. Reviewing a sample format provides insights into the layout and necessary information that should be included to ensure compliance with tax regulations.

RCM Invoice Format in PDF

The customisable RCM invoice format in PDF is a secure and easily shareable document that can be accessed on any device. Review the provided sample to understand how to arrange necessary data and protect financial information.

RCM Invoice Format in Word

The RCM invoice format in Word is a user-friendly and customisable template that provides easy editing capabilities for a company’s needs. Additionally, the format can be converted to PDF for seamless sharing with clients or stakeholders. Reviewing the provided sample can help understand the necessary data and arrangement for the balance sheet.

RCM Invoice Format in Excel

RCM invoice format in Excel allowed for easy calculations, graphing, editing, and sharing options and added security with password protection. The provided sample helps in understanding the required information and layout of the balance sheet.

FAQs on RCM Invoice Format

The supplier is responsible for preparing an RCM invoice for certain transactions under GST regulations in India. Not following the RCM invoice format can result in penalties or fines for non-compliance with tax laws. Yes, the RCM Invoice Format can be customised to fit a company's specific needs while incorporating the essential components tax laws require. In a regular invoice, the supplier is responsible for paying the tax. In an RCM invoice, the recipient is responsible for paying the tax instead of the supplier. The RCM Invoice Format is customisable to provide a company's specific needs. However, it is important to ensure that all necessary details are included per tax regulations to avoid penalties.Who is responsible for preparing an RCM invoice?

What will happen if I do not follow the RCM invoice format?

Can the RCM Invoice Format be customised?

What is the difference between an RCM invoice and a regular invoice?

Can I modify the RCM Invoice Format to fit my company's needs?