GST Grievance

It is necessary for the Goods and Services Tax Network (GSTN) to maintain pace with the demand-supply curve in order to stay competitive. A self-service website for the GSTN has now been made available to the general public by the organization. This becomes easy for the public to submit a grievance using the GST grievance portal in no time. You may get more information about the GST grievance redressal portal in this guide if you desire it.

GST Grievance Redressal Portal and Services offered

It has been decided that the GSTN’s (Goods and Service Tax Network) former Helpdesk would be replaced by a new SELF HELP function, which will eliminate the requirement for taxpayers to send their inquiries to helpdesk@gst.gov.in anymore. GSTN has upgraded their previous Helpdesk into a new SELF HELP, which eliminates the requirement for taxpayers to send their questions to helpdesk@gst.gov.in. The new SELF HELP replaces the previous SELF HELP. GSTN has revamped its previous Helpdesk into a new SELF HELP system in response to the large number of taxpayers who are utilizing the GST site and the obvious challenges they may encounter.

To have your problem resolved, all you have to do is go to the Grievance Redressal Portal and submit a self-reporting ticket with all of the required information to the proper party. You can then relax and wait for an answer from someone familiar with your inquiries’ subject matter to get back to you. In addition to keeping track of the progress of the tickets that are currently open in your account, log in to your account on a frequent basis will also help you save time. The portal’s release date indicates that it was introduced on January 22nd, 2018, and that it became online on January 25th, 2018, which corresponds to the portal’s release date. When this new SELF-HELP system is implemented, the previous HELP DESK system will be phased out and will no longer be in continuous operation as a result.

How to file a Grievance on GST Portal?

A taxpayer can file a complaint on the GST Portal in order to receive assistance from the GST administration in resolving a problem. It is necessary to submit a grievance request for payment-related grievance in order to file a payment-related grievance. If you have any other problems, you can file a complaint with the Grievance Redressal Portal.

The grievance redressal portal is intended to be used by taxpayers to file complaints about problems they are experiencing. Instead of sending an email to the helpdesk, the taxpayer might file a grievance in order to receive a rapid response to his or her concern.

To file a complaint, visit the Grievance Redressal Portal.

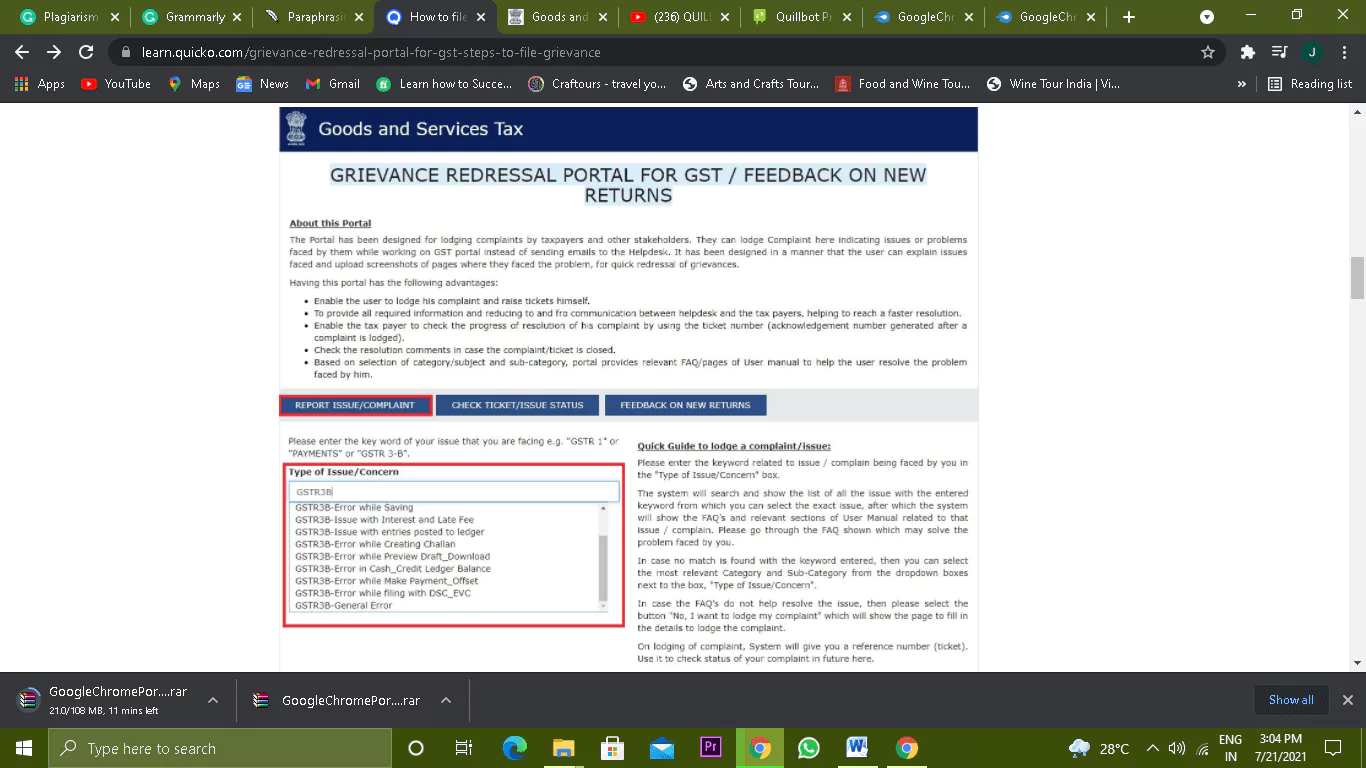

Step 1

Obtain access to the Grievance Redressal Portal and log in using your username and password.

Step 2

Select “Report Issue/Complaint”

Locate and click on the Report Issue Icon on the left-hand side column.

Step 3

In the Type of Issue/Concern, insert a keyword connected to your issue or complaint.

The system would display a list of issues connected to the term entered.

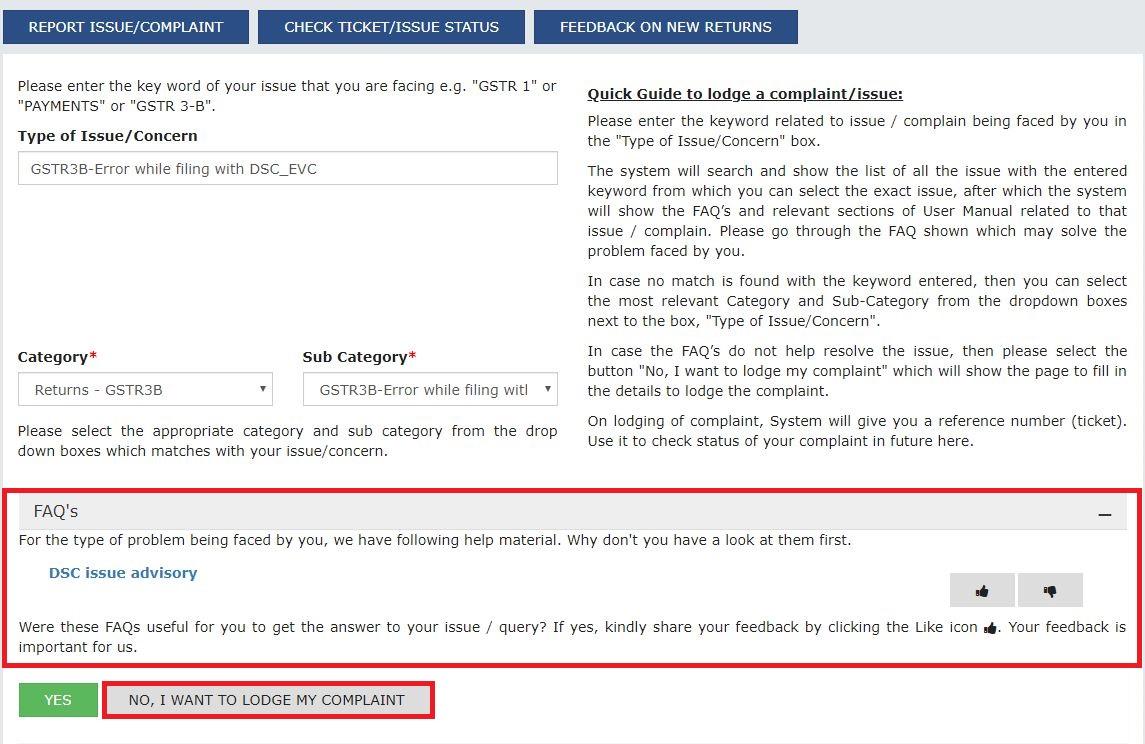

Step 4

Choose a specific problem. The system will show you FAQs and help content about the problem you’ve chosen.

You can look through the content and FAQs to find a solution to your problem.

Step 5

In case the existing FAQs on the GST Portal doesn’t fix your concern, click the ‘No I want to Lodge my Compliant’ Button.

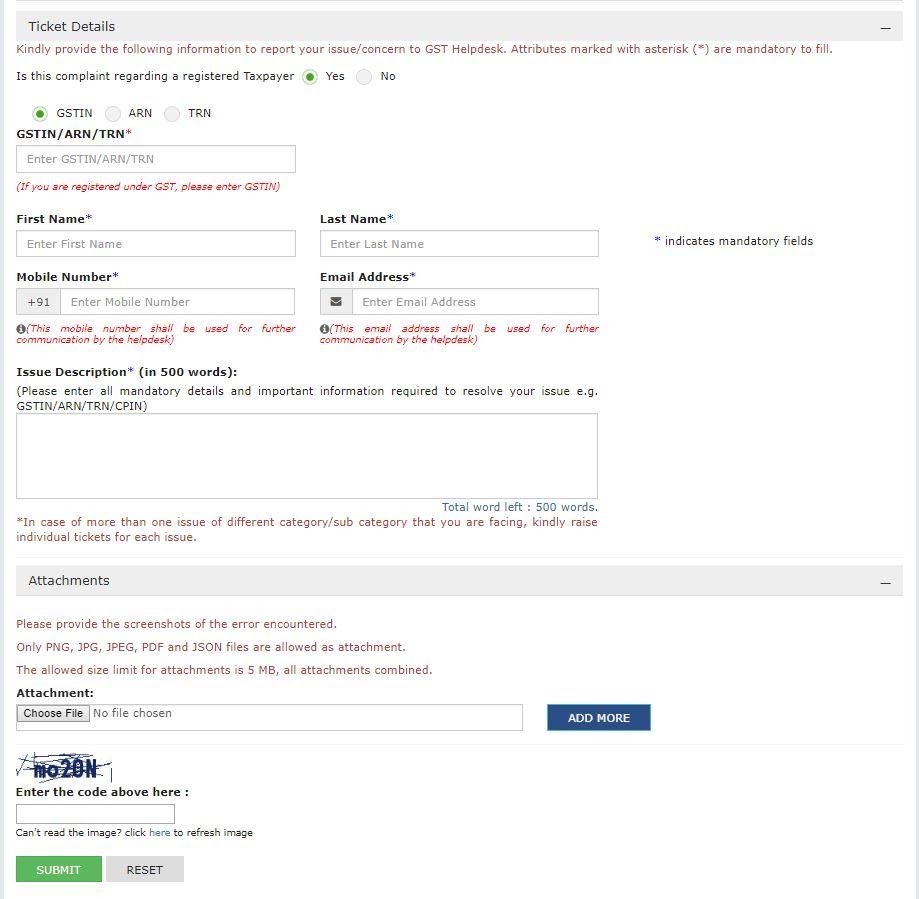

Step 6

Enter the specifics of the issue:

– GSTIN i.e. GST Identification Number or ARN i.e. Acknowledgement Reference Number or TRN i.e. Temporary Reference Number

– First Name & Last Name

– Mobile Number and Email

— A 500-word description of the problem

Step 7

Click on pick file to upload a supporting document connected to the grievance

Hence, it is vital to have the supporting documents for submitting Grievance. Enter & submit the captcha.

Step 7

A success notification with a TRN (Ticket Reference Number) will appear on the screen.

The TRN allows the taxpayer to keep track of the ticket’s status.

Best Features of GST Grievance Redressal Portal

- Currently, a technology-based integrated application system is in use that allows users to report troubles from any location and at any time (24/7), regardless of the time of day or night they are experiencing them.

- With the help of this program, it is possible to produce automatic acknowledgement and final response letters for complaining recipients.

- It ensures that a uniform and rigorous approach to monitoring the process is followed throughout the organization by implementing a classification and standardization system across all government agencies.

- Our Grievance Redressal Portal helps to speed the settlement of complaints by decreasing the amount of back and forth contact between the support desk and users.

- This service, which allows clients to track the progress of a complaint by inserting the ticket number, is quite valuable and should be used more frequently.

- It is the user’s responsibility to go back and study the comments that were made after the ticket or complaint has been resolved

- The GST website provides registered taxpayers with the opportunity to peruse the relevant FAQ page or sections of the user handbook in order to resolve any problems or issues that may have arisen over the course of their business operations.

- Furthermore, it makes it easier for information to be transferred automatically between a support desk and the system’s registered users by automating the process.

FAQs – GST Grievance

Can I file a complaint about which issues?

In the following situations, a grievance can be filed:

NEFT/RTGS related issues amount debited from a bank account, Cash Ledger not updated

Please do not file a complaint if any of the following conditions apply:

- Prior to the debit of funds from the bank account for a period of 24 hours

- If the payment status is PAID and the amount in the Cash Ledger is updated.

- Payment is not initiated from the GST Portal in the case of E-payment.

- If the CPIN is the subject of a Memorandum of Error (MoE).

- The payment status is Failed, and the funds have not been deducted from the bank account.

- The status of an OTC payment is AWAITING BANK CLEARANCE, and the cheque/demand draught has not been received.

Who is eligible to file a complaint? Is it necessary for me to be a registered user of the GST Portal in order to file grievances?

The right to file a complaint about payment-related concerns can be exercised by any registered taxpayer or by any user who has been issued a Temporary ID.

Will grievances that have been lodged prior to logging in be taken into consideration?

When login into the system, you can submit your complaints either before or after you log in.

In what manner should a GST complaint or grievance be filed?

After navigating to Services > User Services > Grievance/Complaints and clicking on the form, fill out the information.

What methods are available to me to keep track of my GST Portal Grievance or Complaint progress?

After entering the grievance number, select Inquire Status from the drop-down menu.

It is necessary for the Goods and Services Tax Network (GSTN) to maintain pace with the demand-supply curve in order to stay competitive. A self-service website for the GSTN has now been made available to the general public by the organization. This becomes easy for the public to submit a grievance using the GST grievance portal in no time. You may get more information about the GST grievance redressal portal in this guide if you desire it.