GST Certificate Download

How To Download GST Registration Certificate Online?

You should be able to access your GST account to download your GST Registration Certificate.

Following are the step-by-step instructions to download a certificate.

Step 1 : Go to the official GST portal https://www.gst.gov.in

Step 2 : Click on the “Login” button.

Step 3 : Enter your credentials (username and password) to login.

Step 4 : Click on Services, then select User Services. Go to View/Download Certificate.

Step 5 : Click on the Download button to download your certificate.

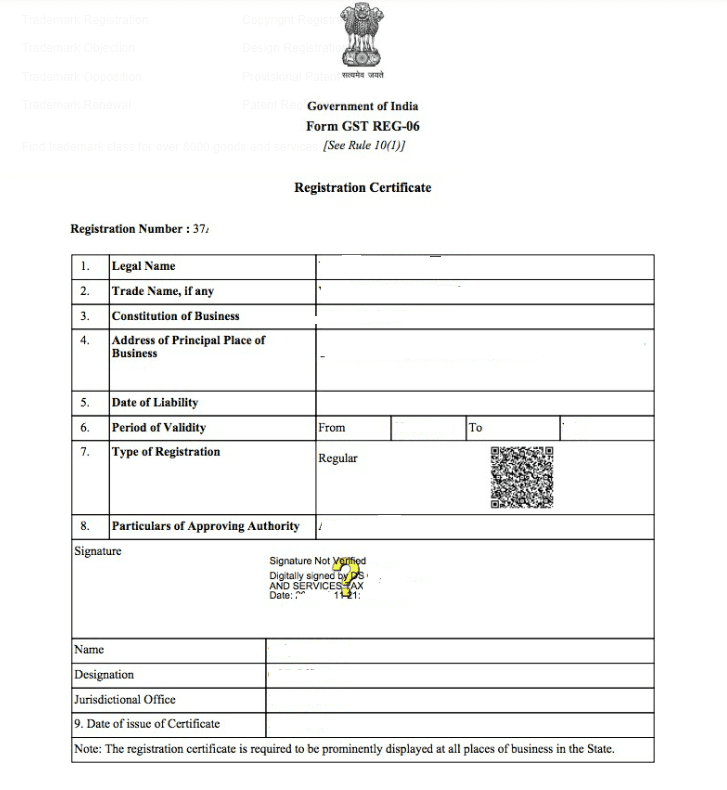

Sample of GST Registration Certificate

Below is a sample of GST Registration Certificate

Contents of a GST Certificate

As seen above, a GST Certificate comes with Annexures A and B that contain the following items:

- The GSTIN of the taxpayer

- Business name

- Business type (Sole proprietorship, partnership, etc.)

- Business address

- Liability date

- Validity period

- Registration type

- Digital signatures of approving authorities

- Date of issue of certificate

Annexure-A has the following details:

- The GSTIN of the taxpayer

- The taxpayer’s legal name

- The name of the business

- The additional places of the business

Annexure-B has the following details:

- The GSTIN of the taxpayer

- The taxpayer’s legal name

- The name of the business

- Information of the proprietor, partners, director, trustees, etc. including photograph, name, designation, and address

How to edit GST Certificate online

Here are the steps you can follow to edit a GST certificate:

Step 1 : Go to the official GST portal https://www.gst.gov.in

Step 2 : Click on Login

Step 3 : Enter your username and password to login

Step 4 : Go to Services and then select Registration

Step 5 : Click on Amendment of Registration

Step 6 : Make the necessary changes

Step 7 : Go to the Verification tab and check the Verification box

Step 8 : Go to the Authorized Signatory drop-down list and select the authorised signature

Step 9 : Go to the Location field and enter the name of the place

Step 10 : Sign the application using Digital Signature Certificate (DSC)

Step 11 : You will get a confirmation mail and SMS updating the status of the application

Step 12 : After the application is approved, you can view or download it from the GST portal.

FAQs

What is the validity of the GST certificate?

If you are a regular taxpayer, your GST certificate does not expire unless a tax authority cancels it. If you are a casual taxpayer, your GST certificate is valid for 90 days from the date of registration. You can extend the validity after the expiry date.

How can I search for my GST information?

You can search for your GST certificate using your GSTIN, PAN number, or company name. You have to type the details in the search box of GST portal to access your GST certificate.

Can I get a physical copy of the GST certificate?

The Government of India does not issue a physical copy of the GST certificate. You will have to get your certificate online and then print it out.

What are the charges for getting a GST certificate?

You can get the GST certificate from the GST portal free of cost

Why do I need a GST certificate?

The GST certificate is proof of the validity of your business. You can also check if other businesses have GST certificates for verification.

Can we download GST certificate with GST number?

You can not download your GST Registration Certificate without logging in to the GST portal.

What is GST registration certificate?

A recognised document that serves as proof of GST registration is a GST registration certificate. A business must register for GST if its annual revenue exceeds the threshold.

WHO issues GST certificate?

After reviewing and approving Form GST REG-06, the Goods and Services Tax department issues a GST certificate.

Is GST registration free?

GST registration is cost-free.

Can we find GST number by name?

Yes

- Enter the name with the right spelling.

- Enter at least 10 characters while searching.

- Enter the state name and the first few letters to find the appropriate information.