Businesses having multiple outlets or operations at different places might be well aware of a delivery challan or delivery challan format. But issuing a delivery challan might be confusing for those who are just starting out in a business.

A delivery challan is issued when goods are transported from one place to another but not necessarily because of a sale. Goods are being delivered, but no purchase has been made! Little confusing, right? Let’s dig deeper to understand what exactly a delivery challan is, delivery challan format, when a delivery challan is issued, which businesses need to issue delivery challan and other such information in detail.

What is a Delivery Challan?

A delivery challan is a document created for the transportation of goods from one place to another, which may or may not result in sales. Hence, no GST is applicable to such supply.

If a factory sends goods from one warehouse to another, it issues a delivery challan. If a bakery sends raw material from the head brand to the sub-branch, it creates a delivery challan. A delivery challan typically helps track and verify the goods of a shipment.

A delivery challan is also called a dispatch challan or a delivery slip. It is sent along with the goods shipped for delivery and contains the details of the goods being transported.

Three copies of delivery challan must be created and should be marked as follows:

| Copies of Delivery Challan | Used By |

| Original – ORIGINAL FOR CONSIGNEE | Buyer |

| Duplicate – DUPLICATE FOR TRANSPORTER | Transporter |

| Triplicate – TRIPLICATE FOR CONSIGNER | Seller |

Sample Delivery Challan Format

Mandatory Components of a Delivery Challan

The GST regime mandates that the delivery challan must contain the following details.

- Serial number in one or multiple series – Not exceeding 16 characters

- Date and challan number

- The name, address, and the GSTIN of the consignor

- The name, address, GSTIN, or UIN of the registered consignee. If the consignee is unregistered, you should mention the place of supply instead of the GSTIN or UIN

- HSN code of the goods being transported

- Description of the goods

- The exact or provisional quantity of goods being transported

- The taxable amount of the supply

- The applicable GST rate, broken down into IGST, CGST, SGST, and cess

- The place of supply of the goods if the transportation is being done between two states

- Signature of the supplier or designated authority of the supplier

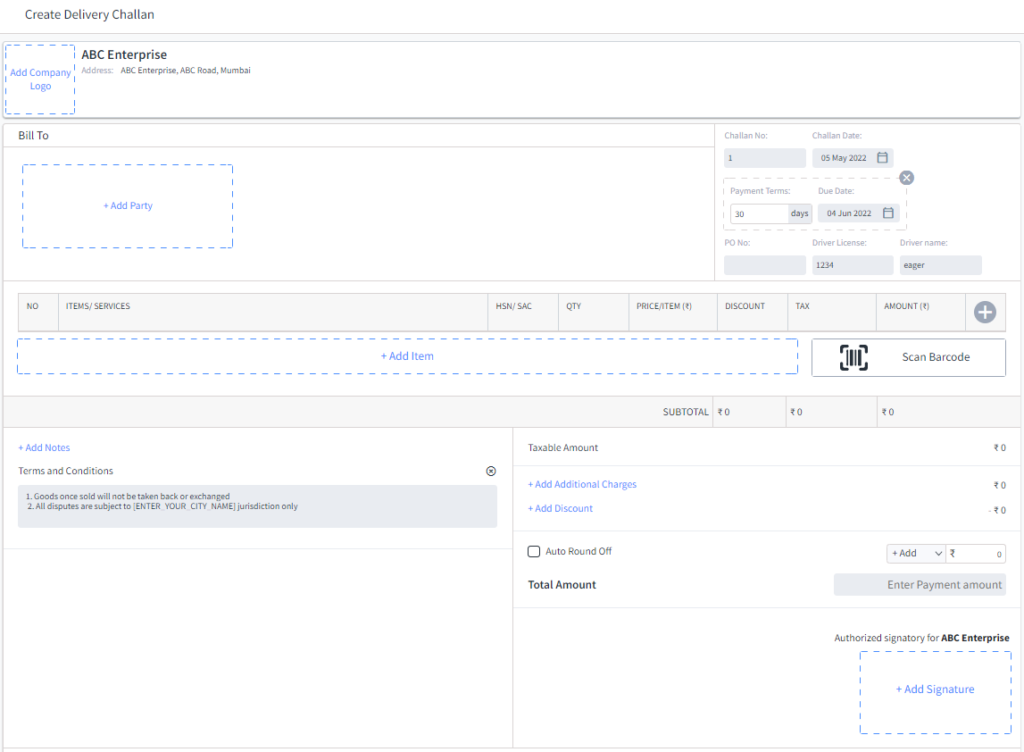

How to use Delivery Challan Format?

The delivery challan format or template helps you create the challan easily. You can use the delivery challan format, fill in all the necessary details of the transported goods and take a print of the same. You can sign the challan and send it to the recipient.

When to Issue a Delivery Challan?

Section 55(1) of the CGST Rules specifies when suppliers can issue a delivery challan instead of an invoice.

- During the supply of liquid gas, when the quantity of the gas is unknown

- When goods are transported for job work.

- If the principal is sending goods to a job worker

- If one job worker is transporting goods to another job worker

- If the job worker is sending goods back to the principal

- When the goods are being transported before they are supplied. For example, moving goods from the factory to the warehouse or from one warehouse to another.

Occasionally, issuing this challan in an acceptable format is needed for transporting goods. Such cases are as follows –

- When transporting goods on an approval basis

If you are transporting the goods (inter or intra-state) on a sale or return basis, and then they are removed before the supply happens, you would need a challan.

- When transporting “art” to galleries

If works of art are transported to galleries for exhibition, such transport can be done with these challans.

- Transporting goods abroad for promotion or exhibition

As per the CBIC Circular No. 108/27/2019-GST issued on 18th July 2019, if goods are sent outside India for exhibition or promotional activities, such transportation cannot be treated as ‘supply’ or ‘export’. Thus, such transportation should be done under this challan.

- Transporting goods in multiple shipments

If goods are transported using different modes of shipment in a partial or full non-assembled state, the supplier must issue a tax invoice when transporting the first consignment. Then, a challan should be issued for every subsequent consignment, where you should provide the invoice reference.

- When issuing tax invoices is not possible when removing the goods

As per Rule 55(4) of CGST and SGST Rules, 2017, if the goods being transported are meant for sale or supply. Still, it is impossible to issue the tax invoice, and the supplier can issue a delivery challan and transport the goods. The tax invoice would then be issued after the delivery of the goods.

- When an e-way bill is not needed

According to Rule 55A of the CGST Rules with effect from 23rd January 2018, if the e-way bill is not needed and when the tax invoice or Bill of Supply is not needed, the goods should be transported using this challan.

Businesses that Issue Delivery Challan

- Businesses that are involved in the trading of goods, i.e. trading businesses

- Owners having multiple warehouses where goods are usually transported between different warehouses

- Suppliers of goods

- Wholesalers of goods

- Manufacturers of goods

Delivery Challan Format in Word

Using Microsoft Word to create a delivery challan is a simple and convenient option. The basic layout of a delivery challan in Word includes a header with the company’s name and logo, a section for the recipient’s information, and a table or list of the goods being transported. It is important to include all relevant details, such as the delivery date, the vehicle number, and the number of packages.

Delivery Challan Format in Excel

Excel is a popular choice for creating delivery challans because of its ability to organise and calculate data. A delivery challan in Excel can be set up as a spreadsheet with separate columns for the product name, quantity, and value. This allows for easy calculation of the total value of the goods transported.

Include all necessary information in the header, including the company’s name and the recipient’s details. Details of the goods, quantity, place of shipment, etc., can be included below in the description box. Creating a delivery challan in Excel is easy compared to other formats as it already has pre-defined cells and columns.

Delivery Challan Format in PDF

A delivery challan in PDF format is easily readable on any device. To create a PDF delivery challan, you can use a program like Adobe Acrobat or a website that converts Word or Excel documents to PDF. The layout and content of the delivery challan format will be the same as in Word or Excel, with the header containing the company’s information, the recipient’s details, and a list or table of the goods being transported. As with any delivery challan, it is important to include all relevant details to ensure accurate tracking and delivery of the goods.

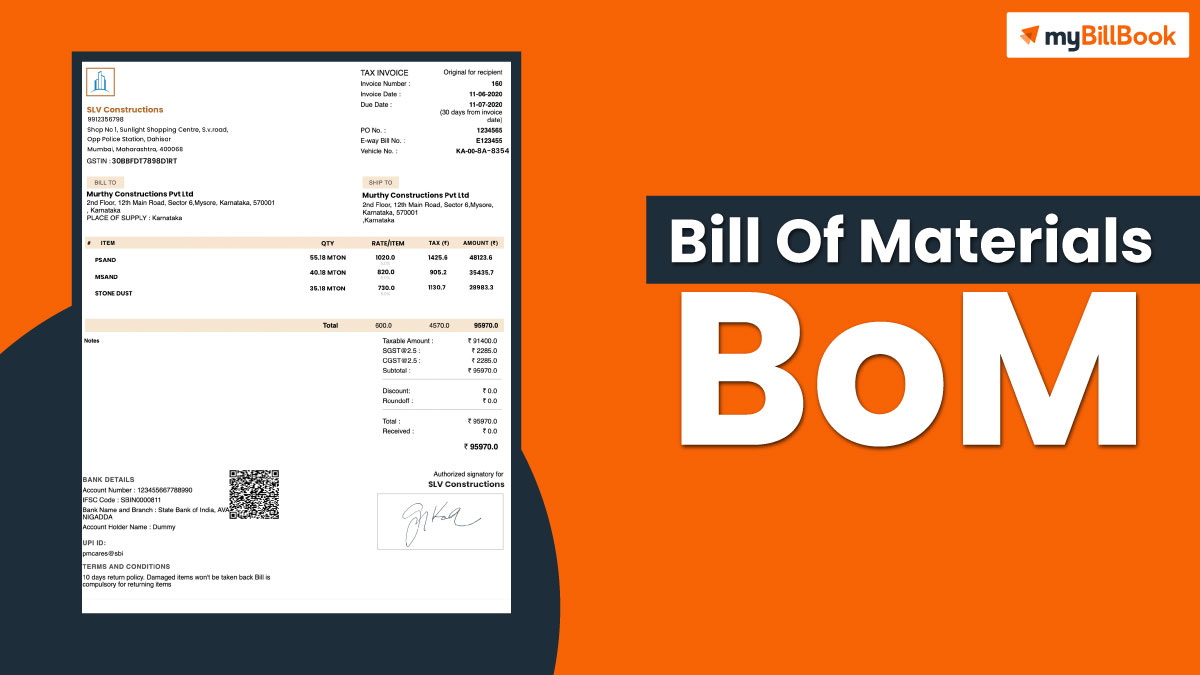

Delivery Challan Vs. Invoice

A GST invoice is issued when the supply of goods or services is made or when the supplier has received payment.

In contrast, a delivery challan is given for the transportation of goods.

A delivery challan may or may not include the value of goods, but it never states the tax charged on the goods. But an invoice always shows the taxes charged on goods sod.

Sometimes, both delivery challan and invoice are merged and called “Tax invoice cum delivery challan”

FAQs on Delivery Challan

What is the rule for issuing a delivery challan?

As per Rule 55 (2) of CGST Rules, a delivery challan must be issued in triplicate. The original one is meant for the consignee (recipient of goods), the duplicate copy is for the transporter of goods, and the triplicate copy is meant for the consignor (supplier of goods).

Does the delivery challan format contain the details of the mode of transport?

Yes, the challan should have the mode of transportation being used to transport the goods.

Can I use a delivery challan if I transport the goods from a warehouse in one state to another warehouse in another state?

Yes, a delivery challan can be used for the inter-state movement of goods from one warehouse to another. Therefore, you should ensure that the format contains the details of the warehouses too.

What is the delivery challan for job work in GST?

A delivery challan issued for the following is termed as delivery challan for job work in GST

- Sending goods by the principal to a job worker

- One job worker to another job worker

- Return of goods after job work to the principal.

Can we generate an e-way Bill on the delivery challan?

The delivery challan, invoice, bill of sale, and transporter’s ID must be available to generate an e-way bill.